CRED iQ’s Overall Distress Rate Reaches a Fourth Straight Record High

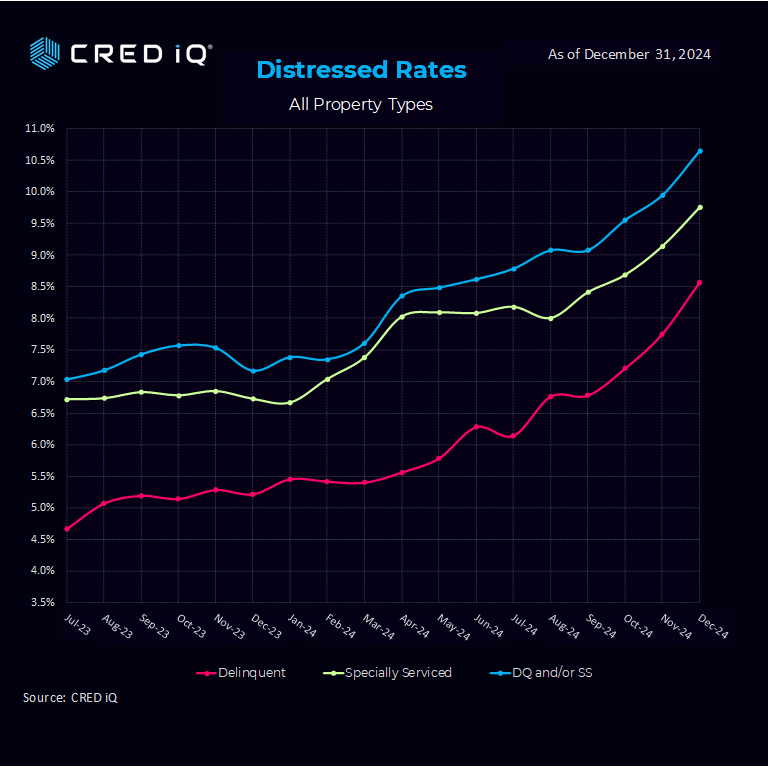

The CRED iQ research team evaluated payment statuses reported for each loan (securitized by CMBS financing), along with special servicing status as part of our monthly distress update. In this special year-end report, we add several new dimensions to get a sense of how distress rates evolved.

The CRED iQ overall distress rate added 60 basis points, logging its fourth straight record high of 10.6%. The CRED iQ delinquency rate increased to 8.6% from 7.7% in the November print. Similarly, the CRED iQ special serving rate added 70 basis points to 9.8%

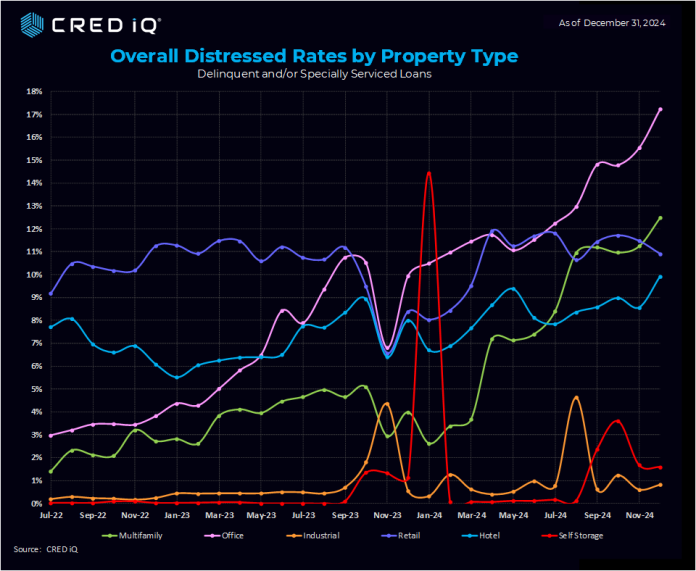

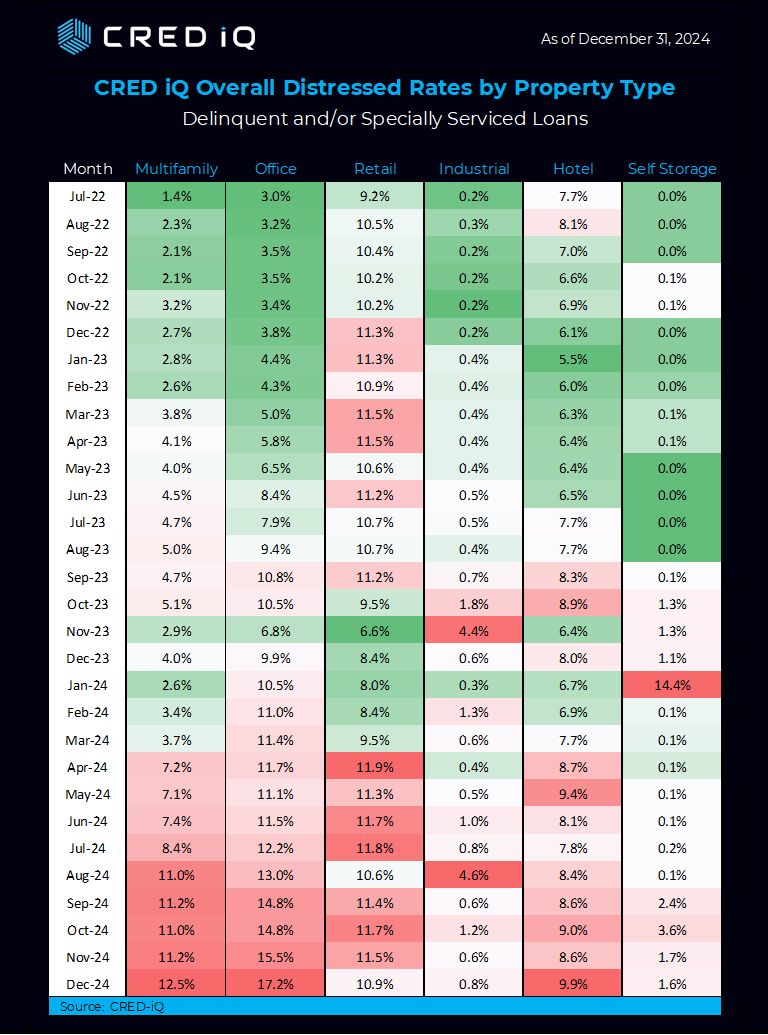

Segment Review

The office segment saw its largest overall distress rate increase of the year in December—rising from 15.5% in our November print to 17.2% in December. Office maintains a healthy lead as the property type with the most distress, and the largest distress gain in December across all property types.

Taking over the number two spot from retail, multifamily notched a distress rate of 12.5%, an increase of 130 basis points since November. As a reminder, the multifamily segment started the year with a distress rate of just 2.6%

Retail was one of three property types that improved their distress rate. Retails distress rate was reduced by 60 basis points to 10.9% –now the third most distressed segment

Hotels added 130 basis points to log a distress rate of 9.9% in December—landing in the number four slot.

Industrial and self-storage saw modest reductions in their tiny distress rates of 0.8% and 1.6% respectively.

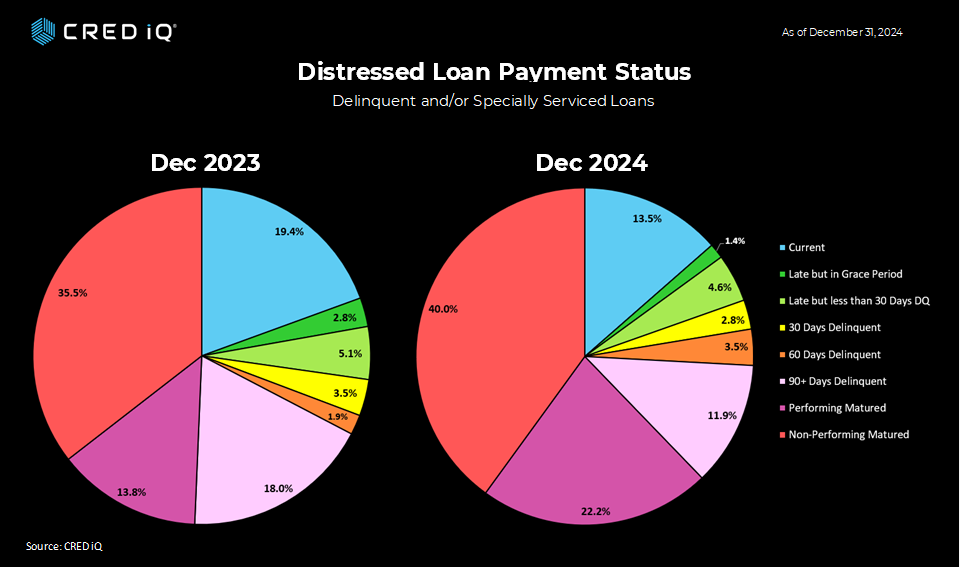

Payment Status

Our team explored how payment status has evolved over the course of 2024. Some takeaways:

- 19.4% of loans were current in December of ‘23, versus 13.5% as we finished 2024

- Combining current with late but in the grace period and late by last than 30 days delinquent, 2024 watched this ‘wider current’ metric sink from 27.3% to 19.6%, a 770 basis point decrease

- Combining performing matured with non-performing matured, December ‘23 logged 49.3% while December ’24 logged 62.2% in the maturity category

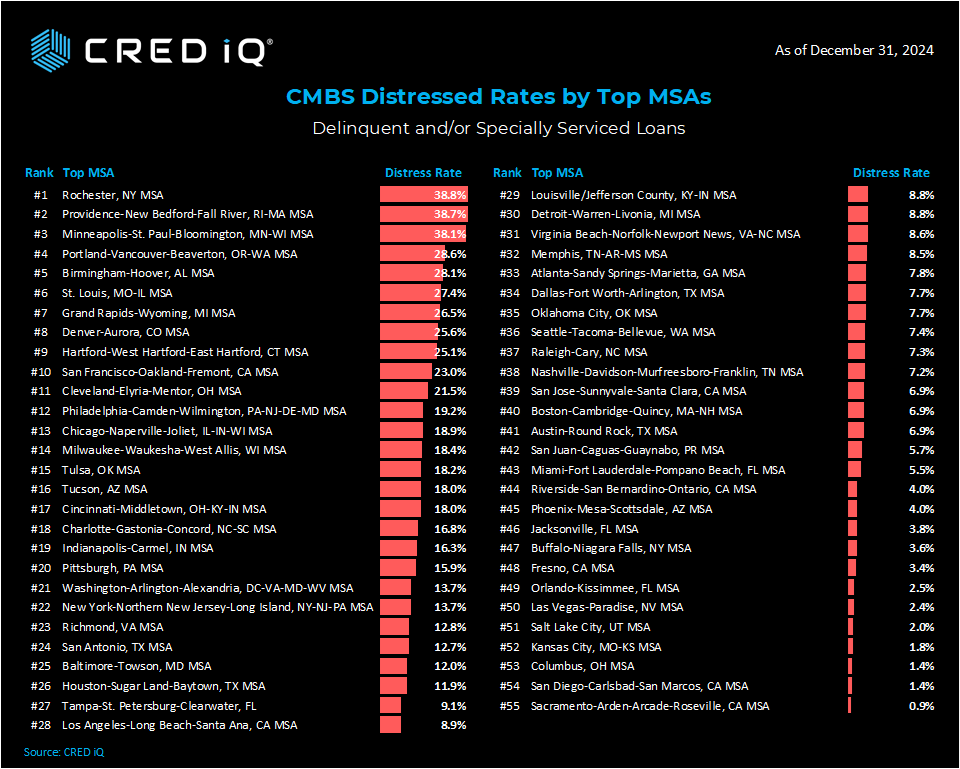

Geographic Review

We wanted to add a geographic perspective to this special year-end report. Our analysis shows a very close three-way race for the most distressed MSA in the US. The top three MSAs and their market destress rates are Rochester, NY (33.8%), Providence-New Bedford-Fall River, RI/MA (38.7%) and Minneapolis-St. Paul-Bloomington, MN/WI (38.1%).

On the other end of the scale, Sacramento CA, San Diego CA and Columbus OH were the least distressed in our study logging distress rates of 0.9%, 1.4%, and 1.4% respectively.

Historical Perspective

Finally, we extended the date ranges to show distress trending dating back to July of 2022 to gain a wider viewpoint as we jump into 2025.

Office Loan Highlight

The $205.4 million SBLL loan ($347/SF) backed by the 2400 Market Street office property in Philadelphia defaulted on the December 2024 maturity, resulting in a Performing Matured loan status. Servicer commentary indicates a maturity extension is in process.

The 591,878 SF mid-rise office property is in the Market Street West submarket. Built in 1929 and renovated in 2018, the property was valued at $317.3 million ($536/SF) at underwriting in October 2021. The property was most recently 99% occupied and had a DSCR of 0.91.

Analysis Methodology

It’s important to note that CRED iQ’s distress rate factors in all CMBS properties that are securitized in conduits and single-borrower large loan deal types. CRED iQ tracks Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO loan metrics in separate analyses.

CRED iQ’s distress rate aggregates the two indicators of distress – delinquency rate and specially serviced rate – yielding the distress rate. The index includes any loan with a payment status of 30+ days delinquent or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.