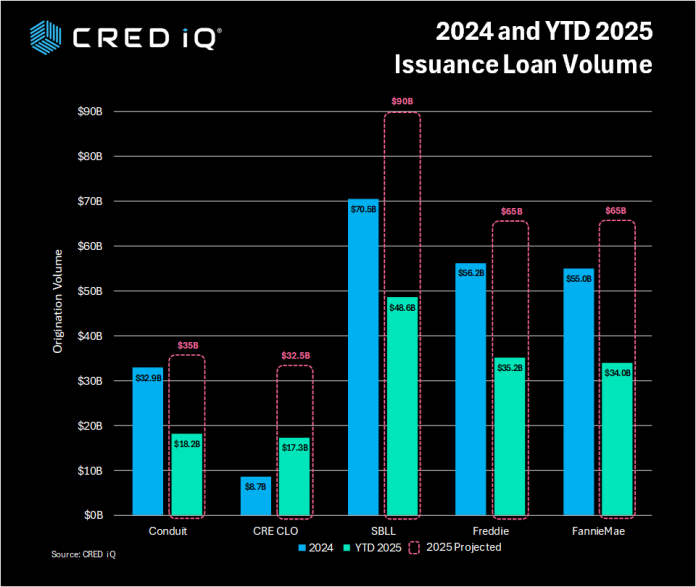

As we have crossed the midpoint of 2025, the CRED iQ research team focused upon the new issuance volumes across the securitized and agency ecosystems. We wanted to understand 2025 YTD volumes for each deal type, and then projected full year metrics which we can compare to 2024 levels.

Our analysis covered the CMBS Conduit, CRE CLO, SBLL, Freddie and Fannie Mae loan volumes. Our projections indicate increased volumes in every category when compared to 2024.

Projected Issuance Volumes and comparison to 2024

CMBS Conduit $35 billion (versus $32.98B in 2024)

CRE CLO $32.5 billion (versus $8.7B in 2024)

SBLL $90 billion (versus $70.5B in 2024)

Freddie Mac $65 billion (versus $56.2B in 2024)

FannieMae $65 billion (versus $55B in 2024)

CRE CLO loans are projected to notch the largest gains compared to 2024 –nearly quadrupling 2024 volumes. SBLL is forecasted to issue ~$19.5 billion more loans than in 2024 –landing in second place. Freddie and Fannie are projected to add ~$9 billion and $10 billion respectively vs 2024. Conduit loans expected to add ~$2 billion more in issuances.

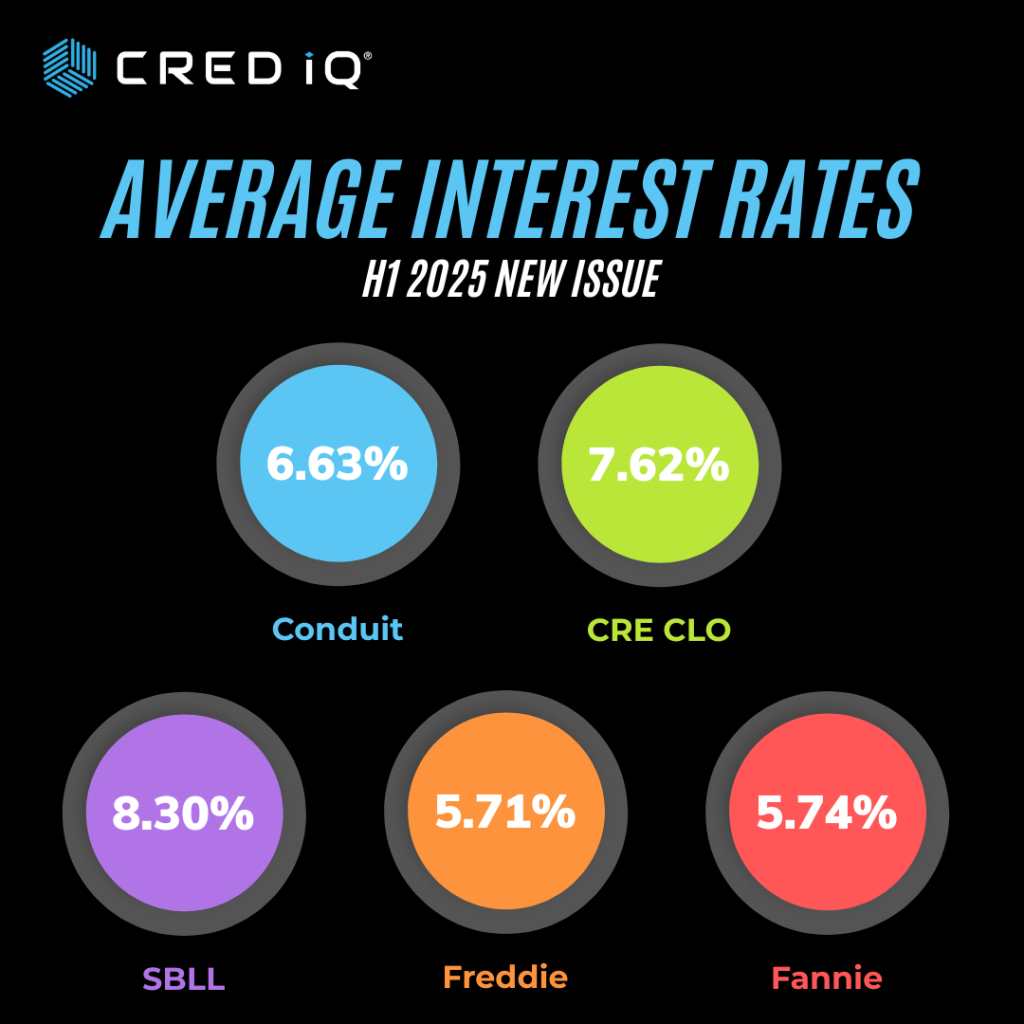

Interest Rate Averages

Interest rate averages varied by loan type for the first six months of 2025:

CMBS Conduit 6.63%

CRE CLO 7.62%

SBLL 8.30%

Freddie Mac 5.71%

FannieMae 5.74%

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.