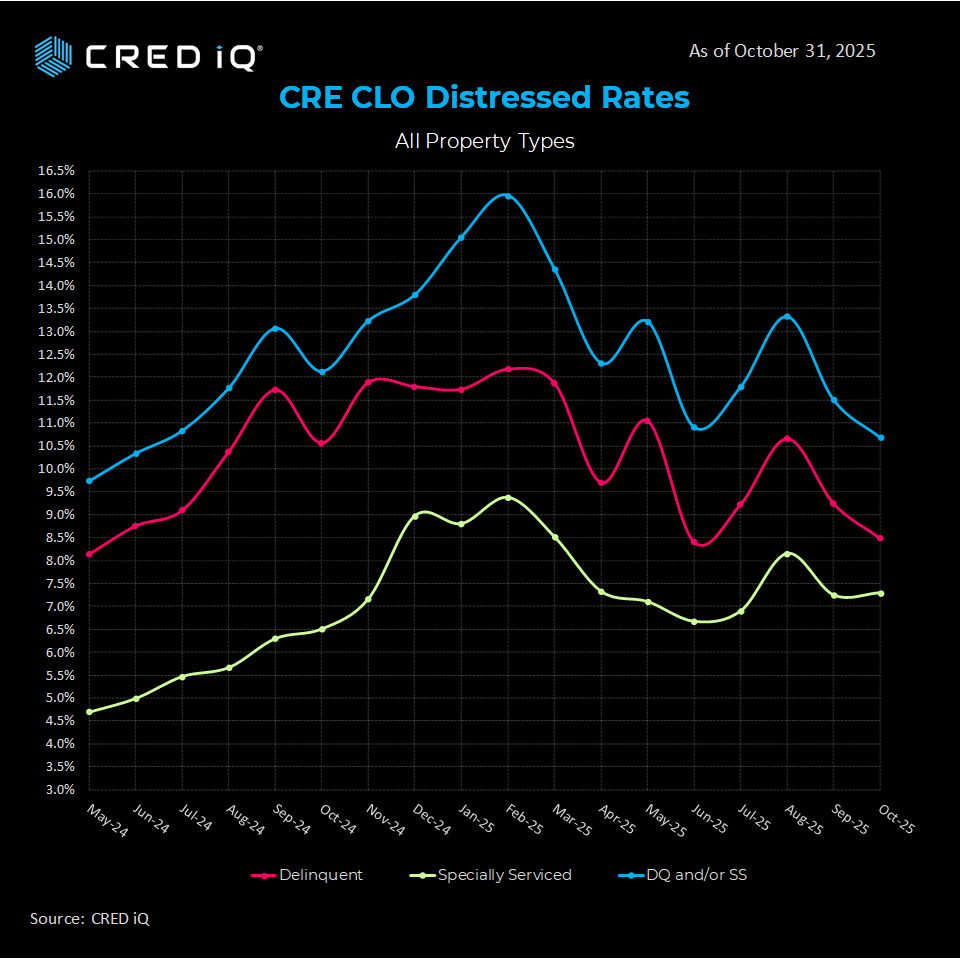

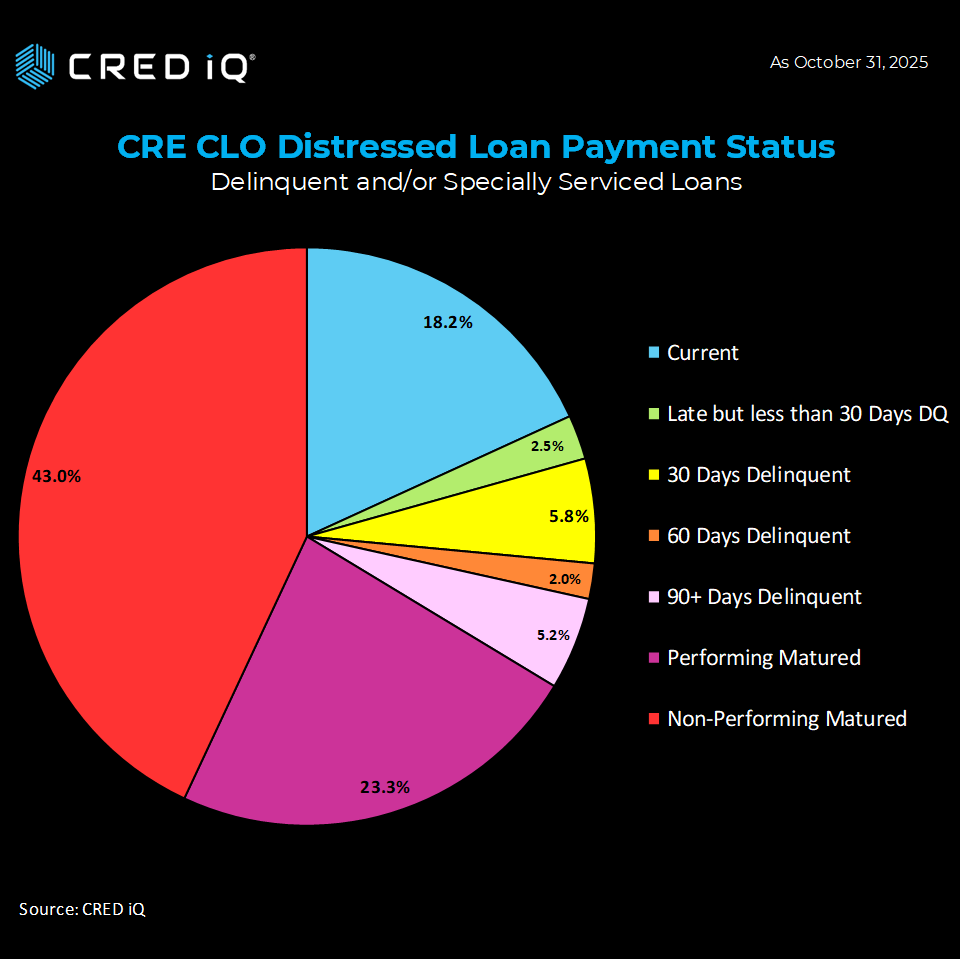

The CRED iQ CRE CLO distressed rate notched its second consecutive reduction, reaching the lowest mark of 2025. CRE CLO issuance year-to-date as of November 2025 totals $25 billion, which compares to $8.7 billion, this same time last year, showing a remarkable rebound for the sector. Meanwhile, loans that have passed their maturity dates grew and non-performing matured loans added a whopping 720 basis points (BPS) to 43.0%.

Delinquency and Special Servicing Dynamics

The CRED iQ distressed rate compressed for the second consecutive month to 10.7% in October, down 82 basis points (BPS) MoM and 144 bps year-over-year from October 2024’s 12.1%.

The CRE CLO delinquency (DQ) rates in CRE CLOs ticked down to 8.5% in October from 9.2% in September, marking a month-over-month (MoM) decline of 76 BPS. This follows a volatile 2025, where DQ peaked at 12.2% in February before easing. The CRE CLO special servicing (SS) rate added 5 BPS to 7.3% from 7.2%.

Payment Status Breakdown

Payment statuses reveal a maturing portfolio, with 66.3% of ALA in matured loans ($3.8 billion), split between performing (23.3%) and non-performing (43.0%) categories. Current loans shaved 100 BPS to18.2% ($1.0 billion), while late payments (<30 days DQ jumped from 0.5% in September to 2.5% ($142 million). Delinquent loans saw a reduction from 19.0% in September to 13.0% in this October print.

Case Study

A $70.3 million loan backed by Outlook DTC, a 242-unit multifamily property in Denver’s Southeast submarket, has fallen to non-performing matured status after failing to pay off at its October 2025 maturity. The loan was added to the servicer’s watchlist in August 2025 due to declining occupancy and approaching maturity. The property most recently reported an occupancy of 79.8% and a DSCR of 0.77, signaling continued cash flow stress ahead of default.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.