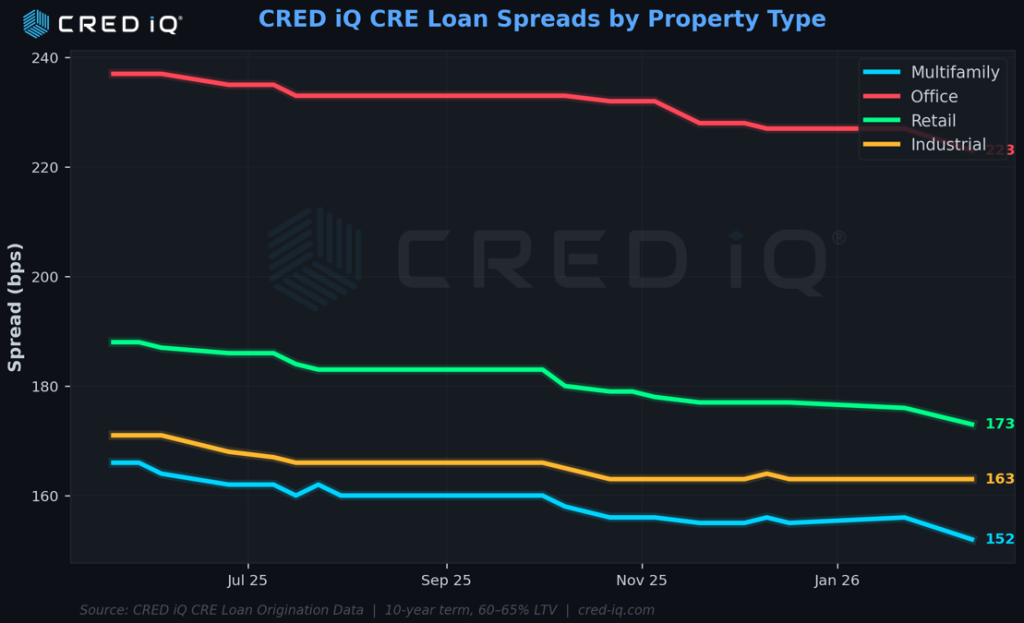

Commercial real estate lending spreads have tightened across every major property type since mid-2025, but the pace and magnitude of compression vary dramatically by sector—and the gap between winners and laggards remains wide. That’s the key finding from CRED iQ’s latest analysis of CRE loan origination data spanning May 2025 through February 2026.

CRED AI Labs – Learn more about our new professional services division

Multifamily continues to lead with the tightest spreads in the market at 152 basis points over Treasuries, down 14 bps from the 166 bps level CRED iQ recorded in May 2025. Industrial follows at 163 bps, reflecting lenders’ continued preference for logistics and warehouse assets anchored by investment-grade tenants. Retail has posted the most dramatic improvement, compressing 15 bps to 173 bps as lender appetite returns for grocery-anchored and experiential retail centers with strong occupancy and cash flow profiles.

Office remains the clear outlier. Despite compressing from 237 bps to 223 bps since May 2025, office spreads still carry a 71 bps premium over multifamily—a persistent risk surcharge driven by elevated vacancy, tenant downsizing, and uncertain return-to-office patterns. Recent originations tracked by CRED iQ, including a loan on the Netflix headquarters in Los Gatos (6.03% coupon, 55.4% LTV, 1.69x DSCR), show that even trophy single-tenant office assets price at spreads consistent with the broader office composite.

Looking ahead, CRED iQ’s research team expects further modest compression across all sectors by year-end 2026, with multifamily and industrial spreads potentially falling below 150 bps and 155 bps, respectively. The office-to-multifamily spread premium should narrow modestly but is likely to remain above 55 bps through 2026 as the sector works through its structural reset. Combined with a base-case 10-year Treasury forecast of 3.85–4.00%, all-in rates for institutional-quality CRE loans should settle in the low-to-mid 5% range for favored property types—a significant improvement from the 6%+ environment that defined early 2025.

About CRED iQ

CRED iQ is a commercial real estate intelligence platform providing institutional-grade CMBS, CLO, and property-level data spanning 30+ years and over 150 million properties. With an API-first infrastructure and advanced analytics, CRED iQ delivers comprehensive market intelligence to commercial real estate professionals, lenders, investors, and servicers. Through CRED AI Labs, its professional services division, CRED iQ combines deep CRE domain expertise with artificial intelligence to power next-generation workflows and decision-making across the commercial real estate industry. Learn more at here.