A CRED iQ Preliminary Analysis

DATA HEREIN PROVIDED TO CRED IQ IS FROM A PRELIMINARY PROSPECTUS AND MAY BE AMENDED OR SUPPLEMENTED PRIOR TO TIME OF SALE

Deal Overview

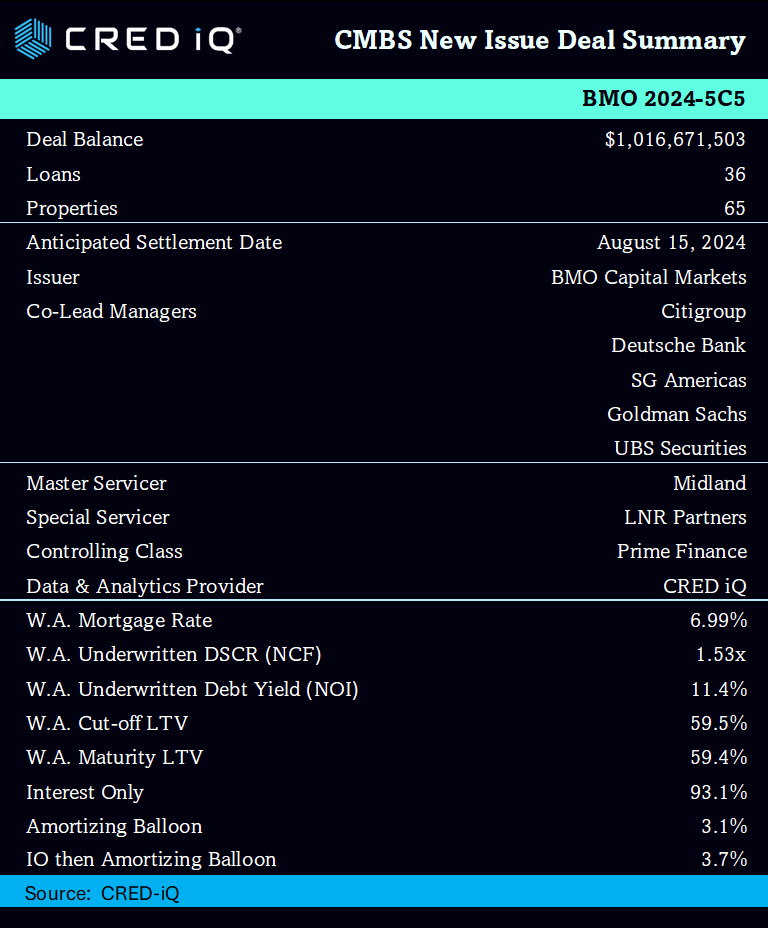

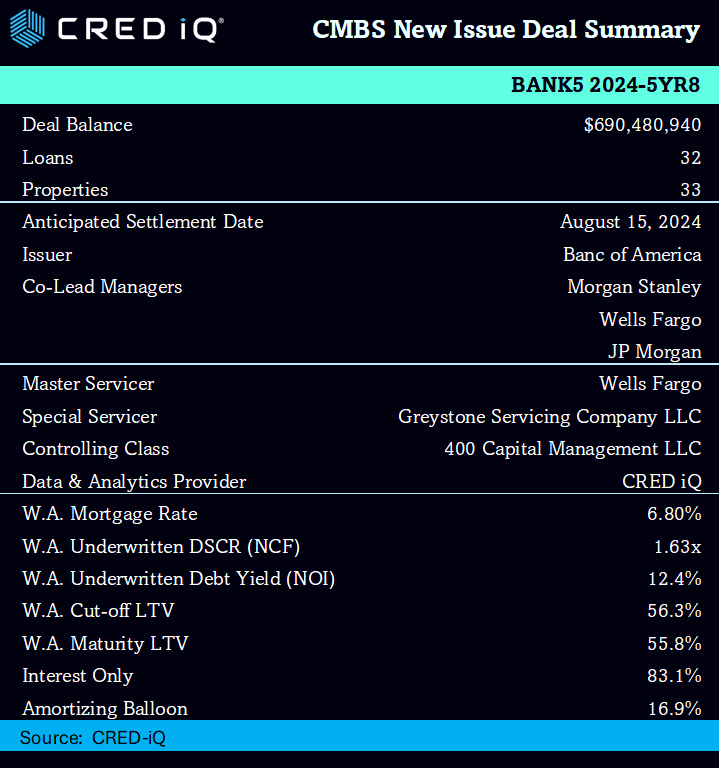

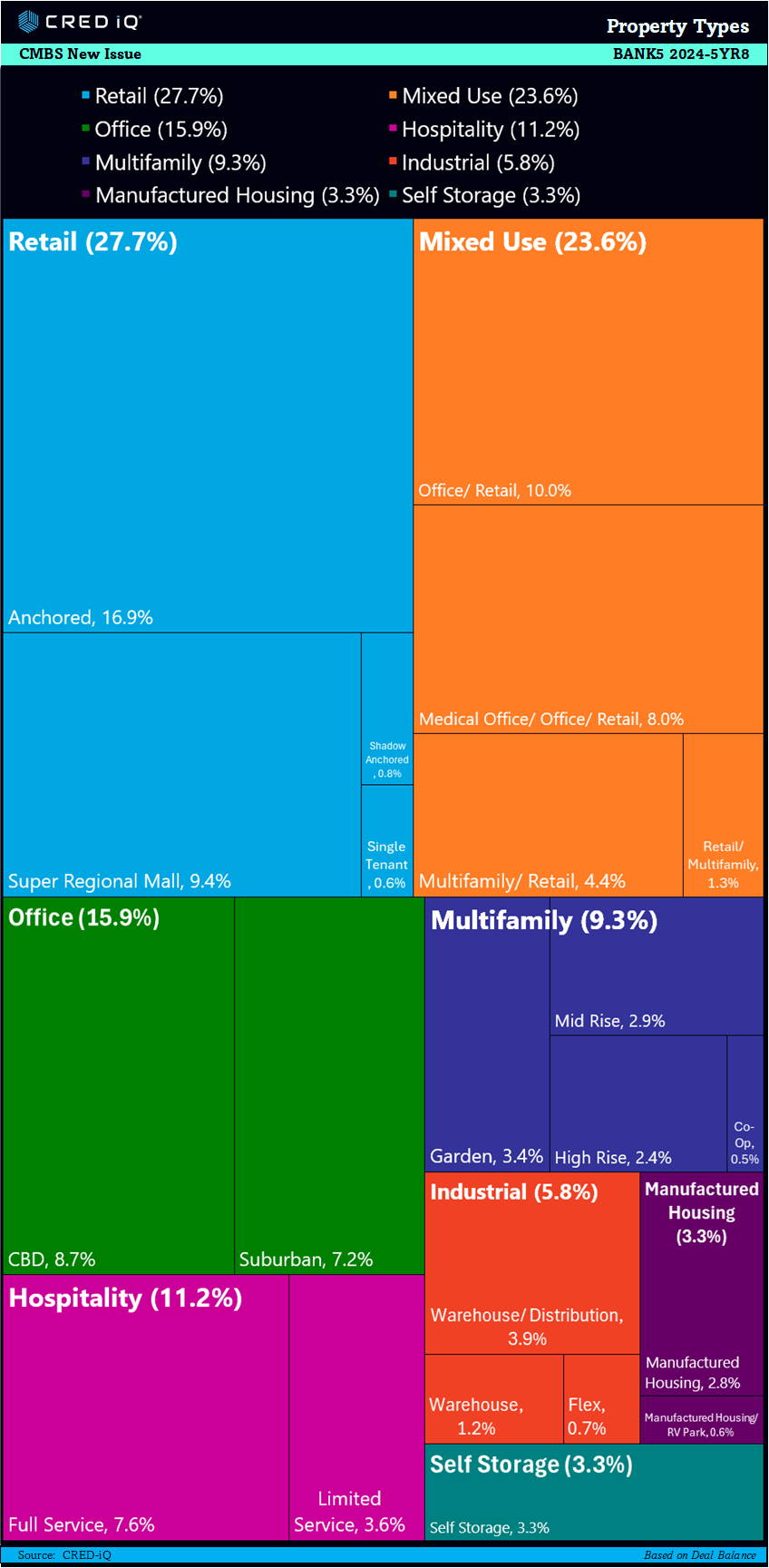

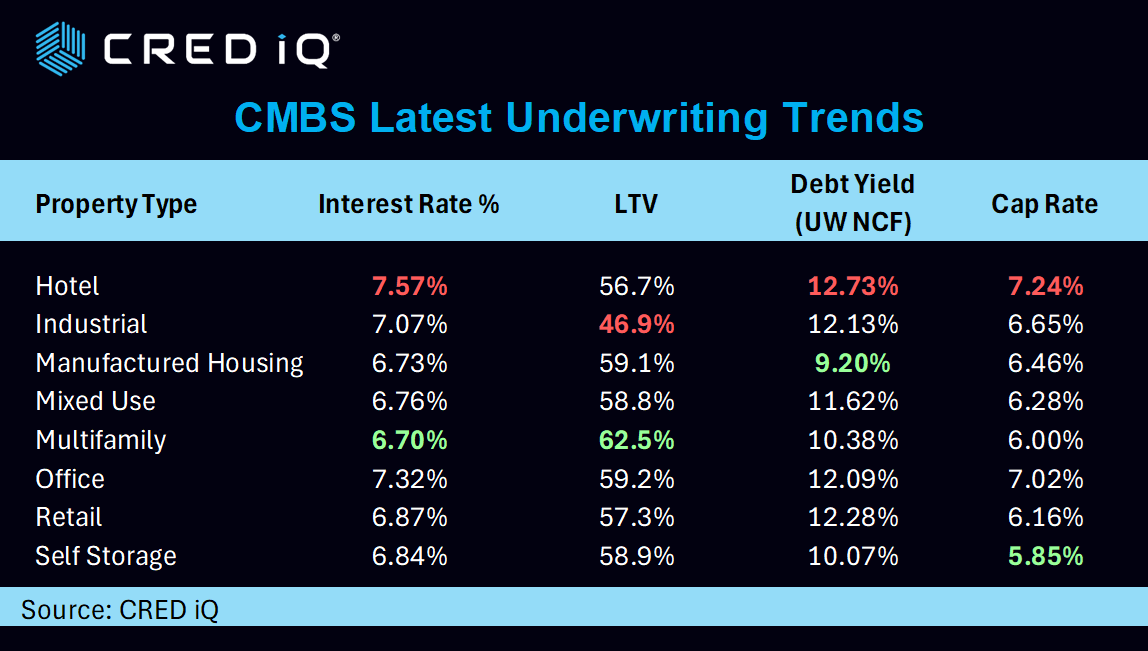

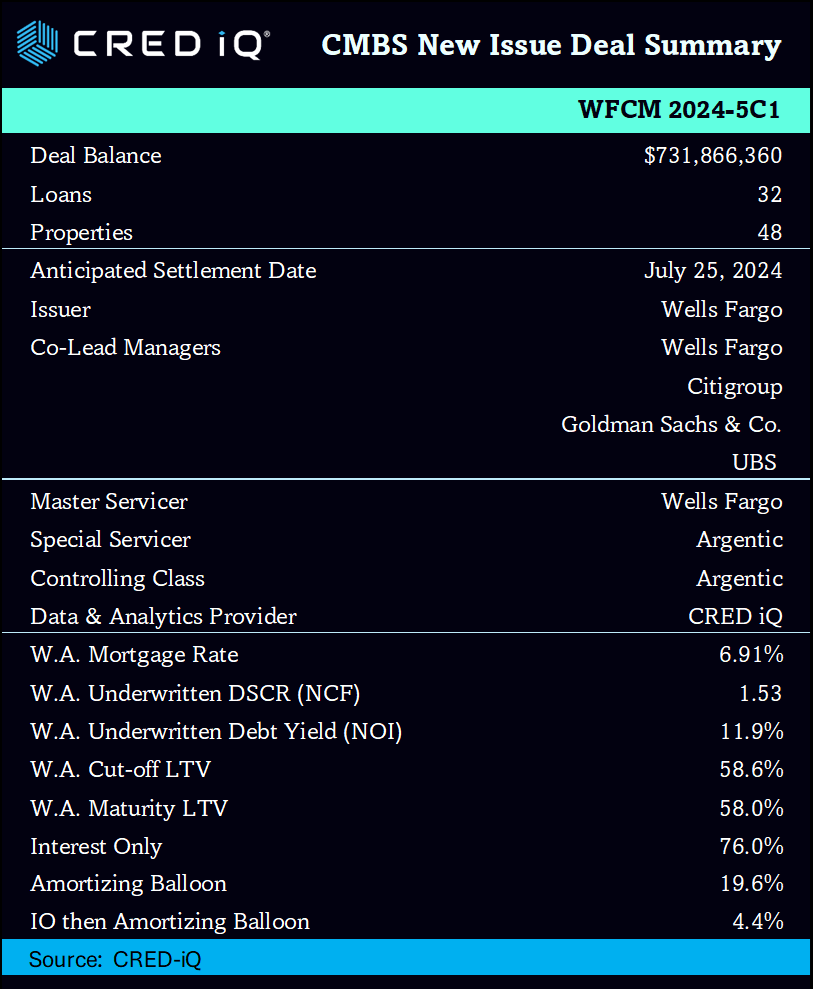

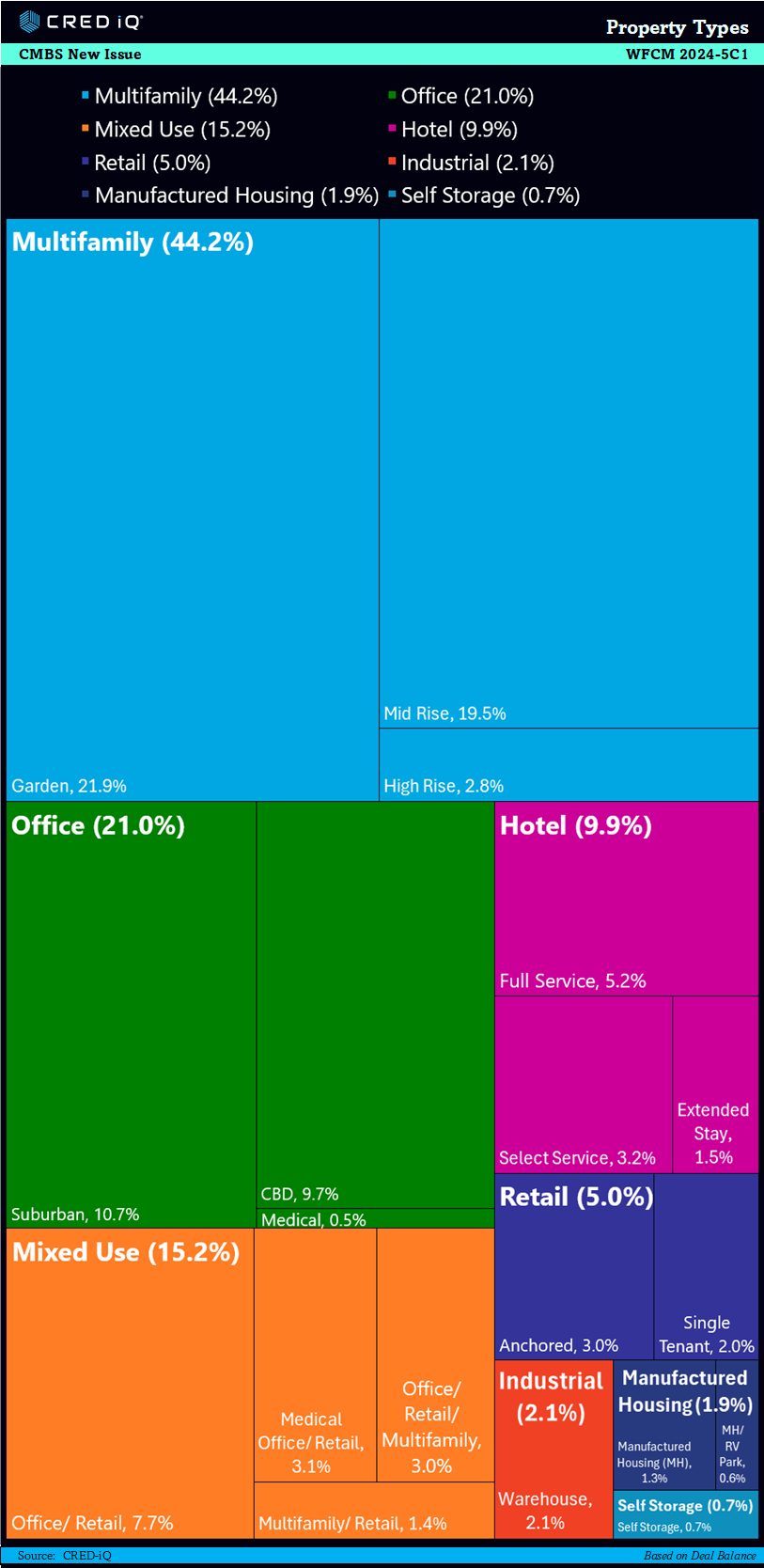

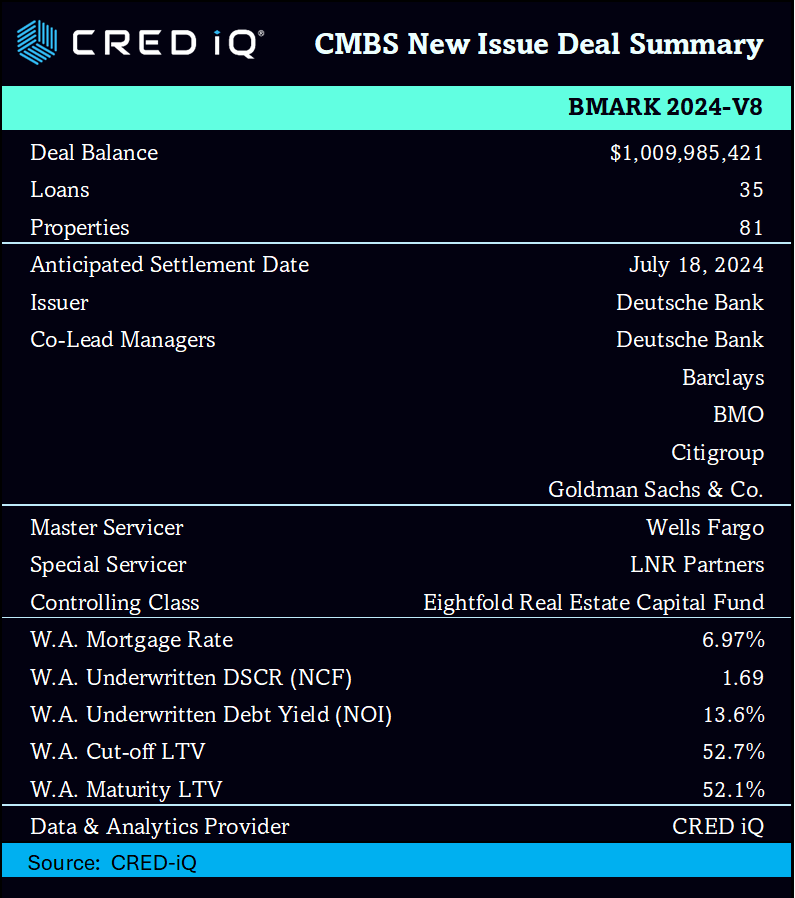

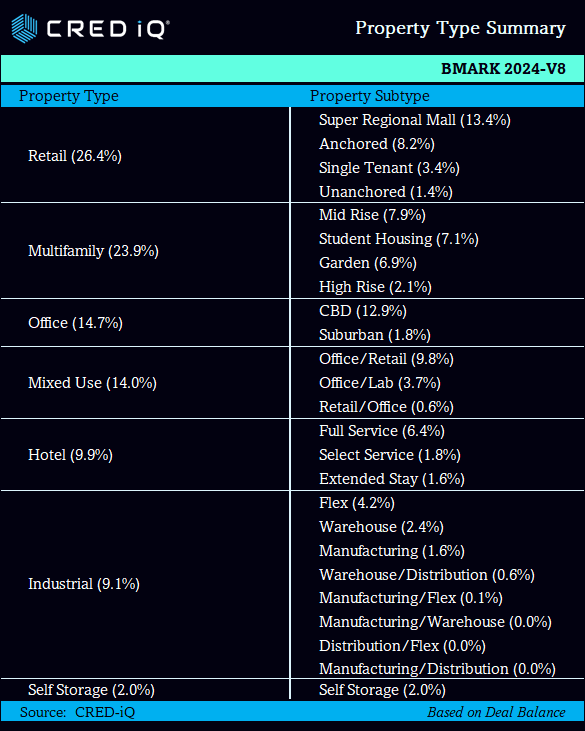

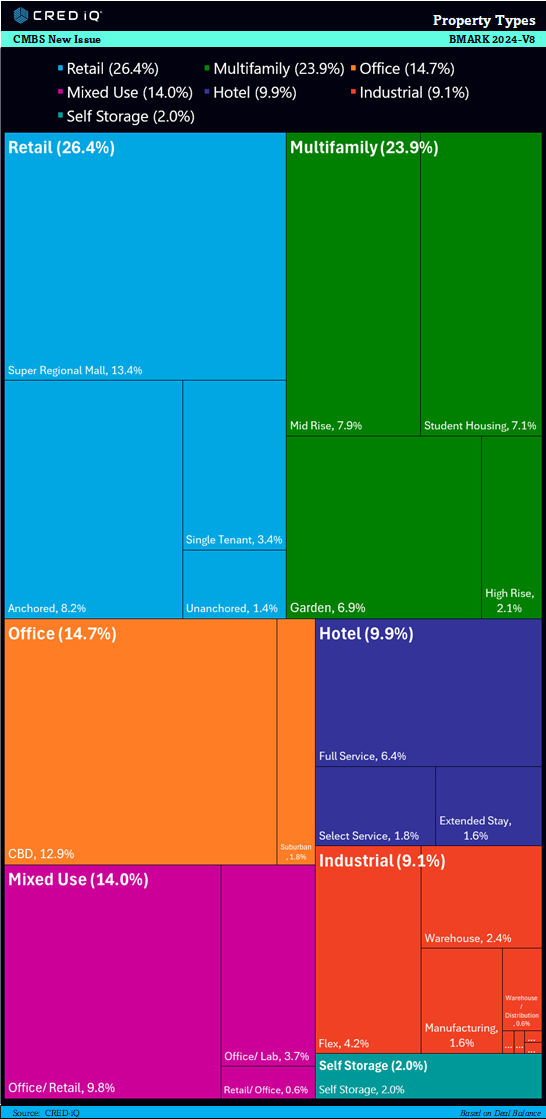

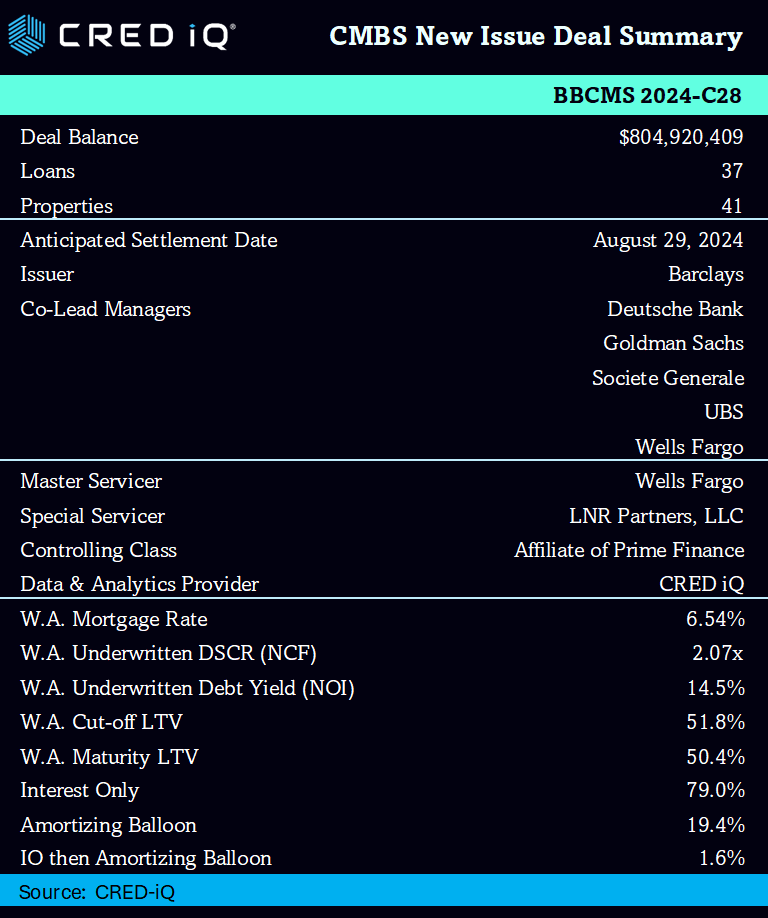

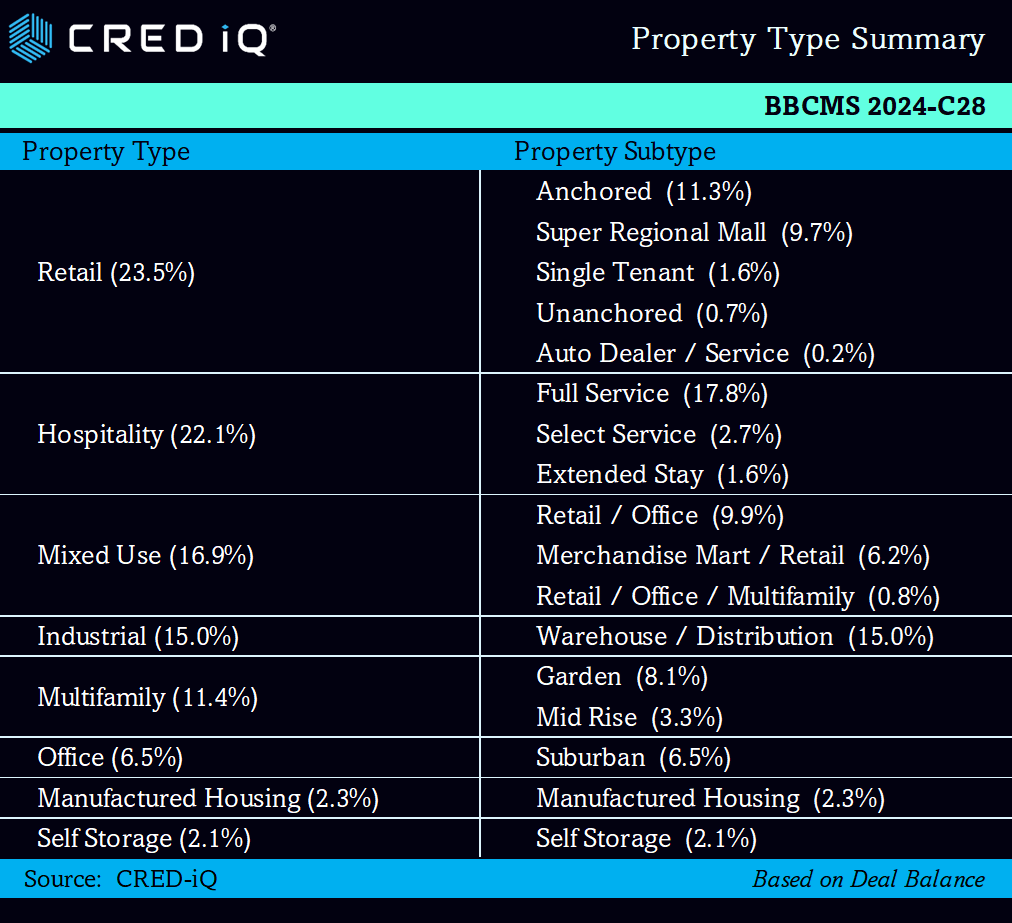

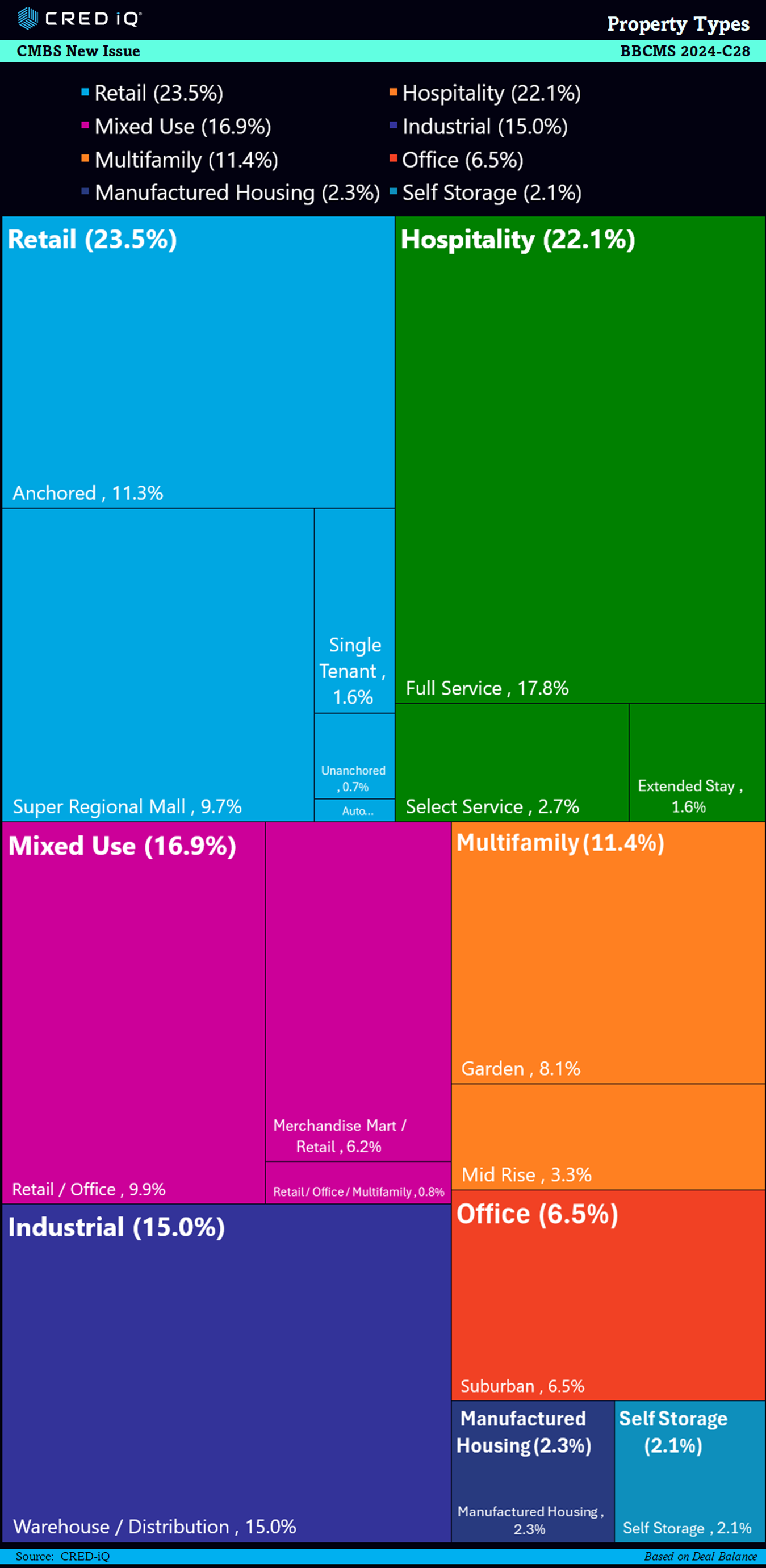

The BBCMS 2024-C28 CMBS deal is an extensive new issuance in the commercial mortgage-backed securities market, with a total pooled balance of approximately $804.9 million. Jointly managed by prominent financial institutions such as Barclays, Deutsche Bank, Goldman Sachs, Societe Generale, UBS, and Wells Fargo, this deal encompasses 37 loans secured by 41 properties across a variety of sectors, including retail, hospitality, mixed use, and industrial. The strategic geographic distribution of these properties ensures balanced exposure across major markets, thereby reducing regional risks and enhancing overall portfolio stability. The deal’s conservative underwriting practices are reflected in its weighted average loan-to-value (LTV) ratio of 50.4%, and the weighted average mortgage interest rate is 6.54%, which provides attractive returns for investors.

Key Metrics

The loan pool for BBCMS 2024-C28 is meticulously structured to include a mix of amortizing and interest-only loans, with 21.0% of the mortgage pool having scheduled amortization, ensuring gradual principal repayment and enhanced cash flow stability. The remaining 79.0% of the pool consists of interest-only payments throughout the loan term, offering investors a steady income stream. The pool boasts a weighted average debt service coverage ratio (DSCR) of 2.07x, signifying strong cash flow relative to debt obligations and underscoring the financial robustness of the underlying properties. Moreover, the weighted average net operating income (NOI) debt yield of 14.5% highlights the high earning potential of the assets, further reinforced by rigorous underwriting standards. These metrics collectively illustrate the sound financial performance and low-risk profile of the deal, making it an attractive proposition for investors seeking stability and reliable returns in the CRE market.

Geography & Top Assets

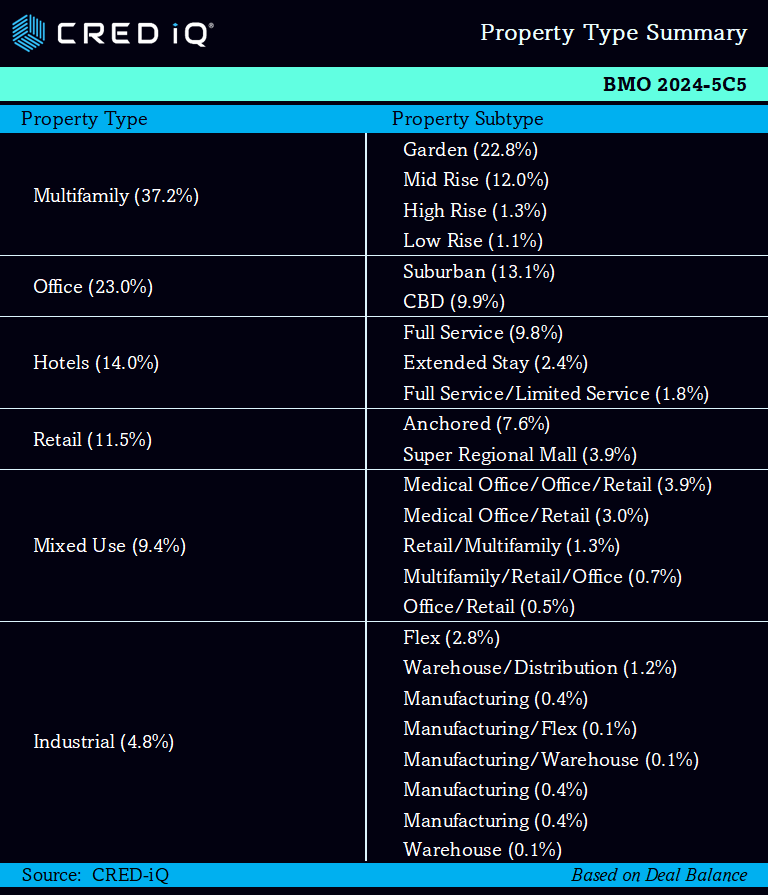

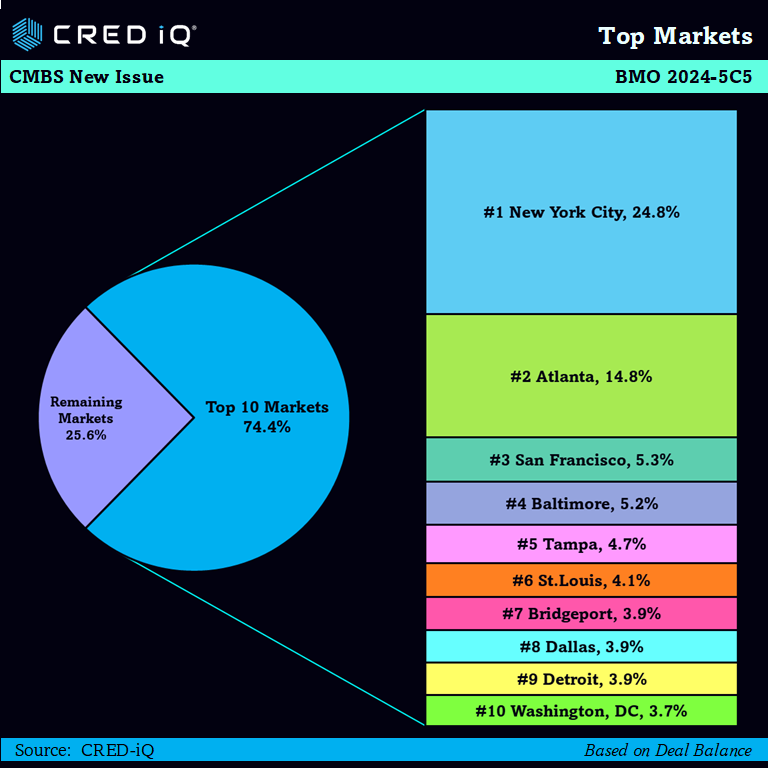

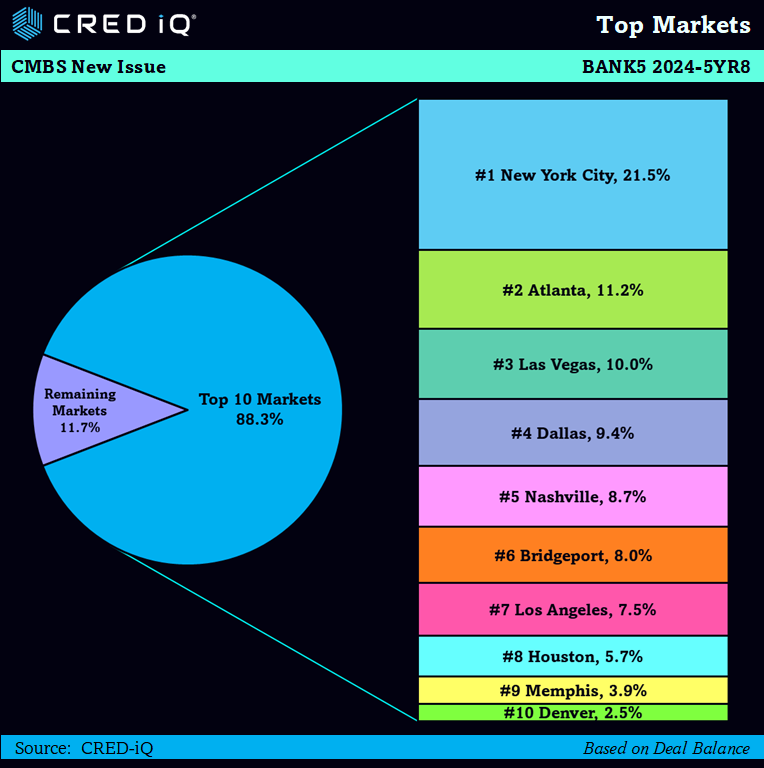

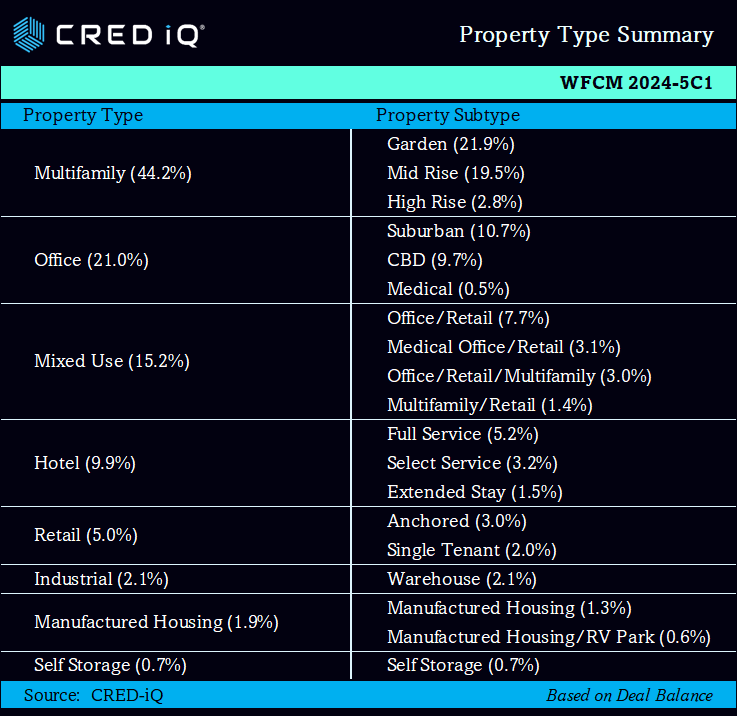

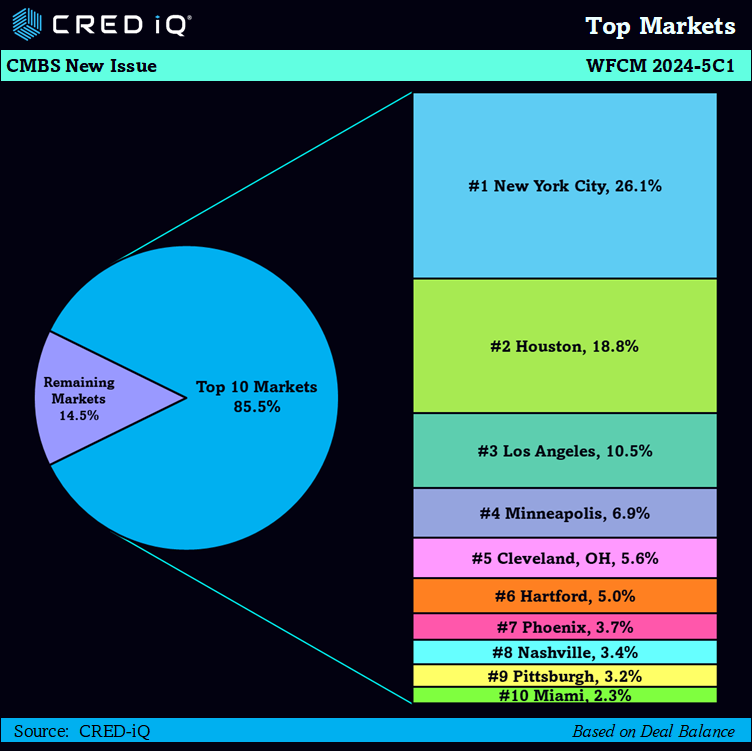

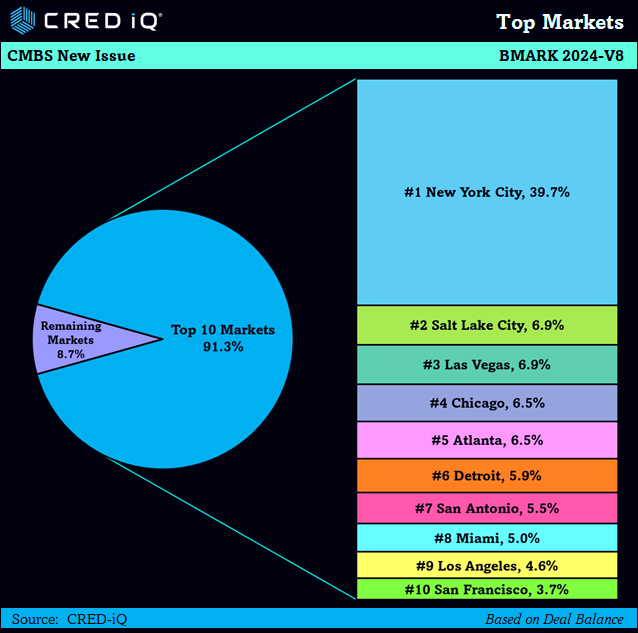

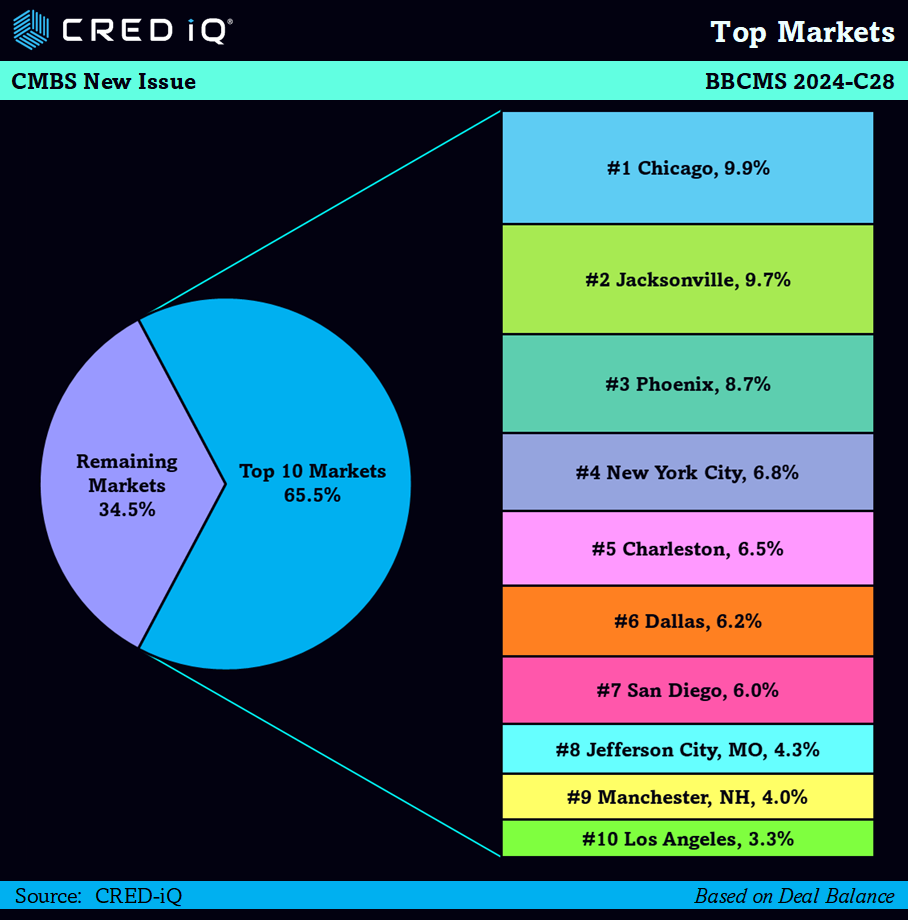

The BBCMS 2024-C28 CMBS deal also emphasizes geographic and sectoral diversification as key strengths. The properties backing the loans are strategically located in prime markets, including high-growth areas in Chicago, Jacksonville, and Phoenix ensuring exposure to dynamic economic environments. This geographic spread mitigates the impact of localized economic downturns, providing a buffer against regional market volatility. Sector-wise, the inclusion of retail, hospitality, mixed use, and industrial properties ensures a balanced portfolio that can adapt to shifting market conditions and demand patterns. The deal also features robust credit enhancement through subordinate classes, which provide an additional layer of protection for senior tranche investors.

For subscribers to CRED iQ

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals. With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

If you would like to learn more about CRED iQ’s products and services, please contact team@cred-iq.com or (215) 220-6776.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING SOLD IN AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARD WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.