As 2025 comes to a close, the CRED iQ research team wanted to take a moment and reflect upon a year which was filled with uncertainty, elevating distress and even optimism.

In this issue, we look back at 2025 and the stories that captured the markets. As we get ready to turn the page on 2025, we are pleased to present our most-read research of the year.

1. Maturity Wall Grows with $440 Billion Coming Due Over the Next Two Years

This blog explores the expanding “maturity wall” in CRE, where a staggering $440 billion in loans are set to mature within the next two years. It discusses the challenges borrowers face in refinancing amid higher interest rates and tighter lending conditions, potentially leading to increased defaults or forced sales. Key implications include heightened market volatility and opportunities for distressed asset investors.

2. Cap Rate Trends are Steadily Increasing

The post analyzes the upward trajectory of capitalization rates across various CRE sectors, signaling a shift toward higher yields as property values adjust to economic pressures. It highlights factors like inflation, rising borrowing costs, and reduced investor appetite, with data showing consistent quarter-over-quarter increases. Readers gain insights into how this trend affects valuation strategies and investment returns.

3. Multifamily Distress Volumes Hits 12-Year High

Focusing on the multifamily sector, this article details how distress volumes have reached levels not seen in 12 years, driven by factors such as oversupply, rent growth slowdowns, and operational challenges. It includes metrics on delinquent loans and foreclosures, offering comparisons to historical peaks. The summary underscores risks for lenders and opportunities for value-add strategies in affected markets.

4. The Hottest U.S. Multifamily Markets in 2025

This forward-looking piece identifies the top U.S. multifamily markets poised for growth in 2025, based on factors like population influx, job creation, and rental demand. It ranks cities or regions with strong fundamentals, such as low vacancy rates and robust economic drivers. Investors can use these insights to prioritize allocations in high-potential areas amid broader sector uncertainties.

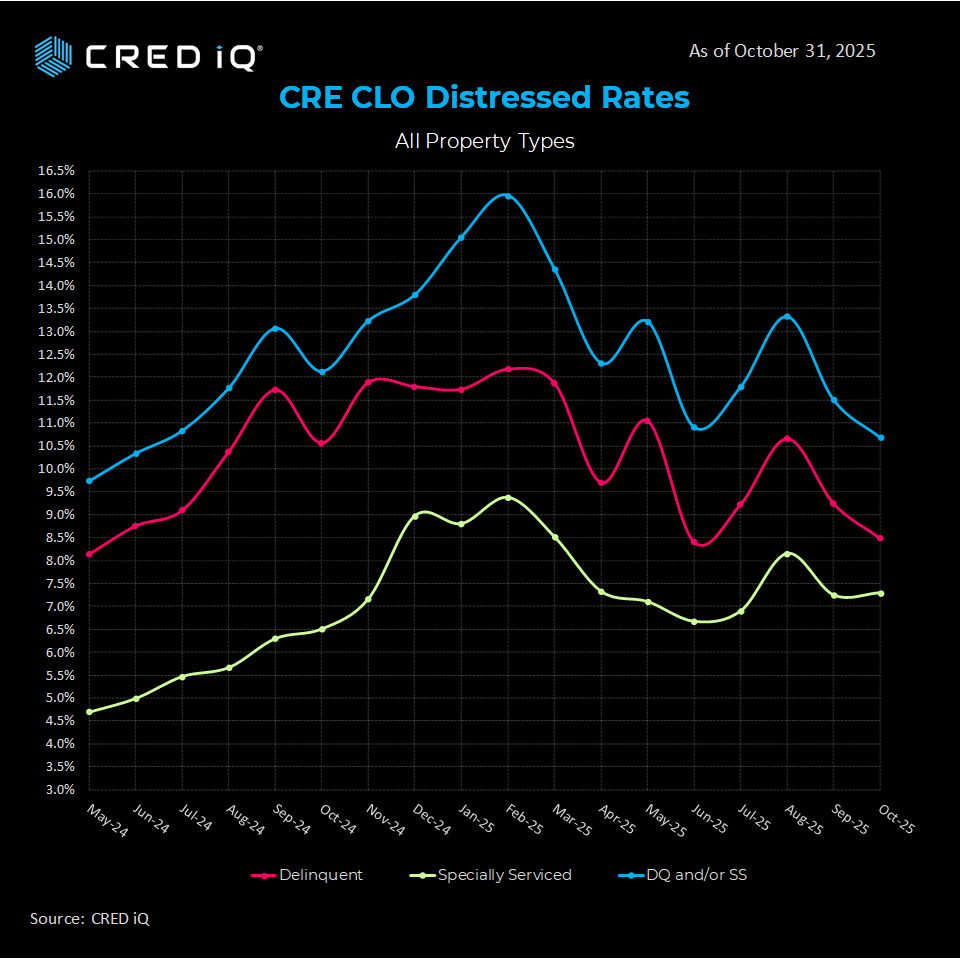

5. CRE CLO Distress Rate Drops 230 Basis Points in June

The blog reports a significant decline in distress rates for commercial real estate collateralized loan obligations (CRE CLOs) by 230 basis points in June, indicating a potential stabilization or recovery phase. It examines underlying causes, such as improved liquidity or policy interventions, with breakdowns by asset class. This positive shift suggests easing pressures in structured finance, though ongoing monitoring is advised.

6. The Extend & Pretend Surge: $40 Billion in CRE Loan Modifications Signals a Shifting Market

This analysis covers the surge in “extend and pretend” strategies, where $40 billion in CRE loans have been modified to delay maturities and avoid defaults. It discusses how lenders and borrowers are navigating high interest rates through restructurings, with implications for market transparency and future distress. The post highlights this as a sign of adapting to prolonged economic headwinds.

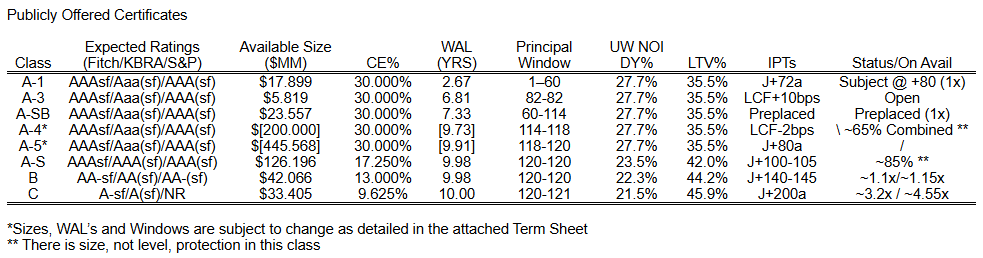

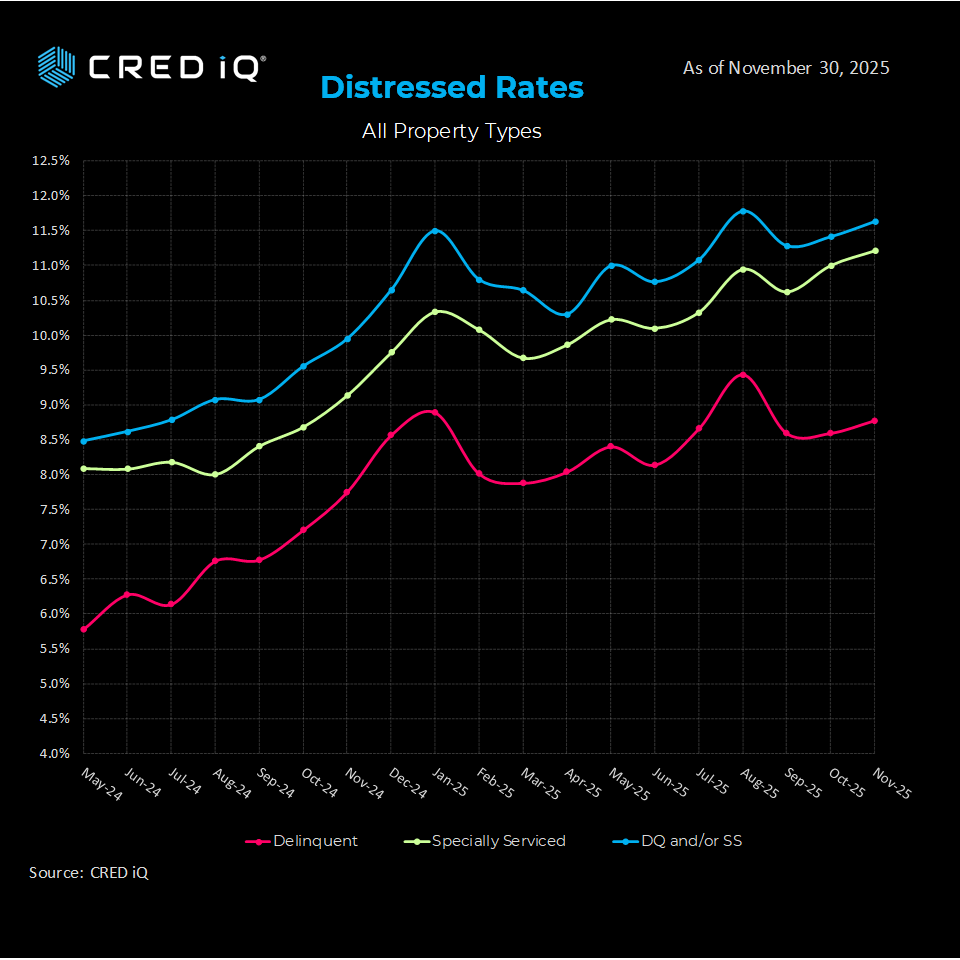

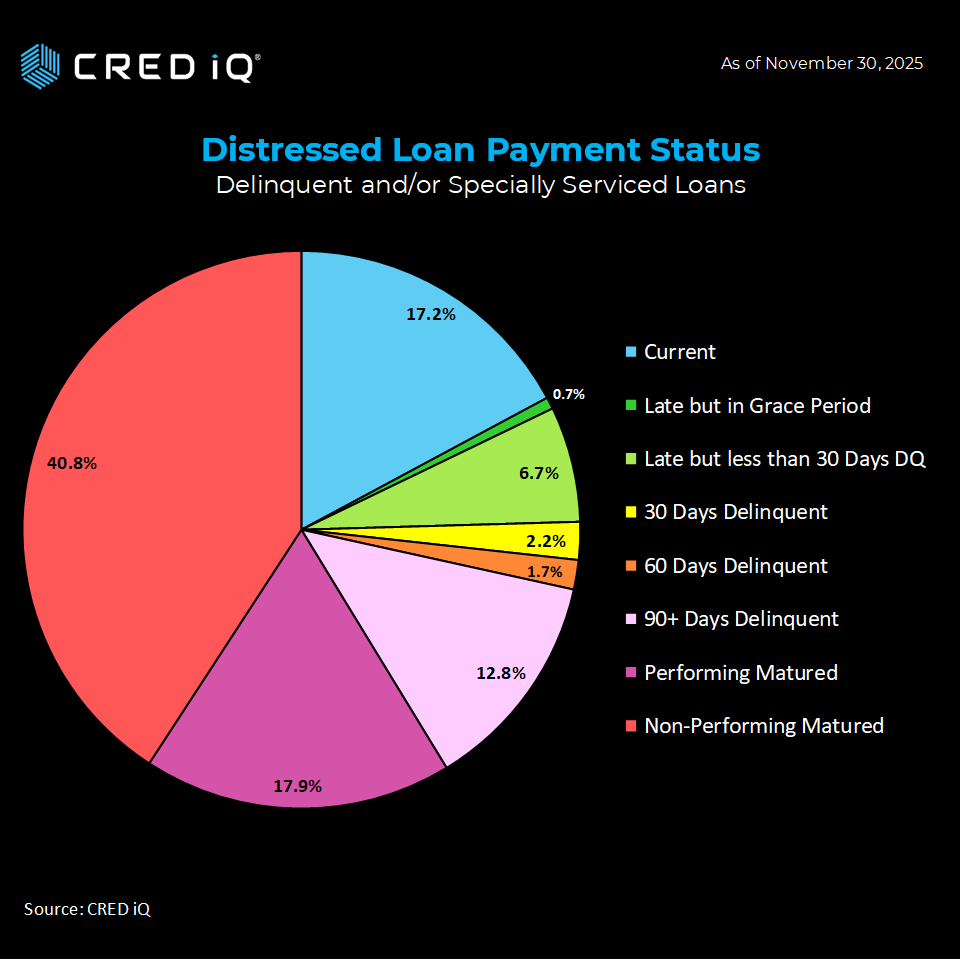

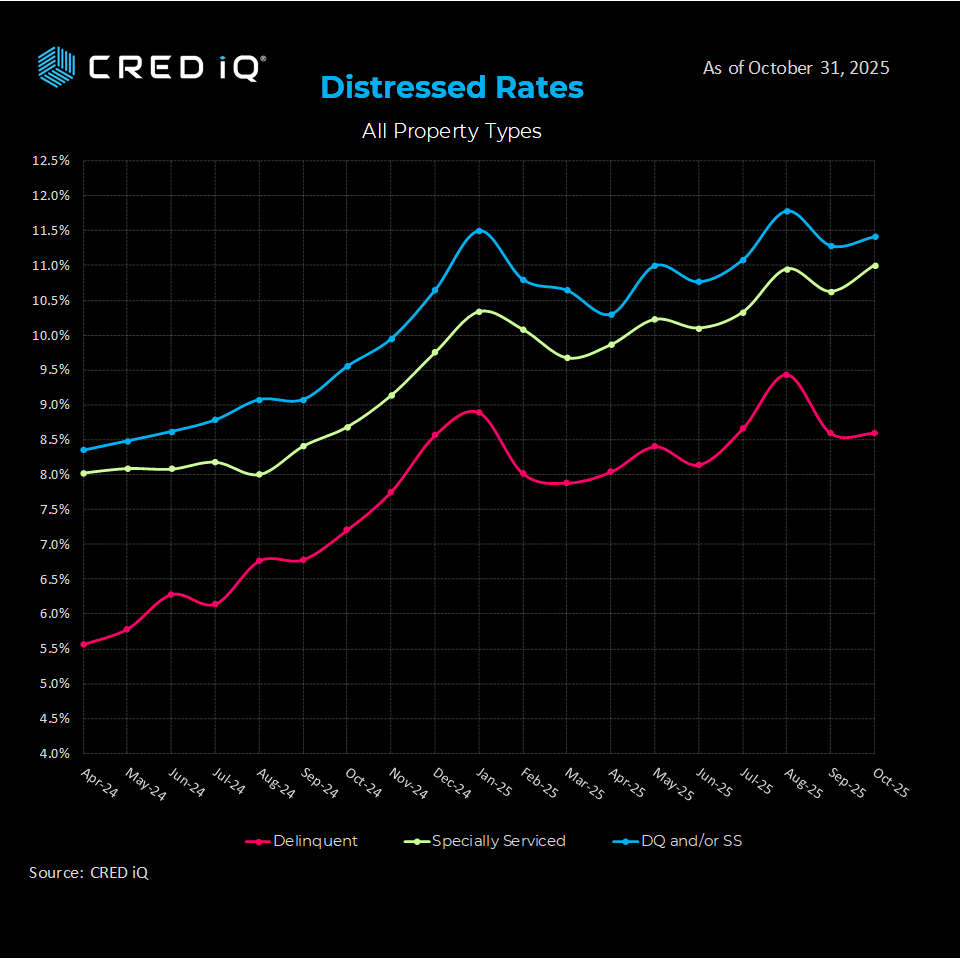

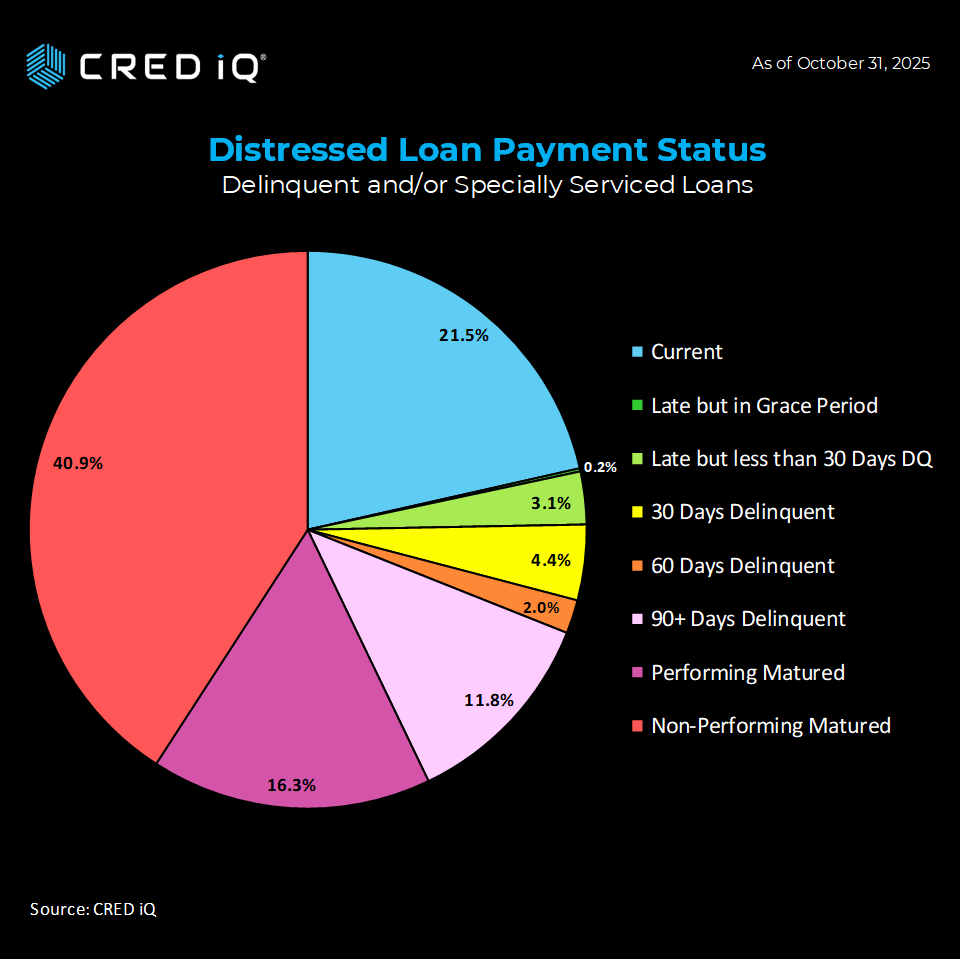

7. CMBS Distress Rate Reaches 11% – Breaking a Streak of 3 Consecutive Reductions

Detailing a reversal in trends, the article notes that commercial mortgage-backed securities (CMBS) distress rates have climbed to 11%, ending a three-month decline. It breaks down contributions from sectors like office and retail, with data on special servicing transfers. This uptick signals renewed concerns over asset performance and could influence investor sentiment in securitized markets.

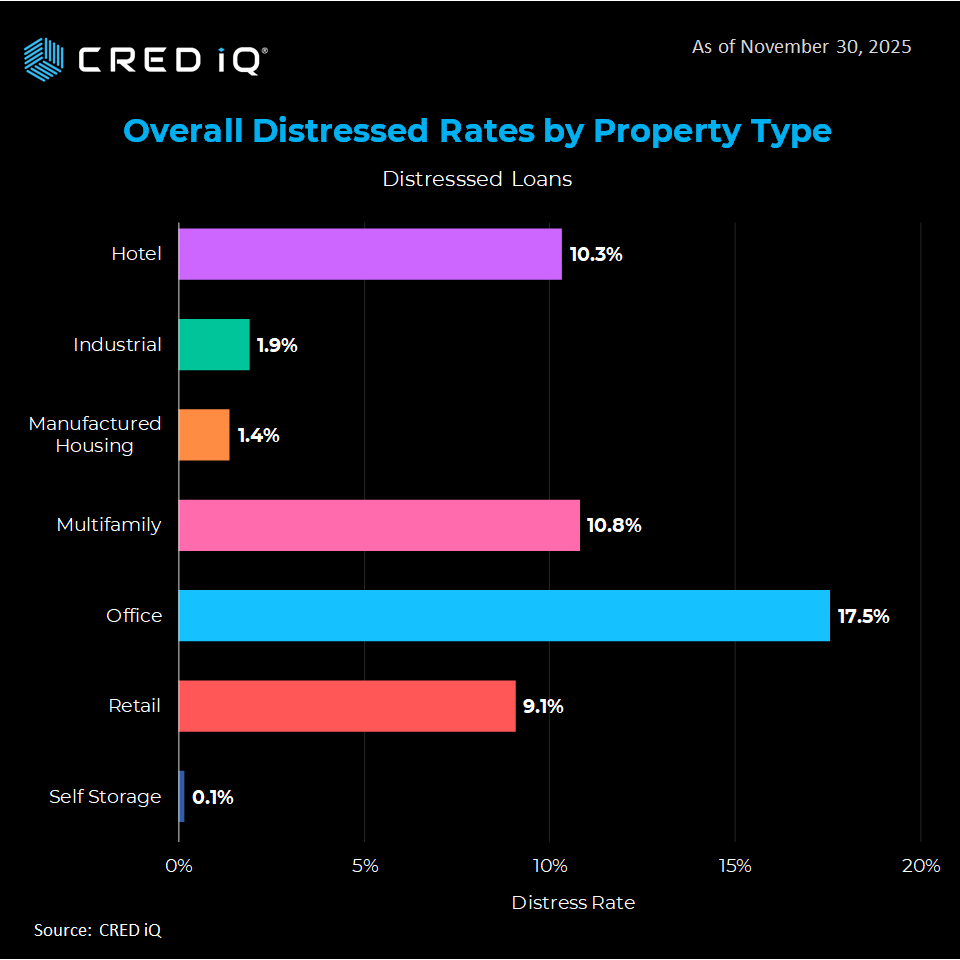

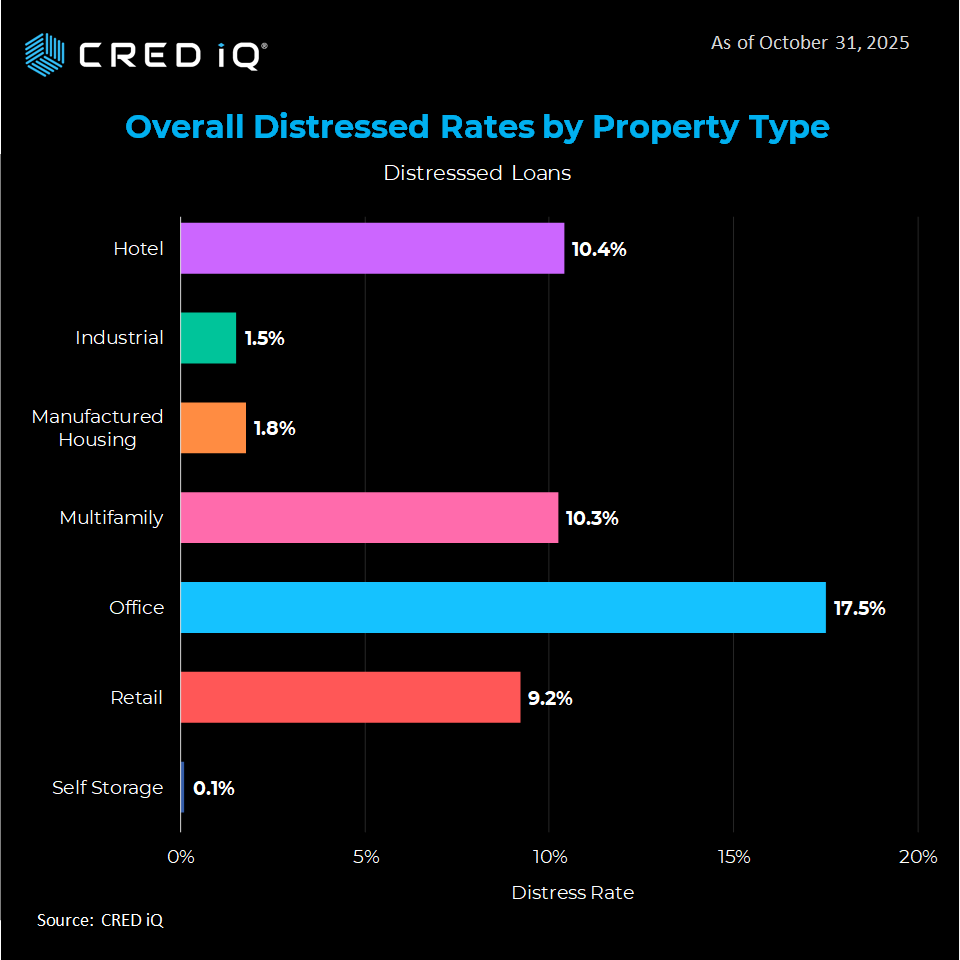

8. Office Distress Rate Eclipses 17%

The post examines the office sector’s distress rate surpassing 17%, amid persistent remote work trends and vacancy spikes. It includes regional variations and loan performance metrics, attributing the rise to obsolescence and reduced demand. Implications focus on the need for repurposing strategies and the long-term outlook for office investments.

9. Tracking CRE Delinquency Trends: Insights from the Great Financial Crisis to Q1 2025

This historical overview tracks CRE delinquency trends from the 2008 Great Financial Crisis through Q1 2025, providing comparative data on peaks, recoveries, and current trajectories. It identifies patterns in delinquency rates across property types, offering lessons for risk management. The analysis helps contextualize today’s environment against past cycles, aiding in forecasting potential resolutions.

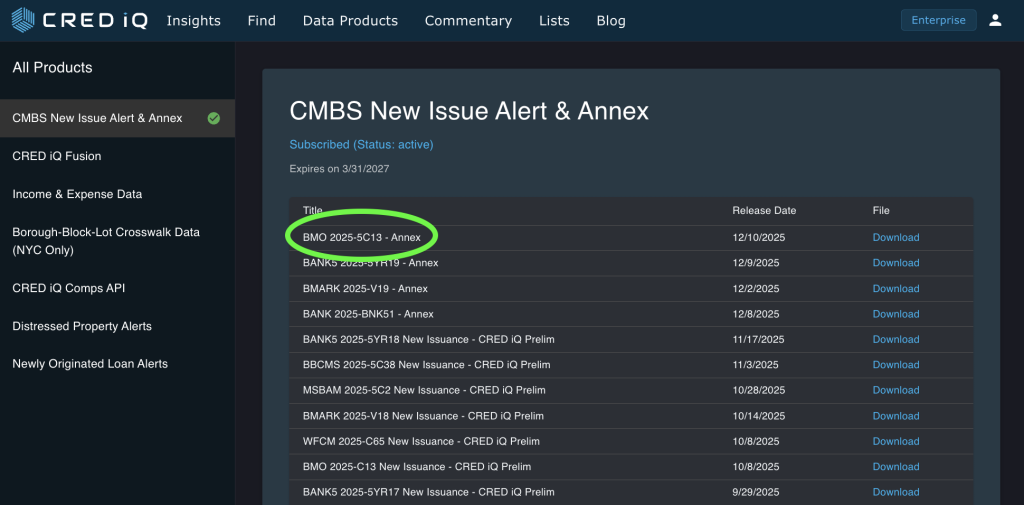

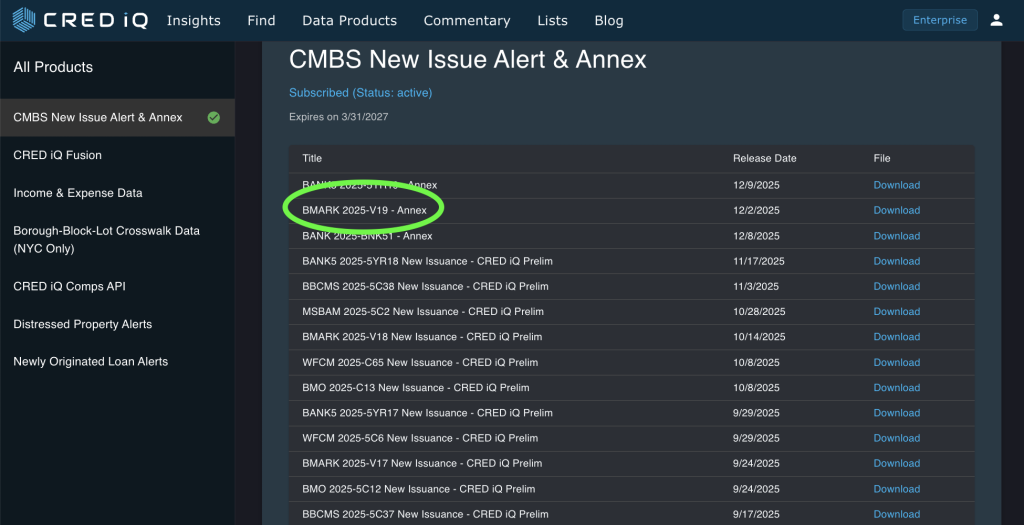

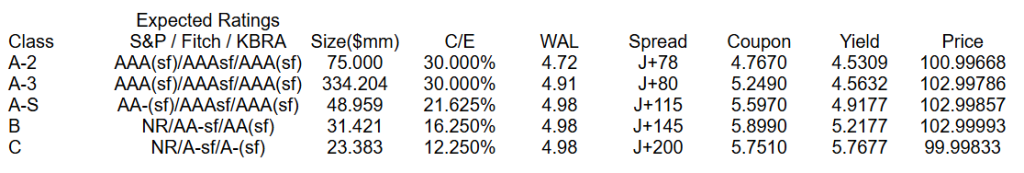

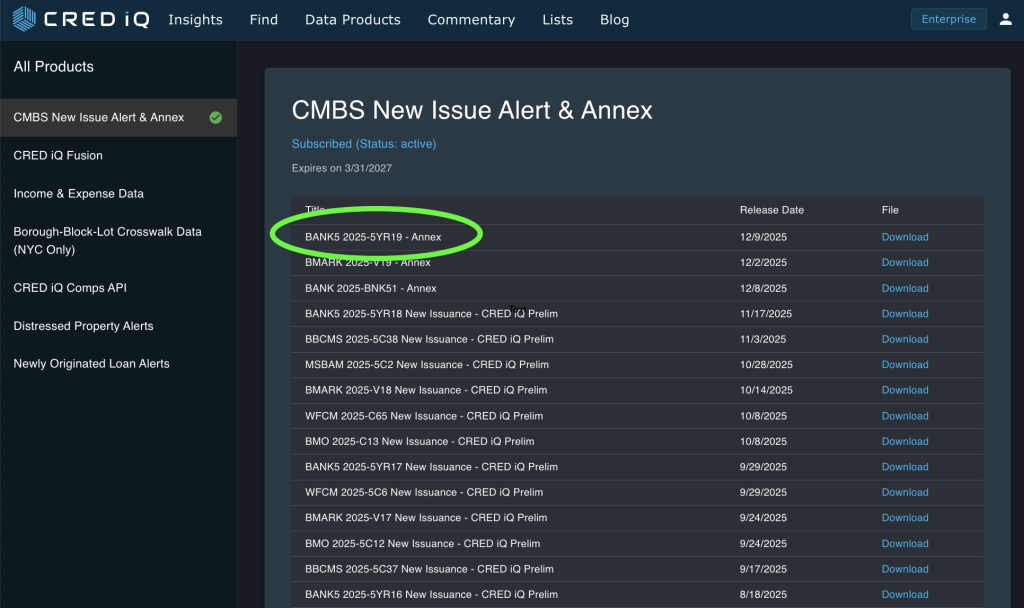

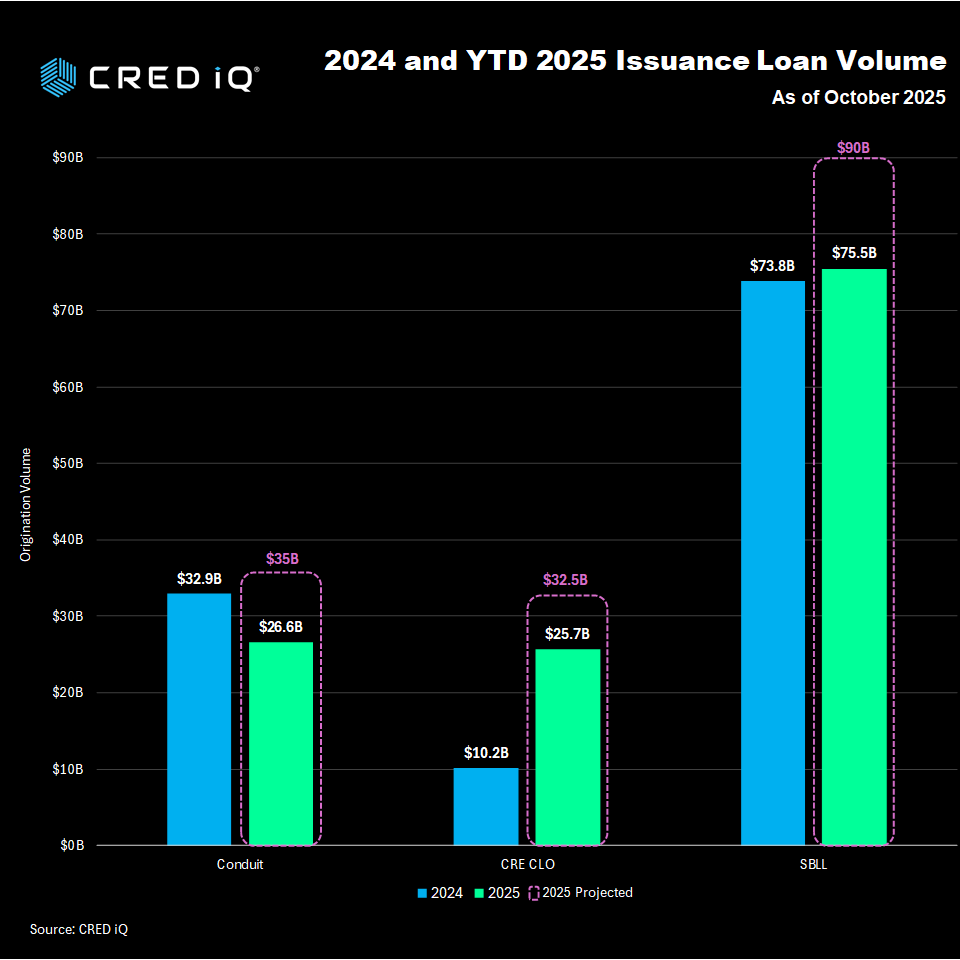

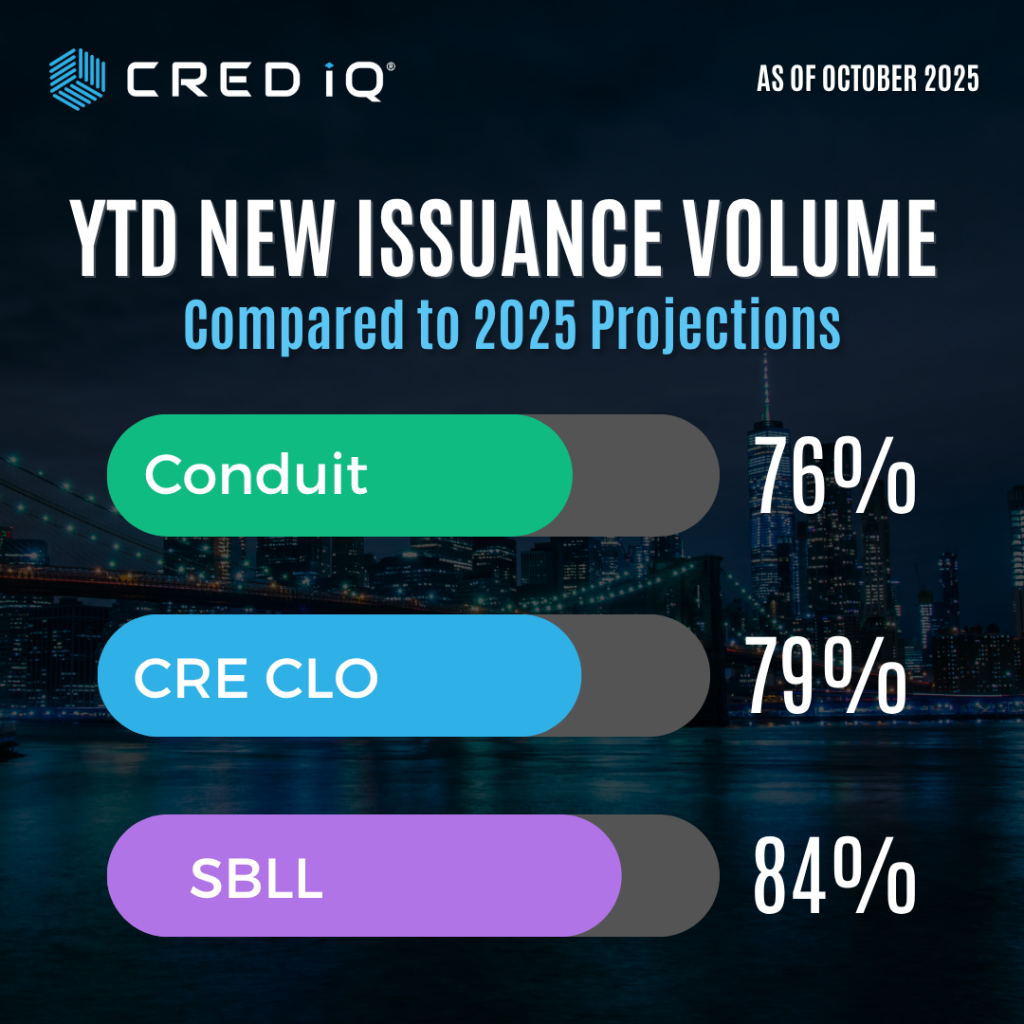

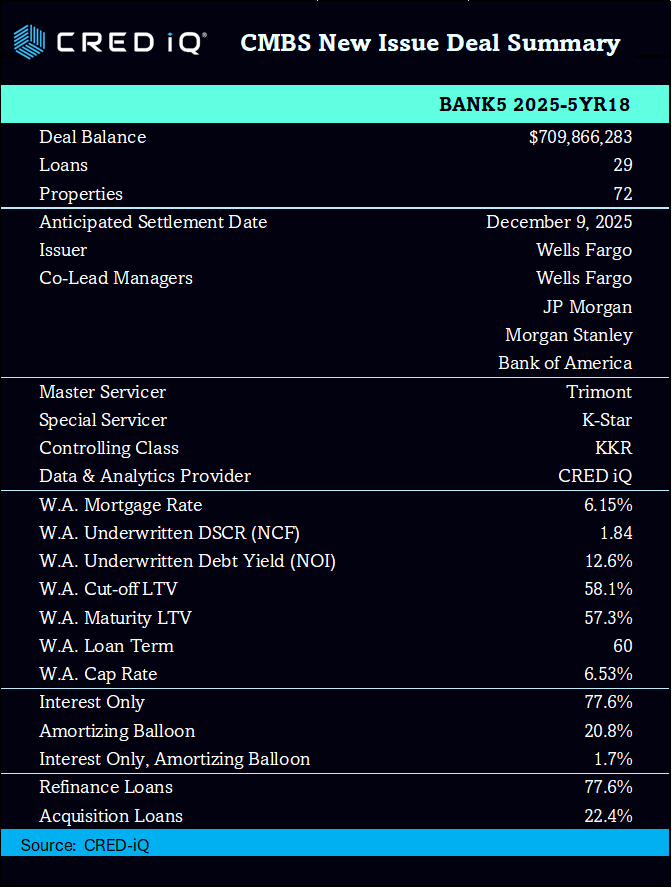

10. Top CMBS Conduit Originators of 2025 – A Mid-Year Review

Offering a mid-year snapshot, the blog ranks the leading originators of CMBS conduit loans in 2025, based on volume and market share. It discusses key players’ strategies, deal structures, and shifts in origination activity amid evolving regulations. This review provides valuable benchmarks for industry participants tracking securitization trends and competitive dynamics.