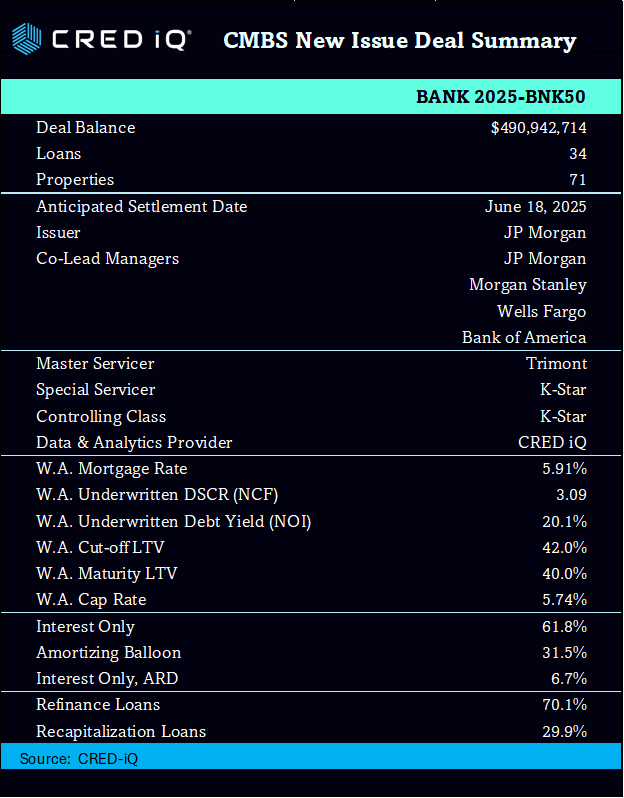

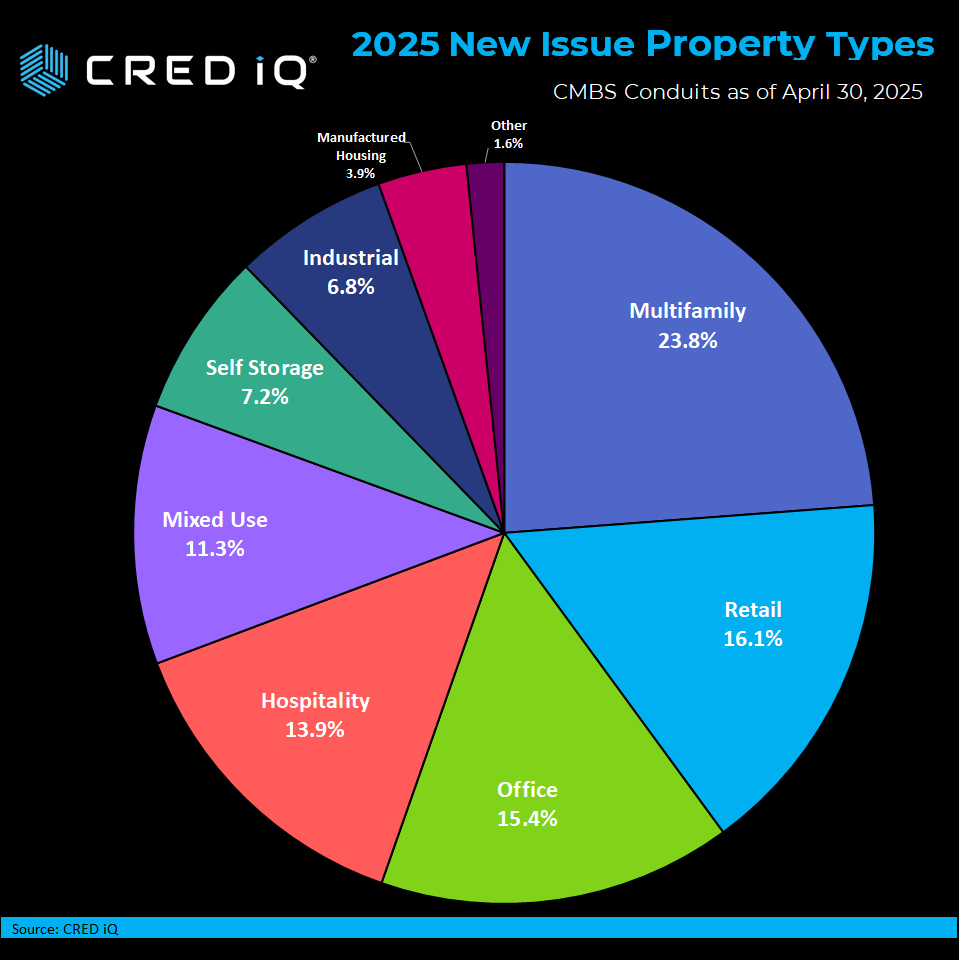

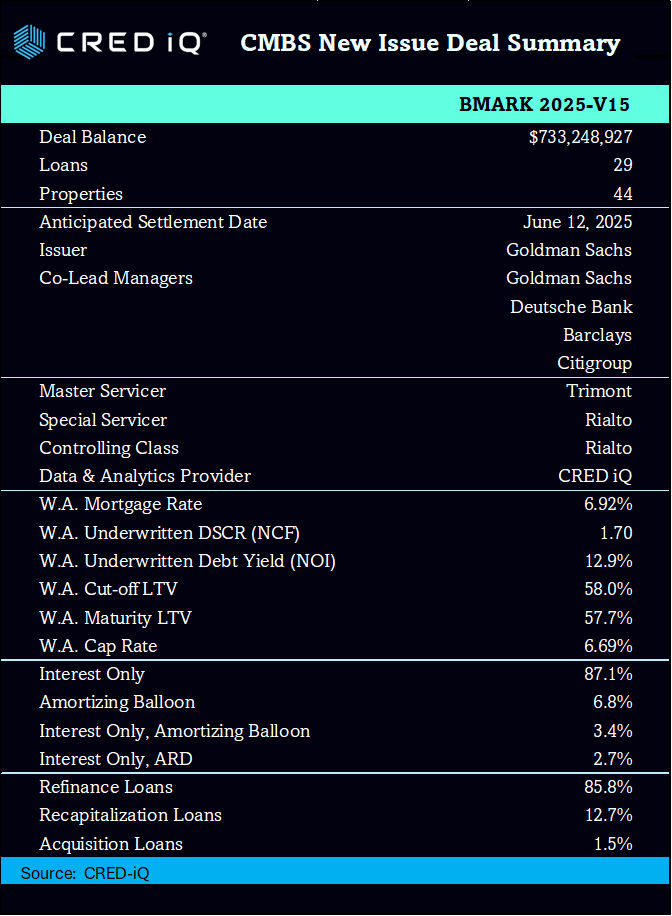

CRED iQ analyzed underwriting metrics for the latest 10 transactions that have been packaged into CMBS securitizations. Our analysis examined cap rates, interest rates, and debt yields. We further broke down these statistics by property type and then compared our results to CRED iQ’s previous report issued in February.

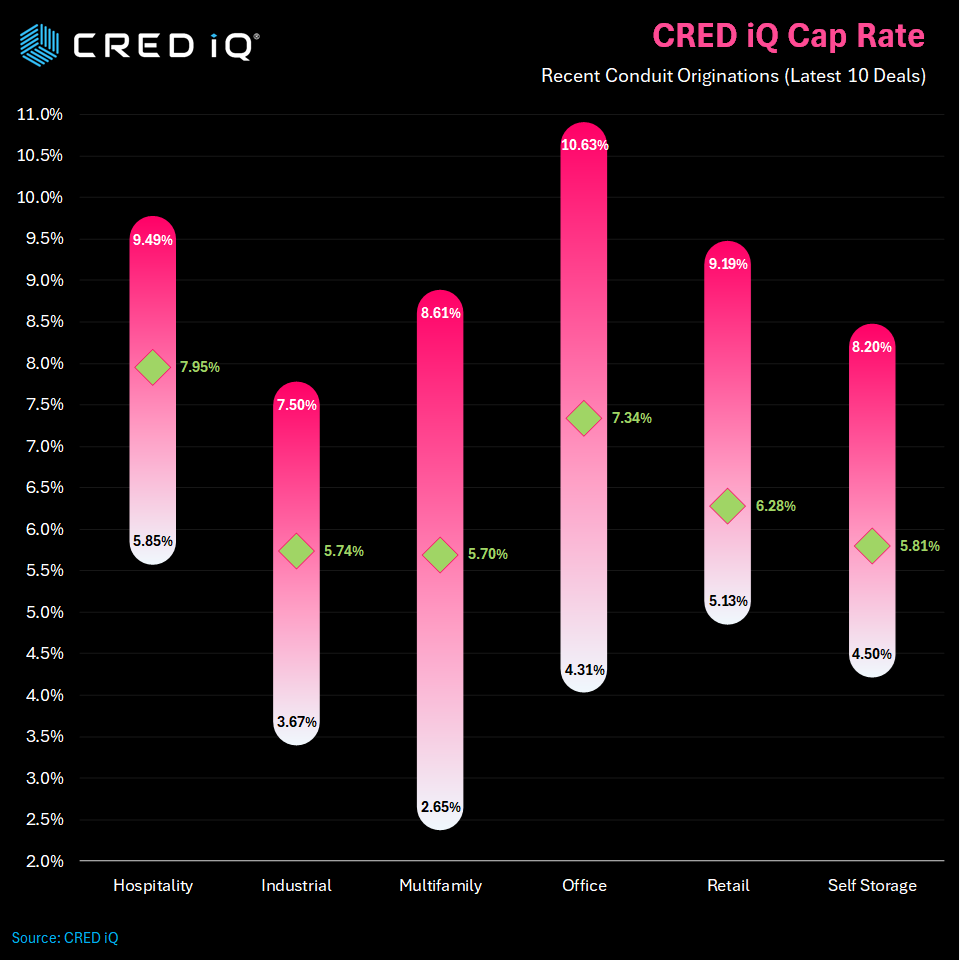

Cap Rate Analysis

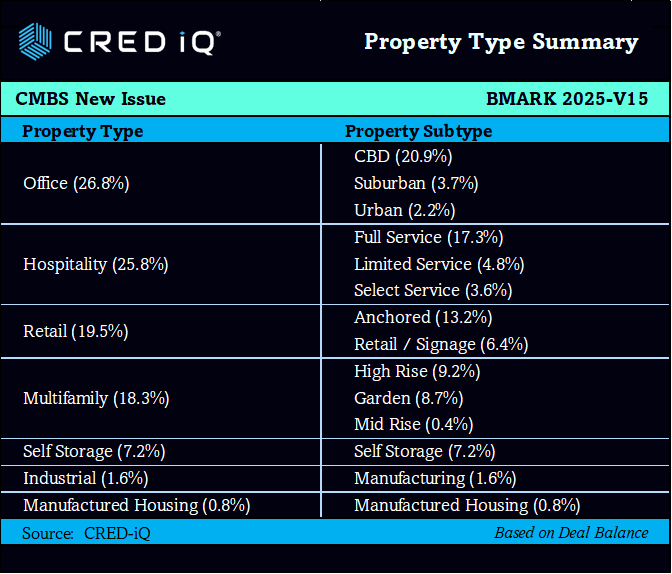

Office cap rates ranged from 4.31% to 10.63% with an average of 7.34%, down 10 BPS February print (7.44%). Multifamily cap rates ranged from 2.65% to 8.61% with an average of 5.70%, which is down from an average of 5.91% from February. Retail cap rates ranged from 5.13% to 9.19% with an average of 6.28%, down 41 BPS.

Cap Rates for industrial assets ranged from 3.67% to 7.50% with an average of 5.74%, which is down from 6.38% in the February print. Self storage cap rates ranged from 4.50% to 8.20% with an average of 5.81%, which is down 41 basis points from our previous February print. Hospitality cap rates ranged from 5.85% to 9.49% with an average of 7.95%, which is up from 7.31% in Q1. Hospitality was the only segment with a upward trajectory on average cap rates.

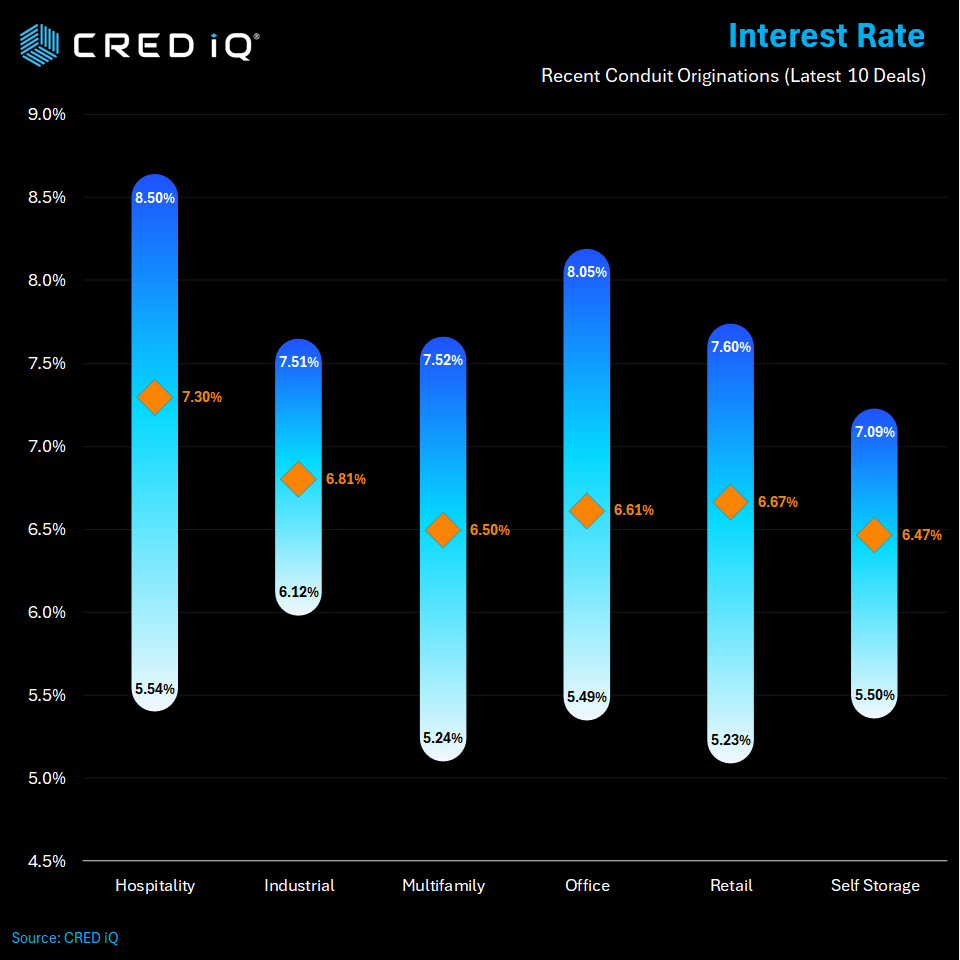

Interest Rate Analysis

Office interest rates ranged from 5.49% to 8.05 % with an average of 6.61%, which is down 5 BPS from 6.66% in Q3 2024. Interest rates for multifamily loans in CMBS deals ranged from 5.24% to 7.52% with an average of 6.50%, which is also down 8 basis points from 6.58%. Retail interest rates ranged from 5.23% to 7.60% with an average of 6.67%, which is up from an average of 6.51% in the February print.

Average interest rates for industrial assets ranged from 6.12% to 7.51% with an average of 6.81%, up from 6.38% in mid-Q1. Self storage interest rates ranged from 5.50% to 7.09% with an average of 6.47%, up 18 BPS. Hospitality rates ranged from 5.54% to 8.50% with an average of 7.30%, up from 6.89% in the February print.

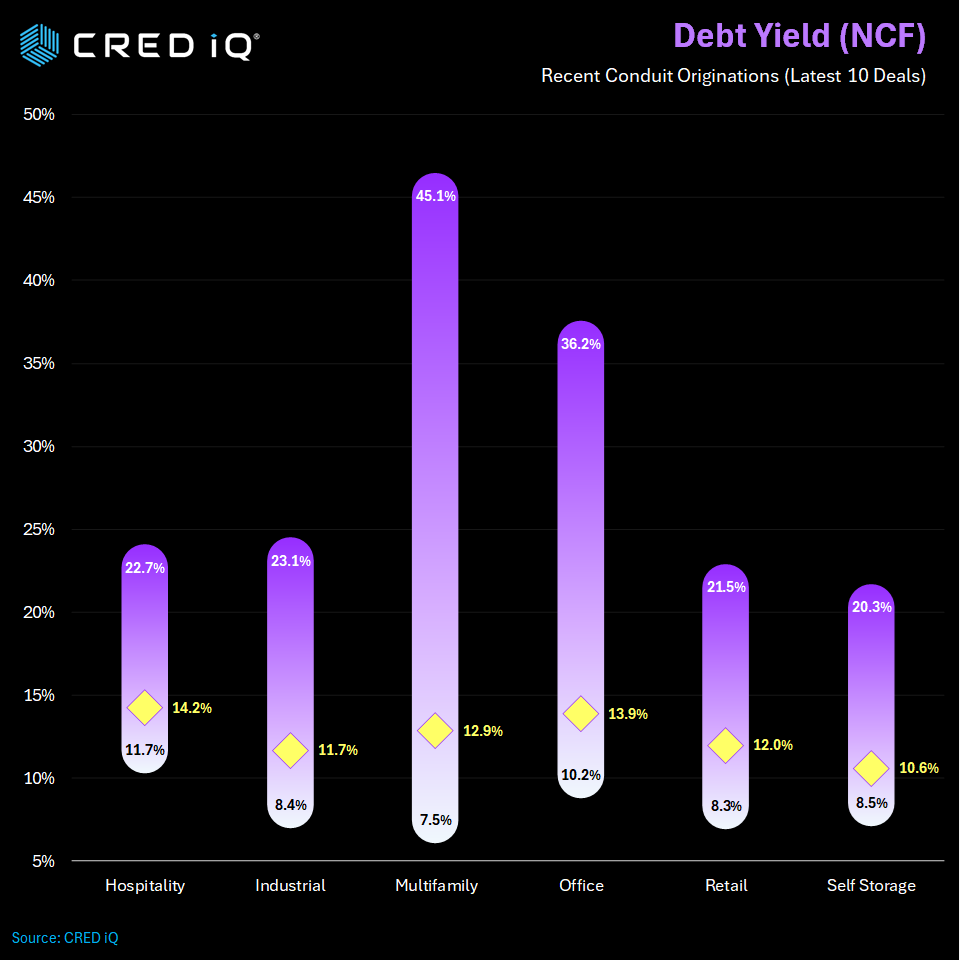

Debt Yield Analysis

Debt yield trends for offices ranged from 10.2% to 36.2% with an average of 13.9%, which is up from 13.0% in February. Average debt yields for multifamily loans in CMBS deals ranged from 7.5% to 45.1% with an average of 12.9%, which is up 340 basis points from an average of 9.50% in the prior quarter. Retail debt yields ranged from 8.3% to 21.5% with an average of 12.0%, which is up from an average of 11.6% in mid-Q1.

Macro Takeaways

Comparing loan volumes to our February report, the office segment saw a 123% increase in properties –the highest of all property types. Multifamily came in second with a 71% increase. Meanwhile hospitality and industrial notched the greatest decrease in property/loan volumes at -78% and -76%, respectively. From a deal balance perspective, office saw the greatest increase since February (+92%), while industrial (-58%) logged the biggest decrease.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.