This week, CRED iQ calculated real-time valuations for five specially serviced loans that have not received an updated appraisal or BOV. The CRED iQ valuations factor in a base-case (Most Likely), a downside (loss of major tenant), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and contact information, sign up for a free trial here.

3 Park Avenue

667,446-sf CBD Office, New York City, NY 10016

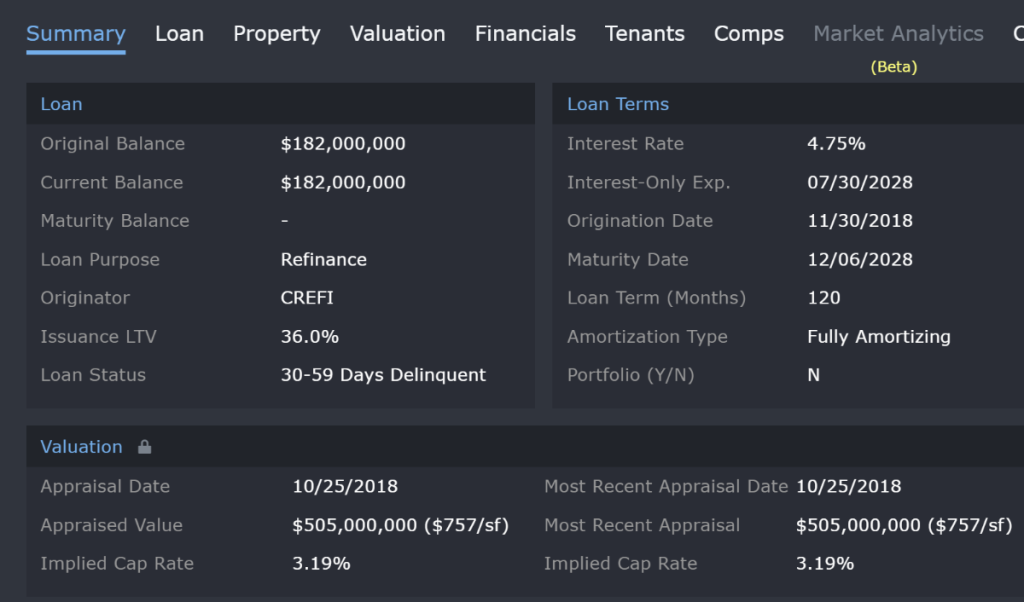

The $182.0 million senior loan transferred to the special servicer in March 2021 for delinquency and a low DSCR. 3 Park Avenue, a 667,466 SF office and retail building located on the corner of 34th Street and Park Avenue in New York, NY. Borrower is both the Landlord and the Tenant on the leasehold estate. The property was developed in 1975, compromised of 41 stories with ~640,000 SF of office space and ~26,000 SF of retail space.

As of May 2021, the loan is showing delinquent and has been delinquent at least three times in within the last 12 months. The Borrower presented the Lender with a relief request related to COVID-19 economic impact. ROR Letter was mailed certified to the Borrower. The occupancy as 09/30/2020 also decreased below 80% of UW occupancy to 61.54% from the 85.47% as of 09/30/2019. YTD09 2020 DSCR is 1.23x compared to YE 2019 DSCR of 1.77x. For the full valuation report and loan-level details, click here.

One City Centre

602,122-sf, CBD Office, Houston, TX 77002

The loan transferred to the special servicer in March 2021 for imminent monetary default. CRED iQ ran an updated valuation that valued the office tower at $58.7 million ($98/sf) given its current occupancy of 28.5%.

Tenant Rents and other revenue are in Cash Sweep. PNA was signed by Borrower and discussions took place with SS. March financials and April rent roll were provided. The Major Tenant – Waste Management did not sign a new lease and elected to vacate the building the end of 2020. Borrower is not willing to fund the operating shortfall and debt service monthly. Borrower is asking to utilize funds held in Sweep Account to pay for operating expenses and Waste Management credit owed for overpayment of 2020 operating costs. For the full valuation report and loan-level details, click here.

Arbor Place Mall

546,374-sf, Regional Mall, Douglasville, GA

The Loan transferred to special servicing on 4/22/20 for imminent monetary default. The Borrower stated that they were not going to be able to cover shortfalls at the property. The loan is secured by a regional mall located in Douglasville, GA.

The Lender is working with the Borrower on a loan modification to determine if there are reasonable terms that can be negotiated that are acceptable to the Lender. The Borrower has kept the loan payments current, and the parent company of the Borrower has filed bankruptcy along with the Guarantor for this loan. Midland is monitoring the bankruptcy to determine if there is any action needed by the lender. For the full valuation report and loan-level details, click here.

Mall St. Matthews

668,508-sf Regional Mall, Louisville, KY 40207

The property is a 673,782 sf regional mall in Louisville, KY. Borrower was unable to pay off the loan on the maturity date. The special Servicer is currently in discussion with the borrower on a potential workout and/or deed-in-lieu. For the full valuation report and loan-level details, click here.

Meadows Mall

308,620-sf Regional Mall, Las Vegas, NV 89107

The loan transferred to MLS Special Servicing 10-1-2020 due to Monetary Default. Cash trap has been sprung and all rents are being swept into the lockbox. Borrower has requested forbearance, and that Lockbox funds be released to fund operating expenses. BOV and Appraisal have been received. Discussions to arrive at a sustainable resolution are ongoing. For the full valuation report and loan-level details, click here.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: