This week, CRED iQ calculated real-time valuations for 5 distressed properties that have recently transferred to special servicing, including a storied New York City hotel and a couple of mixed-use projects. The CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

Royalton Park Avenue

(Gansevoort Park Avenue)

249 Keys, Full-Service Hotel, New York, NY 10016

This $124.0 million loan transferred to special servicing on June 3, 2021 due to imminent default. The loan is secured by a luxury boutique hotel that is lcoated in the NoMad submarket of Manhattan and operates under the Royalton brand. Although the mortgage loan was originated in 2012, when the hotel was operating under the Gansevoort brand, the property was acquired for $200 million, equal to $800,000 per key, in 2017 by a joint venture between GreenOak Real Estate and Highgate Hotels. The hotel is temporarily closed and the earliest available reservations were for September 1, 2021.

Although COVID-19 was cited a contributing factor for the transfer to special servicing, the property had operational concerns pre-pandemic with a DSCR of 0.52 in 2019 based on $4.7 million in NCF. This represented a 70% decline since origination. The hotel had a net loss of $8.7 million in 2020 and a modification for relief in the form of relaxed cash management and reserve requirements was previously granted in May 2020. Negotiations between the borrower and LNR, as special servicer, are ongoing. For the full valuation report and loan-level details, click here.

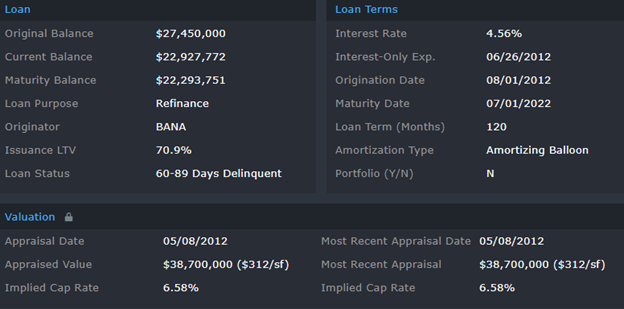

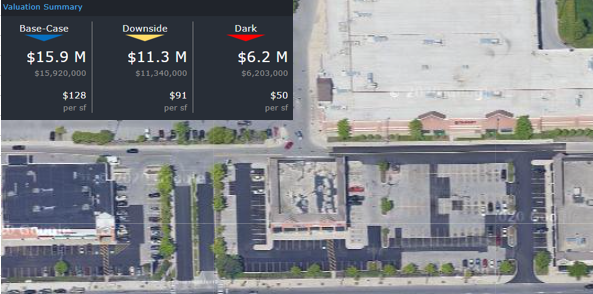

Chatham Village

124,018 sf, Retail, Chicago, IL 60619

This $22.9 million loan transferred to special servicing on June 8, 2021 due to payment default. The loan is secured by four retail buildings, including a single-tenant Walgreens outparcel, located on the South Side of Chicago. All four buildings were formerly shadow-anchored by Target, but the retailer closed the adjacent non-collateral location in 2018. Without a complementary shadow anchor, occupancy across the 3 buildings with in-line suites declined. News broke in March 2021 that Discover would convert the former Target into a credit card call center; however, the development may not produce the necessary foot traffic needed for the property’s retail tenants to achieve sales targets. For the full valuation report and loan-level details, click here.

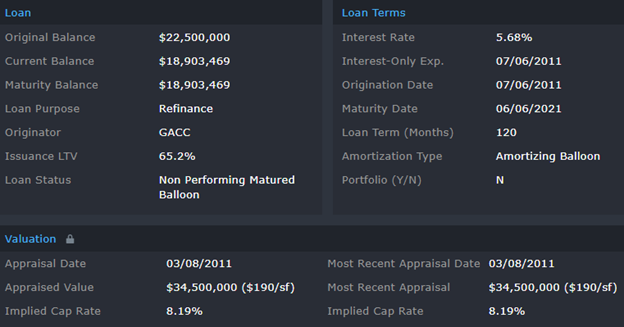

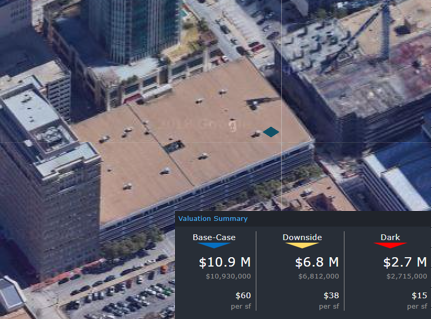

The Tower

181,285 sf Mixed-Use (Office/Retail), Fort Worth, TX 76102

This $18.9 million loan transferred to special servicing on June 1, 2021, days before its June 6, 2021 maturity date. The loan is secured by office and ground floor retail space that is part of six condominium units. Only four of the six condominium units are collateral for the loan and the condominium association pays ground rent for a portion of the building. Further complicating matters, the property has a tenant-in-common ownership structure. Check out CRED iQ’s Contacts page for more details about owners on record.

The property’s largest tenant had been Alcon Laboratories until it vacated in January 2021 through a lease termination option. Occupancy at the property declined to 48%, which may add difficulty in the borrower group’s search for refinancing options. For the full valuation report and loan-level details, click here.

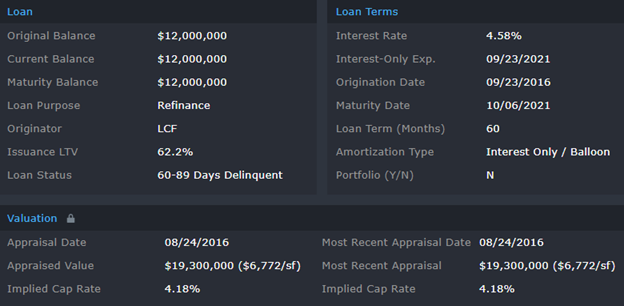

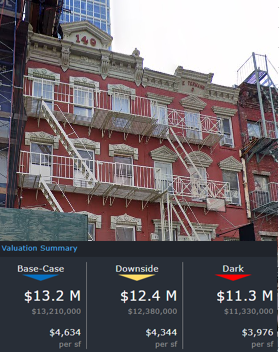

147-149 Grand Street

8,409 sf, Mixed-Use (Retail/Multifamily), New York, NY 10013

This $12.0 million loan transferred to special servicing on June 7, 2021 due to payment default. The loan is secured by a mixed-use building located in the SoHo submarket of Manhattan that contains 2,850 sf of ground-floor retail space and 6 multifamily units on the upper levels. The loan had a DSCR of 0.77 in 2020 based on $432,000 in NCF and is scheduled to mature in October 2021. Midland Loan Services, as special servicer, sent a default notice and pre-negotiation letter to the borrower. For the full valuation report and loan-level details, click here.

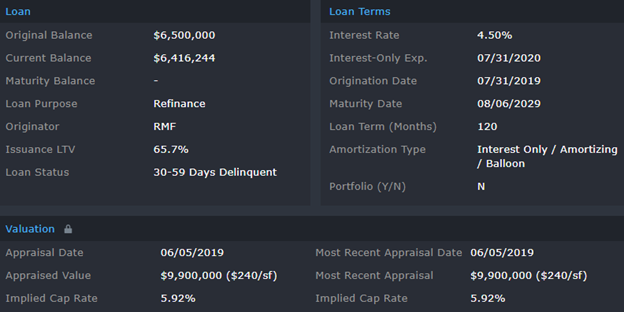

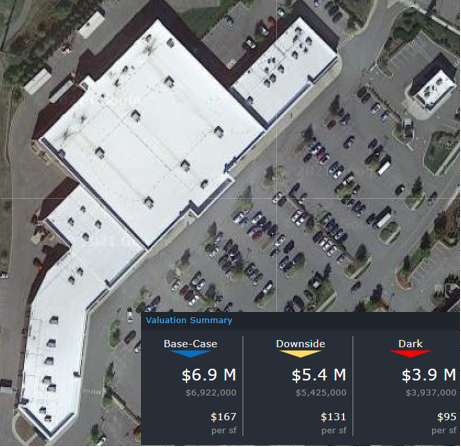

Indian Lake West Plaza

41,328 sf, Retail, Hendersonville, TN 37075

This $6.4 million loan transferred to special servicing on June 14, 2021 due to delinquency. The loan is secured by 41,328 sf of in-line retail space that is shadow-anchored by a Hobby Lobby. Occupancy declined to 84% in early 2021 when the property’s fourth-largest tenant, FitRev Gym, relocated to a nearby Walmart-anchored shopping center. Prior to the transfer to special servicing, the Borrower had cited pandemic-related hardships as a reason for the property being distressed. Complicating matters, the property’s largest tenant, Tuesday Morning, has a lease expiration in January 2022. For the full valuation report and loan-level details, click here.

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: