This week, CRED iQ calculated real-time valuations for 5 regional malls that have had title transfers in the past year and are now REO. The updated valuations serve as a follow-up to our August 18 blog – CRED iQ in the News – Regional Mall Distress. The featured assets are the 5 largest malls, by outstanding debt, that have become REO since the onset of the pandemic. One of the featured properties, Oakdale Mall, reportedly has secured a buyer with major redevelopment plants. Check out the commentary below for more detail! CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

Town Center at Cobb

559,940 sf, Regional Mall, Kennesaw, GA 30144

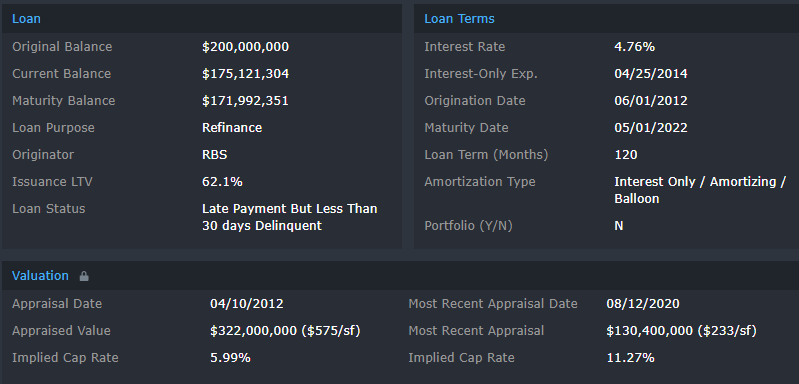

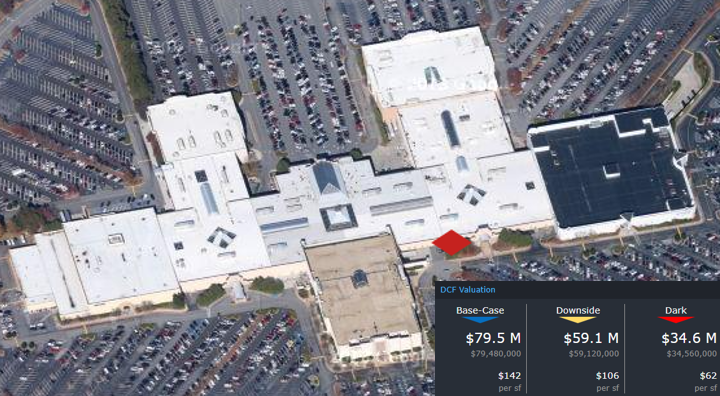

This property, which has outstanding debt of $172.5 million, has been with the special servicer since June 2020. Title to the property transferred to KeyBank, as special servicer, from Simon Property Group in January 2021 via foreclosure. KeyBank appears to still be in the process of assessing the timeline for liquidation, although March 2022 was provided as an estimated resolution date.

The Town Center at Cobb, located approximately 25 miles northwest of Atlanta, features 5 anchor pads that include 2 separate Macy’s boxes, a vacant former Sears box, a JCPenney, and a Belk. The REO portion of the property only includes the ground and improvements for the 128,819-sf Belk parcel as the other 4 pads did not secure the mortgage debt. Additionally, Belk has a near-term lease expiration in August 2022. An updated appraisal of $130.4 million ($233/sf) was reported last August and was equal to a 60% decline in value since the mortgage loan was originated. CRED-iQ’s Base-Case Valuation calculates a lower figure given uncertainty regarding Belk’s lease renewal and continued occupancy declines. For the full valuation report and loan-level details, click here.

Florence Mall

384,111 sf, Regional Mall, Florence, KY 41042

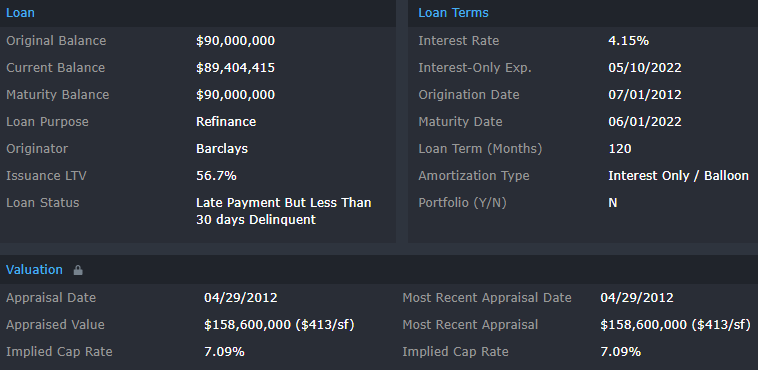

This property, which has outstanding debt of $89.4 million, has been with the special servicer since July 2020. Florence Mall, located in the suburbs of Cincinnati, OH, was formerly owned by Brookfield Property Partners but the firm agreed to a deed-in-lieu of foreclosure agreement with KeyBank in January 2021. The REO portion of the property solely consists of in-line space and a 68,324-sf movie theater outparcel. A vacant former Sears box, 2 separate Macy’s boxes, and a JCPenney make up the non-collateral anchor mix.

Updated servicer commentary stated the property was 82% occupied. The last full-year financials for the property indicated a DSCR of 2.16 for 2019, which is a prime example of the acceleration of credit deterioration brought on by the pandemic in the form of tenant departures, rent collection issues, and reduced foot traffic. JLL has been put in place to manage the property until the mall can be put to market for a liquidation sale. For the full valuation report and loan-level details, click here.

Southland Mall

660,736 sf, Regional Mall, Cutler Bay, FL 33189

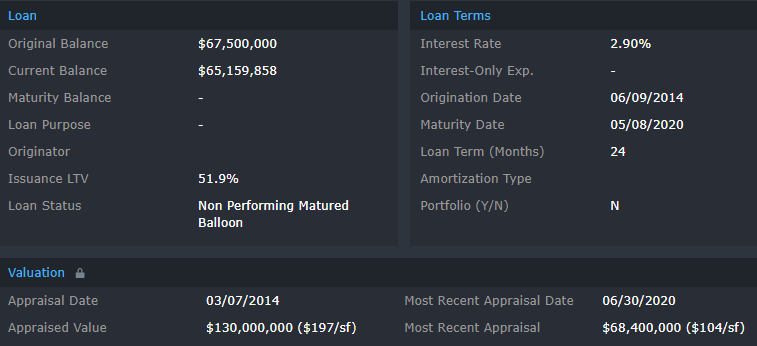

This property, which has outstanding debt of $65.2 million, has been with the special servicer since April 2020. KeyBank, as special servicer, pursued foreclosure on the mall and acquired title to the property in March 2021. Southland Mall is located about 20 miles south of Miami and features 4 anchor parcels: a vacant former Sears, Macy’s, JCPenney, and Regal Cinemas. Sears and Macy’s are owned by separate entities and are not part of the REO collateral. However, the REO title vesting includes a 148,841-sf freestanding retail strip located to the north of the mall that is leased to a 28,450-sf Ross Dress for Less and was leased to a former K-Mart, which is now partly occupied by a church.

Prior to the mall’s foreclosure, it was encumbered by floating-rate mortgage debt as well as $41.0 million in mezzanine debt, which equated to a 91% LTV based on cumulative debt at origination. Prospective buyers will likely be concerned with lease rollover risk at the property as leases for the three-largest tenants, accounting for 28% of the GLA, are scheduled to expire in 2022. For the full valuation report and loan-level details, click here.

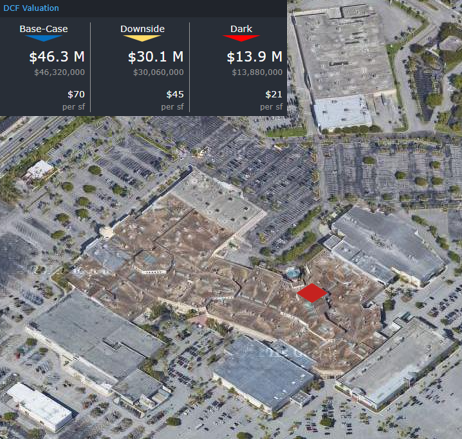

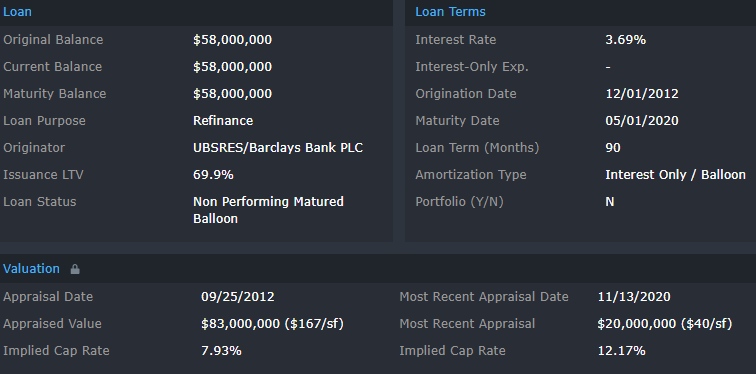

Newgate Mall

497,962 sf, Regional Mall, Ogden, UT 84405

This property, which has outstanding debt of $58.0 million, has been with the special servicer since March 2020. Rialto foreclosed on the property and acquired title from Time Equities Inc. in March 2021. The mall is now managed by The Woodmont Company and the sale of the asset is targeted for early-2022. The Newgate Mall, located 35 miles north of Salt Lake City, has 3 anchor pads consisting of a 149,624-sf vacant former Sears, Dillard’s, and a Burlington Coat Factory. Dillard’s and Burlington are owned by separate entities and are not part of the REO offering. The Burlington space has turned over several times in recent history, with the box previously occupied by GlowGolf and Mervyn’s prior to that. The REO portion of the property also includes a 61,970-sf junior anchor Cinemark movie theater and a DownEast Home & Clothing, which backfilled a former Sports Authority. For the full valuation report and loan-level details, click here.

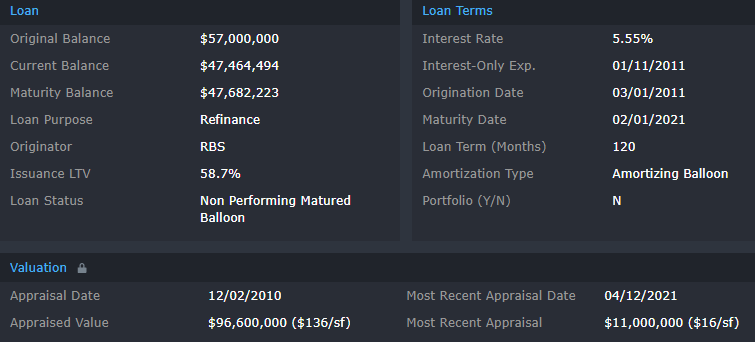

Oakdale Mall

708,695 sf, Regional Mall, Johnson City, NY 13790

This property, which has outstanding debt of $47.5 million, has been with the special servicer since June 2018. Rialto acquired title to the property from Interstate Properties through a deed-in-lieu of foreclosure agreement in September 2020. The mall had been severely distressed pre-COVID when the mortgage loan had a below breakeven DSCR in 2018 and 2019. Positive developments for the mall came to fruition in recent weeks in the form of a 25-year payment-in-lieu-of-taxes (PILOT) program that would reduce real estate tax expense for the property from approximately $3.5 million to $449,000 for the next 5 years before scaling back up to $1.1 million in year 25. The PILOT agreement is in conjunction with a potential sale to Spark JC LLC, a local developer that acquired the vacant Sears portion of the mall in 2019. SPARK JC LLC plans to convert the former Sears box into a hospital and social services center.

The development firm also reportedly negotiated a $6.5 million settlement with Rialto for a tax lawsuit and is finalizing the acquisition of the property for approximately $8.5 million ($12/sf). In total, the redevelopment project is estimated to cost $116.0 million with plans convert the Oakdale Mall into a diversified mixed-use project named Oakdale Commons. For additional details, full valuation report, and loan-level details, click here.

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: