This week, CRED iQ calculated real-time valuations for 5 properties that are either vacant or dark, including two hotels that have been closed due to the pandemic and two vacant office buildings in the San Jose, CA MSA. Vacant or non-operational properties are opportunities for off-market transactions. In cases of distress, new ownership has the ability to infuse capital into a project and vacant suites are always on the radar of leasing brokers. For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

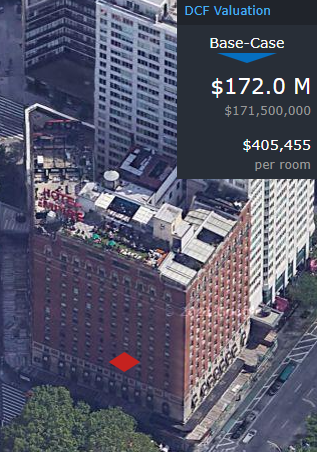

Empire Hotel & Retail

423 keys, Hotel, New York, NY 10023

The Empire Hotel, located in the Lincoln Square submarket of Manhattan, closed in March 2020 due to the pandemic and has been out of operation throughout 2021. The hotel, as well as 61,223 sf in retail space, secures a $169.3 million loan that transferred to special servicing in May 2021. The loan was modified shortly after the onset of the pandemic in May 2020 to allow the borrower to fund debt service payments with reserves. The modification proved to be insufficient in keeping the loan current and the borrower appears to be requesting for additional relief.

Multiple sources point to January 2022 as possible timeframe for reopening for the hotel, which operates independently. Despite zero incoming revenue from the hotel portion of property, the retail spaces have been operational on a limited basis throughout the pandemic, apart from the 16,000-sf rooftop lounge. Retail occupancy includes ground-floor retail tenants Duane Reade (12,557 sf) and Starbucks (2,676 sf). Still, the pandemic wasn’t the initial cause of distress for loan, which had a below breakeven DSCR of 0.78 during 2019 due to increases in operational leverage. For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

| Property Name | Empire Hotel |

| Address | 44 West 63rd Street New York, NY 10023 |

| Outstanding Balance | $169,267,019 |

| Interest Rate | 4.57% |

| Maturity Date | 1/6/2023 |

| Most Recent Appraisal | $393,000,000 |

| Most Recent Appraisal Date | 11/20/2012 |

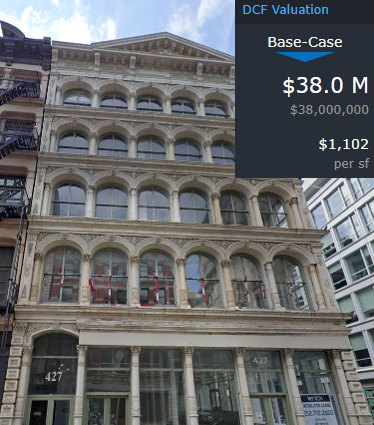

427 Broadway

34,498 sf, Mixed-Use (Office/Retail), New York, NY 10013

Last week’s WAR Report took us to the corner of Broadway and Howard Street in the SoHo submarket of Manhattan to evaluate the vacant 428 Broadway. We don’t have to look any further than across the street for another vacant property with 427 Broadway. The property is part of a 2-building portfolio that secures a $76.5 million mortgage loan. The debt stack also includes an $11.5 million mezzanine loan that was held by Jefferies LoanCore at origination. The second property that is part of the portfolio is 459 Broadway. The loan shares the same sponsor, Jacob Chetrit, as 428 Broadway. The loan transferred to special servicing in June 2021 and Rialto, as special servicer, is discussing potential workouts with the borrower.

427 Broadway is a five-story building that contains ground-floor and below-grade retail space in addition to four floors of office space. The vacant retail space was formerly occupied by American Apparel (8,498 sf), which vacated in July 2017. The vacant office space was formerly occupied by Night Agency (6,500 sf) and Psyop Media Company (19,500 sf). Psyop Media Company vacated ahead of its April 2025 lease expiration and is obligated to pay a termination fee of approximately $4.0 million. As mentioned last week, the high-street retail leasing environment in Manhattan remains extremely challenging, especially with a concentration of vacancies in the SoHo submarket. For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

| Property Name | 427 Broadway |

| Address | 427 Broadway New York, NY 10013 |

| Outstanding Balance | $38,250,000 (allocated loan amount) |

| Interest Rate | 4.95% |

| Maturity Date | 1/6/2025 |

| Most Recent Appraisal | $55,000,000 |

| Most Recent Appraisal Date | 9/29/2014 |

Hotel on Rivington

107 keys, Hotel, New York, NY 10002

Hotel on Rivington was vacant until about two weeks ago when the boutique Lower East Side hotel re-opened. The property had previously been closed since March 2020. Hotel on Rivington secures a $36.3 million loan that matures in March 2026. Despite the property having 0% occupancy for nearly 18 months, the loan has been current in payment. Servicer commentary also indicates a new owner may have assumed the mortgage loan with plans to invest additional capital into the hotel. The property was nearly sold for $65.0 million in November 2018 to the Kushner Companies but the deal ultimately fell through. The 20-story hotel contains 107 keys and is located in the Lower East Side on Manhattan, NY. For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

| Property Name | Hotel on Rivington |

| Address | 107 Rivington Street New York, NY 10002 |

| Outstanding Balance | $36,252,394 |

| Interest Rate | 4.96% |

| Maturity Date | 3/6/2026 |

| Most Recent Appraisal | $66,000,000 |

| Most Recent Appraisal Date | 11/30/2015 |

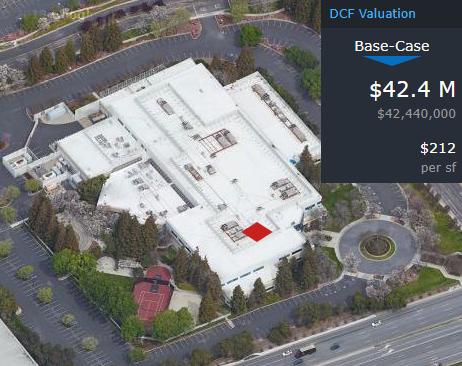

Broadcom Building

200,000 sf, Office, San Jose, CA 95134

This 200,000-sf vacant office building is located in San Jose, CA and secures a $34.8 million mortgage loan. The property was formerly occupied by Broadcom as a single tenant; however, Broadcom vacated in May 2018, ahead of its May 2020 lease expiration. Broadcom paid a $2.5 million termination fee. In total, borrower has reserved about $4.5 million for leasing costs for the property, which is actively being marketed. Colliers has the listing and is marketing the property as a headquarters with flexibility as R&D or lab space and campus-like amenities such as an outdoor amphitheater and tennis courts. The loan has been current in payment; however, it has been over 2 years without positive cash flow at the property. For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

| Property Name | Broadcom Building |

| Address | 3151 Zanker Road San Jose, CA 95134 |

| Outstanding Balance | $34,791,678 |

| Interest Rate | 4.10% |

| Maturity Date | 1/11/2025 |

| Most Recent Appraisal | $55,000,000 |

| Most Recent Appraisal Date | 11/5/2014 |

Tintri Mountain View

67,000 sf, Office, Mountain View, CA 94043

This 67,000-sf vacant office building is located in Mountain View, CA and secures a $21.6 million mortgage loan. The property was formerly occupied by tech firm Tintri as a single tenant through October 2018 when the company vacated. The vacant building was acquired by a joint venture between BioScience Properties Inc. and Harrison Street Real Estate Capital LCC for $40.75 million in February 2021 with a plan to reposition the building for life science use. CBRE has the listing and is marketing the space for flex, R&D, and life science use. The mortgage loan been current in payment despite 0% occupancy and negative net cash flow over the past few years. For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

| Property Name | Tintri Mountain View |

| Address | 303 Ravendale Drive Mountain View, CA 94043 |

| Outstanding Balance | $21,647,495 |

| Interest Rate | 4.39% |

| Maturity Date | 8/5/2024 |

| Most Recent Appraisal | $32,700,000 |

| Most Recent Appraisal Date | 5/14/2014 |

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: