This week, CRED iQ calculated real-time valuations for 5 distressed multifamily properties that secure GNMA loans. Ginnie Mae loans secured by distressed properties as well as loans with near-term maturities are sources for intriguing opportunities within the multifamily sector that expand into several property sub-types, including affordable housing and student housing. Mortgage originators, distressed investors, and commercial brokers are able to search CRED iQ’s database of approximately 15,000 Ginnie Mae loans totaling more than $138 billion in outstanding debt for their next opportunity. The properties featured in this week’s WAR Report secure a subset of the largest distressed Ginnie Mae loans by outstanding balance that are at least 60 days delinquent.

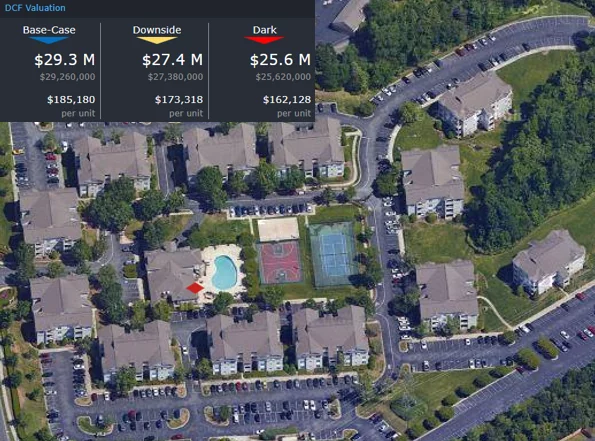

CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS and GNMA loan reporting, including detailed financials and borrower contact information, sign up for a free trial here.

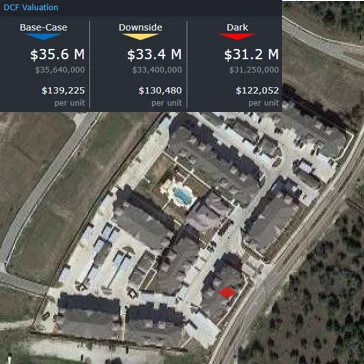

Residence at Oakmont

256 units, Multifamily, Bryan, TX

GNMA 2020-36197DLG1

This $28.8 million loan, which is over 120 days delinquent, is secured by a 3-story, 256-unit multifamily property in Bryan, TX, located about 100 miles northeast of Austin, TX. The loan was over 90 days delinquent in the prior reporting period. The mortgage was issued through the Department of Housing and Urban Development’s (HUD) 221(d)(4) program to facilitate the construction and rehabilitation of multifamily properties for low to moderate-income families. Orix Real Estate Capital originated the mortgage in June 2017 and construction of the property began soon after. The loan has a 3.83% interest rate, a maturity date in April 2059, and a 10% prepayment penalty that declines annually by 100 basis points through the first 10 years its term. For full access to the valuation reports as well as full CMBS and GNMA loan reporting, including borrower contact information, sign up for a free trial here.

| Property Name | Residence At Oakmont |

| Address | 4225 Pendleton Drive Bryan, TX 77802 |

| Outstanding Balance | $28,808,766 |

| Interest Rate | 3.83% |

| Origination Date | 6/28/2017 |

| Maturity Date | 4/1/2059 |

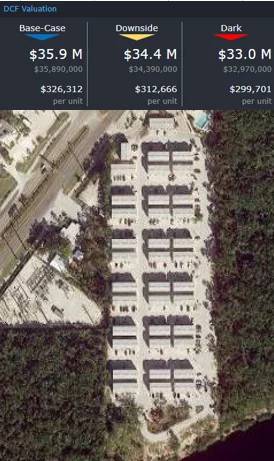

Keys Lake Villas

110 units, Multifamily, Key Largo, FL

GNMA 2017-36196LLN9

This $21.2 million loan, which is 6 months delinquent, is secured by a 2-story, 110-unit multifamily property located in Key Largo, FL. Similar to the Residence at Oakmont, this mortgage was issued through HUD’s 221(d)(4) program to facilitate the construction of multifamily properties for moderate-income families. Wells Fargo Multifamily Capital originated the loan in 2011 just prior to development and construction of the collateral property. The loan, which has an interest rate of 3.62%, is scheduled to exit its prepayment penalty period in January 2022. Maturity is scheduled for August 2052. CRED iQ’s data records indicate the loan was modified, although details regarding the terms of the modification were not provided by the servicer. Despite the distressed nature of the loan, the collateral likely benefits from limited multifamily inventory in the Key Largo market as well as barriers to entry with regards to new development. For full access to the valuation reports as well as full CMBS and GNMA loan reporting, including borrower contact information, sign up for a free trial here.

| Property Name | Keys Lake Villas |

| Address | 106003 Overseas Highway Key Largo, FL 33037 |

| Outstanding Balance | $21,178,406 |

| Interest Rate | 3.62% |

| Origination Date | 6/29/2011 |

| Maturity Date | 8/1/2052 |

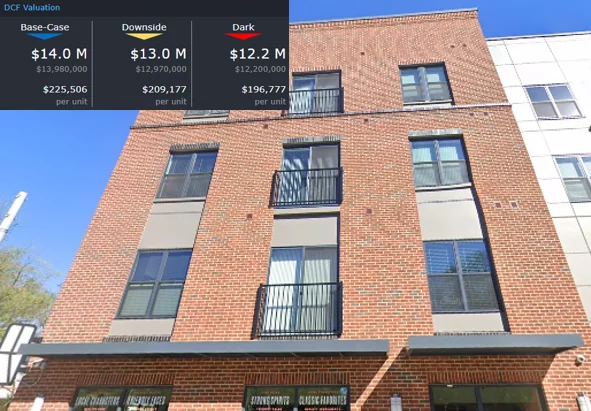

The Jordan Apartments

62 units, Multifamily, Baltimore, MD

GNMA 2020-3617GFUQ8

This $11.6 million loan, which is over 90 days delinquent, is secured by a 62-unit mixed-income apartment complex located in the Bolton Hill neighborhood of Baltimore, MD. The loan was originated by Wells Fargo Multifamily Capital under Section 221(d)(4) in February 2018 through the Choice Neighborhood Program, which operates under the HUD. The loan has a 3.75% interest rate and a 10% prepayment penalty that declines 1% annually. Loan maturity is scheduled for August 2059.

Prior to construction in 2018, the property served as a parking lot for the Linden Park Apartments, a 266-unit senior-living facility that serves as collateral for a $13.6 million GNMA mortgage loan. The Jordan Apartments became open for leasing in 2019 and offers mixed-income rental rates. The property features a ground-floor restaurant and benefits from a 10-year property tax credit from the city of Baltimore based on the property’s National Green Building Standard Certification. CRED iQ’s Base-Case valuation uses estimates for fully unabated property taxes. For full access to the valuation reports as well as full CMBS and GNMA loan reporting, including borrower contact information, sign up for a free trial here.

| Property Name | The Jordan Apartments |

| Address | 1517 Eutaw Place Baltimore, MD 21217 |

| Outstanding Balance | $11,299,360 |

| Interest Rate | 3.75% |

| Origination Date | 2/1/2018 |

| Maturity Date | 8/1/2059 |

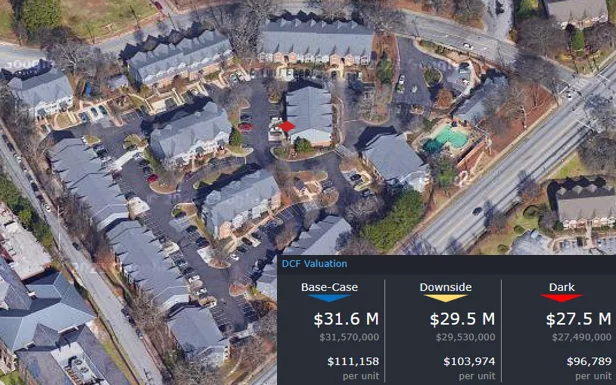

The Village at Castleberry Hill Phase II

284 units, Multifamily, Atlanta, GA

GNMA 2011-36230MEY9

This $8.4 million loan, which is over 60 days delinquent, is secured by a 3-story, 284-unit multifamily property located in the Midtown West submarket of Atlanta, GA. The loan was originated by Prudential Huntoon Paige in December 2010. Mortgage financing was provided through the Section 221(d)(4) program as well as Section 223(a)(7), which provides refinancing of existing FHA loans. The loan has a 4.10% interest rate and became open to prepayment without penalty in January 2021. Maturity is scheduled for March 2039.

The mortgage collateral is Phase II of a larger 449-unit multifamily complex known as The Village at Castleberry Hill. Phase II was constructed in 2011 and benefits from a Low-Income Housing Tax Credit (LIHTC). Of the 284 units, there are 114 units set aside for rents equal to 50% of Area Median Income (AMI) or lower, 57 units with rents at 60% AMI or below, and 57 units with rents at 80% AMI or lower. There are 56 market rate units. The LIHTC presents affordable housing options in a central location within the Atlanta MSA. The collateral property is located in the Castleberry Hill neighborhood of Atlanta, and is adjacent to 3 universities — Morehouse College, Spelman College, and Clark Atlanta University — and is in close proximity to the Mercedes-Benz Stadium. Loan delinquency may be related to the need for rehabilitation for units requiring upgrades since loan origination was more than 10 years ago. For full access to the valuation reports as well as full CMBS and GNMA loan reporting, including borrower contact information, sign up for a free trial here.

| Property Name | The Village at Castleberry Hill |

| Address | 600 Greensferry Avenue Atlanta, GA 30314 |

| Outstanding Balance | $8,366,047 |

| Interest Rate | 4.10% |

| Origination Date | 12/29/2010 |

| Maturity Date | 3/1/2039 |

Latitude 49 Apartments

158 units, Student Housing, Charlotte, NC

GNMA 2012-36177NKX7

This $11.0 million loan, which is over 60 days delinquent, is secured by a 3-story, 158-unit student housing facility located in Charlotte, NC. The collateral provides housing to students enrolled at UNC Charlotte. Orix Real Estate Capital originated the loan in April 2012 under Section 221(d)(4) and 223(a)(7) programs. The loan’s prepayment penalty period will end in May 2022 and loan maturity is scheduled for May 2052. The prepayment penalty started at 8% and declined annually by 100 basis points. The interest rate is 3.19%.

The Latitude 49 Apartments, formerly known as 901 Place Apartments, were constructed in 2000 but have had several issues since initial development including bug infestations and break-ins. The property’s name was changed to ‘Latitude 49’ after a shooting on site in 2019 and the extended fallout of the event in the form of adverse impacts on leasing may be an underlying issue behind the loan’s delinquency. For full access to the valuation reports as well as full CMBS and GNMA loan reporting, including borrower contact information, sign up for a free trial here.

| Property Name | Latitude 49 Apartments |

| Address | 901 Forty Niner Avenue Charlotte, NC 28262 |

| Outstanding Balance | $10,975,166 |

| Interest Rate | 3.19% |

| Origination Date | 4/25/2012 |

| Maturity Date | 5/1/2052 |

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: