This week, CRED iQ examines the impact of commercial real estate values following a November 18, 2021 announcement by CVS Health regarding its strategic review of its retail business. New initiatives in the healthcare company’s omnichannel health strategy include the closures of 300 retail locations per year over the next 3 years. A total of approximately 900 store closures may be unwelcoming news to commercial real estate investors with CVS as primary tenant — property owners may face uncertain prospects for replacement tenants and the costs of backfilling a former CVS location.

For background, CVS listed a retail portfolio of approximately 80.1 million sf in its 2020 annual report, comprising 8,115 stores. CVS owns about 405 of those locations and leases the remainder as a tenant. Additionally, the company operates pharmacies for nearly 2,000 retail chains, including several grocers as well as Target via a 2015 agreement. Specific locations of stores closures have not yet been announced, but a reduction in store density will likely include overlapping operations in particular markets that may be deemed low growth. CVS locations with near-term lease expirations are candidates for closure, or renegotiations of rental rates; however, in the likely scenario where CVS closes stores prior to lease expiration, we expect the company would continue to honor its rent obligations.

CRED iQ leveraged its platform to identify properties leased to CVS as a single tenant or properties leased to CVS as one the 5 largest tenants by GLA on the property’s rent roll. CRED iQ’s subset of nearly 400 properties with CVS as a Top 5 tenant secures approximately $4 billion in outstanding commercial real estate debt. More than half of the properties, accounting for only 19% of the aggregate securitized debt, are single tenant or net lease properties. Classifying properties by lease expiration date, CRED iQ was further able to isolate properties with CVS lease expirations over the next 3 years as shown in the table below:

| Lease Expiration Year | # of Properties | Aggregate Outstanding Balance ($000’s) |

| 2021 or Earlier | 11 | $291,532 |

| 2022 | 14 | $163,782 |

| 2023 | 27 | $327,592 |

| 2024 | 24 | $341,789 |

For a copy of the comprehensive list of all CMBS properties with CVS as a Top 5 tenant — including over 200 single tenant locations, please reach out to Shane Beeson (shane@cred-iq.com) or click the link below.

This week’s WAR Report focuses specifically on net lease properties, a property sub-type of retail where the credit quality of a commercial real estate mortgage is often tied to the credit quality of the single tenant’s corporate entity. CVS is a popular tenant among net lease investors because pharmacies qualify as an essential retail use and locations are often centrally located to primary corridors of commerce such as signalized intersections and desirable corner lots. Absent a credit tenant, a property’s location, age, and quality become pertinent factors in evaluating valuation scenarios. Featured properties below include single tenant CVS retail locations with near-term lease expirations or CVS locations that secure loans in special servicing.

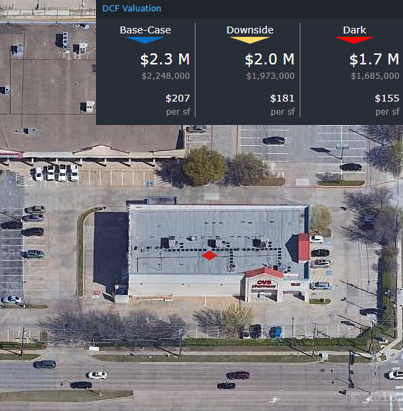

The CRED iQ valuations factor in a base-case (expected lease renewal at in-place rent), a downside (lease renewal at 50% reduction in rent), and dark scenarios (100% vacant). Select valuations are provided for the properties below. For full access to the valuation reports including all 3 valuation scenarios as well as full CMBS loan reporting, with detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

Solomon CVS Portfolio

37,431 sf, Single Tenant Retail, Texas and Mississippi [View Details]

This $6.8 million loan is secured by a portfolio of 3 single tenant CVS Pharmacy retail stores. Two of the properties are located outside of Dallas, TX and the third property is located outside of Jackson, MS. The CVS location at 1501 Independence Parkway in Plano, TX had a lease expiration on October 26, 2021. CVS was still operational at the location into November; however, store density may be a concern with another CVS located less than 2 miles away. Both stores are well-positioned on corner lots but the competitive CVS benefits from Aldi as a grocery anchor whereas the subject CVS has less compelling demand generators. Other competition in the area includes several Walgreens locations and pharmacies operated by Walmart, Kroger, and Tom Thumb. The property was constructed in 1996 and does not appear to have been renovated.

The CVS in Brandon, MS has a lease expiration in August 2023 and the CVS in Paris, TX has a lease expiration in April 2024. Both locations are strategically located at intersections with minimal cannibalization from proximate CVS locations. Loan maturity is slated for September 6, 2025. For the full valuation report and loan-level details for the CVS Plano property, click here.

| Property Name | Size (sf) | Address | Allocated Loan Amount | CRED iQ Base-Case Value | CRED iQ Dark Value |

| CVS Brandon | 13,813 | 112 Stribling Lane Brandon, MS 34042 | $2,279,342 | $5,647,000 ($409/sf) | $4,700,000 ($340/sf) |

| CVS Paris | 12,738 | 3710 Lamar Avenue Paris, TX 75462 | $2,279,342 | $4,308,000 ($338/sf) | $3,416,000 ($268/sf) |

| CVS Plano | 10,880 | 1501 Independence Parkway Plano, TX 75075 | $2,279,342 | $2,248,000 ($207/sf) | $1,685,000 ($155/sf) |

CVS – Goshen

10,000 sf, Single Tenant Retail, Goshen, IN [View Details]

This $3.0 million loan transferred to special servicing on February 26, 2020 due to delinquency and an unresponsive borrower. The loan was originated in March 2018 but the borrower has not reported updated financial statements since origination. CVS pays $25/sf at the freestanding building with a lease that expires in January 2038. The borrower estimated sales at the property to be approximately $1,350 per square foot. However, local residents have noted the pharmacy’s inability to stay open regularly throughout the pandemic amid staff shortages. Also notable, there is a Target, which contains a CVS Pharmacy, located 5 miles away that may be the more preferable option in terms of convenience, reliability, and amenities. The property has been listed for sale for $5 million, equal to $500/sf. The long-term lease is a positive factor; however, this particular location may be at risk of having a dark tenant. The property was constructed in 2000. For the full valuation report and loan-level details, click here.

| Property Name | CVS Goshen |

| Address | 410 South Main Street Goshen, IN 46526 |

| Outstanding Balance | $3,000,000 |

| Interest Rate | 5.18% |

| Maturity Date | 4/1/2028 |

| CVS Lease Expiration Date | 1/31/2038 |

| Most Recent Appraisal | $4,550,000 ($455/sf) |

| Most Recent Appraisal Date | 8/18/2021 |

CVS – Johnson City

10,125 sf, Single Tenant Retail, Johnson City, NY [View Details]

This 10,125-sf freestanding CVS Pharmacy, located in Johnson City, NY, is part of a 2-property portfolio that serves as collateral for a $3.8 million loan. The property’s lease with CVS expires on January 31, 2024, which is within the company’s 3-year timeframe for closures. The building, which was constructed in 1998, is one of the oldest single tenant CVS locations within CRED iQ’s database. The property’s location is on a main thoroughfare but is inferior to a neighboring Walgreens, which has a dedicated turning lane and a three-way junction. This particular CVS location on Main Street also competes with another CVS Pharmacy, located less than a mile away; although the Main Street pharmacy is more proximate to a UHS medical center, which is part of the region’s primary healthcare system, and several medical offices. Loan maturity is scheduled for August 6, 2025. For the full valuation report and loan-level details, click here.

| Property Name | CVS Johnson City |

| Address | 345 Main Street Johnson City, NY 13790 |

| Outstanding Balance | $2,112,506 |

| Interest Rate | 4.70% |

| Maturity Date | 8/6/2025 |

| CVS Lease Expiration Date | 1/31/2024 |

| Most Recent Appraisal | $3,200,000 ($316/sf) |

| Most Recent Appraisal Date | 5/22/2015 |

CVS Akron

10,125 sf, Single Tenant Retail, Akron, OH [View Details]

This $1.5 million loan is secured by a 10,125-sf freestanding CVS Pharmacy in Akron, OH. The loan was added to the servicer’s watchlist in August 2019 with commentary stating that CVS vacated at lease expiration in January 2020; however, additional servicer data offers a contradictory lease expiration date of January 31, 2025, which is in the final year of announced store closures. CRED iQ confirmed the 780 Brittain Road location was operational shortly following the closure announcement; however financial statements for year end 2020 indicate base rent was reduced by approximately 32% compared to the prior year. The property shares a signalized intersection with Walgreens. A superior CVS with more flexible store hours is located only 1.5 miles away in an Acme-anchored shopping center. The property was constructed in 1999. For the full valuation report and loan-level details, click here.

| Property Name | CVS Akron |

| Address | 780 Brittain Road Akron, OH 44305 |

| Outstanding Balance | $1,538,392 |

| Interest Rate | 4.63% |

| Maturity Date | 4/6/2026 |

| CVS Lease Expiration Date | 1/31/2025 |

| Most Recent Appraisal | $2,610,000 ($258/sf) |

| Most Recent Appraisal Date | 1/29/2016 |

Conroe CVS

13,824 sf, Single Tenant Retail, Conroe, TX [View Details]

This $364,000 loan is secured by a CVS Pharmacy in Conroe, TX, located approximately 40 miles north of Houston. CVS has a lease expiration in October 2022. The near-term lease expiration suggests the Conroe location is a candidate for closure. The property competes with 3 Walgreens stores within a 5 miles radius but there are no other CVS locations in the area. One option for CVS is to open a Pharmacy or MinuteClinic in a neighboring Target, which was last remodeled in 2018. The Conroe location was constructed in 2002. For the full valuation report and loan-level details, click here.

| Property Name | Conroe CVS |

| Address | 910 West Davis Street Conroe, TX 77301 |

| Outstanding Balance | $364,914 |

| Interest Rate | 4.54% |

| Maturity Date | 2/1/2023 |

| CVS Lease Expiration Date | 10/31/2022 |

| Most Recent Appraisal | $5,680,000 ($411/sf) |

| Most Recent Appraisal Date | 12/6/2012 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.