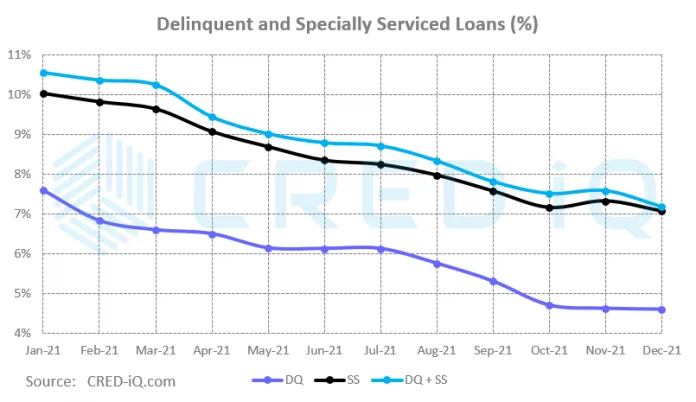

The CRED iQ overall delinquency rate had a modest decline this month, which marks its 18th consecutive improvement. The delinquency rate, equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $500+ billion in CMBS conduit and single-asset single-borrower (SASB) loans was 4.59%, which compares to the prior month’s rate of 4.62%. Additionally, CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), declined month-over-month to 7.06% from 7.32%, after a brief increase in the prior month. The special servicing rate has declined 11 out of the 12 previous months. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 7.18% of CMBS loans that are specially serviced, delinquent, or a combination of both. The overall distressed rate declined compared to the prior month rate of 7.58% given both declines in the delinquency and special servicing rates.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

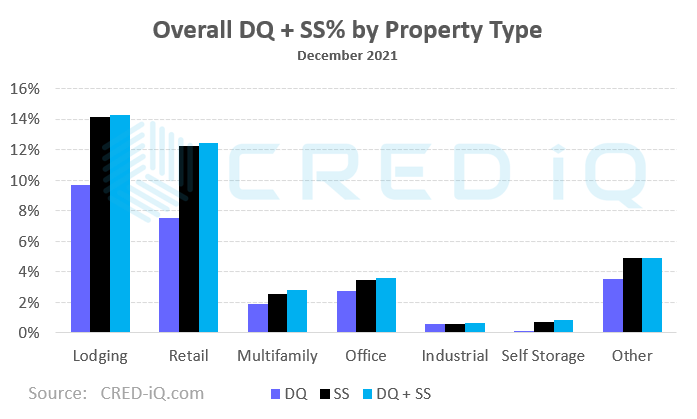

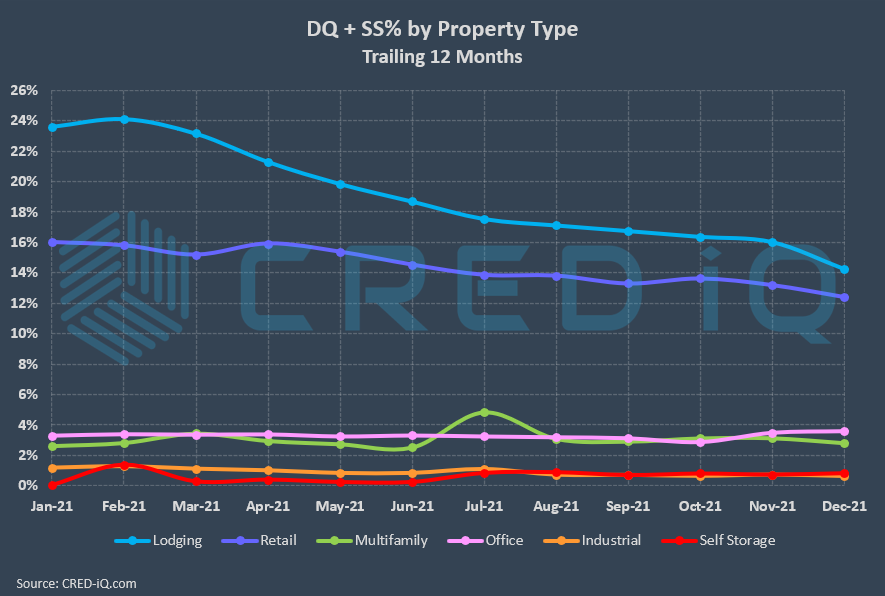

By property type, the delinquency rate for office notably increased to 2.74%, compared to 2.18% in the prior month. The increase in office delinquency was carried by two loans secured by Chicago office buildings — 181 West Madison and 135 South LaSalle. The $100 million 135 South LaSalle loan, which was featured in CRED iQ’s July 20, 2021 WAR Report, became delinquent due to insufficient cash flow after the collateral property’s largest tenant, Bank of America, vacated at lease expiration. The $240 million 181 West Madison loan became delinquent following the bankruptcy filing of the loan sponsor, HNA Group. The $1.2 billion 245 Park Avenue loan had a similar fate last month.

New delinquencies pushed the office delinquency rate to its highest level in 12 months. Both of the newly delinquent Chicago office loans transferred to special servicing this month, resulting in the second consecutive increase in the office special servicing rate.

Lodging continues to have the highest delinquency (9.71%) and special servicing (14.16%) rates among property types, followed by retail delinquency (7.52%) and special servicing (12.23%) rates. Both lodging and retail exhibited improvements compared to the prior month, which is a trend that has been consistent over the past year as those loans continue to be worked out and resolved.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

CRED iQ also monitors an overall distressed rate (DQ + SS%) by property type to account for loans that qualify for either delinquent or special servicing subsets. The overall distressed rates typically track slightly higher than special servicing rates as most delinquent loans are also with the special servicer. This month, overall distressed rates for office and self-storage increased while lodging, retail, multifamily, and industrial declined. The 3 largest loans to transfer to special servicing this month were also delinquent. Two of those loans are secured by the aforementioned office properties located in the Chicago, IL MSA. The third loan, and 2nd largest transfer, was the $180 million 1551 Broadway loan, which is secured by Times Square retail. For additional information for these 3 loans, click View Details below:

| [View Details] | [View Details] | [View Details] | |

| Loan | 181 West Madison | 1551 Broadway | 135 South LaSalle |

| Balance | $240,000,000 | $180,000,000 | $100,000,000 |

| Special Servicer Transfer Date | 11/2/2021 | 11/15/2021 | 11/17/2021 |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.