This week, CRED iQ calculated real-time valuations for 5 properties that have major tenants with lease expirations in the next 6 months. Featured leases include central business district (CBD) office space in Manhattan, Baltimore, Los Angeles, and Indianapolis as well as suburban office space in the Detroit MSA. Lease expirations are opportunities for tenant reps to source options and find solutions for clients. Additionally, lease expirations can serve as a preemptive signal of distress for CRE loans if prospects for leasing the newly vacant space are low.

The CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). Select valuations are provided for the properties below. For full access to the valuation reports including all 3 valuation scenarios as well as full CMBS loan reporting, with detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

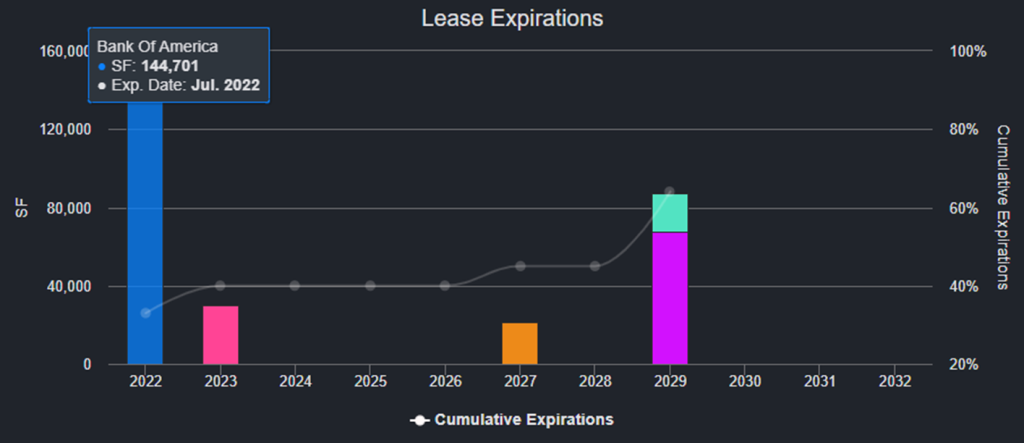

Bank of America Plaza

438,996 sf, Suburban Office, Troy, MI [View Details]

Bank of America has a 144,701-sf lease scheduled to expire on July 31, 2022 at an office property located in Troy, MI, approximately 18 miles outside of Detroit. The office building secures a $45.3 million mortgage that is scheduled to mature in September 2024. The impending lease expiration has implications for the upcoming loan maturity. Bank of America’s space accounts for 33% of the property’s NRA and the tenant has 3, 5-year extension options available at lease expiration. However, servicer commentary for the loan indicates the tenant is in negotiations with the borrower regarding extension terms. Additional negotiations may portend a reduced footprint for the tenant if Bank of America no longer has a need for the total space under contract or a lower rental rent if rent steps outlined in the original terms of the 5-year option outpaced market rent for Troy, MI. Considerations for a positive outcome prior to lease expiration include Bank of America’s financial commitment to the building — over $7 million in capital investments — as well as the relative superior class of the property, which was LEED-certified Silver in 2015. For the full valuation report and loan-level details, click here.

| Property Name | Bank of America Plaza |

| Address | 2600 West Big Beaver Road Troy, MI 48084 |

| Loan Balance | $45,322,217 |

| Interest Rate | 4.06% |

| Maturity Date | 9/6/2024 |

| Most Recent Appraisal | $79,200,000 ($180/sf) |

| Most Recent Appraisal Date | 7/17/2017 |

| CRED iQ Base-Case Value | $69,170,000 ($158/sf) |

Ditson Building

58,850 sf, CBD Office, New York, NY [View Details]

TTC USA Consulting has a 27,750-sf lease scheduled to expire on June 30, 2022 at a 10-story office building in the Midtown South submarket of Manhattan, NY. TTC USA Consulting uses the space as a showroom for Turkish Trade Centers. The tenant previously occupied 33,300 sf at the property pursuant to a lease that expired on December 1, 2021. TTC USA Consulting subsequently reduced its footprint by 5,550 sf and signed a short-term lease extension through June 30, 2022. The short-term extension may foreshadow the possibility of TTC USA Consulting’s intention to vacate, especially considering the tenant’s lease had a 5-year extension option available at the previous December 2021 expiration date. Furthermore, the tenant only physically uses the space for showroom events, which have been infrequent throughout the pandemic. Following its downsizing at the building, TTC USA Consulting now accounts for 47% of the property’s NRA. CRED iQ estimates occupancy could decline to 43% should TTC USA Consulting vacate at lease expiration. For the full valuation report and loan-level details, click here.

| Property Name | Ditson Building |

| Address | 8-10 East 34th Street New York, NY 10016 |

| Loan Balance | $37,500,000 |

| Interest Rate | 5.43% |

| Maturity Date | 8/1/2028 |

| Most Recent Appraisal | $62,000,000 ($1,054/sf) |

| Most Recent Appraisal Date | 4/20/2018 |

| CRED iQ Downside Value | $31,770,000 ($540/sf) |

650 South Exeter Street

206,355 sf, CBD Office, Baltimore, MD [View Details]

Laureate Education is vacating 103,335 sf of space at an office condominium in the Harbor East submarket of Baltimore, MD at its lease expiration on June 30, 2022. The office condominium is part of a mixed-use property that includes part of a parking garage and a movie theater. Altogether, the property secures a $25 million mortgage. Laureate Education’s lease was originally scheduled to expire in June 2027, but the for-profit education operator terminated its lease in March 2021. The lease termination required 15 months’ notice, which effectively adjusted the lease expiration to June 2022. Laureate Education leases approximately half of the office condo and its departure will leave the property approximately 33% occupied.

Aside from the 103,335 sf of space that will need to be marketed as available for lease, there is a possibility that additional space in the building will soon hit the market. The property’s second largest tenant, Morgan Stanley Financial Advisors, also has a lease that is set to expire in 2022. Morgan Stanley’s lease accounts for 19% of the office condo’s NRA but the tenant has 2, 5-year extension options. Baltimore has had its fair share of struggles with office vacancy — CRED iQ’s January 10, 2021 WAR Report discusses office tenants’ location preferences for the Harbor Point submarket over the Inner Harbor/CBD submarkets. Positive attributes for the soon-to-be vacant office space are its close proximity to Harbor Point and relatively newer build compared to similar office properties in the market. For the full valuation report and loan-level details, click here.

| Property Name | 650 South Exeter Street |

| Address | 650 South Exeter Street Baltimore, MD 21202 |

| Loan Balance | $25,000,000 |

| Interest Rate | 4.84% |

| Maturity Date | 6/6/2028 |

| Most Recent Appraisal | $79,400,00 ($385/sf) |

| Most Recent Appraisal Date | 11/17/2017 |

| CRED iQ Downside Value | $26,000,000 ($126/sf) |

1950 Sawtelle Boulevard

106,875 sf, Office, Los Angeles, CA [View Details]

Two tenants have upcoming lease expirations in April and May at an office building in West Los Angeles. Lot 5 Media has a 45,158-sf lease, accounting for 42% of NRA, that is scheduled to expire on May 31, 2022. Lot 5 Media uses the space for post-production media services including turn-key offices outfitted with various media and production amenities. Kung Fu Factory, a video game developer, has a 14,882-sf lease, accounting for 14% of the GLA, that expires on April 30, 2022. Both tenants have been in occupancy for more than 5 years. Furthermore, Lot 5 Media has signage on the building and appears to have invested heavily in customizing its space for client offerings. The office building secures a $35.5 million mortgage that matures in January 2026. The property is fairly unique within its neighborhood, which comprises primarily residential housing. Should either Lot 5 Media or Kung Fu Factory vacate, prospective medical office tenants may find amenities at the property appealing. Several smaller suites at the property are used as medical offices and the building has a parking garage for efficient ingress and egress. For the full valuation report and loan-level details, click here.

| Property Name | 1950 Sawtelle Boulevard |

| Address | 1950 Sawtelle Boulevard Los Angeles, CA 90025 |

| Loan Balance | $35,509,740 |

| Interest Rate | 5.07% |

| Maturity Date | 1/6/2026 |

| Most Recent Appraisal | $54,300,000 ($508/sf) |

| Most Recent Appraisal Date | 8/19/2016 |

| CRED iQ Base-Case Value | $44,880,000 ($420/sf) |

117 East Washington

48,702 sf, Mixed Use (Office/Retail), Indianapolis, IN [View Details]

Hensley Legal Group, a local law firm, has a 15,882-sf lease that is scheduled to expire on March 31, 2022 at an office building in CBD Indianapolis. The lease accounts for 33% of the building’s NRA. Hensley Legal Group is one of 3 tenants at the property, which secures a $6.2 million mortgage. The largest tenant, which accounts for 40% of the property’s NRA, is an affiliate of the loan sponsor and the smallest tenant, Fogo de Chão, operates a restaurant on the ground floor of the building. Servicer commentary for the loan has not yet confirmed if Henley Legal Group plans to renew or vacate. Should the tenant vacate, the sponsor-affiliated tenant may be a candidate expand into some of the vacant space. Otherwise, occupancy at the property may decline to 77%. For the full valuation report and loan-level details, click here.

| Property Name | 117 East Washington |

| Address | 117 East Washington Street Indianapolis, IN 46204 |

| Loan Balance | $6,151,375 |

| Interest Rate | 4.74% |

| Maturity Date | 9/6/2027 |

| Most Recent Appraisal | $10,300,000 ($211/sf) |

| Most Recent Appraisal Date | 7/6/2017 |

| CRED iQ Base-Case Value | $7,154,000 ($147) |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.