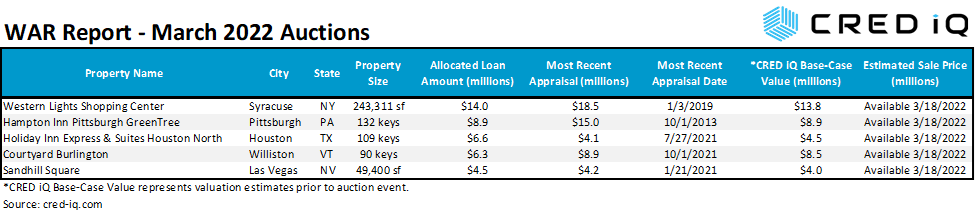

For this edition of the WAR Report, CRED iQ reviewed real-time valuations for five assets that are being marketed for sale this week. Each of these assets is distressed and requires workout by special servicers that have opted for auction sales. While one property is already REO, several properties may be subject to foreclosure if sales do not materialize. This week’s featured properties include three hotels with a history of pre-pandemic distress and two retail properties. All of the assets, four properties and one note, are being sold through an online auction platform with final bids due this week. Valuation guidance for each of the assets is provided prior to the closing of any sales. Contact our team — team@cred-iq.com — for post-auction results and valuation guidance.

CRED iQ valuations factor in a base-case (most likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, with detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

Western Lights Shopping Center

243,311 sf, Retail Community Center, Syracuse, NY [View Details]

This retail center, which secures a $14 million mortgage, has been in special servicing since October 2020. The property has a history of distress and was also in special servicing from December 2018 through June 2020. KeyBank, as special servicer, does not appear to have attempted to take title of the asset yet but the property has been marketed for sale. An auction sale of the property is scheduled for this week.

Western Lights Shopping Center is located about three miles outside the CBD of Syracuse, NY and has a traditional community center layout. The property is grocery-anchored by Price Chopper, accounting for 28% of the property’s NRA, pursuant to a lease that expires in July 2025. Price Chopper competes with a Wegman’s grocery store located across the street. The property is 71% occupied and has not shown any improvement in attracting new tenants since 2018. For the full valuation report and property-level details, click here.

| Property Name | Western Lights Shopping Center |

| Address | 4729 Onondaga Boulevard Syracuse, NY 13219 |

| Property Size | 243,311 sf |

| Outstanding Balance | $13,982,093 |

| Most Recent Appraisal | $18,450,000 ($76/sf) |

| Most Recent Appraisal Date | 1/3/2019 |

Hampton Inn Pittsburgh GreenTree

132 keys, Limited-Service Hotel, Pittsburgh, PA [View Details]

This limited-service hotel, which secures an $8.9 million loan, has been in special servicing since February 2021. Prior to the loan’s transfer to special servicing, a forbearance agreement was signed in August 2020 to provide COVID-related relief. However, cash flow issues existed at the property in 2019, which was evidenced by a below breakeven DSCR for the mortgage. During the forbearance agreement’s repayment period, the loan transferred to special servicing and had delinquent debt service payments. The borrower and special servicer agreed to market the property for sale in order to pay off the loan. The property will be auctioned online this week.

The hotel is located in the Green Tree suburb of Pittsburgh, PA and operates under the Hampton Inn flag pursuant to a franchise agreement that expires on November 30, 2023. Prospective buyers will likely consider costs of a property improvement plan (PIP) required by change of ownership as well as the potential renewal of the franchise agreement. The near-term expiration could also present the opportunity to reposition the hotel under a different brand. The hotel’s closest competitor is a 460-key DoubleTree by Hilton, which benefits from an adjacent sports complex as a primary demand generator. The property averaged 46% occupancy for most of 2021. For the full valuation report and property-level details, click here.

| Property Name | Hampton Inn Pittsburgh GreenTree |

| Address | 555 Trumbull Drive Pittsburgh, PA 15205 |

| Property Size | 132 keys |

| Outstanding Balance | $8,925,012 |

| Most Recent Appraisal | $15,000,000 ($113,636/key) |

| Most Recent Appraisal Date | 10/1/2013 |

Holiday Inn Express & Suites Houston North

109 keys, Limited-Service Hotel, Houston, TX [View Details]

This non-performing loan has an outstanding balance of $6.3 million and is secured by a 109-key limited-service hotel that has been in special servicing since July 2020. Although the loan’s transfer to the special servicer was characterized as COVID-related, the property struggled with cash flow in 2018 and 2019, which yielded below-breakeven DSCRs for the loan. LNR Securities, as special servicer, filed for foreclosure but will attempt to sell the loan prior to scheduling a foreclosure sale. The note sale will be conducted through an online auction this week.

The hotel is located approximately 20 miles north of the Houston, TX CBD and operates as a Holiday Inn Express & Suites pursuant to a franchise agreement with IHG Hotels that expires in October 2024. The property is located fairly close to George Bush Intercontinental Airport (IAH) and has had corporate contracts with airlines in the past, including Spirit Airlines. The hotel faces intense competition given its location along Interstate 45 with more than 10 lodging options within two miles. Additionally, there are three other Holiday Inn Express & Suites locations within 10 miles of the collateral property. For the full valuation report and property-level details, click here.

| Property Name | Holiday Inn Express & Suites Houston North |

| Address | 125 Airtex Drive Houston, TX 77090 |

| Property Size | 109 keys |

| Outstanding Balance | $6,632,621 |

| Most Recent Appraisal | $4,100,000 ($37,615/key) |

| Most Recent Appraisal Date | 7/27/2021 |

Courtyard Burlington

90 keys, Hotel, Williston, VT [View Details]

This hotel, which has outstanding debt of $6.3 million, has been in special servicing since September 2020. The title transferred to Argentic Services Company LP, acting as special servicer, in December 2021. The property was put up for sale via online auction this week. A change of ownership will likely require a PIP to be implemented by any prospective new owner. The last reported PIP for the property cost approximately $928,000.

The property is located approximately seven miles outside of downtown Burlington, VT and operates as a Courtyard by Marriott pursuant to a franchise agreement that expires March 24, 2032. The hotel’s cash flows were severely disrupted by the pandemic; however, operational struggles can be traced back to 2019. Food and beverage operations in 2019 generated a net loss and impaired total net cash flow for the hotel. More efficient operations under new management are a potential value-add opportunity for prospective investors. For the full valuation report and property-level details, click here.

| Property Name | Courtyard Burlington |

| Address | 177 Hurricane Lane Williston, VT 05495 |

| Property Size | 90 keys |

| Outstanding Balance | $6,345,188 |

| Most Recent Appraisal | $8,900,00 ($98,889/key) |

| Most Recent Appraisal Date | 10/1/2021 |

Sandhill Square

49,400 sf, Retail, Las Vegas NV [View Details]

This retail strip center, which has outstanding debt of $4.5 million, has been in special servicing for nearly nine years. The property has been REO since August 2018. However, there is a possibility that the retail center could be sold this week through an online auction. The property has a long history of high vacancy and low net cash flow compared to comparable retail centers. Furthermore, servicer commentary for the property makes note of groundwater contamination issues that still need to be resolved.

The property is located about five miles east of the Las Vegas Strip and has a traditional strip center layout across two buildings. Many of leasable spaces are uniformly sized and the largest occupied suite is approximately 3,850 sf. The property was 72% occupied as of January 2022. For the full valuation report and property-level details, click here.

| Property Name | Sandhill Square |

| Address | 4130-4180 S. Sandhill Road Las Vegas, NV 89121 |

| Property Size | 49,400 sf |

| Outstanding Balance | $4,499,474 |

| Most Recent Appraisal | $4,200,000 ($85/sf) |

| Most Recent Appraisal Date | 1/21/2021 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.