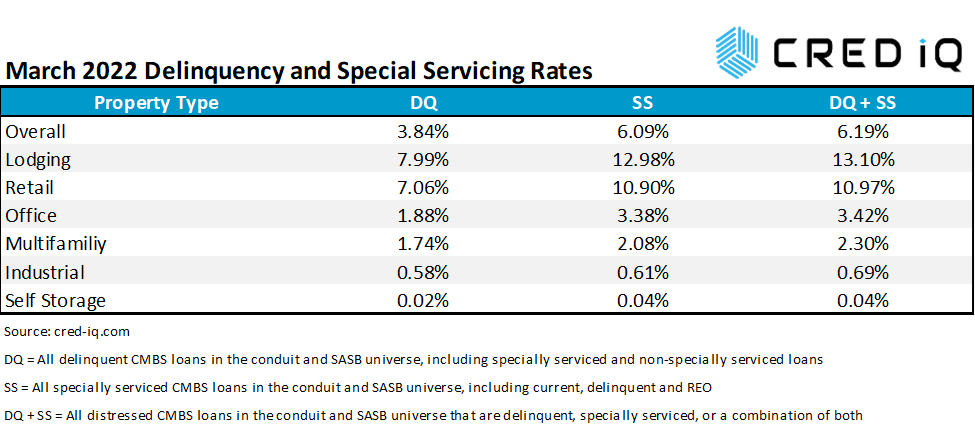

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

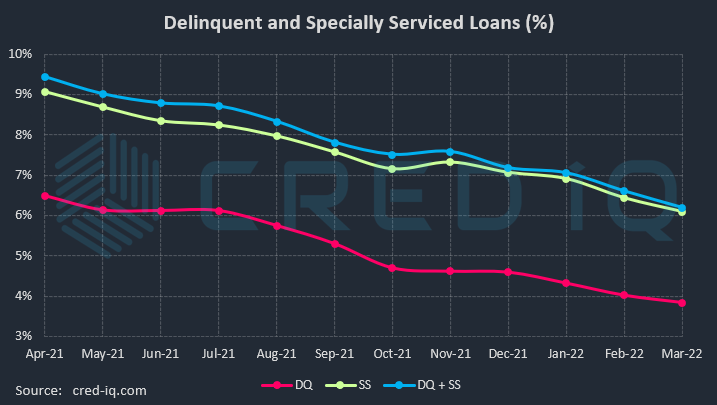

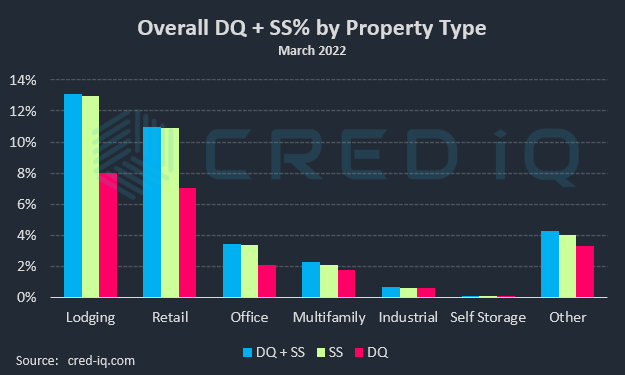

The CRED iQ overall delinquency rate for CMBS declined for the 22nd consecutive month with all major property types — retail, hotel, office, multifamily, and industrial — exhibiting improvements compared to the prior month. The delinquency rate, equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $500+ billion in CMBS conduit and single asset single-borrower (SASB) loans was 3.84%, which compares to the prior month’s rate of 4.02%. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), declined month-over month to 6.09% from 6.43%. A combination of workouts, liquidations, cures, and mortgage rehabilitations have enabled the special servicing rate to decline for the fourth consecutive month. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 6.19% of CMBS loans that are specially serviced, delinquent, or a combination of both. The overall distressed rate declined compared to the prior month rate of 6.40%. The overall distressed rates typically track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

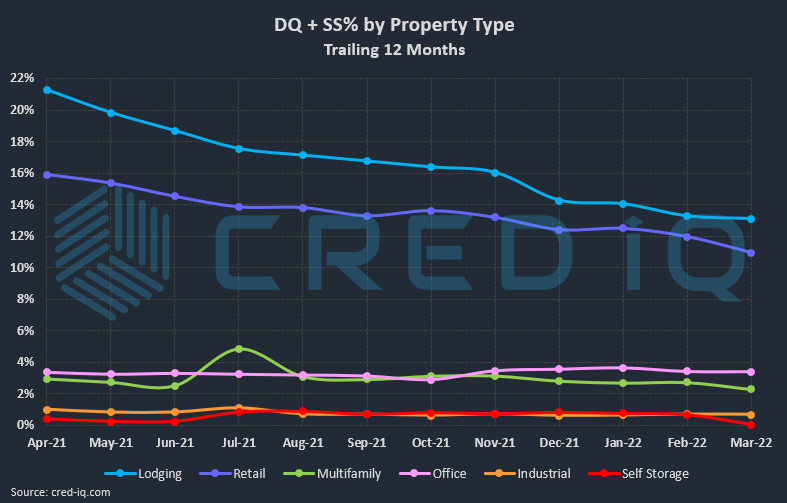

Lodging has shown the most improvement in individual delinquency rates by property type with a 46% decline over the trailing 12 months. The outstanding balance of delinquent lodging loans decreased by more than $450 million compared to the prior month. The lodging delinquency rate was 7.99% this month, which compared to 8.46% a month ago and 14.73% a year ago. An example of a contribution to the decline in the delinquency rate for lodging was the $75.5 million W Chicago – City Center loan, which was paid current and returned to the master servicer in February after a modification.

The delinquency rate for office moved nominally to 1.88%, compared to 1.89% as of February 2022. A subplot to the nominal month-over-month decline is the industry’s anticipation of a special servicing transfer for the $308 million 1740 Broadway loan. Commercial Observer first broke the news of Blackstone handing back the keys to 1740 Broadway in a March 21, 2022 article. The property’s largest tenant, L Brands, had a lease expire in March 2022 and the company vacated, relocating to 55 Water Street. The transfer to special servicing was not reflected in March 2022 servicer data; however, a delinquency is possible in the near term given the recent developments with the loan. Adjusting for the potential delinquency of 1740 Broadway would push the office delinquency over 2.00%.

Special servicing rates for lodging (12.98%), retail (10.90%), and multifamily (2.08%) declined compared to the prior month. The special servicing rate for office increased to 3.38% this month, compared to 3.31% last month, and the industrial special servicing rate increased nominally. Special servicing transfers of loans secured by office properties have steadily occurred throughout Q1 2022. Notable transfers for the March 2022 reporting period include The Pinnacle at Bishop’s Woods in the Milwaukee, WI MSA and 300 East Lombard in Baltimore, MD.

One of the largest loans to transfer to special servicing this month was the $237.2 million Walden Galleria mortgage, which is secured by a 1.5 million-sf portion of a super-regional mall in Buffalo, NY. The loan is scheduled to mature in May 2022 and the borrower, Pyramid Management Group, has reportedly requested a maturity extension. Despite the special servicing transfer, the loan remained current in payment. The loan previously transferred to special servicing in April 2020 and subsequently returned to the master servicer in December 2020 after a modification.

CRED iQ’s overall CMBS distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets. This month, distressed rates decreased for all property types. In addition to Walden Galleria, the $80 million Chicago Ridge Mall was also one of the largest loans to transfer to special servicing this month. The Chicago Ridge Mall loan has a near-term maturity date, July 6, 2022, and a timely pay off appears to be unlikely. For additional information about these two loans, click View Details below:

| [View Details] | [View Details] | |

| Loan | Walden Galleria | Chicago Ridge Mall |

| Balance | $237,181,455 | $80,000,000 |

| Special Servicer Transfer Date | 2/2/2022 | 3/14/2022 |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.