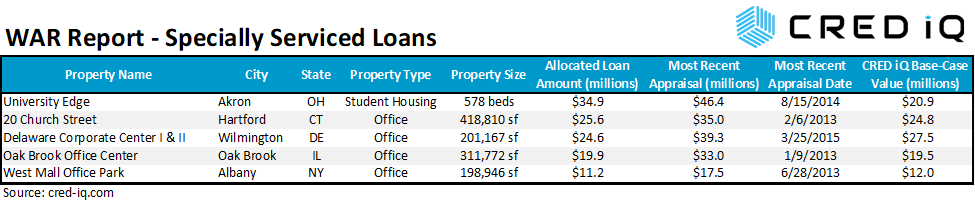

In this week’s WAR Report, CRED iQ calculated real-time valuations for five distressed properties that have transferred to special servicing in March and April 2022. Featured properties include a student housing complex serving the University of Akron as well as multiple office properties in the Hartford, Philadelphia and Chicago MSAs. CRED iQ’s special servicing rate for office loans increased to 3.73% in April 2022, moving inversely compared to the overall special servicing rate for all property types. Three of the five office properties highlighted this week were suburban office campuses — all with notable occupancy issues.

CRED iQ valuations factor in a base-case (most likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

University Edge

578 beds, Student Housing, Akron, OH [View Details]

This $34.9 million loan transferred to special servicing on March 11, 2022 due to imminent monetary default. The collateral property, University Edge, was impacted by the pandemic, resulting in a below breakeven DSCR for the loan during 2020 and through the nine-month period ended September 2021. The loan was current in payment as of April 2022, but workout negotiations have been initiated between the borrower and Midland Loan Services, acting as special servicer.

Historically, the August 2020 distressed workout of 22 Exchange is a notable comparison to University Edge for a potential range of outcomes. 22 Exchange was a 471-bed student housing property located about a half mile away from University Edge. The property became REO in December 2018 and was sold in August 2020 for approximately $12.5 million, equal to $26,539 per bed or $88,028 per unit. The new owner converted the property to traditional multifamily use after acquisition.

University Edge is a 148-unit student housing facility located adjacent to the University of Akron. The property contains 578 beds and 18,380 sf of ground-floor retail, which is primarily leased to food service tenants. Occupancy has slumped since the onset of the pandemic with remote learning opportunities allowing enrolled students more flexibility in housing location farther away from campus. The student housing portion of the property was approximately 84% occupied as of September 2021. Servicer commentary indicated the property was 54% pre-leased for the Fall 2022 semester. For the full valuation report and loan-level details, click here.

| Property Name | University Edge |

| Address | 270 East Exchange Street Akron, OH 44304 |

| Outstanding Balance | $34,854,818 |

| Interest Rate | 4.53% |

| Maturity Date | 11/6/2024 |

| Most Recent Appraisal | $46,400,000 ($80,277/bed) |

| Most Recent Appraisal Date | 8/15/2014 |

Stilts Building (20 Church Street)

418,810 sf, CBD Office, Hartford, CT [View Details]

This $25.6 million loan transferred to special servicing on March 7, 2022 due to non-compliance with cash management provisions. The mortgage has multiple cash management triggers tied to tenant events, including a trigger connected to the collateral property’s 5th largest tenant — the US Department of Housing and Urban Development (HUD). HUD occupies 6% of the collateral property’s NRA pursuant to a lease that expires in October 2022. A cash trap was structured to take effect nine months prior to lease expiration if a renewal has not been signed. Concurrent with the loan’s transfer to special servicer, debt service payments were 30 days delinquent.

The loan is secured by the Stilts Building, a 23-story office tower in the CBD of Hartford, CT. The property was 79% occupied as of year-end 2021, which was a decline compared to 87% in 2020 but not too far off from the occupancy level of 82% in 2012 prior to loan origination. The property has concentrated near-term lease rollover risk with 35% of the property’s NRA expiring in the next 24 months. The elevated lease rollover risk and cash management issues may present complications for the loan’s impending maturity date in April 2023. For the full valuation report and loan-level details, click here.

| Property Name | 20 Church Street |

| Address | 20 Church Street Hartford, CT 06103 |

| Outstanding Balance | $25,604,719 |

| Interest Rate | 4.54% |

| Maturity Date | 4/6/2023 |

| Most Recent Appraisal | $35,000,000 ($84/sf) |

| Most Recent Appraisal Date | 2/6/2013 |

Delaware Corporate Center I & II

201,167 sf, Suburban Office, Wilmington, DE [View Details]

This $24.6 million loan transferred to special servicing on March 15, 2022. The reason for the transfer was not specified at the time of writing. However, the collateral property’s largest tenant, DuPont Capital Management, failed to renew its lease within 12 months of expiration, which triggered a cash trap. DuPont Capital Management occupies 53,227 sf at 1 Righter Parkway, equal to 27% of the office complex’s aggregate NRA, pursuant to a lease that expires in December 2022. The tenant has two, five-year extension options available.

The loan is secured by a leasehold interest in two, three-story office buildings located in the suburbs of Wilmington, DE. Each building — 1 Righter Parkway and 2 Righter Parkway —is subject to individual ground leases that expire in 2046 and 2048, respectively. The ground leases reset every five years with CPI increases. The two office buildings were 96% occupied as of year-end 2021. Occupancy has the potential to decline to approximately 69% should DuPont Capital Management vacate at lease expiration. For the full valuation report and loan-level details, click here.

| Property Name | Delaware Corporate Center I & II |

| Address | 1 and 2 Righter Parkway Wilmington, DE 19083 |

| Outstanding Balance | $24,569,647 |

| Interest Rate | 3.97% |

| Maturity Date | 5/6/2025 |

| Most Recent Appraisal | $39,275,000 ($195/sf) |

| Most Recent Appraisal Date | 3/25/2015 |

Oak Brook Office Center

311,772 sf, Suburban Office, Oak Brook, IL [View Details]

This $19.9 million loan transferred to special servicing on April 1, 2022 due to delinquency. The loan became 60 days delinquent in April 2022. The collateral property’s largest tenant, Sanford LP, had a lease expiration in December 2021. Servicer commentary indicated the tenant, which occupied 39% of the collateral property’s NRA, was looking to downsize its space. The tenant’s search for a smaller office footprint included other properties in the local market.

Oak Brook Office Center is a four-building suburban office park located approximately 20 miles west of Chicago, IL. Sanford LP’s lease was for the entirety of the building located at 2707 Butterfield Road. Occupancy across all four buildings in the office park was 75% as of year-end 2021. Any reduction in space or departure by Sanford LP will likely lead to a below breakeven DSCR for the loan if the vacant space is not backfilled in a timely matter. For the full valuation report and loan-level details, click here.

| Property Name | Oak Brook Office Center |

| Address | 2707 – 2809 Butterfield Road Oak Brook, IL |

| Outstanding Balance | $19,889,728 |

| Interest Rate | 4.38% |

| Maturity Date | 4/1/2023 |

| Most Recent Appraisal | $33,000,000 ($106/sf) |

| Most Recent Appraisal Date | 1/9/2013 |

West Mall Office Park

198,946 sf, Suburban Office, Albany, NY [View Details]

This $11.1 million loan transferred to special servicing on April 7, 2022 due to imminent monetary default. Servicer commentary for the loan stated the borrower had requested COVID-related relief but credit issues appear to be more sustained than implied by a temporary relief request. The loan is secured by West Mall Office Park, a three-building office park located in Albany, NY. Occupancy across all three buildings was 71% as of June 2021 and one of the buildings appears to be vacant. The property’s former largest tenant, for-profit college operator Midred Elley, reduced its footprint at the office park in 2019 from 28% of the aggregate NRA to 19%. Despite the transfer to special servicing, the loan was current in payment as of April 2022. For the full valuation report and loan-level details, click here.

| Property Name | West Mall Office Park |

| Address | 845 – 875 Central Avenue Albany, NY 12206 |

| Outstanding Balance | $11,186,406 |

| Interest Rate | 5.51% |

| Maturity Date | 9/1/2023 |

| Most Recent Appraisal | $17,500,000 ($88/sf) |

| Most Recent Appraisal Date | 6/28/2013 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.