This week, CRED iQ calculated updated valuations for three multifamily properties that secure delinquent GNMA loans. Although Ginnie Mae loans have mortgage insurance from the FHA as well as a timely payment guarantee, delinquent Ginnie Mae loans can still lead to foreclosure that can provide opportunities for distressed investors looking to step in and inject additional capital or create value-add plans by improving operations. Mortgage originators, distressed investors, and commercial brokers can search CRED iQ’s database of approximately 15,000 Ginnie Mae loans totaling more than $138 billion in outstanding debt for their next deal. The properties featured in this week’s WAR Report secure a subset of select Ginnie Mae loans that are at least 30 days delinquent. The highlighted loans are all secured by senior housing collateral, including a skilled nursing facility (SNF) in Plainsboro, NJ near Princeton Medical Center.

CRED iQ valuations factor in base-case (Most Likely), downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS and GNMA loan reporting, including detailed financials and borrower contact information, sign up for a free trial here.

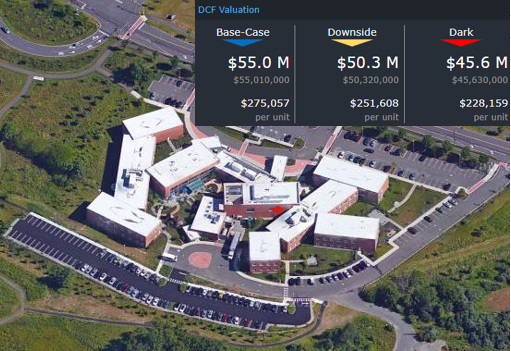

Merwick Care & Rehabilitation

200 beds, SNF (Skilled Nursing Facility), Plainsboro, NJ [View Details]

GNMA 2015-36182CYP6

This $26.5 million loan, which is over 60 days delinquent, is secured by a 200-bed skilled nursing facility in Plainsboro, NJ, located across the street from Princeton Hospital and the adjacent medical center. The mortgage backs a Ginnie Mae project loan pool and was originated by KeyBank in September 2015. The FHA-insured mortgage was issued through the Department of Housing and Urban Development’s (HUD) 232 program for nursing homes and assisted-living facilities pursuant to Section 223(f) for the acquisition or refinancing of existing mortgages. The loan has an interest rate of 3.54% and a 35-year term with a maturity date in October 2050. Call protection is in the form of 0/10 — no lockout and a 10-year declining prepayment penalty, which is estimated to be 3% of the outstanding balance as of 2022.

Merwick Care & Rehabilitation has 200 beds across 128 units and participates in both Medicare and Medicaid. The skilled nursing facility averages approximately 155 residents per day. The property last had a health inspection in December 2021 and 11 health citations were reported, which is higher than the national average and significantly higher than the average for the state of New Jersey. COVID vaccination rates for residents are in line with the national average of 87%. Despite the reported delinquency, the property is strategically located next to a well-established medical center and has several amenities including, a 3,500-sf gym, on-site dialysis, and advanced rehabilitation equipment. For the full valuation report and loan-level details, click here.

| Property Name | Merwick Care & Rehabilitation |

| Address | 100 Plainsboro Road Plainsboro, NJ 08536 |

| Outstanding Balance | $26,468,192 |

| Interest Rate | 3.54% |

| Origination Date | 9/18/2015 |

| Maturity Date | 10/1/2050 |

| FHA Section Code(s) | 232/223(f) |

Bentley Commons at Bedford

97 units, Assisted Living Facility, Bedford, NH [View Details]

GNMA 2016-36195NBG2

This $14.2 million loan, which is over 90 days delinquent, is secured by a 97-unit senior housing facility in Bedford, NH, approximately 55 miles northwest of Boston, MA. Similar to Merwick Care & Rehabilitation, the mortgage loan was endorsed for insurance under Section 232 pursuant to Section 223(f), facilitating financing for nursing homes and assisted-living facilities. Orix Real Estate Capital originated the loan in February 2014 with an original balance of $15.5 million. The fully amortizing loan has a term of 35 years and an interest rate of 3.95%. Prepayment terms include a zero-year lockout and a 10-year declining penalty starting at 10%. Specifically, the loan was five months delinquent as of April 2022 but servicer data indicates the loan has been modified. As for the collateral property, Bentley Commons at Bedford offers one-bedroom and two-bedroom configurations with health services that include hospice care and physical therapy. Minimal COVID cases were reported at the property as of February 2022, but the facility had over 20 confirmed cases a year prior in February 2021. For the full valuation report and loan-level details, click here.

| Property Name | Bentley Commons at Bedford |

| Address | 66 Hawthorne Drive Bedford, NH 03110 |

| Outstanding Balance | $14,156,481 |

| Interest Rate | 3.95% |

| Origination Date | 2/3/2014 |

| Maturity Date | 3/1/2049 |

| FHA Section Code(s) | 232/223(f) |

Watercrest at Victoria Falls

312 units, Assisted Living Facility, Andover, KS [View Details]

GNMA 2020-3617QSPH5

This $13.8 million loan is over 90 days delinquent and is secured by a 312-unit senior housing facility in Andover, KS, approximately 12 miles outside of Wichita. The mortgage backs a Ginnie Mae project loan pool and was originated by Dwight Capital in March 2020. The loan was five months delinquent as of April 2022. The loan falls under both Section 232 and Section 223(f) of FHA’s mortgage insurance program. The loan is fully amortizing throughout its 35-year term and has an interest rate of 3.75%. Prepayment terms are 2/8 — a two-year lockout ending December 2022 followed by an eight-year declining prepayment penalty period starting at 8%. Servicer data indicates the loan has been modified. The property neighbors a management-affiliated skilled nursing facility (SNF), which does not serve as collateral for the mortgage. The adjacent SNF rates poorly on several metrics including health citations and vaccinations rates. Poor management may be a shared attribute contributing to the delinquency at Watercrest at Victoria Falls. For the full valuation report and loan-level details, click here.

| Property Name | Watercrest at Victoria Falls |

| Address | 408 E Central Avenue Andover, KS 67002 |

| Outstanding Balance | $13,750,900 |

| Interest Rate | 3.75% |

| Origination Date | 3/1/2020 |

| Maturity Date | 4/1/2055 |

| FHA Section Code(s) | 232/223(f) |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.