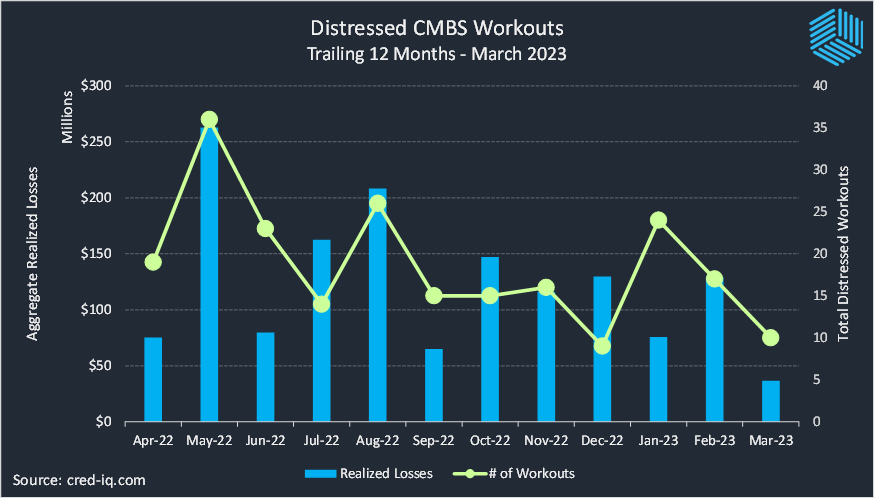

CMBS transactions incurred approximately $36.7 million in realized losses during March 2023 via the workout of distressed assets. CRED iQ identified 10 workouts classified as dispositions, liquidations, or discounted payoffs in March 2023. Of the 10 workouts, only one was resolved without a loss. Of the nine workouts resulting in losses, severities for the month of March ranged from 2% to 95%, based on outstanding balances at disposition. Aggregate realized losses in March 2023 were approximately 72% lower than February 2023 due to the lower quantity of distressed workouts. The aggregate realized loss total of $36.7 million was the lowest level of realized losses for any month over the past year. On a monthly basis, realized losses for CMBS transactions averaged approximately $124 million during the trailing 12 months.

By property type, workouts were concentrated in lodging, accounting for half of the distressed resolutions in March 2023. Distressed workouts for lodging properties had the highest total of aggregate realized losses ($25.6 million), which accounted for 70% of the total for the month. The largest distressed workout featuring a lodging property was the REO liquidation of the Crowne Plaza Houston Katy Freeway, a 207-key full-service hotel located in Houston, TX. The hotel transferred to special servicing in May 2020 due to COVID-related distress and became REO in June 2021. The property had outstanding debt of $28.3 million and the liquidation resulted in a loss of $24.2 million, equal to a severity of 86%. The liquidation was also the largest workout in March by outstanding debt balance.

The largest loss severity among distressed workouts in March was from the REO liquidation of IUP Pratt Studios, a 139-unit student housing property designated for students enrolled at Indiana University of Pennsylvania. Prior to liquidation, the property had been in special servicing since July 2020. The student housing complex had outstanding debt of $4 million prior to its liquidation. The REO sale of the property resulted in a 95% loss severity on outstanding debt.

Excluding defeased loans, there was approximately $5.4 billion in securitized debt among CMBS conduit, Single-Borrower Large-Loan, and Freddie Mac securitizations that was paid off or liquidated in March 2023, which was approximately a 54% increase compared to $3.5 billion in February 2023. In March, 2% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs. The percentage of distressed workouts was 8% in the prior month. Approximately 5% of the loans were paid off with prepayment penalties, which was significantly less than in prior months. Loan prepayment has declined significantly in recent months given the relatively high interest rate environment.

Further excluding Freddie Mac securitizations, lodging had the highest total of outstanding debt payoff in March with approximately 36% of the total by balance. Multifamily had the next highest percentage of outstanding debt payoff with 27% of the total. Among the largest mortgages to pay off was a $560 million loan secured by 59 La Quinta Inn select-service hotels. A total of 109 hotels were encumbered by the mortgage, which had a balance north of $1 billion at origination.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.