SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

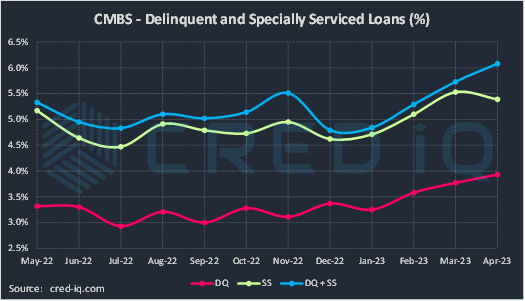

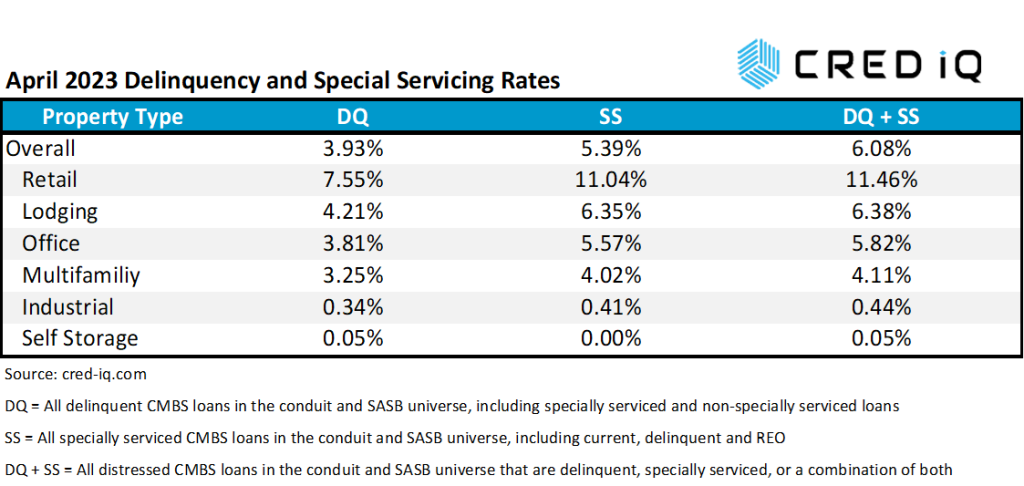

The CRED iQ delinquency rate for CMBS for the month of April 2023 increased for the third consecutive month to 3.93%. The delinquency rate was 16 basis points higher than the prior month’s rate of 3.77%. Increased distress in commercial real estate has deservedly dominated the March and April news cycles and underlying data compiled by CRED iQ for April 2023 underpinned continued commentary on industry distress. The delinquency rate is equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $600+ billion in CMBS conduit and single asset single-borrower (SASB) loans. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), declined month-over-month to 5.39% from 5.53%. This month’s decline in the special servicing rate indicated that workout activity was present and ongoing in the wake of additional delinquencies. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 6.08% of CMBS loans that are specially serviced, delinquent, or a combination of both. The increase in delinquent loans outweighed a relatively smaller decline in special servicing for a net increase in the overall CMBS distressed rate, which compares to the prior month’s distressed rate of 5.73%. Distressed rates generally track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

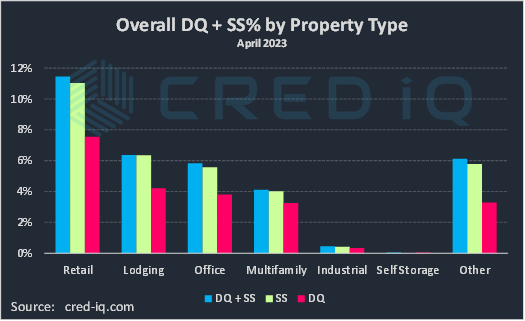

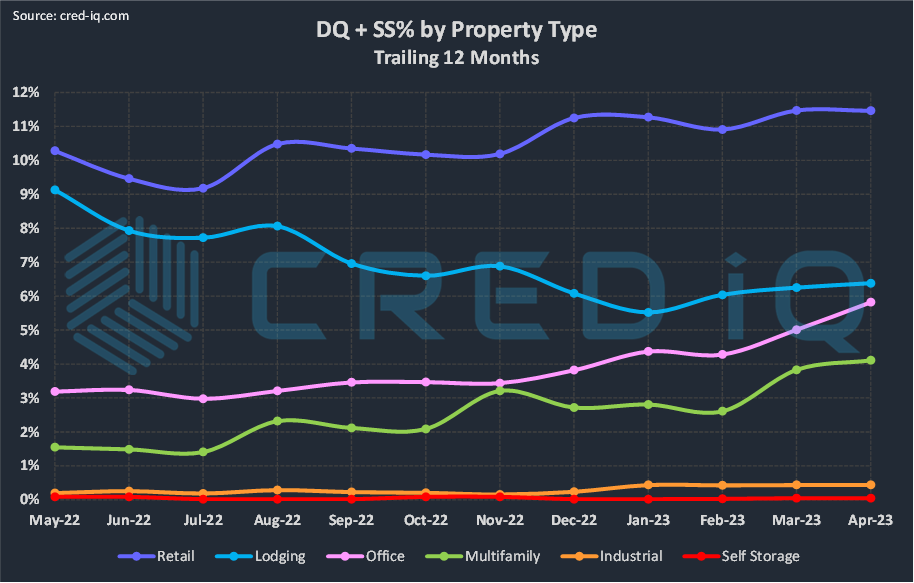

Headwinds intensified for the office sector in April 2023 after additional delinquencies were the source of a month-over-month surge in the percentage of delinquent office loans. The delinquency rate for loans secured by office properties increased to 3.81%, which was 72 basis points higher than March and represented a 23% month-over-month increase. The office delinquency rate has increased for five consecutive months and is more than 2x higher than a year prior. Drivers behind April’s rise in office delinquencies included a $240 million mortgage secured by 600 California Street, a 359,883-SF office tower in San Francisco, CA. The loan was recently reported as 30 days delinquent and also transferred to special servicing in late-March 2023. The embattled coworking firm WeWork is a primary tenant at the property, leasing 52% of the NRA, and is also a general partner in the ownership structure of the building.

The consistent rise in office delinquency is concurrent with a recovery in lodging delinquency, drawing the delinquency rates for both property types closer together. The lodging delinquency rate as of April 2023 was 4.21%, a decline compared to March 2023’s rate of 4.58%. As a point of reference, the delinquency rate for lodging in 2020 during the onset of the pandemic was north of 20% — a substantial recovery for the lodging industry. April’s delinquency decline for lodging narrows the gap between office delinquency (3.81%) and lodging delinquency (4.21%) to just 40 basis points.

The delinquency rate for retail (7.55%) exhibited a month-over-month decline while the CMBS multifamily delinquency rate (3.25%) increased for the second consecutive month. Delinquency rates for industrial (0.33%) and self-storage (0.05%) were relatively unchanged compared to the prior month.

Shifting focus to special servicing rates, CRED iQ observed increases for the office, lodging, and multifamily sectors. Only the special servicing rate for retail properties (11.04%) exhibited a month-over-month decline. Office again took the spotlight as the property type with the highest percentage change in special servicing, increasing from 4.97% as of March 2023 to 5.57% as of April 2203 – equal to a 12% change. Central business district submarkets were responsible for an oversized segment of newly transferred office loans. Examples included an $84.5 million mortgage secured by The Wanamaker Building in Philadelphia, PA and a $56.5 million loan secured by a 190,385-SF office building located at 1201 Connecticut Avenue NW in Washington, DC. Both properties are encumbered by floating-rate debt, factoring into the loans’ credit concerns. CRED iQ first noted lease expiration concerns for The Wanamaker Building’s primary tenants back in April 2022.

Loans secured from suburban office properties were not immune from adverse headwinds either. A $350 million mortgage secured by a 2.2 million-SF, eight-property suburban office portfolio owned by Adventus Realty Trust, with properties located in Illinois and Georgia, transferred to special servicing in Mid-March 2023. Additionally in mid-March 2023, a $161.4 million mortgage secured by nine Brookfield office properties, primarily located in suburban Washington, DC transferred to special servicing.

Aside from the office sector, the special servicing rate for lodging came in at 6.35%, a modest increase compared to March 2023. Multifamily (4.02%) also exhibited an increase in its special servicing rate. The special servicing rate for industrial properties remained relatively unchanged while self-storage did not have any specially serviced inventory.

CRED iQ’s CMBS distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets. This month, the overall distressed rate for CMBS increased to 6.08%. The increase was 35 basis points higher than March’s distressed rate (5.73%), equal to a 6% increase. CRED iQ’s overall distressed rate is at its highest level since March 2022.

For additional information about two of this month’s largest loans that transferred to special servicing, click View Details below:

| [View Details] | [View Details] | |

| Loan | 600 California Street | The Wanamaker Building |

| Balance | $240 million | $84.5 million |

| Special Servicer Transfer Date | 3/24/2023 | 3/27/2023 |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.