CRED iQ examined 190 appraisals of major properties across all assets classes to determine the impact of current market conditions on asset values.

The most notable declines in valuation were dominated by retail and office properties. Some key takeaways:

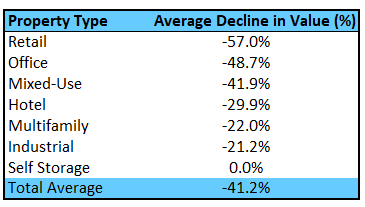

- Across $ 10 billion in assets CRED iQ noted an average of 41.2% decline in valuation from the original appraised value.

- By segment, retail properties experienced the highest decline in value at 57% led by several large malls.

- The office sector was close behind with an average valuation decline of 48.7%

- Self-Storage remained robust with no properties reporting a decline in valuation from specially serviced assets.

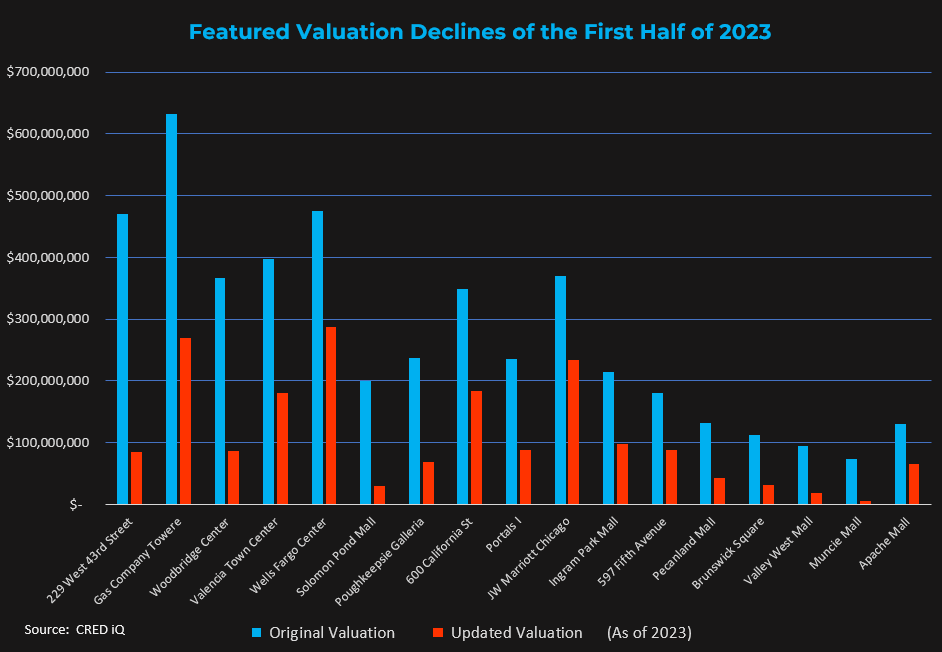

Here are the most notable properties that made our list:

229 West 43rd Street, New York City

This 248,457 square foot retail condo in Times Square topped our list with a jaw dropping $386 million valuation decline.

Gas Company Tower, Los Angels CA

This massive 1,377,053-sf office tower came in a close second on our list. Originally valued at $632 million the current value is $270 million–a decline of $362 million.

Woodbridge Center, Woodbridge NJ

This regional mall spanning 1.1 million square feet saw their valuation decrease by $366 million to $86 million (76.5%) earning them the number three spot.

Wells Fargo Center, Denver

This 1.2 million square foot office tower in Upper Downtown Denver dropped $188 million in value which ranked them fifth on our list.

JW Marriott, Chicago

The only non-retail or office property that made our Top 10 was this 610-room hotel in the Chicago Loop area that experienced a $136 million decline.

Overall, the analysis highlights the need for continued monitoring of real estate assets and their exposure to changing market conditions. The appraisals were based on sales and leasing data from CRED iQ, and other reliable sources. In conclusion, the current market conditions are having a significant impact on the valuation of commercial real estate properties across all asset classes. Retail and office properties are being hit the hardest while self-storage remains resilient. It is crucial to continuously monitor real estate assets and their exposure to changing market conditions.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.