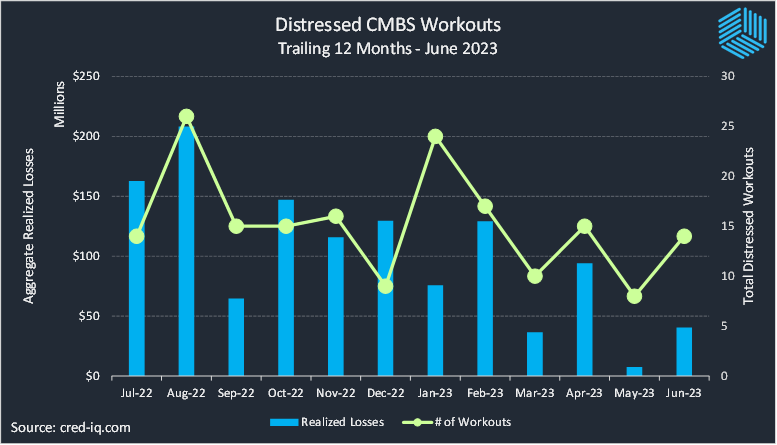

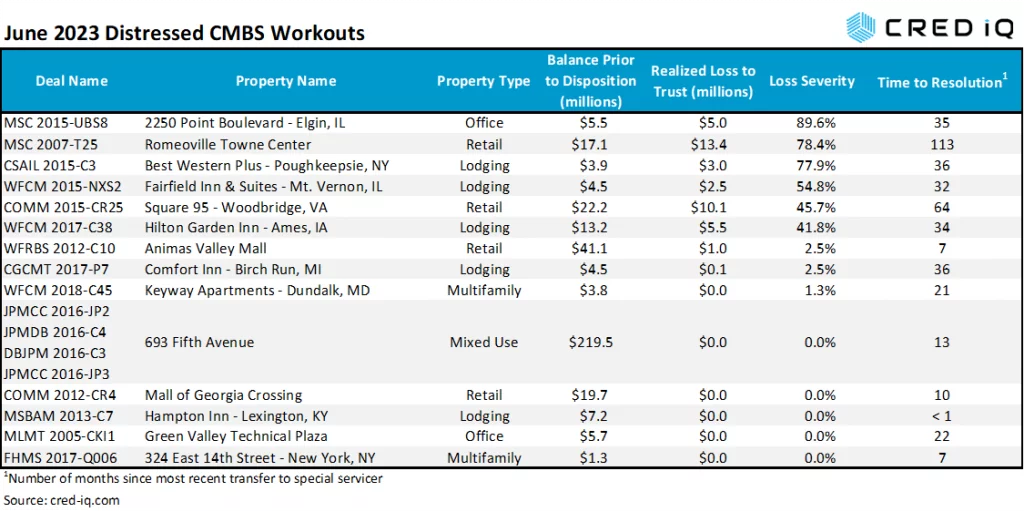

CMBS transactions incurred approximately $41 million in realized losses during June 2023 via the workouts of distressed assets. CRED iQ identified 14 workouts classified as dispositions, liquidations, or discounted payoffs in June 2023. Of the 14 workouts, five were resolved without a principal loss. Of the nine workouts resulting in losses, severities for the month of June ranged from 1% to 90%, based on outstanding balances at disposition. Aggregate realized losses in June 2023 were more than 5x higher than May 2023 due, in part, to a higher volume of distressed workouts including two notable retail workouts. The aggregate realized loss total of $40.7 million was lower than the average aggregate monthly CMBS loss total for the trailing 12 months, which was equal to approximately $101 million.

By property type, workouts were concentrated in lodging and retail. Lodging workouts accounted for five of the 14 distressed resolutions in June 2023 and retail workouts accounted for four distressed workouts. Distressed workouts for retail properties had the highest total of aggregate realized losses ($25 million) by property type, which accounted for 60% of the total for the month. Distressed lodging workouts had the second-highest total of aggregate losses by property type with $11.1 million, or 27% of the total.

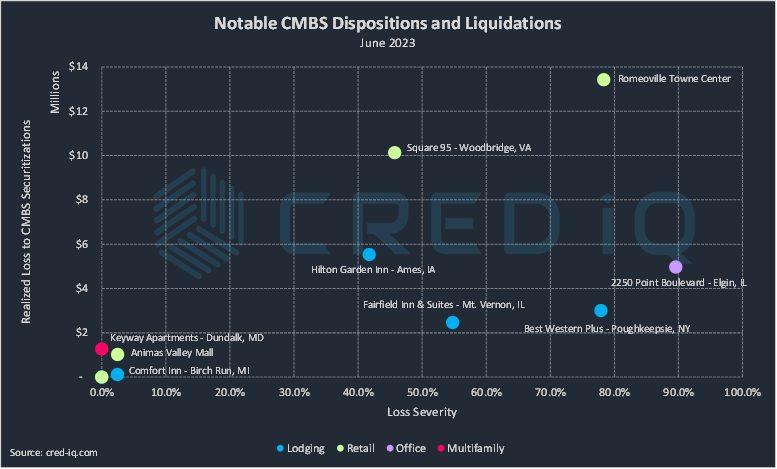

The two largest individual losses were associated with REO retail properties. First, the Romeoville Towne Center, a 108,242-SF community center located 40 miles southwest of Chicago, IL, liquidated with a $13.4 million loss. Outstanding debt at the time of disposition totaled $17.1 million, equal to a 78% loss severity. The property had been REO since February 2019 and had been in special servicing since 2014. Second, a 155,309-SF big-box retail outparcel of the Potomac Mills Mall in Woodbridge, VA known as Square 95, was liquidated with a $10.1 million loss. Outstanding debt on the property totaled $22.1 million prior to disposition, equal to a 46% loss severity.

The largest individual loss severity involved a suburban Chicago office property, 2250 Point Boulevard. The 80,978-SF office building transferred to special servicing in July 2020 and became REO in November 2021. Outstanding debt prior to disposition totaled $5.5 million and the liquidation resulted in a realized loss of $5 million, equal to a 90% severity.

The largest workout by outstanding balance was a $220 million mortgage secured by 693 Fifth Avenue, a 96,514-SF mixed-use (retail/office) property located in Midtown Manhattan, NY. Prior to the loan’s transfer to special servicing in May 2022, the property primarily generated revenue from its retail component, including ground-floor space formerly leased to Valentino. The retail space was backfilled by Burberry in April 2023 and the loan was paid off in June 2023 without incurring a principal loss.

Excluding defeased loans, there was approximately $5.2 billion in securitized debt among CMBS conduit, and Single-Borrower Large-Loan securitizations that was paid off or liquidated in June 2023, which was approximately a 53% increase compared to $3.4 billion in May 2023. In June, 2% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs, which was in line with the prior month. Loan prepayment remained subdued in June — approximately 8% of the loans were paid off with prepayment penalties.

Retail had the highest total of outstanding debt payoff by property type in June with approximately 30% of the total by balance. Lodging had the next highest percentage of outstanding debt payoff with 25% of the total. The $540 million loan secured by the Miracle Mile Shops retail complex in Las Vegas, NV was among the largest mortgages to pay off in June 2023.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.