CRED iQ explores occupancy trends within the multifamily sector.

CRED iQ’s research team wanted to explore the multifamily sector which has been in the spotlight of late. Indeed, according to the MSCI Commercial Property Report, Multifamily prices have been slipping for sixteen consecutive months (December’s flat print broke that streak). Naturally there are many factors at play here – from the macro interest rate environment to inflections arising from massive construction-driven unit growth.

How do these factors impact occupancy? What trends emerge as we look across recent occupancy performance? Our team dug in to the top 50 MSAs to see what we can learn.

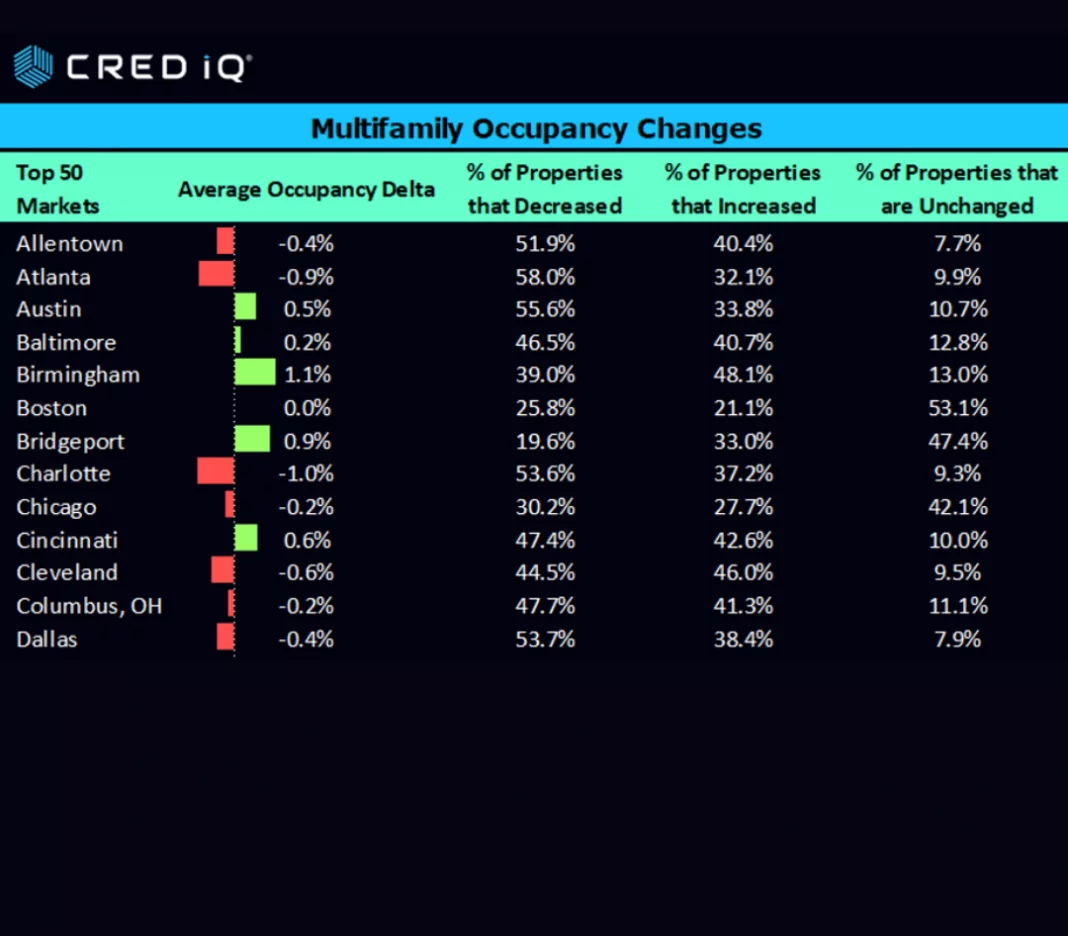

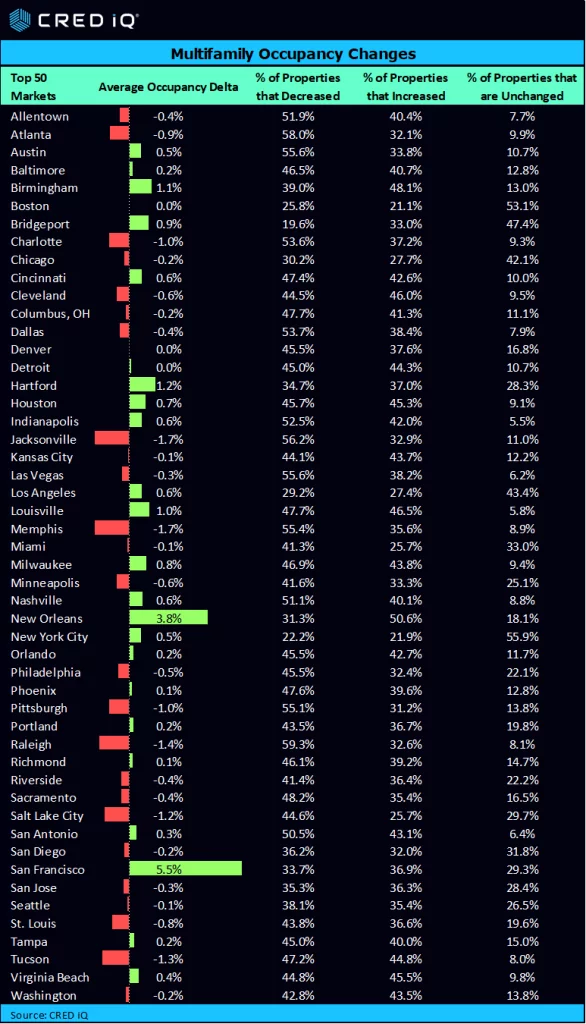

Overall, the average occupancy increased by 0.3%. However, of the 50 largest MSAs tracked by CRED iQ, many markets had declines in occupancy since their previously reported rent roll. CRED iQ examined all multifamily properties that had an occupancy change. Our discovery is that 26 of the Top 50 markets showed an overall decline in their reported occupancies by number of properties.

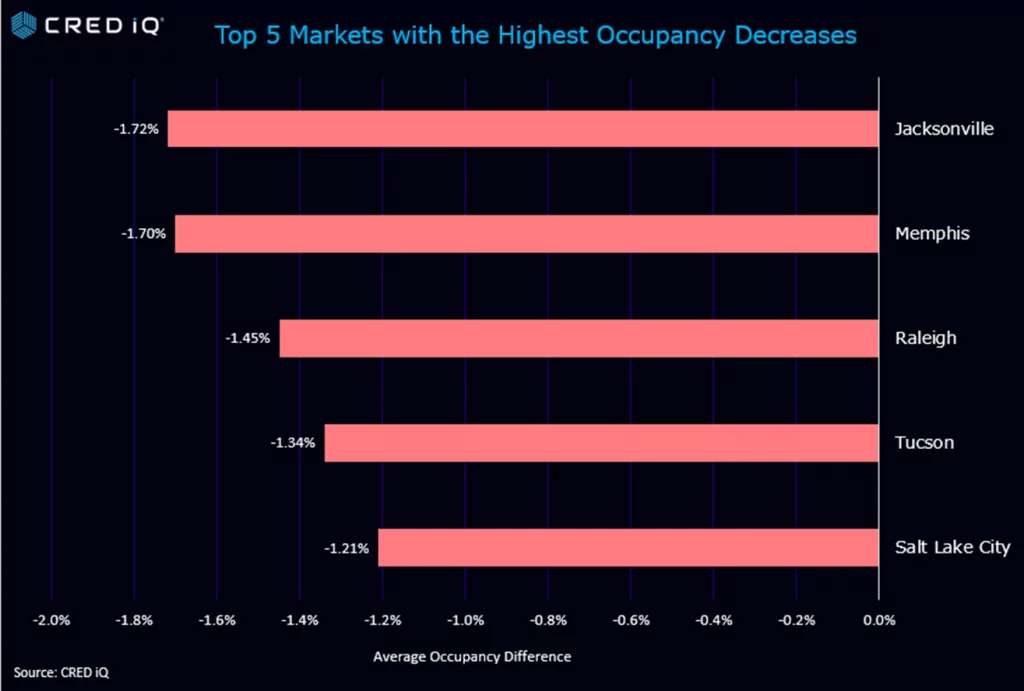

In one market example, Raleigh’s apartments showed that 59% of the properties reported a decline in occupancy and 33% reported an increase, while 8% remained unchanged.

Occupancy at The Proper Raleigh Apartments in Raleigh, NC decreased from 60.2% in December 2022 to 44.8% in September 2023. The 384-unit property is backed by a $44.4 million loan and was added to the servicer’s watchlist in July 2023 due to decreased occupancy. Increased vacancy is attributed to regular unit turnover along with decreased total units due to renovations. Servicer commentary indicates the borrower intends to spend $16.6 million ($43,219/unit) on renovations with work estimated to be completed in 2024.

Atlanta was another market that showed a significant number of properties with falling occupancies. In the CRED iQ analysis, 362 apartment buildings representing 58% of the total we tracked, had a reported drop in occupancy.

The third-largest percentage showing a drop in occupancy was Jacksonville. Approximately 56% of the multifamily properties reported an occupancy decline, 33% increased, while 11% was unchanged.

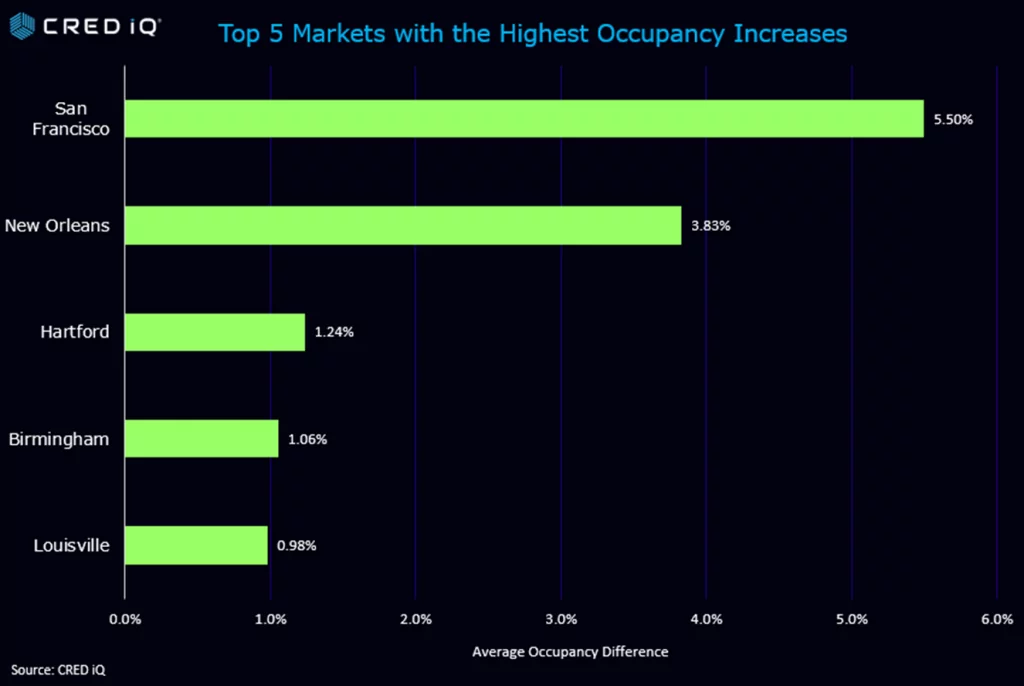

The top 10 markets with the highest occupancy increases (by property counts): New Orleans, Birmingham, Louisville, Cleveland, Virginia Beach, Houston, Tucson, Detroit, Milwaukee and Kansas City.

The Whitney Manor Apartments is a 199-unit multifamily complex located in the New Orleans market. The 21-building complex is backed by a $10.8 million loan that was added to the servicer’s watchlist in October 2023 due to DSCR triggers. Increased expenses drove the DSCR (NCF) to drastically drop from 1.66 at origination in 2020 to 0.18 in September 2023. Despite financial struggles occupancy at the property has increased from 62.0% in December 2021 to 90.0% in September 2023.

The top 10 markets with the highest occupancy decreases: Raleigh, Atlanta, Jacksonville, Las Vegas, Austin, Memphis, Pittsburg, Dallas, Charlotte, Indianapolis

There were 13 markets where at least half of the total properties reported a decrease in occupancy: Allentown, Atlanta, Austin, Charlotte, Dallas, Indianapolis, Jacksonville, Las Vegas, Memphis, Nashville, Pittsburgh, Raleigh and San Antonio.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.