CRED iQ and Cedars Hill Group team up on another Case Study that analyzes a mall in Ohio that resulted in a loss of $92.7 million.

In our last two case studies on The Gas Company Tower and Crossgates Mall we reviewed the history of those properties that led up to their troubles and eventual liquidations that resulted in massive losses for CMBS bond holders. Igal Namdar of Namdar Realty Group, who has been one of the most prolific buyers of distressed malls in the US, made the distinction between distressed and over levered in a Bloomberg interview by pointing out that just because a property has too much debt doesn’t mean it’s a bad property. Commercial real estate has been prominently featured in the press this year and has come to be regarded as a poisonous asset class. However, this viewpoint misses Namdar’s distinction entirely and risks overlooking value-laden investment opportunities. Accordingly, this case study is going to speculate on what the future may hold after these “distressed” properties deleverage through foreclosure or bankruptcy.

CRED iQ’s unique data platform is a tool that can help identify opportunities like properties that are going to enter receivership, or properties that need recapitalization or refinancing, and properties that need capital for revitalization. In today’s rapidly changing market this tool can be combined with creative and innovative financing and other insightful solutions to navigate and unlock value in the ongoing credit cycle. In choosing the property for this case study we turned to CRED iQ’s monthly listing of liquidated loans and coincidentally found a property that Igal Namdar recently purchased.

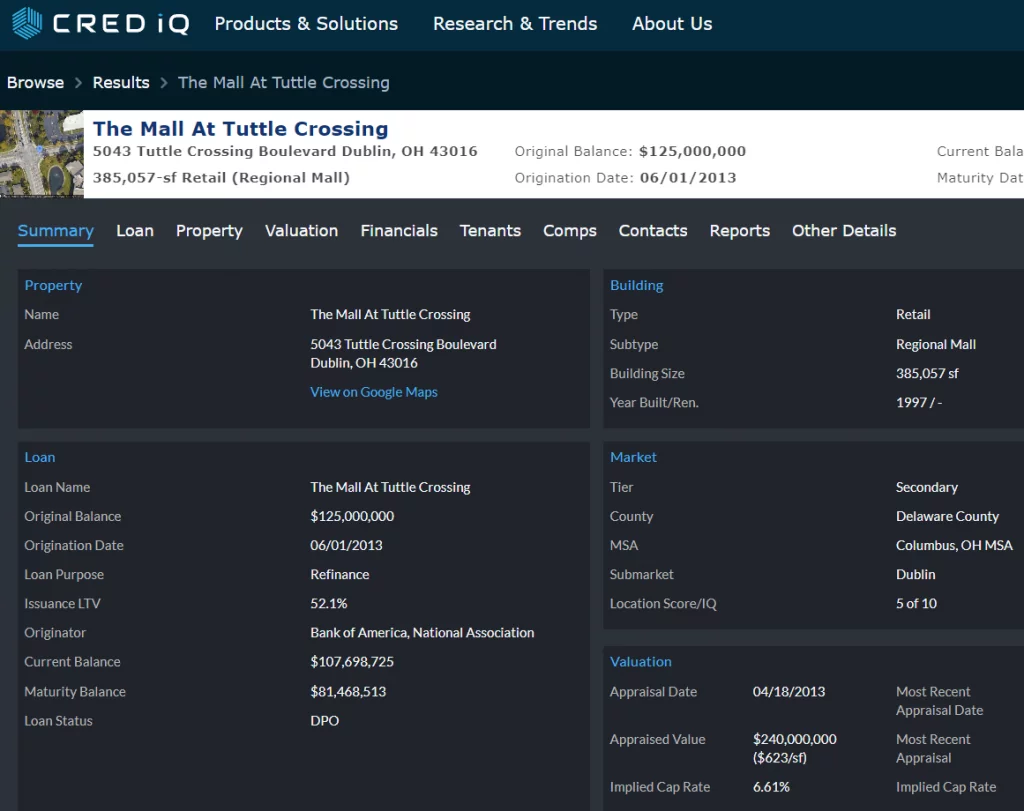

The Mall at Tuttle Crossing headlines CRED iQ’s listing of liquidated loans for the largest realized loss to the CMBS trust after it was purchased in October by a partnership of Namdar Realty Group, Mason Asset Management, and CH Capital Group for $19.5 million which was below the Franklin County Auditor’s assessment of $50 million and the April 2013 appraisal of $240 million. Tuttle Crossing is just the latest in a long series of enclosed malls selling at pennies on the dollar, but it affords us the opportunity to learn what opportunities high-quality, but over levered properties like this may present to discerning investors.

The latest financials we have available are from the six months ending in June and show net cashflow (NCF) of just over $2 million, which provides the Namdar led group with a rough 20% cash-on-cash annualized yield on their investment. Namdar is well-known for their strategy of buying malls like Tuttle Creek at attractive cash-on-cash yields and operating the property as-is, forgoing big and expensive capex investments, instead focusing on bringing in new tenants at cheaper rents which they can afford given their low investment basis. Most municipalities prefer a new owner to inject new capital and redevelop underperforming properties and Namdar has received some criticism for their strategy but many times there are major impediments to redevelopment.

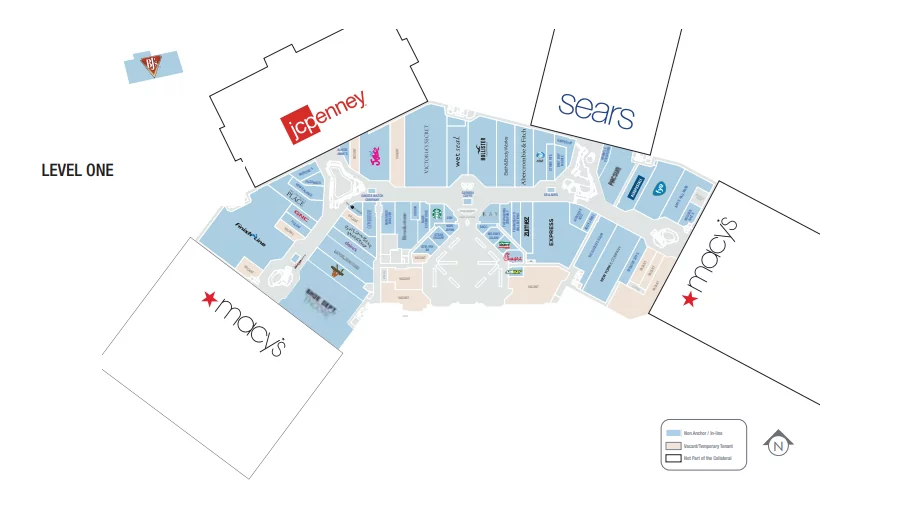

In Tuttle Crossing’s case the major barrier to redevelopment is the fact that the anchor boxes are still owned by the department stores that once filled those spaces. The former Sears box is listed for lease or sale as a mixed-use redevelopment opportunity which would be ideal for retail, multifamily, hotel, office, and industrial. The fact that the site is parceled out and that the Namdar group does not own the site in its entirety makes redevelopment far less attractive for the new owners. The demographics of the area are favorable for a combination of retail, hotel, and multifamily or office if Namdar were able to bring in some higher end tenants turning the property into a living and entertainment destination, but significant capex would be required to do so.

While the ownership of the site is a major impediment there are other recent developments that have made redevelopment of these properties more attractive. First, the recently passed Inflation Reduction Act (IRA) has created new tax credits for green energy manufacturing, solar, and battery storage which can help owners and developers realize significantly more operational savings and offset capex costs. Second, the advent of Commercial Property Assessed Clean Energy (C-PACE) financing has opened up a new and attractive source of capital for the commercial real estate industry. C-PACE utilizes a tax assessment mechanism typically used in tax increment financing (TIF) to provide owners and developers with cheap, long-term capital to make energy efficient investments in their properties. This financing can fund a significant part of any redevelopment project and helps to offset the tightening in credit we have seen from other commercial real estate lenders.

C-PACE financing can be combined with construction financing or replace costly mezzanine or equity financing. Construction financing is typically short-term whereas C-PACE financing can be structured to match the usable life of the installed equipment and be up to 30 years in duration. The tax assessment levied against the property which is used to pay back the lender can usually be passed along to tenants in the form of increased rent. A report published by JLL in January 2022 estimated that properties with green certifications result in a 6% rent premium which demonstrates that tenants are willing to pay a premium for energy efficient properties. A new Westin in Milwaukee was developed which utilized C-PACE financing and was able to pass along the assessment cost via a per day surcharge on guest bills. C-PACE financing is cheaper than equity or mezzanine financing and can be as much at 30% of a capital stack resulting in much higher returns for the developer and their investors.

Ohio has already passed enabling C-PACE legislation and the Columbus-Franklin County Finance Authority administers the C-PACE lending program. In the case of the Mall at Tuttle Crossing the ability to utilize C-PACE financing could align the interests of the Namdar led group with the Columbus-Franklin County who surely wants to see their former premier retail property be revitalized and create new jobs for their community. For the Namdar-led group the ability to borrow at T+400-500bps for 30 years is an attractive source of long-term capital that can be accretive to their bottom line. Additionally, the cost savings from lowered energy usage and tax credits, and the ability to give an older property a modern upgrade and charge premium rents could tip the scales in favor of redevelopment of the site.

The benefits of new financing mechanisms like C-PACE take time to be fully realized by the industry and an awareness must grow among investors and industry participants before its full potential can be realized. CRED iQ provides a treasure trove of information that can help municipalities, lenders, and other industry participants identify these opportunities across the country to revitalize and improve commercial properties.

About Joshua J. Myers, CFA

After a successful 20+ year investing career, Joshua Myers, CFA launched Cedars Hill Group to bring large market expertise to broader audiences. He primarily serves as an outsourced CIO/CFO for family offices, RIAs, and small-to-medium sized businesses. He started as an assistant trader at Susquehanna Investment Group during the Russian default and LTCM failure in 1998. Afterwards, he was Head of Fixed Income at Penn Mutual Life Insurance during the Global Financial Crisis of 2008-2009. He traded distressed CMBS securities in the aftermath of the GFC at Cantor Fitzgerald and most recently was Chairman of the Board for an oil production company during the COVID pandemic. He is a lifelong student of financial markets and writes about current events with a focus on the art of decision making and cognitive psychology.

For more market commentary from Josh subscribe to his Substack at Cedars Hill Group (CHG). You can also follow Josh on LinkedIn and X.

About CRED iQ

CRED iQ is a data & analytics platform used by commercial real estate brokers, lenders, investors, and appraisers. It provides an easy-to-use interface, comprehensive and official loan data, true borrower and owner contact information, and a built-in valuation tool. As an official data provider, CRED iQ’s precise and audited data includes across all property types and geographies, all of which help CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition and lending opportunities, market analysis, underwriting, & risk management.