With higher rates and a challenging lending environment, more and more borrowers are seeking to modify their loans. CRED iQ analyzed all modifications that occurred in 2023 within the securitized universe, including all CMBS, CRE CLO, SASB, Fannie Mae, Freddie Mac, and Ginnie Mae.

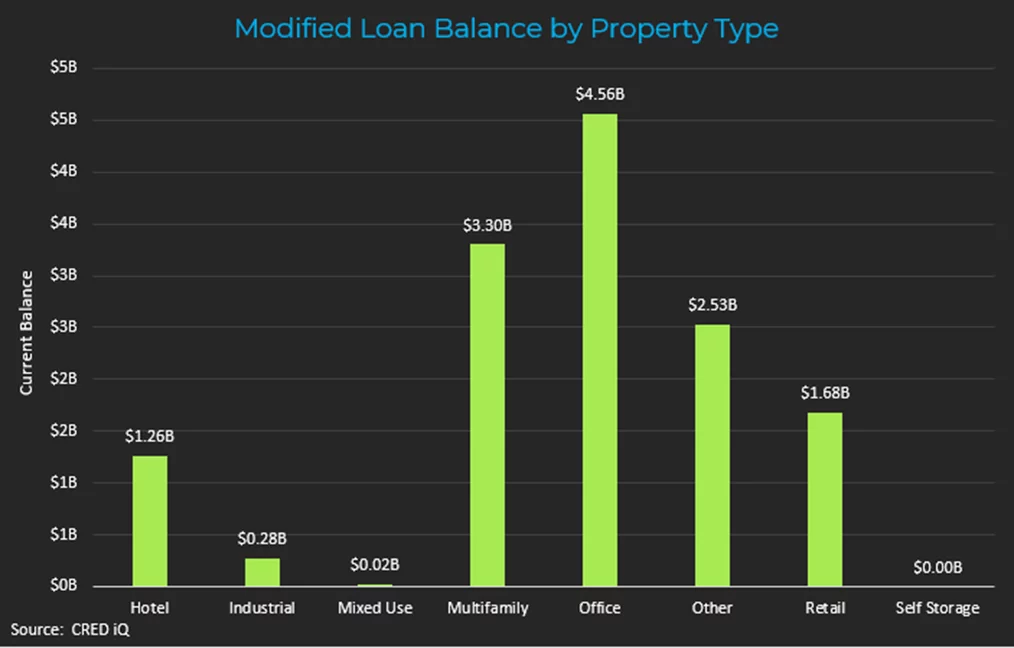

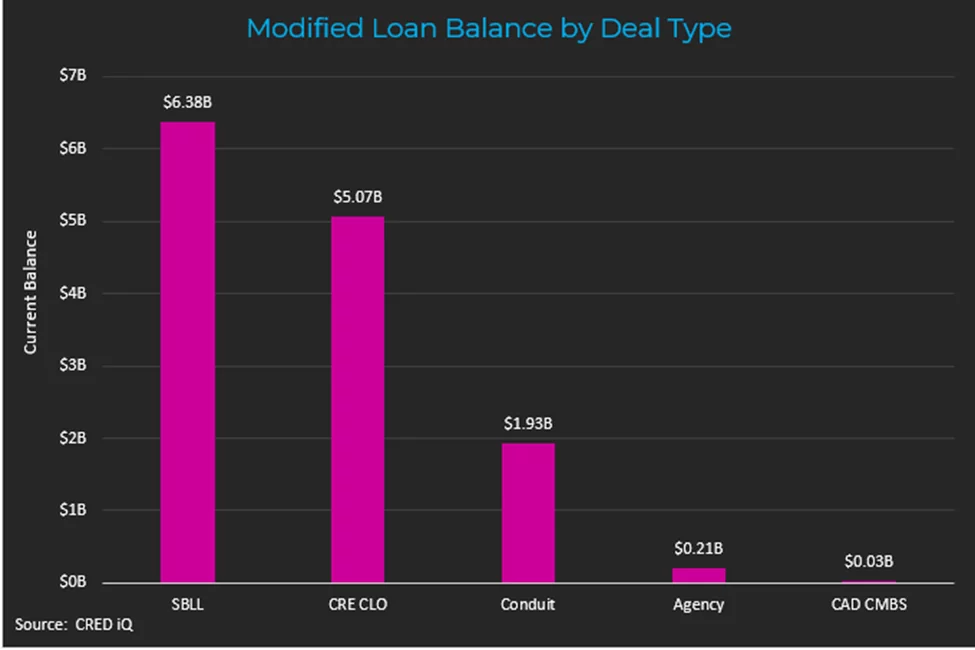

In total, $13.6 billion across 441 loans were modified in 2023. The highest volume of modifications occurred in the second quarter of the year. Single Borrower Large Loan (SBLL) deals represented almost half of this year’s modifications, followed by CRE CLO deals. Office ($4.6B) and multifamily ($3.3B) loans were modified the most in 2023.

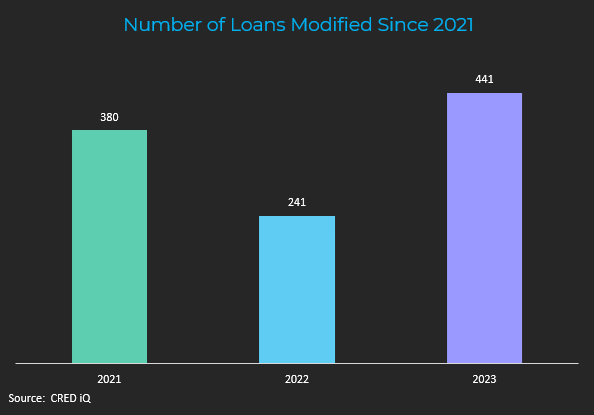

Loan Modifications by Count

The number of modifications in 2023 almost doubled compared to 2022. Extending the loan term has been the most popular modification type in 2023. CRED iQ predicts maturity extension modification will continue to be a popular tool for borrowers in 2024, when $209.6B of CRE debt is slated to mature across the securitized sectors.

Some of the largest loan modifications in 2023 include:

- The 831,000-sf office building at 375 Park Avenue backs $782.8M in debt and was originally set to mature in May 2023. The maturity date was extended by a year.

- The $536.0M loan backed by the Aon Center, a 2.8M-sf office tower in Chicago, was originally set to mature in July 2023. The loan was modified by extending maturity by three years with no change to the interest rate.

- Two modifications occurred in 2023 for the $219.6M loan secured by Aven, a 563-unit multifamily building located in Los Angeles, CA. The first modification took place in May to convert the loan from LIBOR to SOFR. The second modification occurred in September when the one-year maturity extension was utilized to extend the original March 2025 maturity to March 2026.

Property Type & Loan Balance

Deal Type

CRED iQ subscribers get full access to all modified loans, their modified loan terms, full loan details, financials, and borrower contact information.

About CRED iQ

CRED iQ is a commercial real estate data & analytics platform used by investors, lenders, brokers, and other CRE finance professionals. The easy-to-use interface is fully equipped with official loan and financial data. The platform is supplemented with true borrower and ownership contact information, valuation software and refinance models.

As an official market data provider, CRED iQ’s is powered by over $2.0 trillion of audited loan and transaction data that includes all property types and geographies. CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition & lending opportunities, market analysis, underwriting, and risk management.