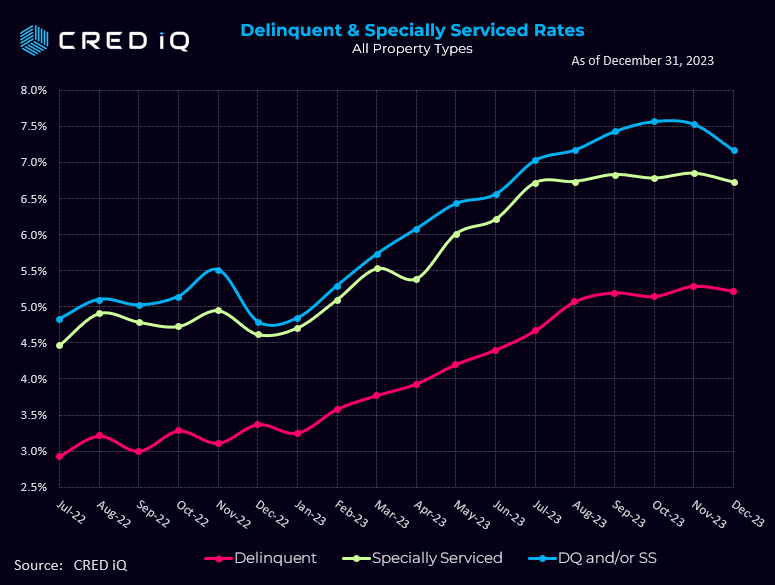

CRED iQ’s overall distress rate for CMBS fell 36 basis points in December to 7.17% from 7.53%.

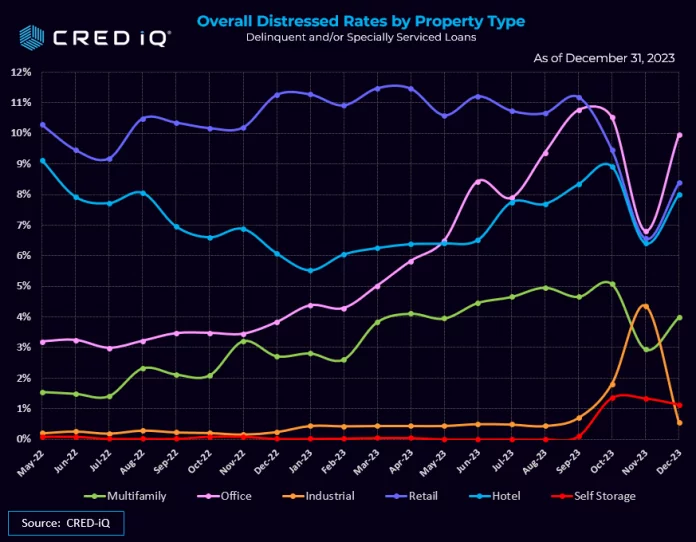

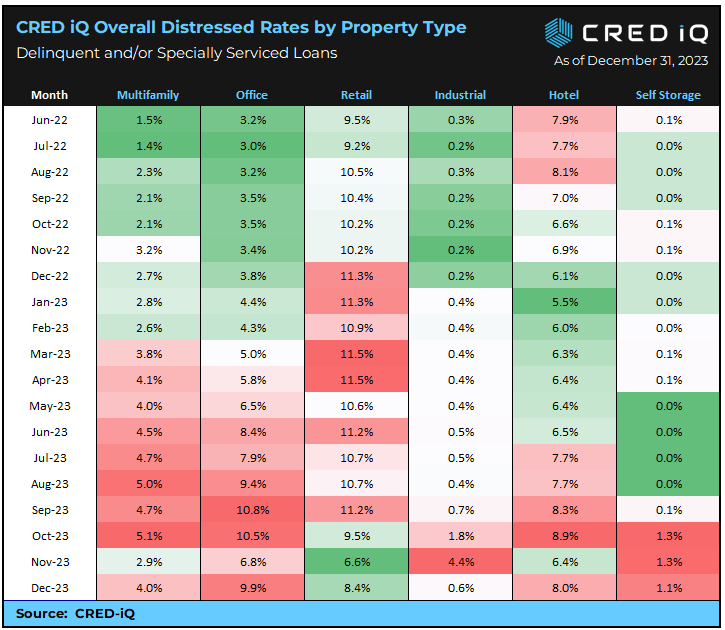

This notched a second straight monthly decrease and matches the August metric. However, office, multifamily, retail, and hotel sectors all increased significantly. The main driver behind the overall metric for all property types was caused by the resolution behind several massive industrial portfolios that helped bring the weighted average down.

CRED iQ’s overall distress rate aggregates the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate. This includes any loan with a payment status of 30+ days or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

The core delinquency rate fell, albeit modestly, from 5.28% to 5.22%. Our special servicing rate, which represents the percentage of CMBS loans that are with the special servicer (includes both delinquent and non-delinquent), fell by 13 basis points to 6.72%. following a modest increase in November.

Overall distress rates for multifamily jumped from 2.94% in November to 3.99% this month. Additionally, the hotel’s distress rate increased 159 basis points to 8.00, while retail’s distressed rate went up by over 180 basis points in one month.

The industrial segment saw the greatest decrease in overall delinquency—dropping a whopping 3.8% to 0.6% –the 10th month in 2023 with a sub 1% overall distress rate. As we reported in November, a major factor was the $2.2 billion industrial portfolio (BX Trust 2021-ACNT) that failed to pay off on its initial November 9, 2023 maturity date is now listed as current by its servicer, Key Bank.

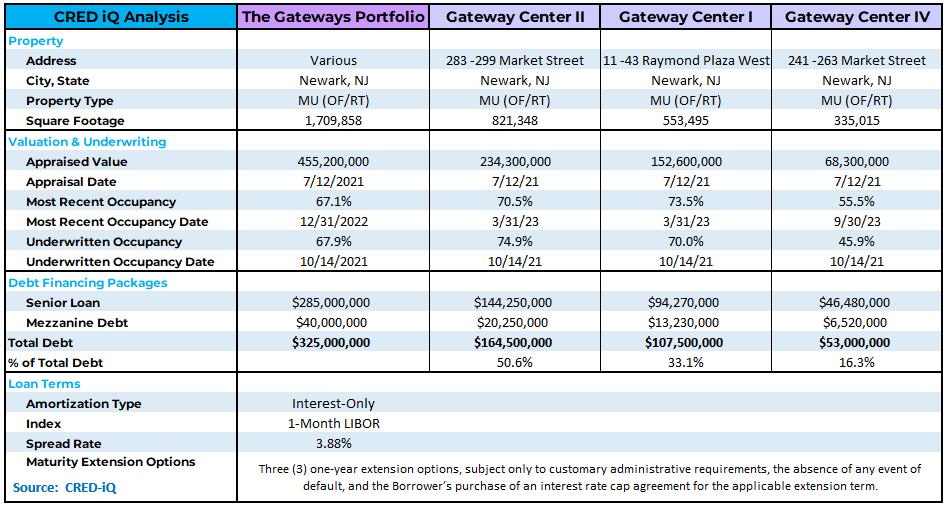

The office segment saw the greatest month-over-month overall distress rate increase from 6.80% to 9.95%. A significant factor was the $285 million The Gateways portfolio (CSMC 2021-GATE), a 1.7M-sf portfolio consisting of three properties with a mix of office and retail space in Newark, NJ. The portfolio failed to pay off at its initial December 9, 2023, maturity date, causing the payment status to change from current to performing matured.

About CRED iQ

CRED iQ is a commercial real estate data & analytics platform used by investors, lenders, brokers, and other CRE finance professionals. The easy-to-use interface is fully equipped with official loan and financial data. The platform is supplemented with true borrower and ownership contact information, valuation software and refinance models.

As an official market data provider, CRED iQ’s is powered by over $2.0 trillion of audited loan and transaction data that includes all property types and geographies. CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition & lending opportunities, market analysis, underwriting, and risk management.