CRED iQ examined loans that were added to the servicer watchlist in during the second half of 2023. Building upon our mid-year 2023 report, our objective was to explore the underlying factors and the associated trend of distressed CRE loans.

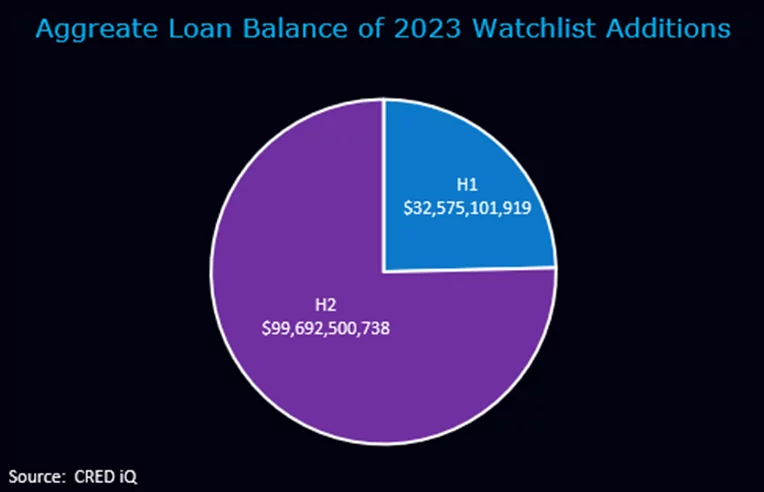

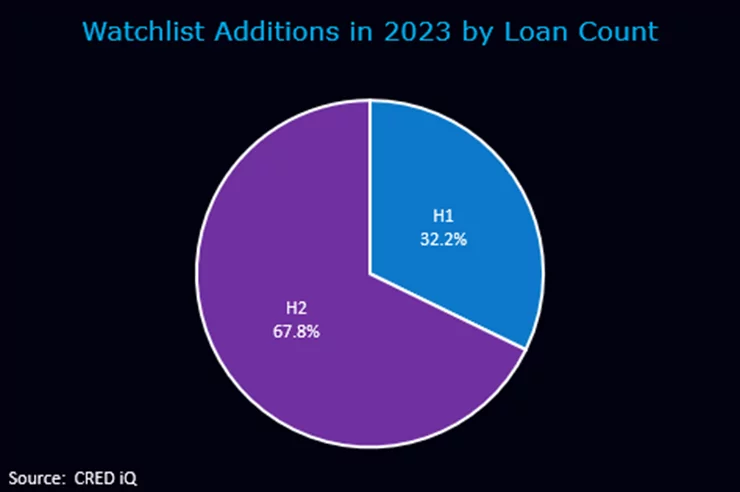

As of the December 2023 remittance reports, 15,373 loans were added to the servicer watchlist in the second half of 2023 (July-December). During the final 6 months of 2023, almost $100 billion of loans have been added to the watchlist for signs of upcoming distress. In that same 6-month period 860 loans were transferred to the special servicer.

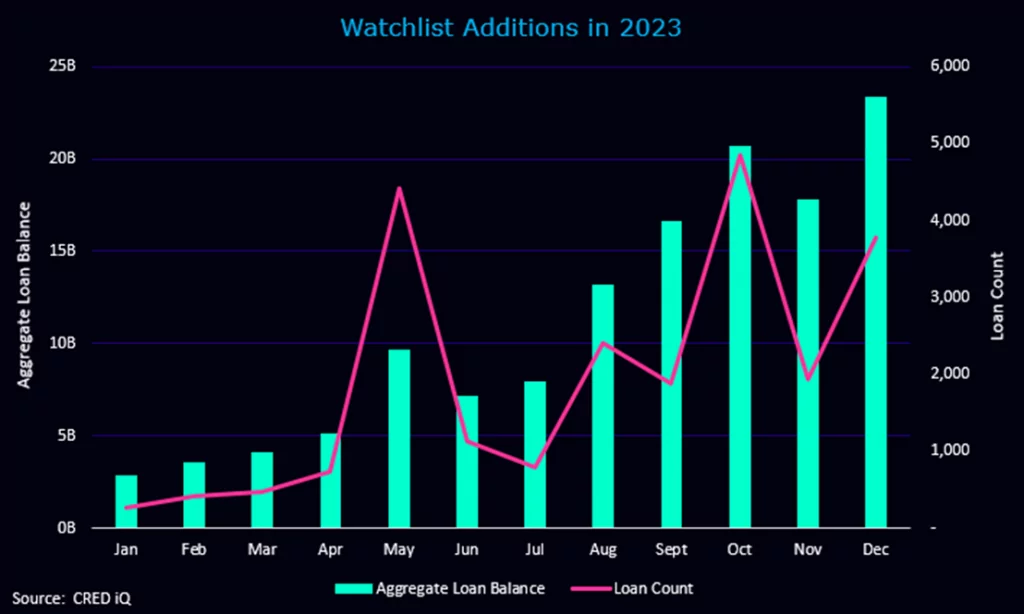

When factoring in the first half results, a total of 23,085 loans were added to the servicer watch list in 2023, with the second half accelerating the pace by roughly 110% compared to the first half of the year. October had the highest amount of loans added to the watchlist with a total of 4,843 loans with a combined unpaid loan balance of $20.7 billion. In total, over $133 billion of loans were added to the watchlist in 2023. This compares to approximately $25 billion that transferred to the special servicer.

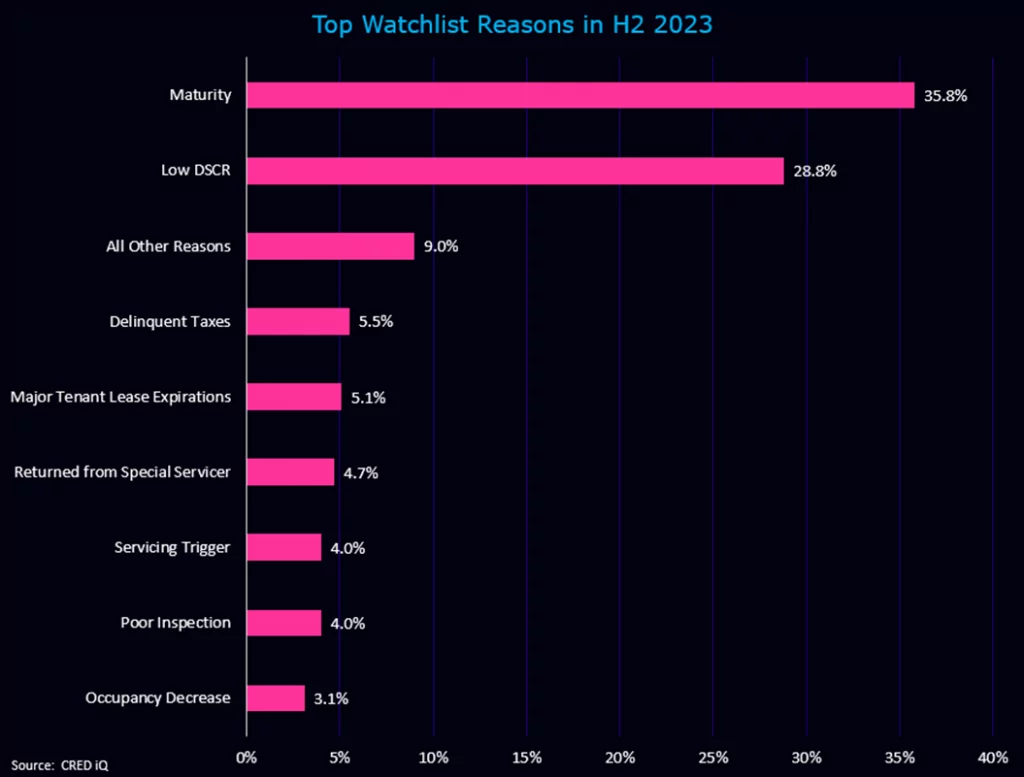

Diving into the underlying credit factors for loans added to the watchlist during the second half of 2023:

- 35.8% of all Watchlist loans were attributable Pending Maturity or ARD.

- DSCR Triggers for Floating Rate loans represented 15.3% of the names on the list. Low DSCRs for Fixed Rate loans compared to underwriting amounted to 8.6% of watchlisted loans in the second half of 2023. Low DSCR Triggers for Fixed Rate loans amounted to 4.9%. Adding the three DSCR buckets together totals 28.8% of all recently added watchlist loans.

- Delinquent taxes accounted for 5.5% of loans added to the watchlist in H2 2023.

- Major tenant expirations were attributable to 5.1% of Watchlist loans during July and December 2023.

An example is the $525.0M loan (inclusive of $143.0M subordinate debt) that was added to the servicer’s watchlist in September 2023 due to concerns with the second largest tenant, WeWork. The loan is backed by the Midtown Center, an 867,654 SF office tower located in downtown Washington, DC. Fannie Mae serves as the largest tenant of the property, accounting for 82% of the gross leasable area (GLA). The subject currently serves as Fannie Mae’s global headquarters. However, the tenant’s space is listed as available for lease starting June 2029, coinciding with Fannie Mae’s lease expiration date. Furthermore, WeWork (13% GLA) declared bankruptcy in November 2023 causing additional occupancy concerns, despite the tenant’s November 2036 lease expiration.

The property most recently reported a 100% occupancy and 2.97 DSCR (NCF) in June 2023. The most recent performance compares to the August 2019 underwritten occupancy of 100%, DSCR of 3.98 (senior debt) and 2.90 (total debt), and an implied cap rate of 4.95%. The most recent property value was the appraised value of $960.0M in August 2019.

About CRED iQ

CRED iQ is a commercial real estate data & analytics platform used by investors, lenders, brokers, and other CRE finance professionals. The easy-to-use interface is fully equipped with official loan and financial data. The platform is supplemented with true borrower and ownership contact information, valuation software and refinance models.

As an official market data provider, CRED iQ’s is powered by over $2.0 trillion of audited loan and transaction data that includes all property types and geographies. CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition & lending opportunities, market analysis, underwriting, and risk management.