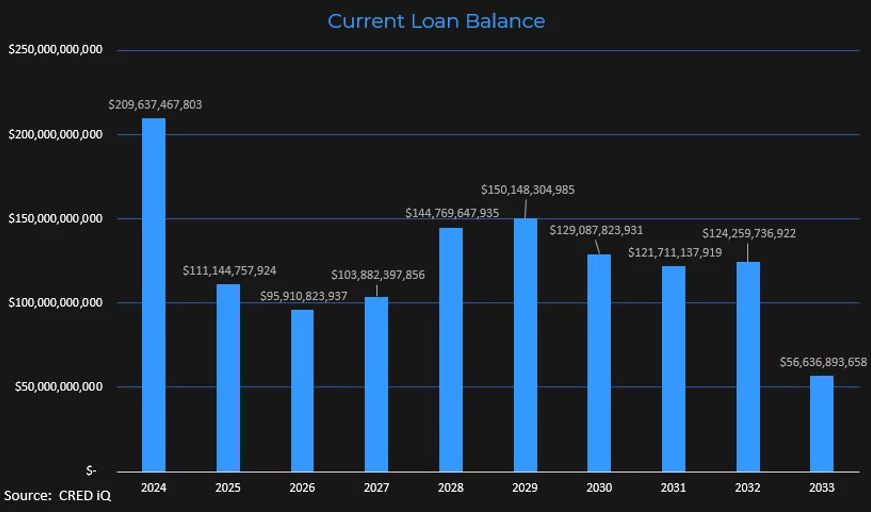

CRED iQ prepared for the year ahead in commercial real estate by analyzing securitized commercial mortgages with maturity dates scheduled in 2024 and 2025. CRED iQ’s database has approximately $210 billion in commercial mortgages that are scheduled to mature in 2024, with an additional $111 billion of CRE debt maturing in 2025. In total, CRED iQ has aggregated and organized a total of $320 billion of commercial mortgages slated to mature within the next 24 months.

The dataset included is comprised of loans securitized in CMBS conduit trusts, single-borrower large-loan securitizations (SBLL) and CRE CLOs, as well as multifamily mortgages securitized through government-sponsored entities.

The next 12 months have the highest volume of scheduled maturities for securitized CRE loans over a period of 10 years ending 2033. Let’s dive into the details.

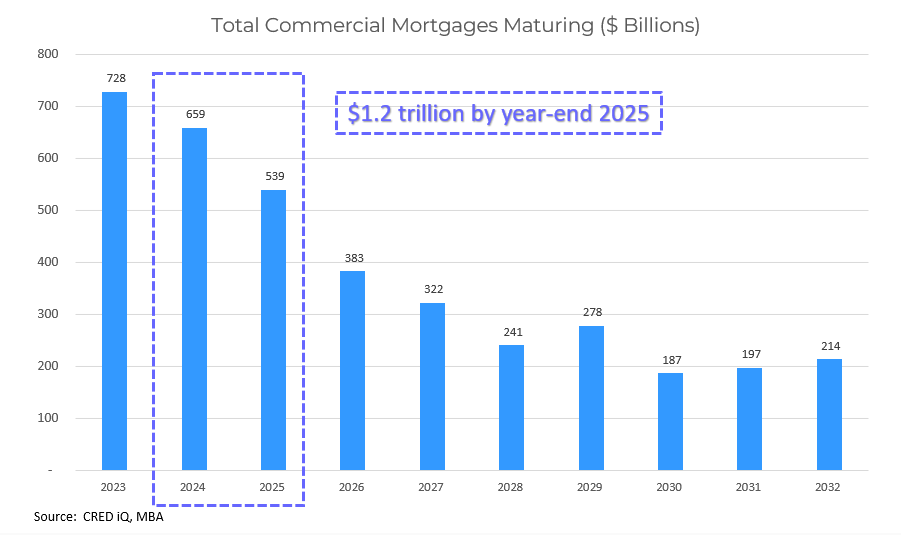

Commercial Mortgages Maturing

- Includes CMBS, Insurance, Bank/Balance Sheet, Agency, and Debt Funds

- In 2024, $659 billion in commercial loans are slated to mature

- In 2025, $539 billion in commercial loans are slated to mature

- In total, $1.2 Trillion will mature in the next 24 months

Maturity by Year: Active Loan Balances of Securitized Universe

- CRED iQ’s securitized universe includes CMBS, SBLL, CRE CLO, Freddie Mac, Fannie Mae, and Ginnie Mae

- 2024 and 2025 have the largest aggregate balances of maturing loans

- In 2024, $210 billion of CRE debt will mature.

- In 2025, $111 billion of CRE debt will mature.

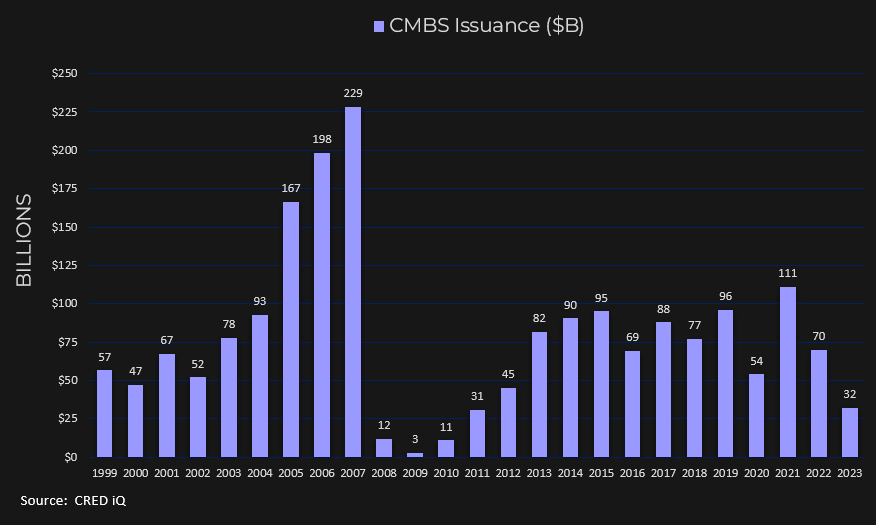

CMBS Issuance Trends

- Since 2012, CMBS issuance has averaged $76 billion per year

- The market significantly slowed down in 2008-2010 due to the Great Financial Crisis

- In 2021, CMBS issuance totaled $111 billion as the market rebounded after the Covid shutdown.

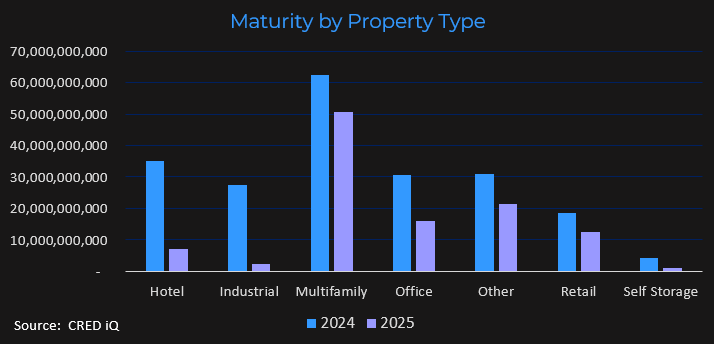

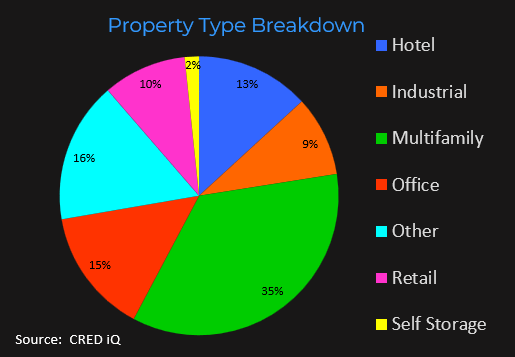

Property Type Analysis

- Multifamily represents the largest asset class of maturing loans. $113 billion (35%) of multifamily will mature these next 24 months.

- The second-largest sector is office ($46.6 billion) then hotel with $42.3 billion.

- Retail loans coming due over the next 24 months total $31 billion.

- Industrial loans totaling $30 billion are slated to mature in 2024 or 2025.

- Self-storage loans have approximately $5.3 billion coming due over the next two years.

Search all Commercial Property Types on the CRED iQ Platform

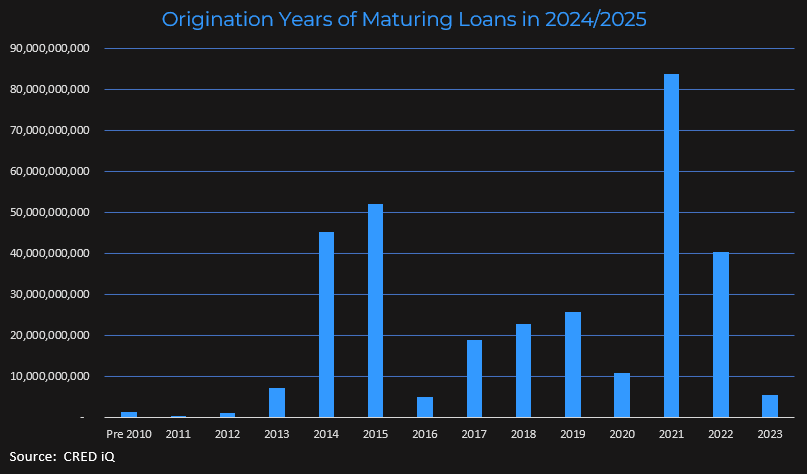

Origination Dates

- Approximately $100 billion of upcoming maturing loans were originated in 2014 or 2015 as 10-year loans.

- Over $80 billion of 2021 originated loans are set to expire in the next 24 months.

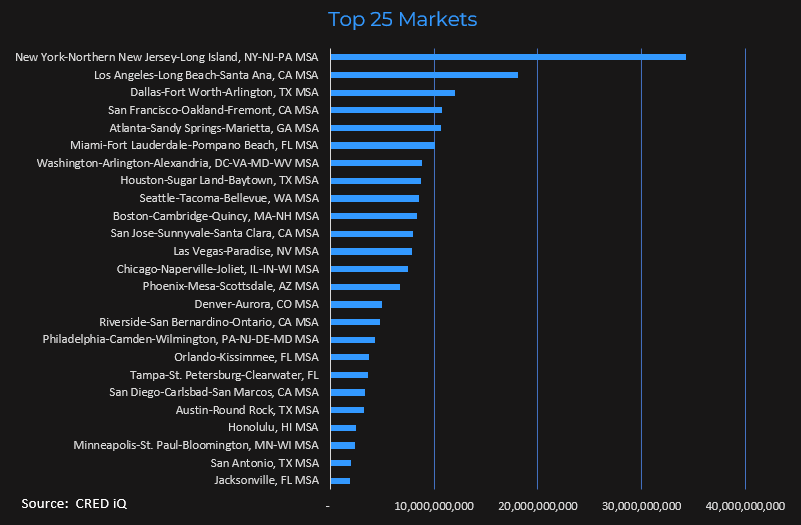

Market Analysis – Top 25 MSAs

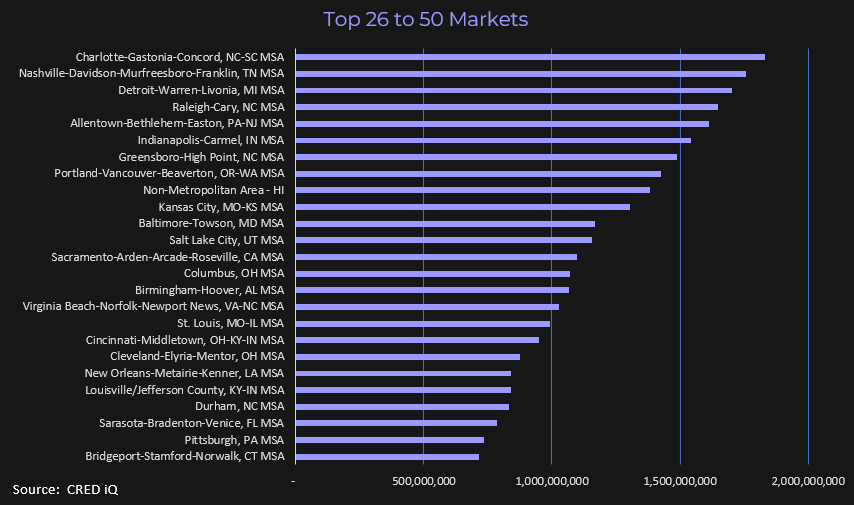

Second-Tier Market Analysis (Top 26 to 50)

- The New York MSA has the largest amount of maturing loans in the next 24 months.

- LA, Dallas, San Francisco and Atlanta are in the Top 5 markets with the highest totals of CRE debt coming due.

- Charlotte, NC ranks in the top of the second tier of markets with $1.8 billion of CRE debt maturing by 2025.

- Nashville, Detroit, Raleigh, and Allentown round out the Top 5 largest markets with maturing loans within the second tier.

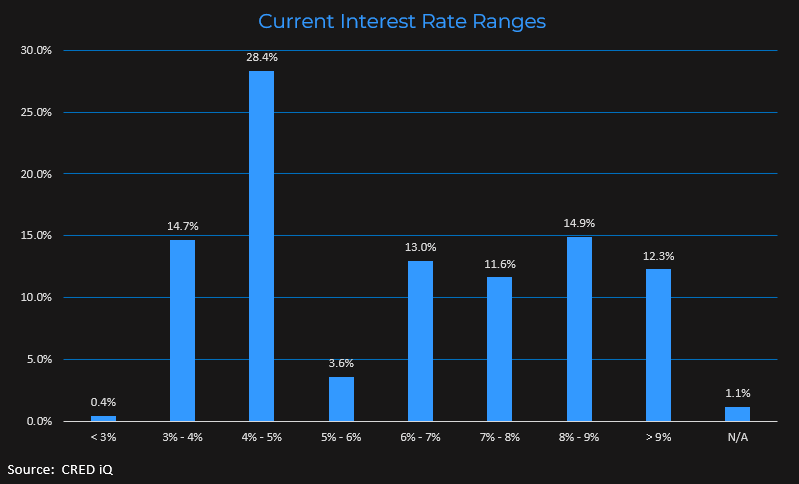

Current Interest Rates

- Of the $320 billion set to mature in 2024 or 2025, 43% have current interest rates below 5.00%.

- 14.7% of maturing loans in the next two years have an existing interest rate under 4.00%.

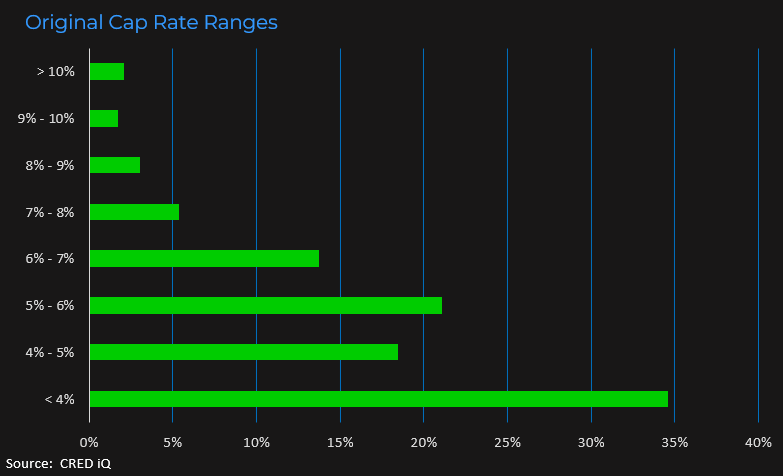

Original Cap Rates

- 35% of the maturing loans had an original cap rate of less than 4.0% at the time of loan origination.

- 18% of the maturing loans in the next two years had a cap rate between 4.0% and 5.0%.

- Most of the maturing loans were originated in 2014 and 2015, during a period of lower cap rates.

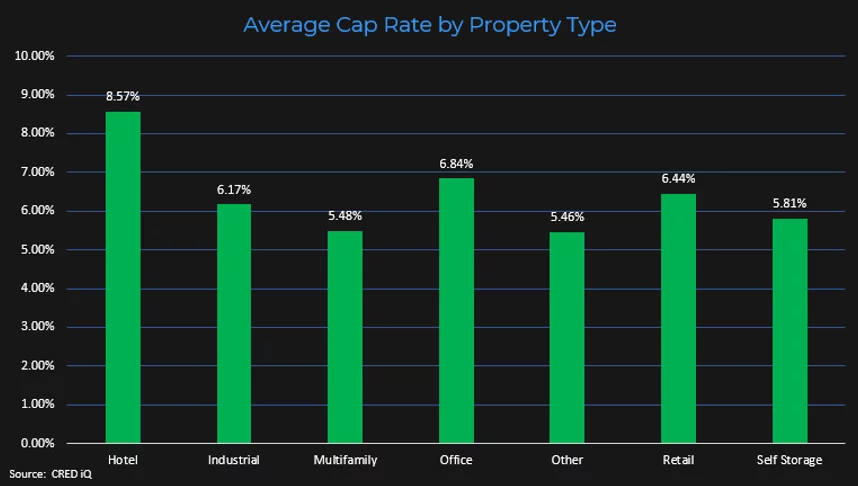

- Multifamily had the lowest average cap rate with 5.48%.

- The second-lowest average cap rate was 5.81% for the self storage sector.

- Average office cap rates at the time of loan origination was 6.84% for the loans that are coming due in the next 24 months.

About CRED iQ

CRED iQ is a data & analytics platform used by commercial real estate brokers, lenders, investors, and appraisers. It provides an easy-to-use interface, comprehensive and official loan data, true borrower and owner contact information, and a built-in valuation tool. As an official data provider, CRED iQ’s precise and audited data includes across all property types and geographies, all of which help CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition and lending opportunities, market analysis, underwriting, & risk management.