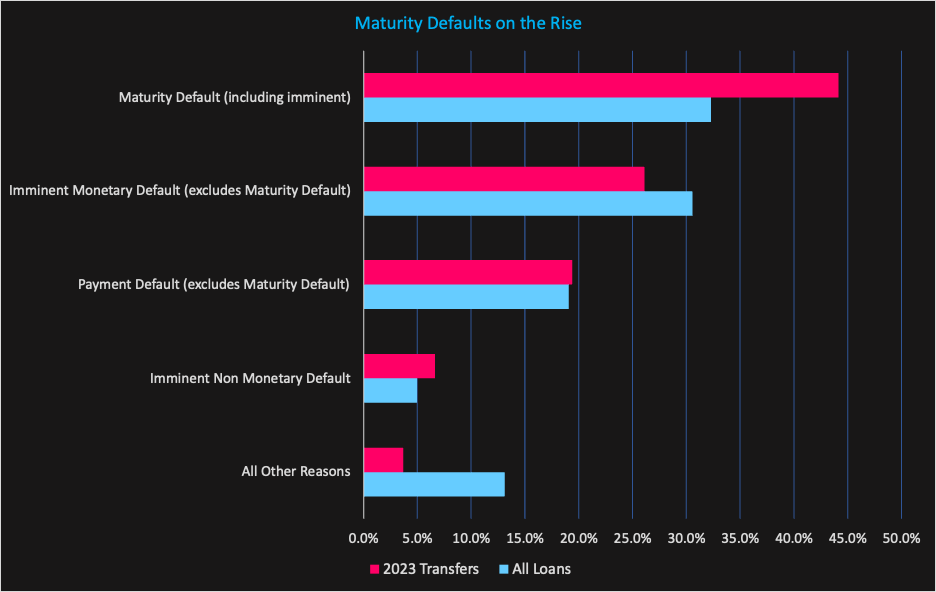

CRED iQ’s research team drilled down into the 2023 maturity data to study both the depth and trends of maturity defaults. Our examination of the recent Special Servicer transfers clearly reveals that defaults are on the rise. Out of all outstanding maturity defaults within CMBS, over 50% occurred in this year alone.

Background: 2023 has been a banner year for CRE maturities

As we reported earlier this year in our 2023 CRE Maturity Outlook: The Year Ahead. CRED iQ’s database has approximately $162 billion in commercial mortgages expiring in 2023, including loans securitized in CMBS conduit trusts, single-borrower large-loan securitizations (SBLL) and CRE CLOs, as well as multifamily mortgages securitized through government-sponsored entities. 2023 features the highest volume of scheduled maturities for securitized CRE loans over a period of 10 years ending 2032.

By securitization type, the SBLL securitization subset of nearly $100 billion comprises the majority (61%) of maturities in 2023; however, approximately 94% of that balance is tied to floating-rate loans that have extension options available, providing no assurances of refinancing or new origination opportunities.

CMBS conduit loans account for the second-highest total of loans with 2023 maturity dates (approximately $29 billion in 2023), accounting for 18% of total scheduled maturities. This group of loans provides for diverse observation across property type, building class, and geographic location. Breaking down 2023 conduit maturities by property type, retail has the highest concentration with 42% of outstanding debt and is followed by office with 22%. Lodging has the third-highest concentration with 14% of the outstanding balance of maturities in 2023.

Takeaways

The rising interest rate environment has significantly impacted the performance of CRE loans across the board and maturity defaults are on the rise.

- As a percentage of all maturity defaults, 52% of them occurred this year.

- The maturity default percentage of all specially serviced loans amounted to 32.3%.

- The maturity default percentage of loans that transferred to the Special Servicer in 2023 totaled 44.1%, an 11.9% increase from the overall totals.

- $41 billion of loans are actively with the Special Servicer, of which $16 billion occurred this year alone.

The second largest culprit as a reason to be transferred to the Special Servicer is for imminent monetary default.

Brief Case Study

One example of a recent maturity default is the $310 million River Point North loan that transferred to the Special Servicer in May 2023. The property that secures the debt is a 1.7 million square foot (SF) mixed-use property that contains 1.3 million SF of Class-A office space and 400,000 SF of space that is leased by the 535-key Holiday Inn Mart Plaza Hotel in downtown Chicago. The borrower of the loan, Blackstone, also has $60 million in mezzanine debt for a total capital stack of $370 million.

The loan was transferred due to Blackstone’s written confirmation that they would be unable to pay amounts owed under the loan. The loan matured in July 2023. The property is 72% leased compared to 93% at origination. The loan is being fully cash managed due to low debt yield with all excess trapped to trust’s held reserve.

Outlook

We expect maturity defaults to keep rising over the next year as interest rates remain elevated, as well as lack of sales transactions for price discovery, and the downward spiral of office properties.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.