CRED iQ’s research team focused upon the difficulties of refinancing a floating rate commercial real estate loan in a rising interest rate environment.

The commercial real estate market is often a reflection of broader economic trends, and one of the most significant factors impacting property owners and investors today is the rising interest rate environment. In such a climate, refinancing a floating rate commercial real estate loan becomes increasingly challenging. CRED iQ’s report on Floating loans revealed that ~44% of floating rate loans with near term expirations will see rate cap agreements expiring before those loans mature.

Based on SOFR data posted by the Federal Reserve Bank of New York, its apparent the rise in SOFR is having a dramatic effect on pending floating rate loan maturities.

This article delves into the difficulties faced by borrowers when their floating rate loans mature in a time of escalating interest rates and explores potential strategies to address these challenges.

Based on the Secured Overnight Funding Rate (SOFR)data posted by the Federal Reserve Bank of New York, its apparent the rise in SOFR is having a dramatic effect on pending floating rate loan maturities.

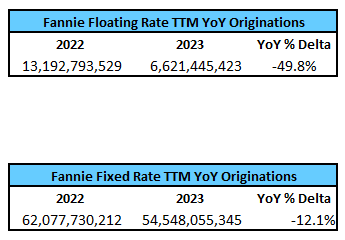

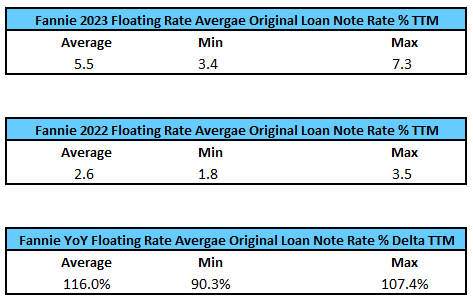

CRED iQ has examined trends in Fannie Mae floating rate loans over the trailing twelve months (TTM) and discovered that 2023 has presented notable challenges for borrowers currently within their loan term and those nearing maturity.

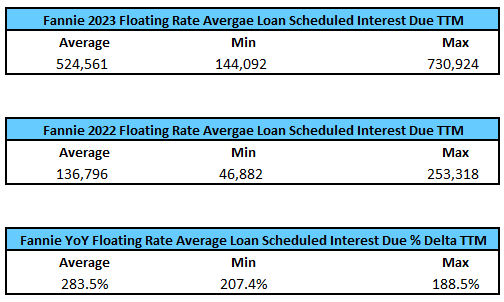

The data below clearly illustrates the effects of the rising interest rate environment when analyzing Fannie Mae floating rate issuance, including the aggregate Average Original Note Rate, Average Loan Scheduled Interest Due, and how these metrics vary by Seller.

The data here underscores a significant decline in year-over-year originations of floating rate loans. This drop coincides with a roughly 500 basis point increase in SOFR over the past 18 months, causing borrowers to perceive diminishing advantages in floating rate debt.

When analyzing the trailing twelve-month (TTM) data, it’s evident that the average interest due on Fannie Mae loans has surged by over 280%. This surge is exerting substantial pressure on Debt Service Coverage Ratio (DSCR) and Loan-to-Value (LTV) ratios for these properties. We are currently observing a challenging environment for both lenders and borrowers, and it is likely to continue testing the stability of the floating rate market in the near-term future.

Floating rate loans have been a popular choice for commercial real estate borrowers due to their initial lower interest rates and flexibility. However, when the interest rate environment shifts from historically low rates to an upward trajectory, borrowers can find themselves in a perfect storm of financial challenges at loan maturity.

- Interest Rate Risk: The fundamental difficulty in refinancing a floating rate commercial real estate loan during a rising interest rate environment is the inherent interest rate risk. As rates increase, borrowers face the prospect of higher interest payments, potentially straining their cash flow and making debt service less affordable.

- Debt Service Coverage Ratio (DSCR) Constraints: Lenders may require a higher DSCR when refinancing loans in a rising rate environment. As interest rates climb, borrowers may struggle to meet these stricter criteria, limiting their refinancing options.

- Reduced Property Valuation: Rising interest rates can negatively impact property valuations. Higher financing costs can lead to lower property income and, consequently, a reduction in property value, making it challenging to secure favorable refinancing terms.

- Limited Lender Appetite: In an environment of rising rates, lenders may become more risk-averse, making it harder for borrowers to find willing lenders. This can result in a smaller pool of potential refinancing partners and potentially less favorable terms.

While refinancing floating rate commercial real estate loans in a rising interest rate environment is undoubtedly challenging, there are strategies that borrowers can employ to mitigate these difficulties:

- Early Planning: Begin planning for loan maturity well in advance, preferably a year or more before the loan comes due. This allows for strategic decision-making and proactive actions.

- Exploration of Fixed-Rate Options: Consider converting from a floating rate loan to a fixed-rate loan if market conditions are favorable. Fixed-rate loans provide stability and predictability in a rising interest rate environment.

- Alternative Financing Sources: Explore alternative lenders, such as credit unions, private lenders, or non-traditional financing sources, as they may offer more flexibility and tailored solutions.

- Property Performance Enhancement: Work on improving the property’s income potential by implementing cost-cutting measures or rent increases to enhance its financial performance and appeal to lenders.

- Risk Management Strategies: Consider interest rate hedging tools like interest rate swaps or caps to mitigate interest rate risk and provide protection against sudden rate spikes.

- Diversification of Financing: Diversify your financing sources to reduce reliance on a single lender, which can enhance your ability to secure financing in a challenging environment.

Refinancing a floating rate commercial real estate loan in a rising interest rate environment is indeed fraught with difficulties. Nevertheless, with careful planning, flexibility, and a proactive approach, borrowers can navigate these challenges successfully. It is essential to assess your property’s financial health, market conditions, and potential refinancing options in the ever-evolving landscape of commercial real estate financing.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.