CRED iQ monitors distressed rates and market performance for nearly 400 MSAs across the United States, covering over $900 billion in outstanding commercial real estate (CRE) debt. Distressed rates include loans that are specially serviced, delinquent (30 days past due or worse), or a combination of both.

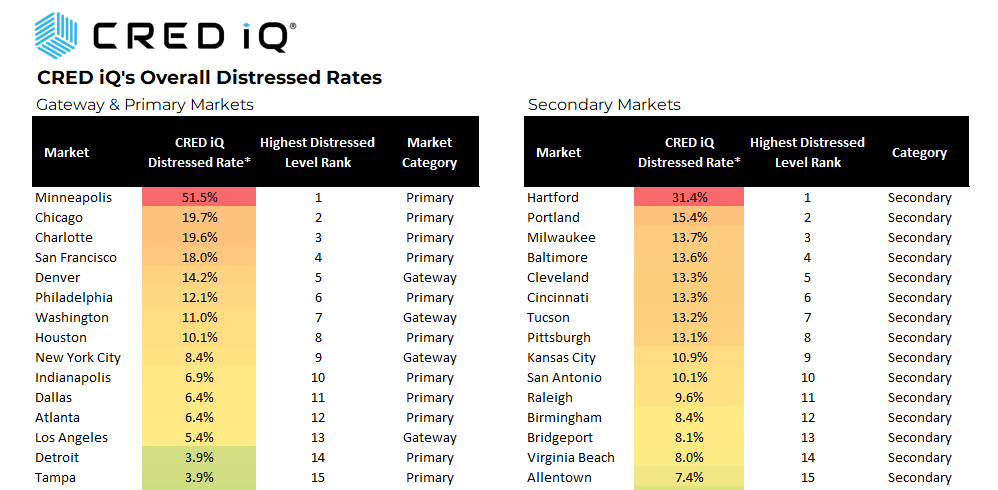

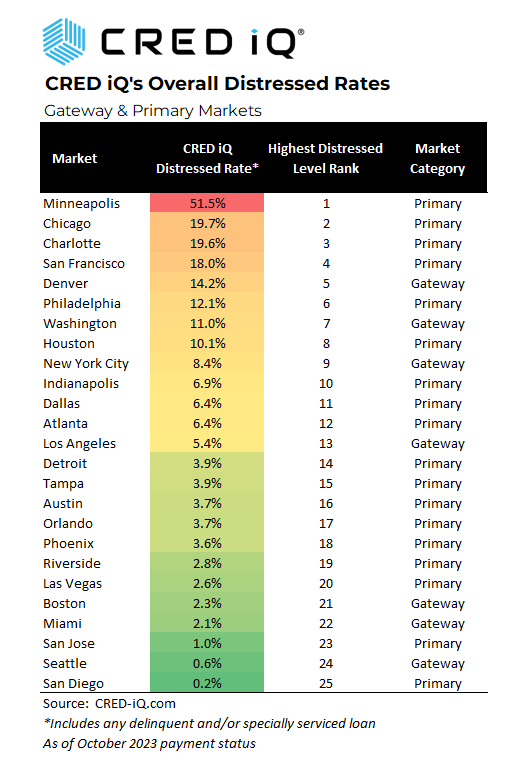

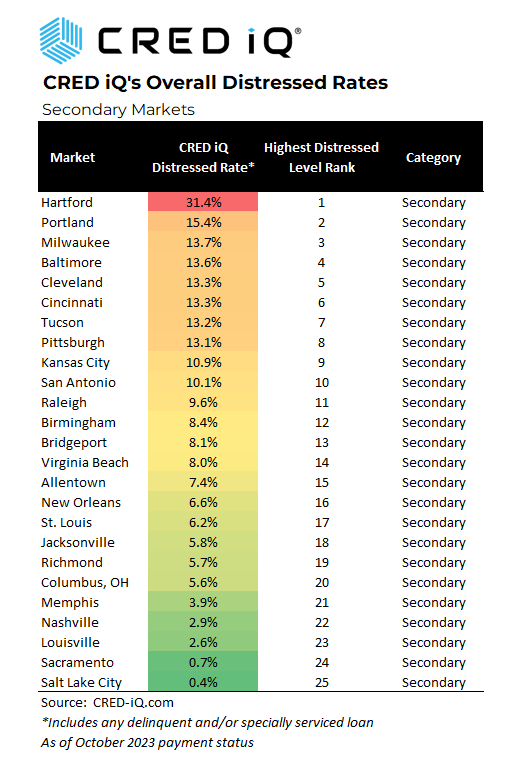

Out of the 50 largest MSAs tracked by CRED iQ, the analysis split the MSAs into two groups: Primary/Gateway and Secondary markets. Average distressed rates for the Gateway/Primary market cohort are 8.8% while the secondary markets averaged 9.2%.

Notable markets within the Primary/ Gateway cohort with the largest levels of distress included Minneapolis (51.5%), Chicago (19.7%), and Charlotte (19.6%). Minneapolis remains an outlier due to a handful of extremely large loans that are in distress. The strongest performing markets within the Gateway/Primary segments include San Diego (0.2%), Seattle (0.6%), and San Jose (1.0%). Surprisingly, the analysis illustrates that four of the seven gateway markets are showing significant levels of distress as of the October 2023 reporting period. The worst performing gateway markets include Denver (14.2%), Washington DC (11.0%), New York City (8.4%), and Los Angeles (5.4%). On the other hand, the best performing gateway markets are Boston, Miami and Seattle.

Comparing the levels of distress across the 25 largest markets within the Secondary cohort, Hartford (31.4%), Portland, OR (15.4%) and Milwaukee (13.7%) are the highest. Hartford ranks number two overall across all 50 markets. A significant contributor to the elevated levels of distress was the recent special servicer transfer of the $79 million office loan for CityPlace I. The loan, which is secured by an 884,000-SF CBD office building transferred to the special servicer (Midland) on October 11, 2023.

Some of the strongest performing secondary markets with the lowest level of commercial real estate distress include Salt Lake City (0.4%), Sacramento (0.7%), and Louisville (2.6%). Ten of the 25 secondary markets are showing distress levels of 10.0% or higher.

CRED iQ’s early signals of upcoming distress include loans that have been added to the servicer’s watchlist for credit-related issues. Issues include weak financial performance, low occupancy, high tenant rollover, upcoming maturity risk among other reasons to be flagged as possible troubles. Some notable loans that were added to the watchlist in October include:

- Grand Central Plaza (Office: 622 Third Avenue, NYC) – $260 million, Low DSCR

- Republic Plaza (Office: 370 17Th Street, Denver) – $235 million, Maturity

- JW Orlando Grande Lakes (Resort Hotel: Orlando) – $593 million Senior Loan + $53 million in Mezzanine Debt, Maturity

As reported in CRED iQ’s October Delinquency Report, the Office, Retail/Mixed Use and Lodging segments drove the highest levels of distress rates as measured by property type. These segments had a major impact on market distress rates across the country. The WeWork bankruptcy filing announced this week has been impacting distress levels in markets such as New York City all year.

The Washington DC Market (the #2 Gateway market at 11%) was impacted by Office distress. Examples include 1615 L Street NW, a 417,383 square foot office building which transferred to the Special Servicer for Imminent Monetary Default

San Francisco (coming in at #4 in the Primary/Gateway cohort) saw continued turbulence across office, retail and lodging. The transfer of iconic Hilton San Francisco, a 1,900 key hotel along with the smaller Hilton Parc 55 for imminent monetary defaults of a combined valuation of over $1.5 billion. On the retail front, the $1.2 billion Westfield San Francisco was transferred for imminent monetary default earlier this year.

In summary, Minneapolis holds on to the number one position in our study as it has for well over a year, expanding its distress rate to 51.5% (up from 33.6% in our June report). Hartford, which leads the Secondary cohort, comes in at second place overall with a 31.4% distress rate. Chicago and Charlotte are neck-and-neck with 19.7% and 19.6% respectively earning them third and fourth place overall in our study.