CRED iQ’s research team explored geographic distress trends across the United States in our latest research. We ran our analysis based upon current loan balances of all of the loans CRED iQ tracks within each market and then calculated the proportion of loans that are distressed.

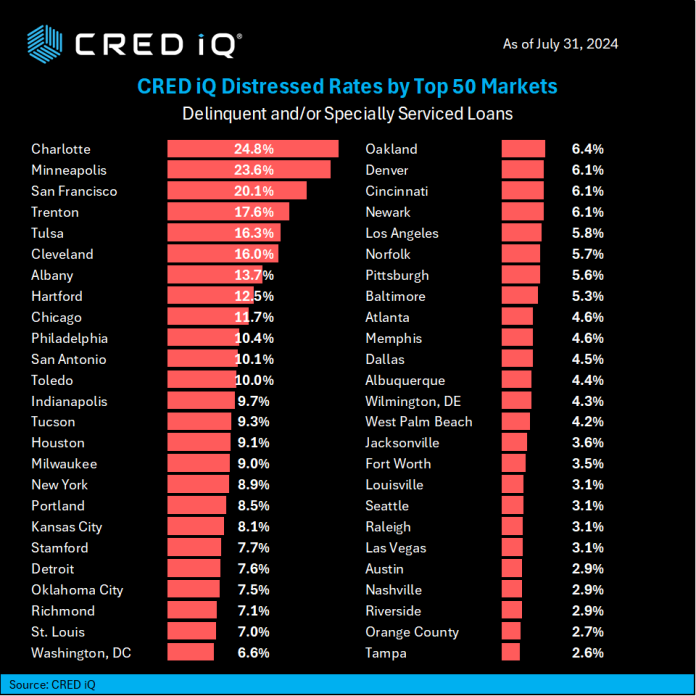

Across the top 50 MSAs, our team calculated the CRED iQ Distress Rate for each market (which combines Delinquent and/or Specially Serviced loans). Charlotte logged the highest level of distress with 24.8% of their loans in distress, followed by Minneapolis (23.6%), San Francisco (20.1%), Trenton (17.6%) and Tulsa (16.3%) – rounding out the top 5 MSAs with the highest levels of distress. To provide perspective, the overall distress rate for all loans across every market was 8.8% as of July 2024.

Some of the strongest performing MSAs in the top 50 include Tampa operating at 2.6% distress today, while Orange County, Riverside, Nashville and Austin operating under 3%.

Among the scope of distressed loans in our analysis, a number are quite noteworthy including a $152.3 million loan backed by the 539,813 SF Northlake Mall in the Charlotte market. The loan transferred to the special servicer in November 2019 due to balloon payment default. The loan is non-performing matured as it only paid through November 2022.

The regional mall is in the North Charlotte submarket is 72.4% occupied. The property was valued at $253.0M at underwriting in September, 2014

Early Warning Signals

CRED iQ’s early signals of upcoming distress include loans that have been added to the servicer’s watchlist for credit-related issues. Issues include weak financial performance, low occupancy, high tenant rollover, upcoming maturity risk among other reasons to be flagged as possible troubles.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.