The CRED iQ team evaluated payment statuses reported for each loan (securitized by CMBS financing), along with special servicing status as part of our monthly distress update.

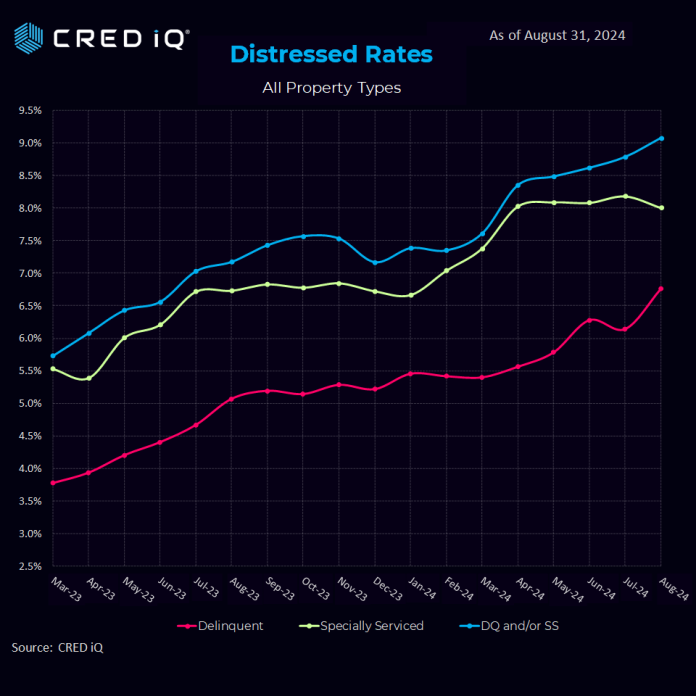

The overall CRED iQ distress rate increased from 8.8% to 9.1% over the past month, achieving a sixth straight record high. CRED iQ’s special servicing rate came in flat month-over-month at 8.0%, while the CRED iQ delinquency rate increased by 66 basis points (reaching 6.8%) this month.

Segment Review

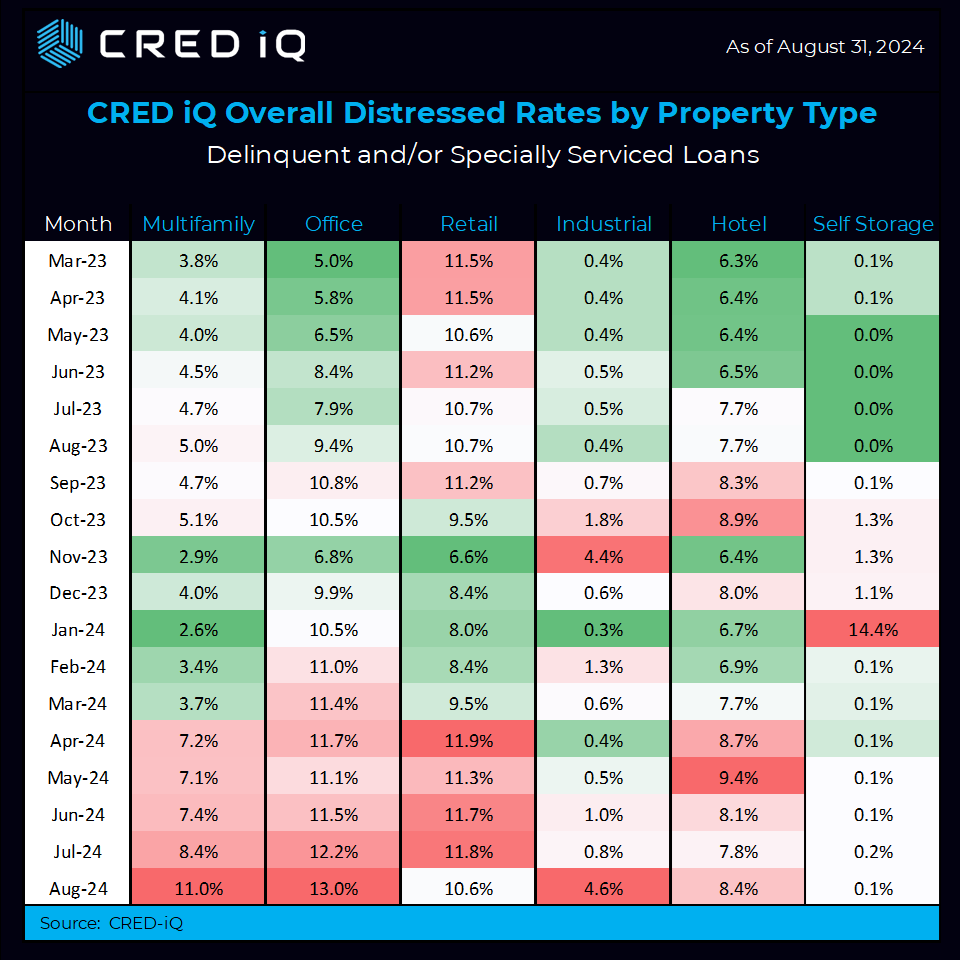

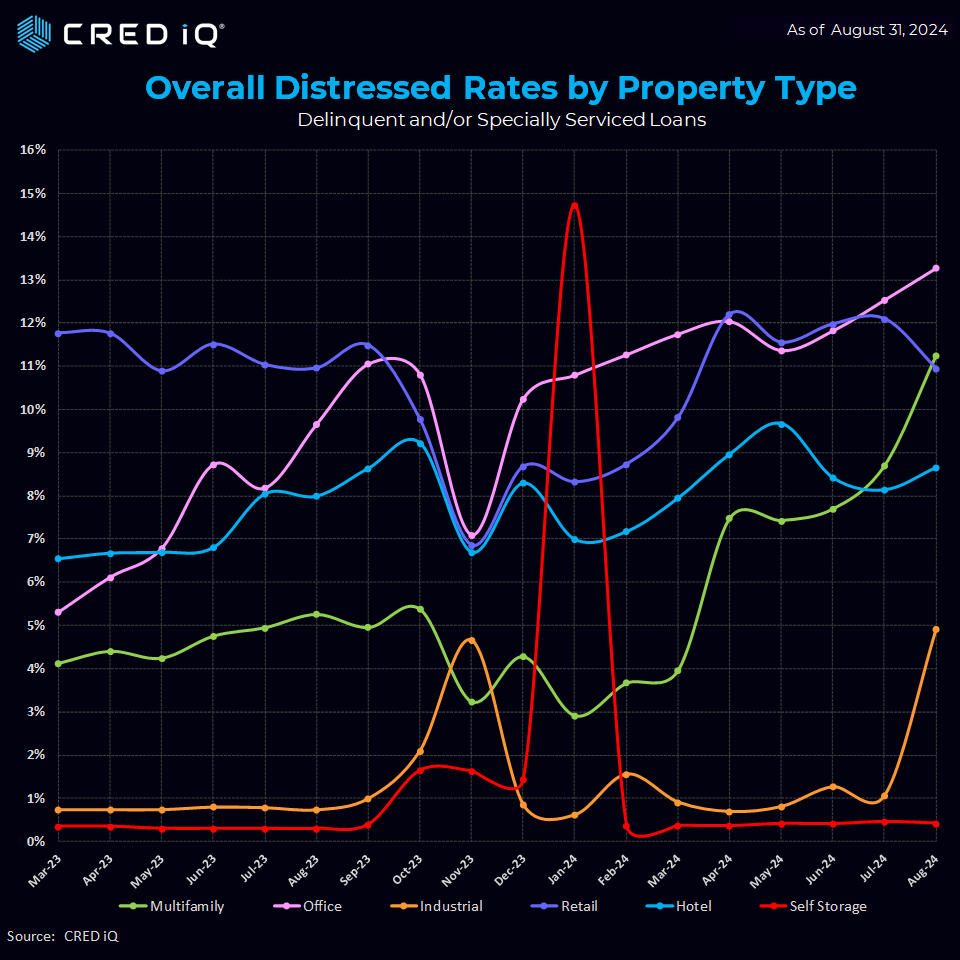

Multifamily continued its momentum rising to 11.0% from last month’s 8.4%, a dramatic 260 basis point increase in one month. Just eight months ago, that rate was 2.6%. The multifamily segment surpassed retail to secure the second highest level of distress among all CRE segments. These figures include all multifamily securitized with CMBS financing.

The office segment saw an increase in its distress rate in August–adding 80 basis points to 13.0% while maintaining its leadership as the sector with the highest overall distress level.

Retail improved by reducing its distress rate from 11.8% to 10.6% in this print—settling in at third place. The hotel segment added 60 basis points to 8.4%.

Uncharacteristically, the industrial segment saw a sharp increase from 0.8% to 4.6%–the largest increase of all property types. This increase is largely attributable to one SBLL portfolio valued at $2.18 billion (please see “Loan Highlight” below). Meanwhile, self-storage continued to perform with nearly zero distress – coming in at 0.1%.

Payment Status

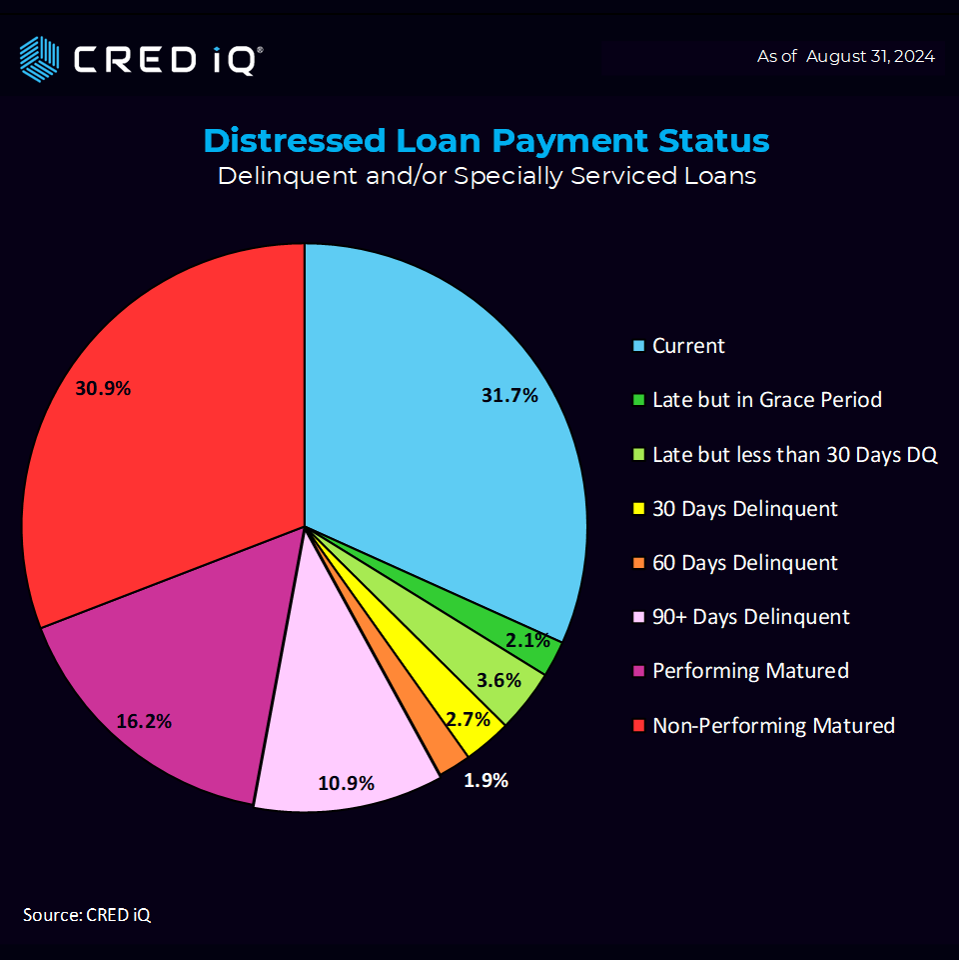

Looking at distressed loan payment status, 31.7% of the loans are current – up significantly from last month’s 21.2%. 2.1% of loans are attributable to late (but in the grace period) and 3.6% of loans were late (but less than 30 days DQ). Combining these three metrics 37.4% of all loans were current / late within the grace period / less than 30 days delinquent.

Non-Performing Matured saw a reduction from 39.0% to 30.9%, as did 90+ Days Delinquent dropping from 14.2% to 10.9%. Performing Matured increased from 12.9% in July to 16.2% in August.

Analysis Methodology

CRED iQ’s distress rate aggregates the two indicators of distress – delinquency rate and specially serviced rate – yielding the distress rate. The index includes any loan with a payment status of 30+ days delinquent or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

It’s important to note that CRED iQ’s distress rate factors in all CMBS properties that are securitized in conduits and single-borrower large loan deal types. CRED iQ tracks Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO loan metrics in separate analyses.

As mentioned in our August report, our analysis exposes a meaningful gap between the distress and watchlist rates which could imply that the special serving & delinquency percentages may be likely to grow.

Loan Highlight

Nvip 1-15, a $2.18 billion ($133/SF) SBLL loan backed by a 138 industrial and office/flex property portfolio, defaulted this month after failing to payoff at maturity. The interest-only loan also has $1.96 billion ($119/SF) in additional debt. The loan has three, one-year maturity extension options representing a fully extended maturity of August 2027. Servicer commentary indicates the borrower provided written notice to exercise the first maturity extension option.

The 16.4 million SF portfolio consists of properties throughout six states: CA, FL, VA, TX, MD, and WA. The portfolio was 98.5% occupied and performing with a DSCR of 0.73. The collateral was valued at $4.2 billion ($256/SF) at underwriting in June 2022.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.