The CRED iQ research team focused upon the underwriting of the latest market transactions. We wanted to understand they key loan metrics across this universe to get a real-time sense of the current environment and trending.

CRED iQ analyzed underwriting metrics for the latest 8 new issue CMBS conduit deals issued since our previous report in July.

We reviewed 499 properties associated with 304 new loans totaling just over $7 billion in loan originations. Our analysis examined interest rates, loan-to-values (“LTV”), debt yields, and CRED iQ cap rates. We further broke down these statistics by property type.

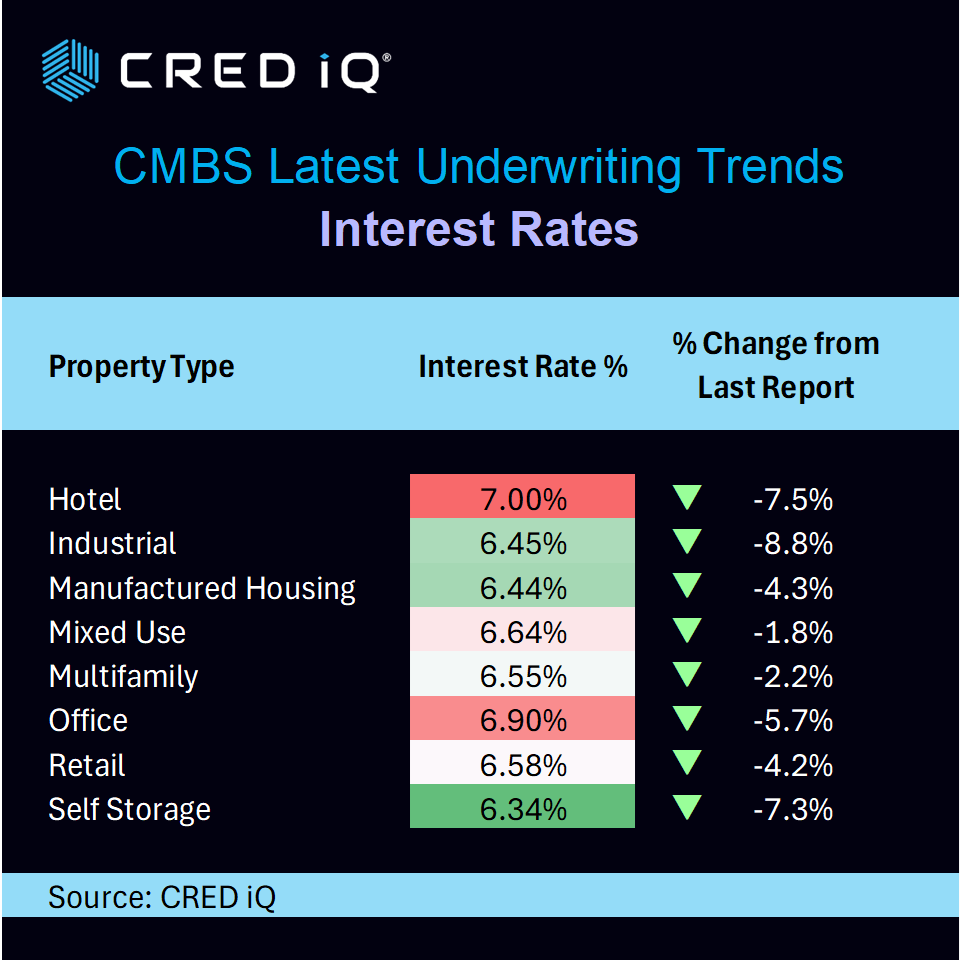

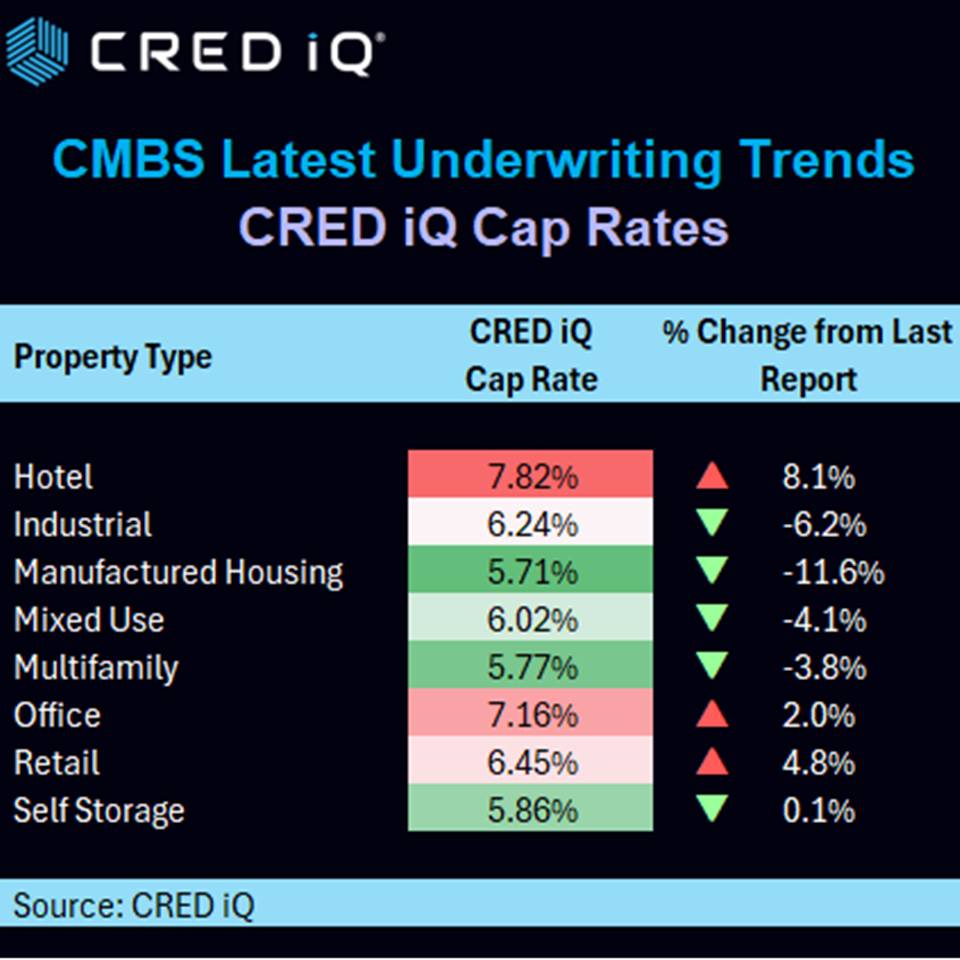

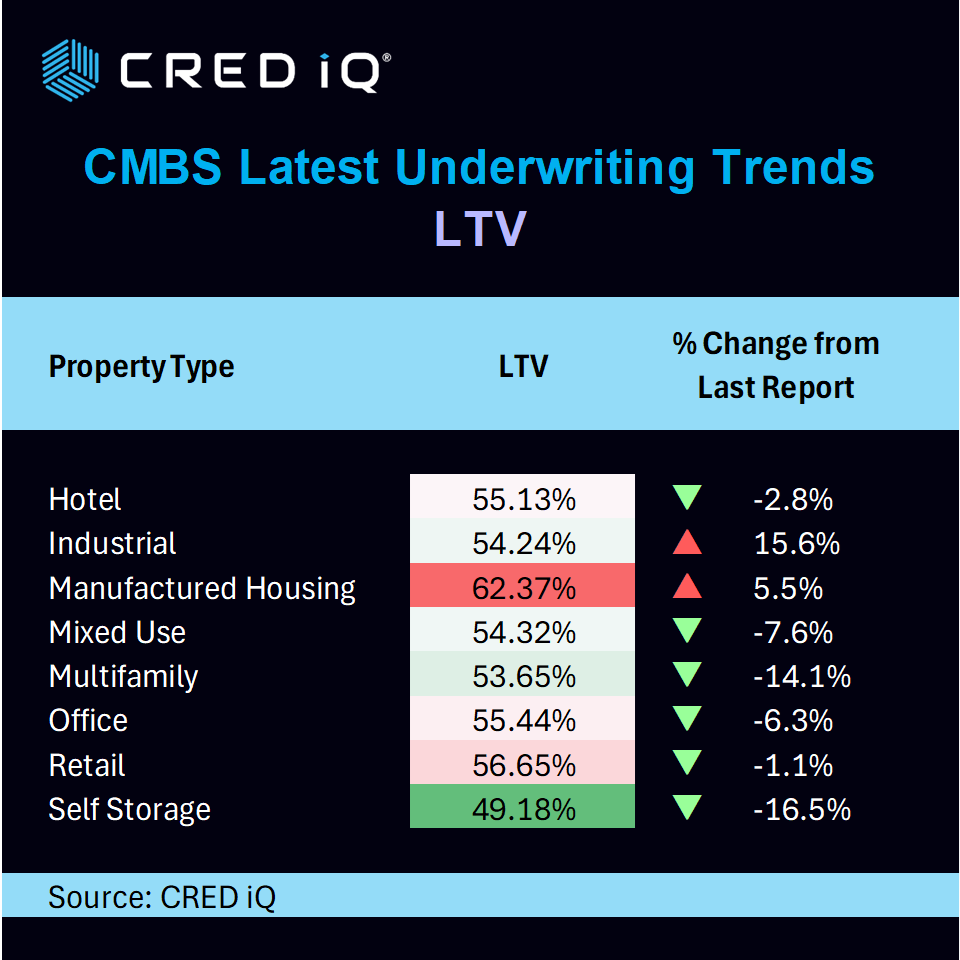

The average interest rate across all loans and property types was 6.6%, average LTV was 54.9%, implied cap rates averaged 6.34% with debt yields averaging 14.0%.

Not surprisingly our analysis confirmed interest rate reductions across all property types since our July report. Reductions ranged from 1.8% in mixed-use to industrial’s reduction of 8.8%.

Apart from Industrial and Manufactured Housing, LTV levels notched decreases in all other property types. Cap rates saw reductions in 5 of 8 property types. Debt yields were a mixed bag with surges in multifamily and self-storage.

Office

The office segment saw interest rates drop 42 basis points from 7.32 to 6.90%. Debt yields increased from 12.09% to 13.19%. LTV levels dropped from 59.2% to 55.4% while cap rates increased from 7.02% to 7.16% since our July analysis.

In total, 35 properties (of the 499 total in our analysis) were secured by office assets, comprising a total loan balance of $999.9 million.

Multifamily

The multifamily sector’s average interest rate dropped from 6.70% to 6.55%, a 15-basis point change. Debt yields decreased from 10.38% to 9.93%. LTV levels dropped from 62.5% to 53.7% while cap rates declined from 6.00% to 5.77% since our July report.

There were 122 properties secured by multifamily properties totaling $1.6 billion in new loan originations.

Retail

Retail interest rates dropped from 6.87% to 6.58% on average in the last 3 months ago. However, average cap rates for the retail sector increase from 6.16% to 6.45%. The average debt yield declined from 12.28% to 11.55% while average LTVs went from 57.3% to 56.7% since the July print.

The retail segment had a total of $1.4 billion. In total, 60 properties were secured by retail properties.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.