This week, the CRED iQ research team wanted to offer an initial glimpse of our upcoming 2025 Almanac which is set for publication next week.

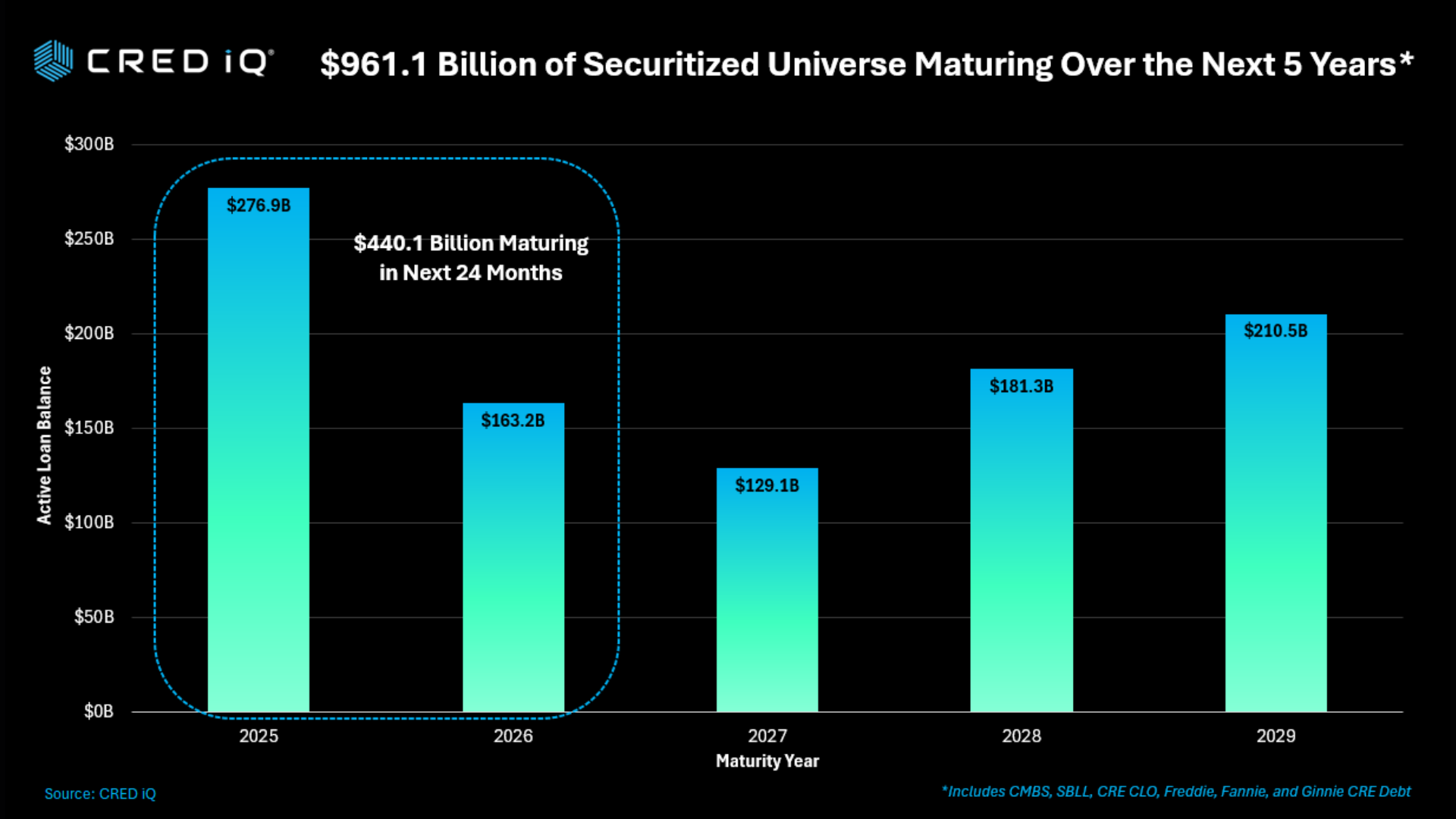

In today’s report, we analyzed the securitized commercial mortgages with maturity dates scheduled in 2025 and 2026. Within the securitized universe, approximately $277 billion in commercial mortgages are scheduled to mature in 2025, with an additional $163 billion maturing in 2026. In total, CRED iQ has aggregated and organized a total of $440 billion of commercial mortgages slated to mature within the next 24 months.

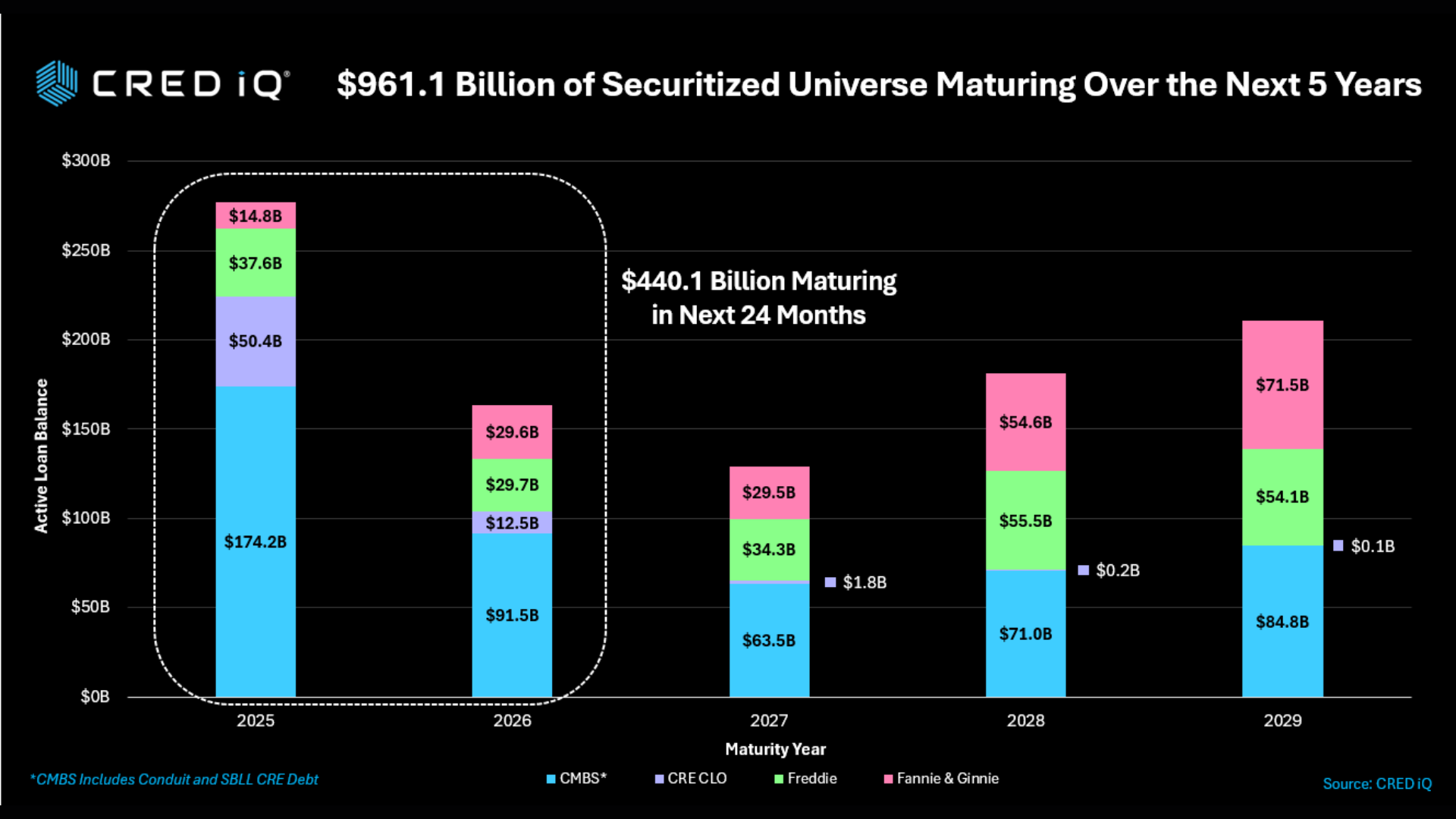

The scope of CRED iQ’s analysis is comprised of loans securitized in CMBS conduit trusts, single-borrower large-loan securitizations (SBLL) and CRE CLOs, as well as multifamily mortgages securitized through government-sponsored entities.

Thanks in part to the $36 billion in loan modifications executed over the course of the past three years, the next 12 months have the highest volume of scheduled maturities for securitized CRE loans over a period of 10 years ending 2034. Let’s dive into the details.

Securitized Universe

(includes CMBS, SBLL, CRE CLO, Freddie Mac, Fannie Mae, and Ginnie Mae)

2025 and 2029 have the largest aggregate balances of maturing loans over the next five years

- In 2025, $275 billion of CRE debt will mature.

- In 2029, $211 billion of CRE debt will mature.

The CMBS sector comprises a majority of the maturity throughout 2025 and 2026 logging $174 billion and $92 billion in each year respectively. The Freddie Mac and CRE CLO sectors round out the top 4.

Property Type Analysis

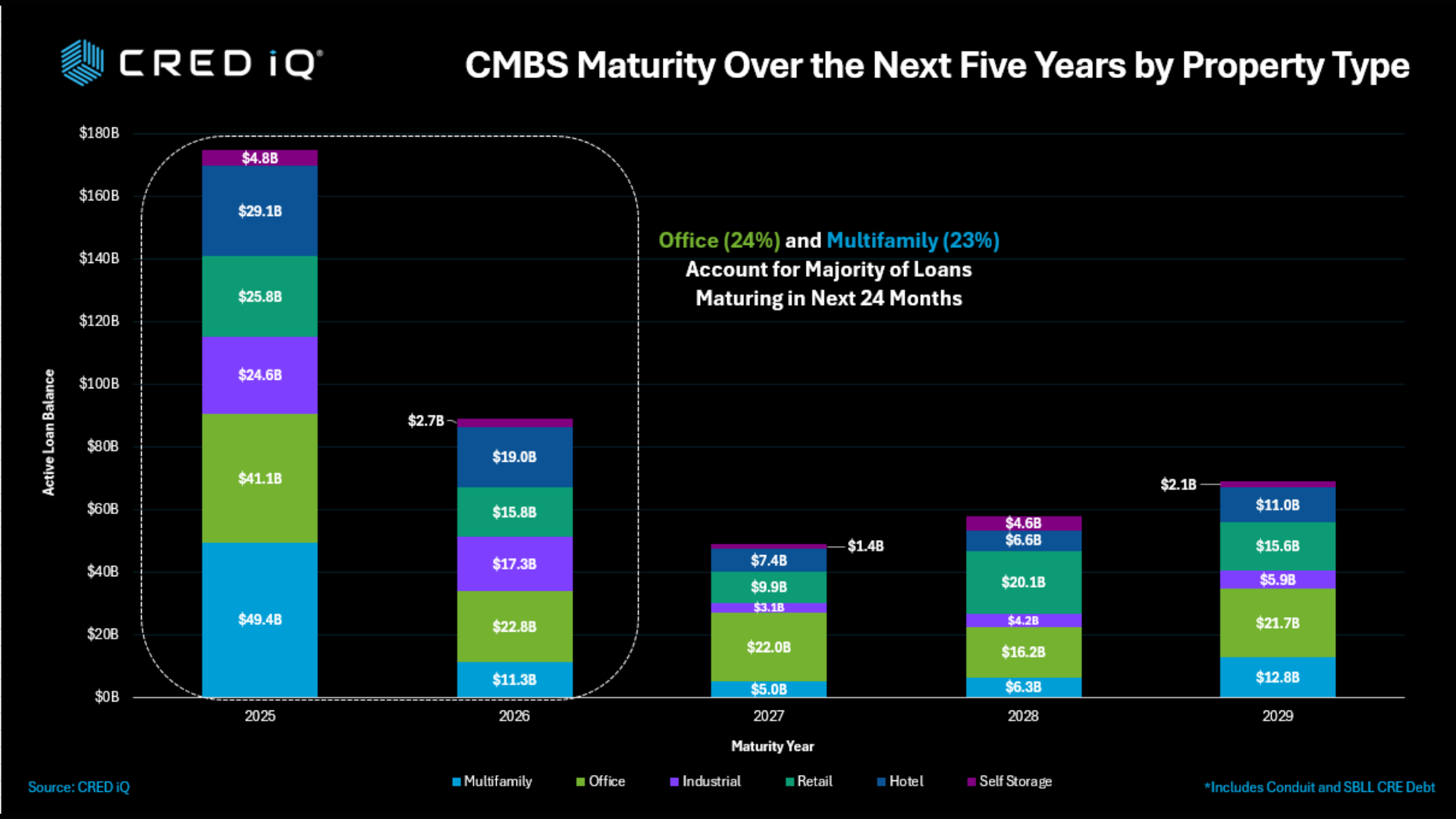

Office properties represent 24% of all maturing loans across 2025 and 2026 ($64 billion). Right behind office, is the multifamily segment which comprises 23% of the maturing loans during the period ($61 billion).

Hotel properties will see $48 billion in loans maturing during the next 24 months. The industrial and retail segments follow ~$42 billion each.

CRED iQ Almanac 2025

Stay tuned for details on how you can download the official handbook of CRE Finance. CRED iQ’s 2025 Almanac: Maturity Outlook and Chartbook is coming next week!

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.