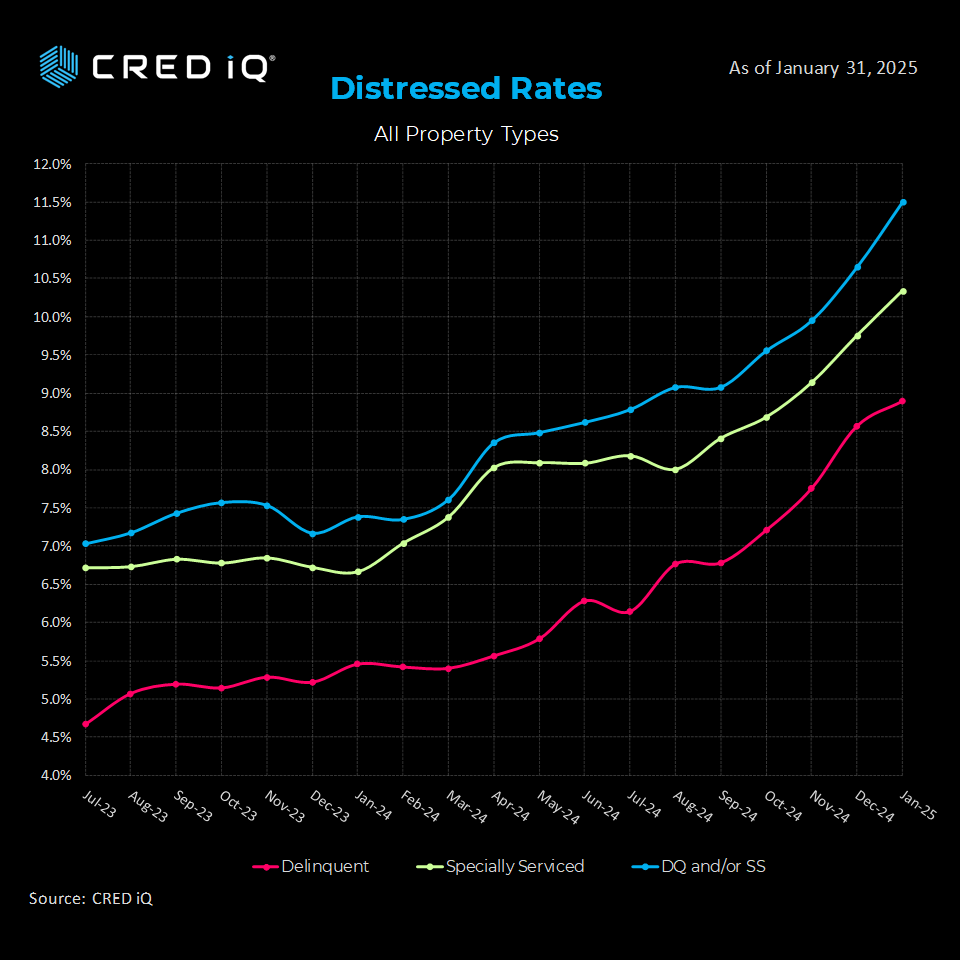

Overall Distress Rate Reaches 11.5%, Adding 90 Basis Points in January 2025

The CRED iQ research team evaluated payment statuses reported for each loan (securitized by CMBS financing), along with special servicing status as part of our monthly distress update.

The CRED iQ overall distress rate added 90 basis points, continuing the upward trend by logging its fourth straight record high of 11.5%. The CRED iQ delinquency rate ticked up from 10.6% in the December print to 11.5%. The CRED iQ special serving rate added 50 basis points this month and now stands at10.3%. A year prior, the special servicing rate was 6.7%.

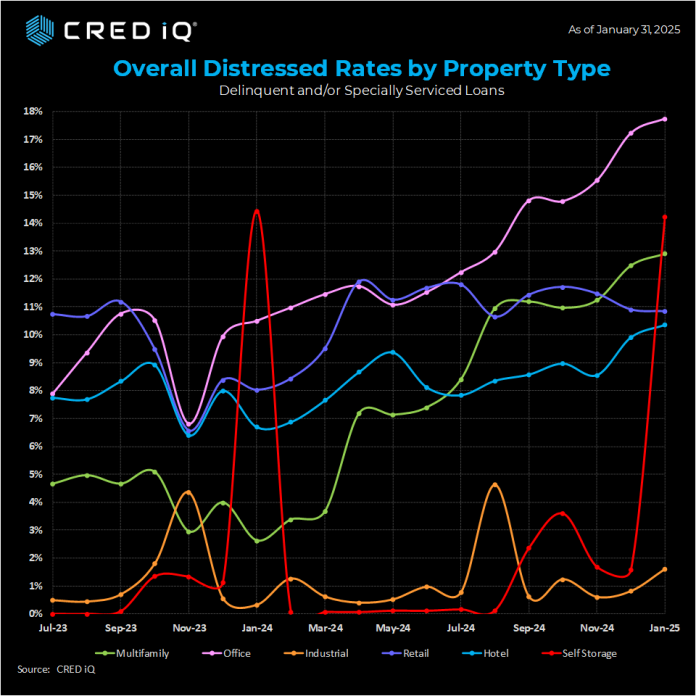

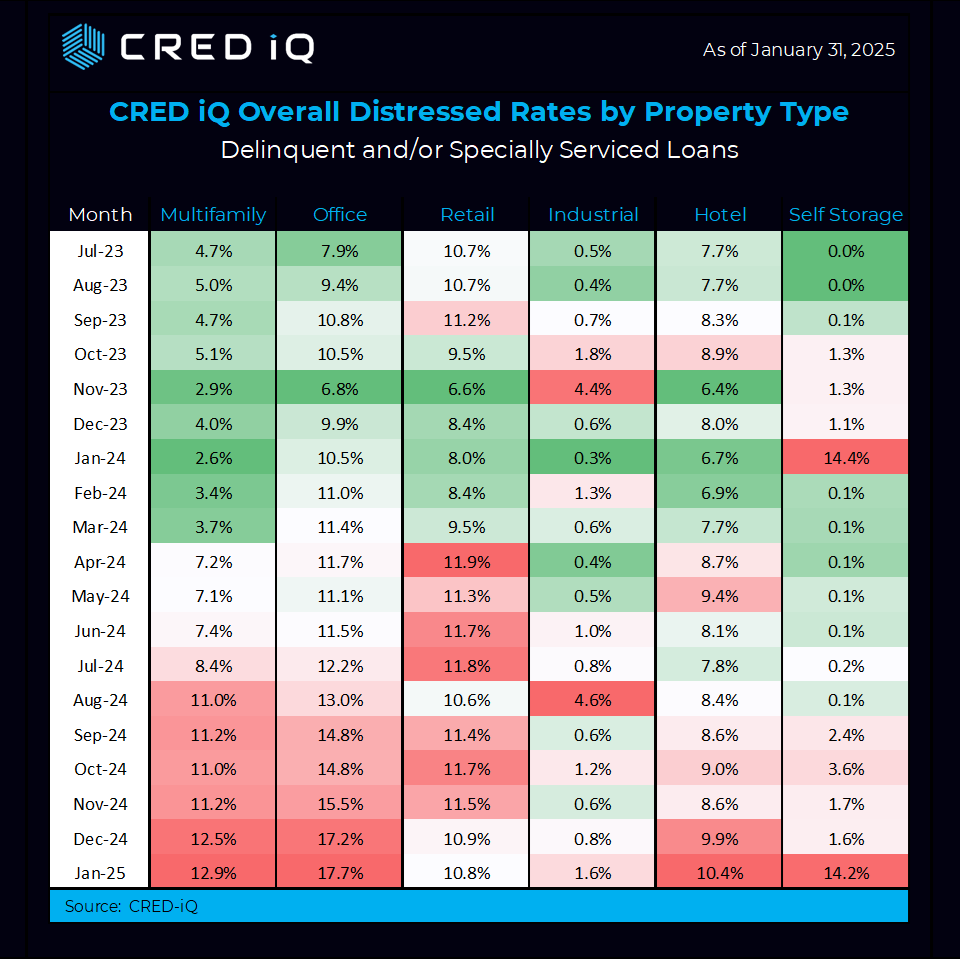

Segment Review

Following its largest overall distress rate increase of the year in December, the office segment’s overall distress rate continued to climb; albeit more modestly adding 50 basis points to 17.7%. Office maintains its decisive leadership as the most distressed property type.

The data shows the self-storage category roaring to the second position with a 14.2% overall distress rating (after spending most of the year below 1%).

This is misleading due to a portfolio consisting of 16 self-storage properties in the Chelsea submarket of NYC is backed by a $2.08 billion single borrower loan. Failure to payoff at the January 2025 maturity date led to a performing matured payment status. Servicer commentary indicates the first of three one-year extension options is being exercised.

Multifamily saw a 40 basis point increase to 12.9% — a clear second place (putting aside the self-storage anomaly). The multifamily segment was at a 2.6% distress rate in January 2024.

Retail turned in a mostly flat month-over-month print at 10.8%–enough to hold on to third place.

Not far behind and closing fast is the hotel segment which added another 50 basis points, notching a 10.4% overall distress rate

Retail was one of three property types that improved their distress rate. Retails distress rate was reduced by 60 basis points to 10.9% –now the third most distressed segment

Industrial uncharacteristically added 80 basis points, the largest increase among property types. With that said, the overall distress rate is only 1.6%.

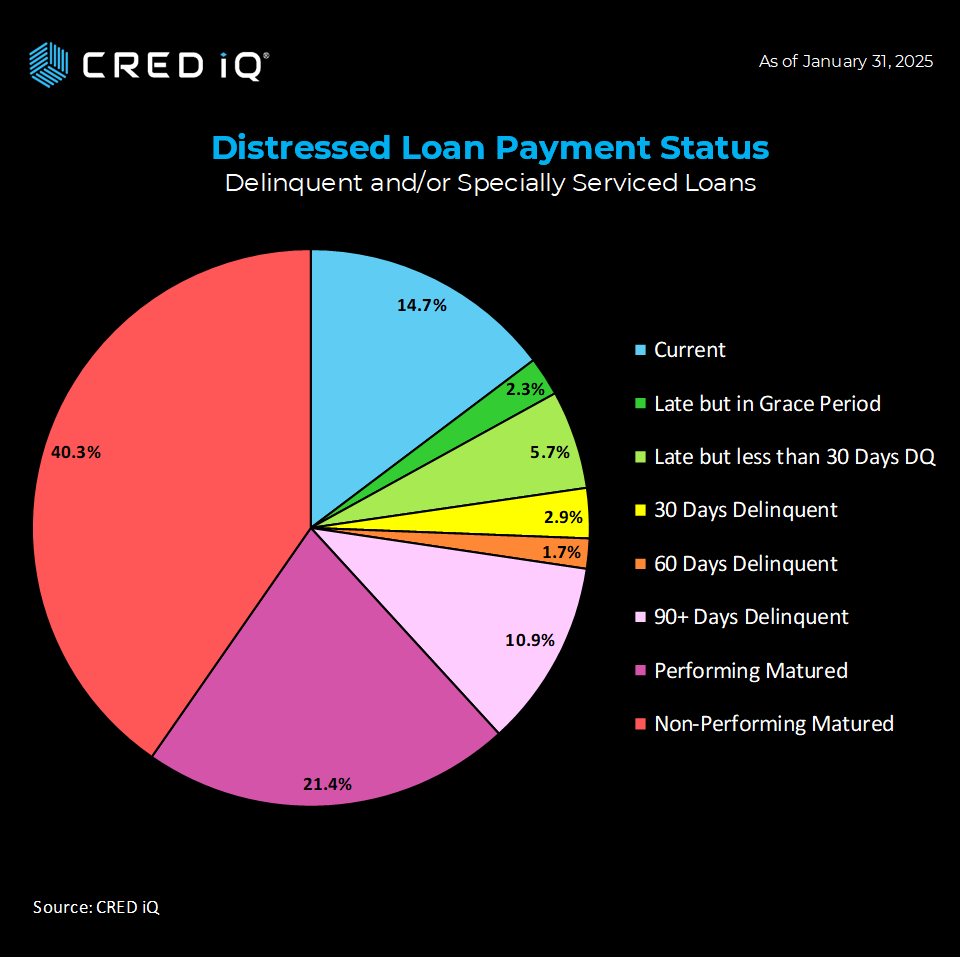

Payment Status

Our team explored how payment status has evolved over the course of 2024. Some takeaways:

January saw an increase in loans that are marked as current; rising from 13.5% in December to 14.7% as of January 31st.

Combining current with late but in the grace period and late by last than 30 days delinquent, this ‘wider current’ metric regained its footing, notching 22.7% a 310 basis point favorable swing.

Combining performing matured with non-performing matured, January saw a modest decrease from 62.2% in December to 61.7% in January.

Analysis Methodology

CRED iQ’s distress rate factors in all CMBS properties that are securitized in conduits and single-borrower large loan deal types. CRED iQ tracks Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO loan metrics in separate analyses.

CRED iQ’s distress rate aggregates the two indicators of distress – delinquency rate and specially serviced rate – yielding the distress rate. The index includes any loan with a payment status of 30+ days delinquent or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.