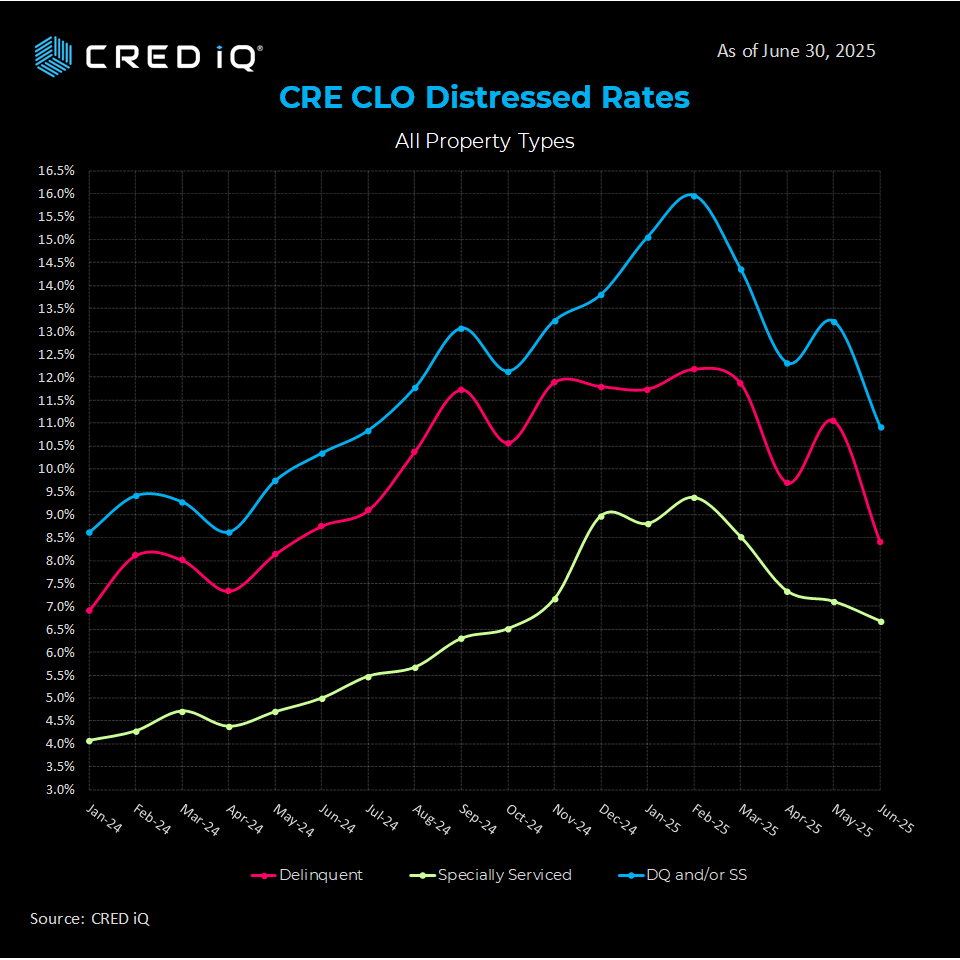

The commercial real estate collateralized loan obligation (CRE CLO) market is experiencing a turbulent 2025, with distress and delinquency rates reflecting the challenges of a shifting economic landscape. According to CRED iQ’s June 2025 CRE CLO Distress Report, the distress rate—encompassing loans 30+ days delinquent, past maturity, or in special servicing—dropped significantly by 230 basis points (BPS) to 10.9% from 13.2% in May. This follows a volatile pattern, with an 80 BPS rise in May and reductions in three of the past four months, leaving investors questioning the market’s long-term trajectory.

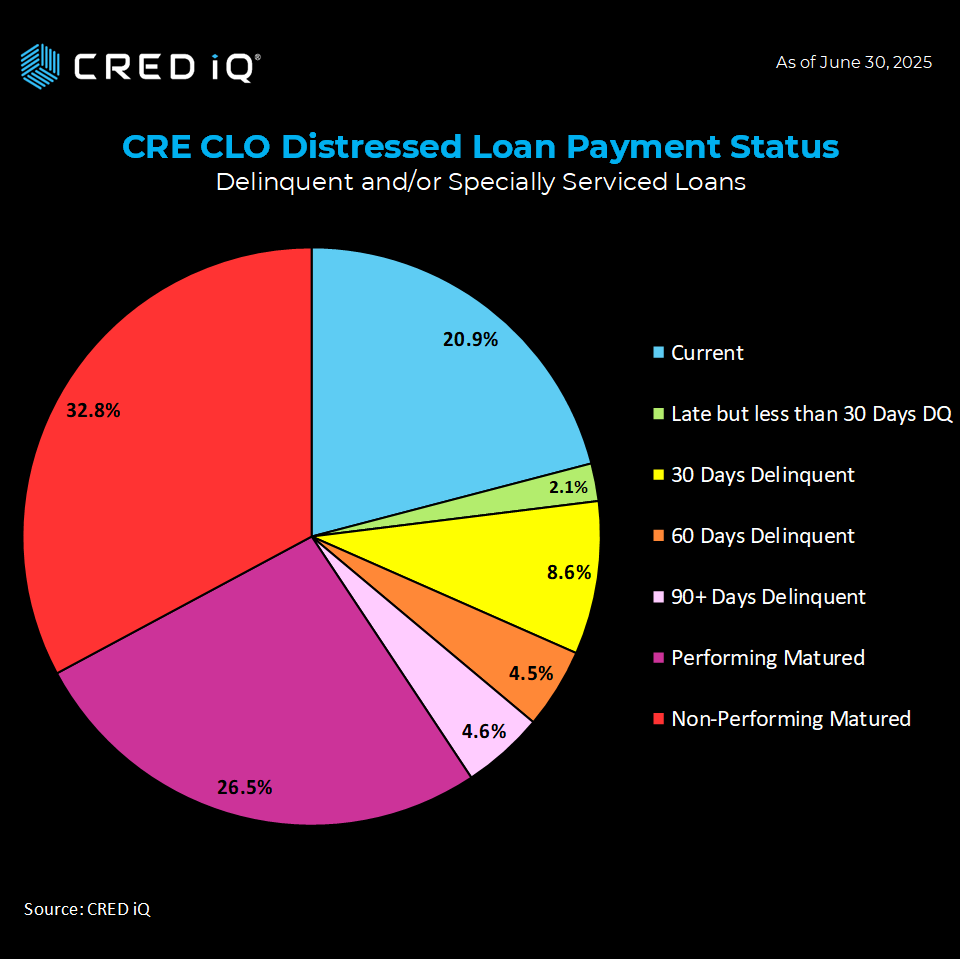

Delinquency rates, a critical indicator, fell 260 BPS to 8.4% in June, while the special servicing rate declined 40 BPS to 6.7%. These improvements are underpinned by a surge in current loans, with 20.9% ($1.4 billion) of CRE CLO loans current, up 660 BPS from $979.3 million in May. However, 59.3% of loans have surpassed their maturity dates, with 26.5% classified as “performing matured” (up from 14.4%) and 32.8% as “non-performing matured” (down from 50%). Pre-maturity delinquencies also eased to 17.7% from 19.1%.

This volatility stems from loans originated in 2021–2022, when low interest rates and high valuations fueled aggressive lending. These floating-rate, three-year loans are now hitting maturity walls in a high-rate environment, complicating refinancing. Borrowers are increasingly relying on extension options or month-to-month arrangements to avoid default, as seen in the case of Harmon at 370 Apartments in Las Vegas. This $91.4 million multifamily loan, with a $12.9 million future funding commitment, transitioned to performing matured status in June 2025 due failure to pay off at maturity.

Historical data from CRED iQ highlights the broader trend. Distress rates climbed from 8.6% in January 2024 to 15.1% in January 2025, driven by maturing loans and rising rates.

For investors and lenders, the CRE CLO market’s seesaw trends underscore the need for vigilance. Platforms like CRED iQ provide critical insights into loan performance, helping stakeholders navigate risks and seize opportunities in this resilient yet volatile market.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.