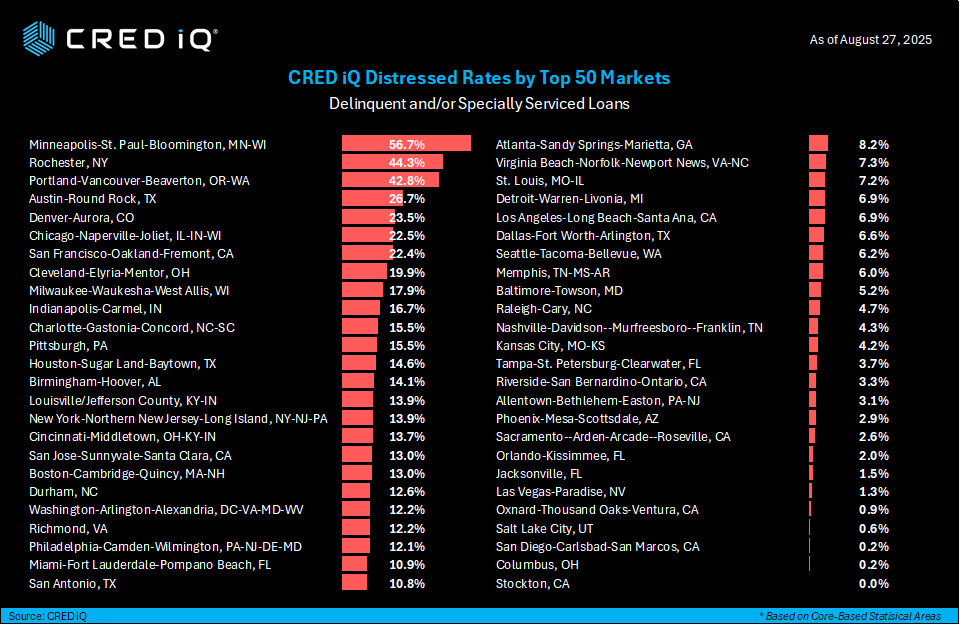

As we gear up for the Labor Day weekend, the CRED iQ research team has taken a deep dive into the state of commercial real estate across the nation. We’ve analyzed a staggering $341.1 billion in loans spanning the top 50 U.S. markets, focusing on signs of distress. Specifically, we flagged loans that are either delinquent or have been handed off to special servicers. From there, we calculated a “distress rate” for each market—the percentage of loans falling into these troubled categories.

This snapshot reveals stark regional differences, with some markets showing alarming levels of strain while others remain remarkably resilient. Leading the pack in distress is Minneapolis-St. Paul-Bloomington, MN-WI, where a whopping 56.7% of loans are flagged. Close on its heels are Rochester, NY (44.3%), and Portland-Vancouver-Beaverton, OR-WA (42.8%). Rounding out the top five are Austin-Round Rock, TX (26.7%), and Denver-Aurora, CO (23.5%)—highlighting a cluster of Midwestern and Western markets feeling the heat.

On the flip side, several markets are holding strong with minimal distress. Stockton, CA tops the list of least distressed at 0.0%, followed closely by Columbus, OH (0.2%) and San Diego-Carlsbad-San Marcos, CA (0.2%). Salt Lake City, UT (0.6%) and Oxnard-Thousand Oaks-Ventura, CA (0.9%) also stand out for their low rates.

These rankings underscore the uneven recovery in commercial real estate, influenced by factors like office vacancies, economic shifts, and tenant dynamics. For a full breakdown, check out the table below, sorted from highest to lowest distress rate.

Spotlight on a Distressed Loan: 7700 Parmer in Austin

To put these numbers into perspective, let’s zoom in on a key example from one of the top distressed markets. The 7700 Parmer office property in Austin—a 911,579 square-foot asset—is backed by a $177 million loan that’s recently been transferred to the special servicer due to an imminent monetary default. This interest-only loan is set to mature in December 2025, with no extensions noted at origination.

Major tenants include Google (33% of gross leasable area, lease expires September 2027), Electronic Arts (19%, expires August 2026), and eBay Inc. (10%, expires May 2028). Occupancy stands at 74%, with a debt service coverage ratio (DSCR) of 1.96—solid on paper, but clearly not enough to avoid trouble amid broader market pressures.

Stories like this highlight why Austin ranks high on our distress list and serve as a reminder of the vulnerabilities in office-heavy portfolios.

What Does This Mean for CRE Investors?

These rankings offer valuable insights for investors, lenders, and stakeholders navigating the post-pandemic landscape. Markets like Minneapolis and Rochester may require extra due diligence, while low-distress areas like Stockton and Columbus could present more stable opportunities. As always, at CRED iQ, we’re committed to providing data-driven analysis to help you stay ahead. Stay tuned for more updates, and enjoy your Labor Day weekend!

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.