As we move into the final quarter of 2025, commercial real estate (CRE) investors and CMBS stakeholders are closely monitoring delinquency and distress signals amid a backdrop of moderating interest rates and economic stabilization. At CRED iQ, our latest data reveals persistent challenges in certain sectors, balanced by signs of resilience elsewhere. This update draws on our comprehensive delinquency, specially serviced, and overall distress rates, alongside key market metrics from CRED iQ, to provide actionable insights for navigating this evolving landscape.

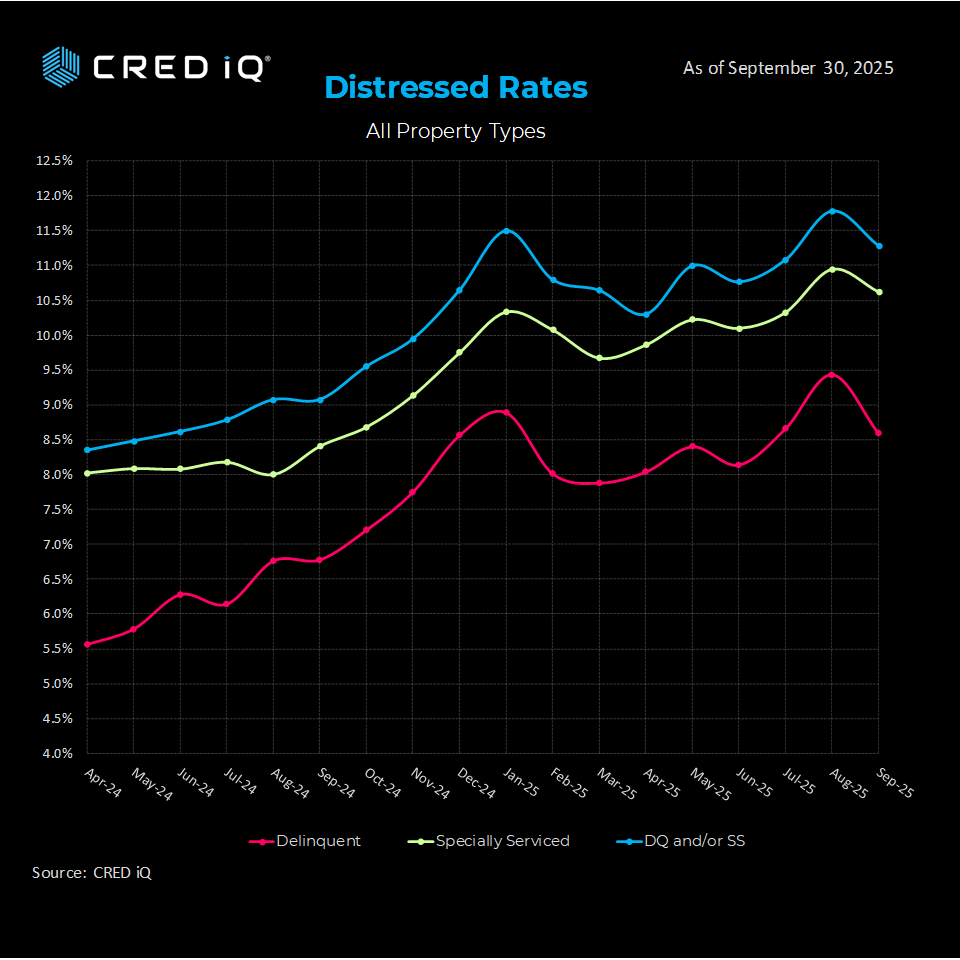

Starting with CMBS delinquency trends, our tracking shows a slight downward trend in overall distress as of September 2025. Delinquency rates stood at 8.59%, down from 9.44% in August, while specially serviced loans declined to 10.63% from 10.95%. The combined delinquent and/or specially serviced rate reached 11.28%, marking a modest decrease from 11.78% the prior month. Looking back, this metric has hovered between 10-12% throughout 2025, a stark contrast to the sub-5% levels seen in 2022-2023. For instance, in January 2025, the combined rate was 11.50%, peaking at 11.78% in August before this slight easing. Office properties continue to drive much of this distress, with broader implications for portfolio risk management.

Drilling deeper into property-type specifics from recent CRED iQ loan and market stats (as of late September 2025), CMBS delinquency rates underscore sectoral divergences. Office loans remain the most pressured followed by Multifamily. Retail and hotel sectors showed improvement this month, while Industrial properties, buoyed by e-commerce, maintain the lowest delinquency rate.

Beyond distress, broader market metrics paint a picture of cautious optimism. Treasury yields have stabilized, with the 10-Year at 4.18% as of late September, up from 3.80% a year prior but down from recent highs. The Fed’s rate cuts—now at 4.00-4.25% bounds—have eased borrowing costs, potentially supporting refinancing amid $957 billion in CRE maturities for 2025, led by banks ($450 billion) and CMBS/CRE CLOs ($230 billion). Cap rates tracked by CRED iQ edged higher nationally to 6.40% from 6.30% a year ago, with retail at 7.10% and office at 7.00%, while CPPI grew 0.9% YOY, indicating modest price appreciation.

Issuance volumes are a bright spot: YTD private-label CMBS hit $91.4 billion, up 26% YOY, driven by SASB ($66.9B). Agency CMBS surged 39% to $105.7 billion, with Fannie Mae and Freddie Mac leading. CRE CLOs exploded 234% to $22.7 billion, reflecting investor appetite for yield. Lending shares shifted, with agencies at 20% in 1H 2025 (down from 25% in 2024), while debt funds/REITs rose to 14%. Total CRE debt outstanding reached $6.2 trillion, dominated by banks (49%).

Economic indicators bolster this view: CPI cooled to 2.9% YOY, unemployment at 4.3%, and nonfarm payrolls added 22K in the latest month—soft but stable. For investors, these trends suggest selective opportunities in industrial and multifamily, but vigilance on office exposure. At CRED iQ, we recommend stress-testing portfolios against upcoming maturities and monitoring special servicing transfers closely. As rates potentially ease further post the October FOMC, refinancing windows may widen, but distress resolution will be key to 2026 stability.

Informed with CRED iQ

As the CRE sector continues to adapt to macroeconomic shifts, CRED iQ’s comprehensive analytics offer a critical resource for decision-makers. For a deeper dive into our data or to discuss how these trends impact your portfolio, contact our team today. Stay tuned for our next update, where we’ll continue to track the metrics driving the CMBS market.

For more information, visit CRED-iQ.com or reach out to our research team at Team@CRED-iQ.com.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.