Commercial Real Estate Collateralized Loan Obligations (CRE CLOs) continue to exhibit resilience in the face of economic headwinds, with delinquency, special servicing, and overall distress rates remaining subdued through September 2025. Drawing from CRED iQ’s proprietary dataset, this analysis highlights key metrics for CMBS and CRE CLO investors navigating portfolio risks.

Delinquency and Special Servicing Dynamics

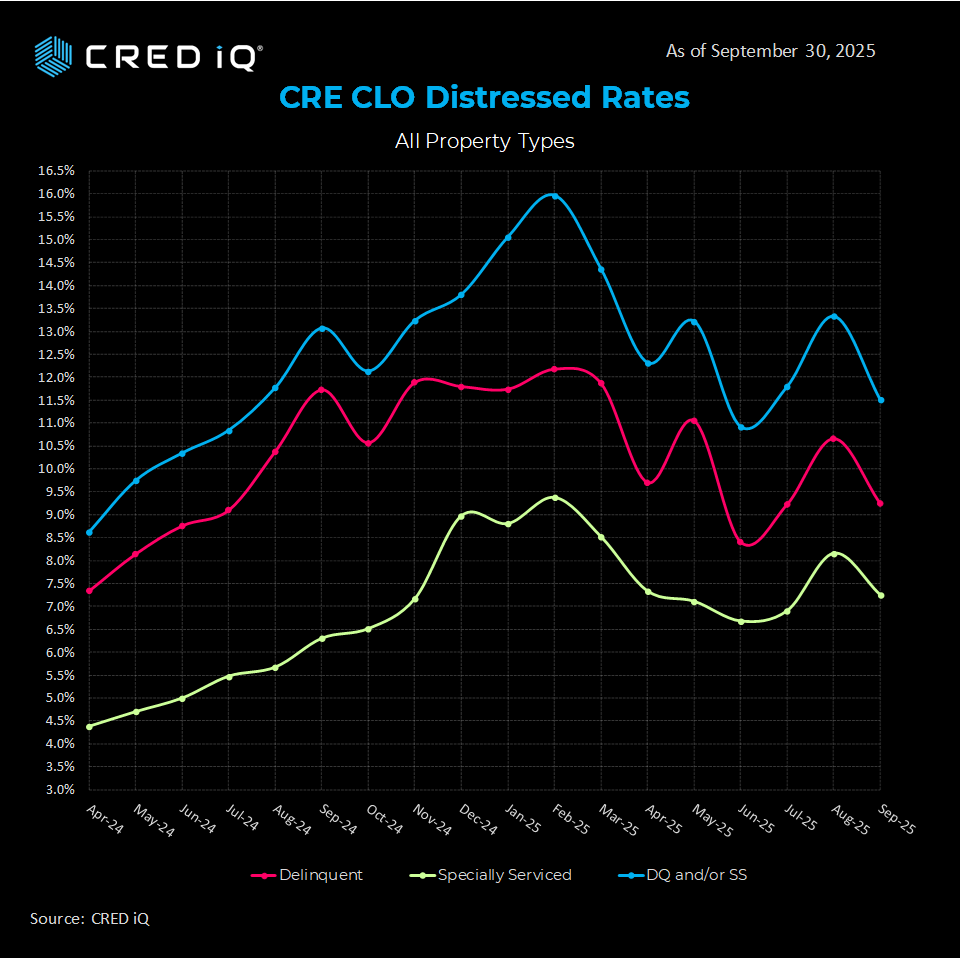

Delinquency (DQ) rates in CRE CLOs ticked down to 9.2% in September 2025 from 10.7% in August, marking a month-over-month (MoM) decline of 150BPS. This follows a volatile H1 2025, where DQ peaked at 12.2% in February before easing. Special servicing (SS) rates mirrored this trend, falling to 7.2% from 8.2%.

The CRED iQ distress rate (DQ and/or SS) compressed to 11.5% in September, down 180 BPS MoM and 160 bps year-over-year from September 2024’s 13.1%.

Cumulative balances underscore the scale: September’s distressed pool totaled $6.2 billion across $54.0 billion in allocated loan amounts (ALA), representing just 11.5% exposure. Compared to the 2025 low of 10.9% in June 2025, September distress increased by 60 bps.

Payment Status Breakdown

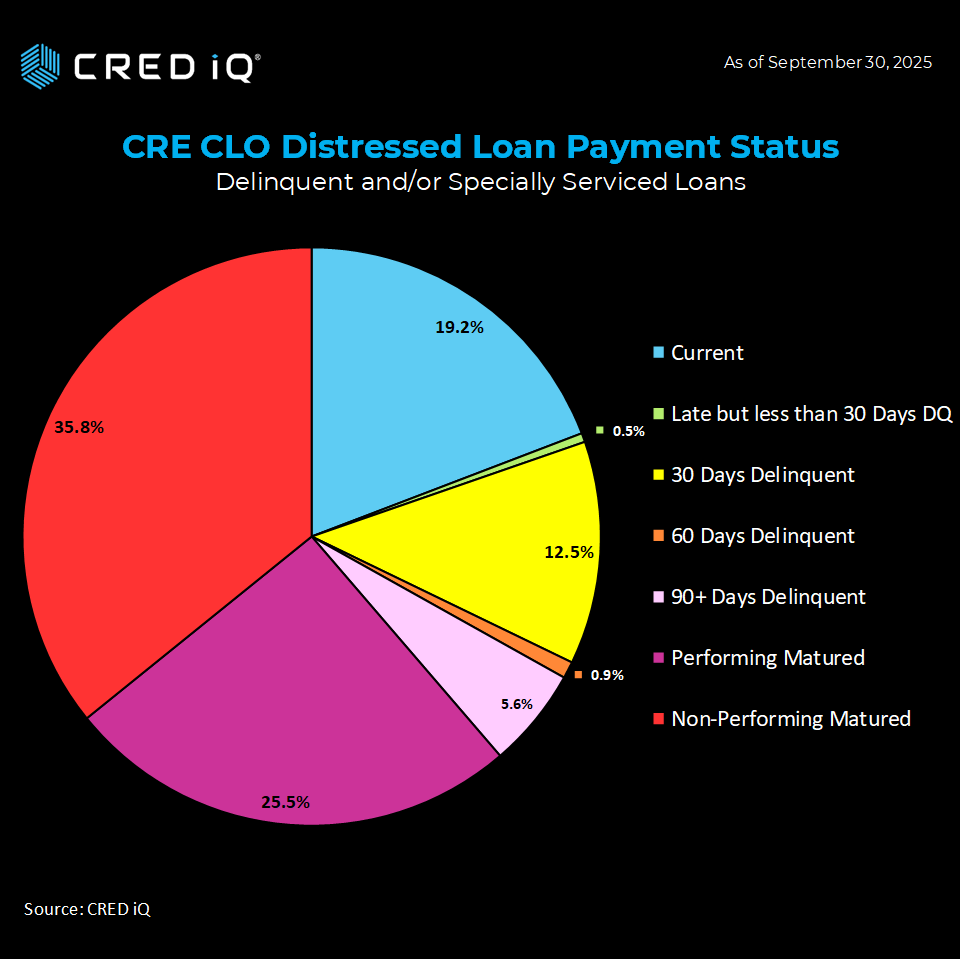

Payment statuses reveal a maturing portfolio, with 61.3% of ALA in matured loans ($3.8 billion), split between performing (25.5%) and non-performing (35.8%) categories. Current loans hold steady at 19.2% ($1.2 billion), while late payments (<30 days DQ) are negligible at 0.5% ($31.2 million). DQ buckets dominate distress: 30-day at 12.5% of total ALA, 60-day at 0.9%, and 90+ days at 5.6%, totaling 19.0% exposure.

This distribution highlights liquidity risks in matured non-performers, yet low early-stage delinquencies (under 1% combined late/grace) suggest proactive servicing. Investors should prioritize stress testing for extension risks in leveraged deals.

CRED iQ monitoring indicates potential for further compression if rate cuts materialize, though sector-specific rotations remain. For more information, visit CRED iQ or reach out to our research team at Team@CRED-iQ.com.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.