CRE Loan Modifications: Q3 Report

In the dynamic landscape of commercial real estate (CRE), loan modifications serve as a critical indicator of market stress, borrower resilience, and sector-specific challenges. As of the third quarter of 2025, data from CRED iQ reveals the ‘extend and pretend’ trend continues.

This analysis draws from a dataset encompassing modified loans totaling approximately $11.2 billion in ending balances, spanning July through September 2025. While modifications can range from maturity extensions to forbearance agreements, the trends highlight vulnerabilities in certain property types and a concentration among larger loan sizes. Below, we delve into these patterns, offering insights for investors, lenders, and market participants.

Overview of Recent Modification Activity

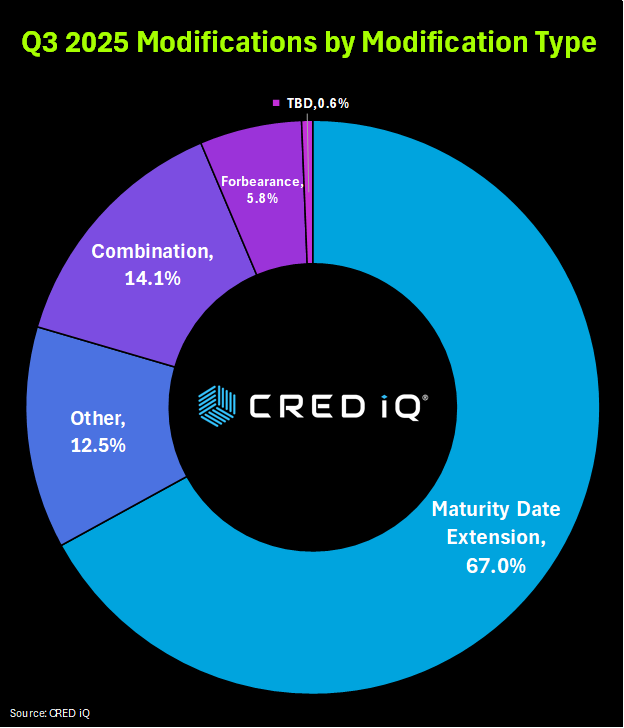

Before breaking down by property type and loan size, it’s worth noting the broader context. By category, maturity date extensions dominated, accounting for 101 loans and 67% of the loan balance, underscoring a prevalent strategy to defer repayments rather than restructure fundamentally.

Modifications by Property Type

Property types exhibit varied exposure to modifications, with hotels leading in balanced impact, while multifamily properties show higher loan counts. Here’s a breakdown:

- Hotels: This sector tops the list with 53 loans modified, totaling $5.5 billion

- Office: 36 loans amounting to $1.4 billion

- Multifamily: Leading in volume with 55 loans, but a balance of $1.4 billion

- Mixed Use: 20 loans for $891.9 million

- Retail: Only 6 loans totaling $156.2 million

- Self Storage: 3 loans for $150.0 million. This niche sector shows minimal modifications, aligning with its reputation for steady demand and lower volatility.

- Industrial: 5 loans totaling $55.8 million

These figures illustrate a clear hierarchy: hospitality and traditional office spaces are bearing the brunt, while industrial and storage sectors remain outliers in stability.

Modifications by Loan Size

Shifting to loan size buckets, the data underscores a skew toward larger loans, which dominates the modified balance.

- $100M+: 50 loans totaling $5.9 billion. This bucket alone accounts for over half the modified value, suggesting mega-loans are disproportionately affected.

- $50M-$100M: 38 loans for $2.5 billion Mid-to-large loans here contribute significantly

- $20M-$50M: 73 loans amounting to $2.3 billion The highest count but lower balance percentage implies a broader distribution of mid-sized modifications.

- $10M-$20M: 24 loans for $670.4 million, showing a smaller impact

- Less than $10M: 30 loans totaling $145.9 million. Minimal balance weight, indicating smaller loans are less frequently modified or resolved through other means.

Key Takeaways and Implications

The Q3 2025 data paints a picture of targeted distress in CRE, with hotels and offices leading modifications by property type, and larger loans ($50M+) comprising over 74% of the balance. Stay tuned to CRED iQ for deeper dives into CRE data and analytics. For custom insights or full datasets, visit our platform.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.