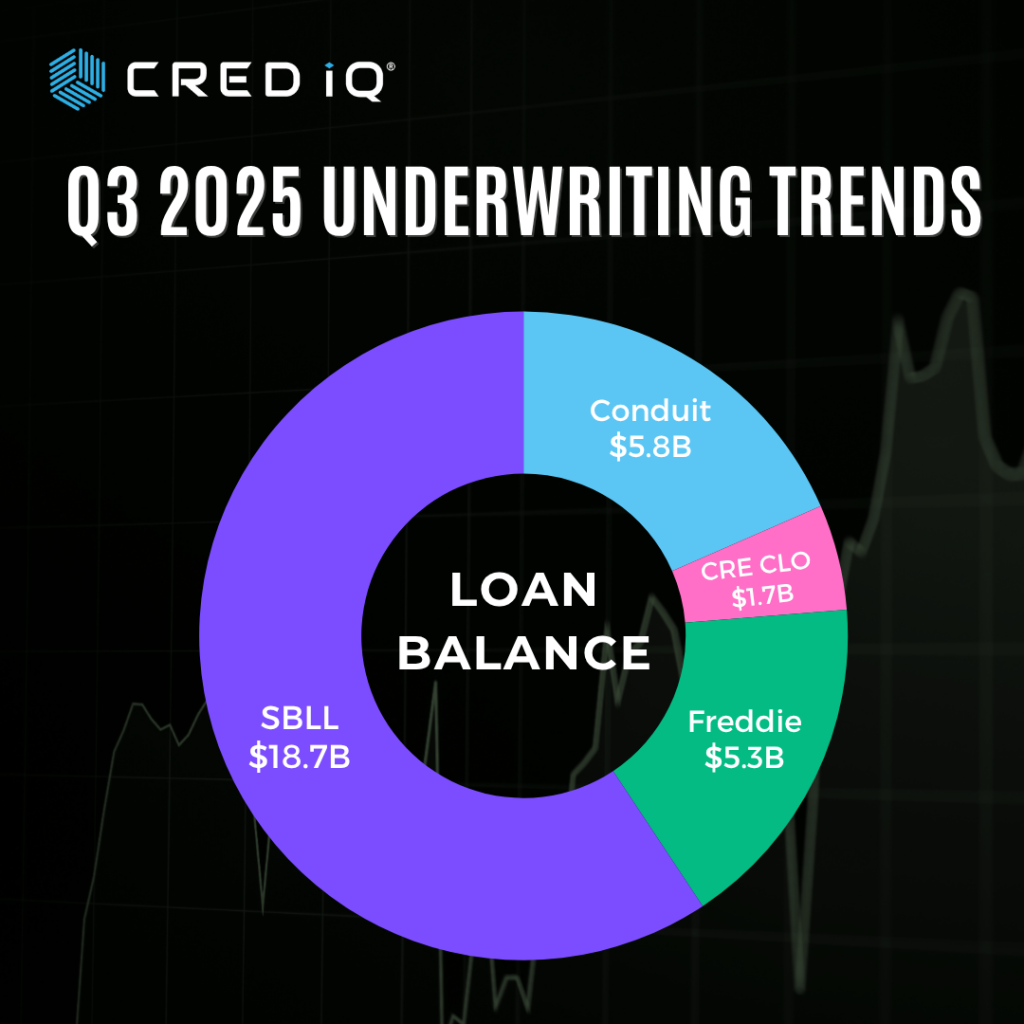

The CRED iQ research team focused upon the underwriting of the latest market transactions. CRED iQ analyzed underwriting metrics for $31.5 billion in new issuances from the third quarter alone. We reviewed 576 loans across 51 deals. Interest rate and cap rate analysis by property type is highlighted below.

2025 YTD new issuances totaled $123.8 billion

- Conduit: $20.8 billion

- CRE CLO: $19.4 billion

- Freddie Mac: $22.0 billion

- SBLL: $61.5 billion

Q3 volumes were down across the board as compared to Q2.

- Deals, balances, and loans saw reductions of 9%, 18%, and 50% respectively in Q3 vs. Q2

Deeper Dive – Recent Conduit Activity

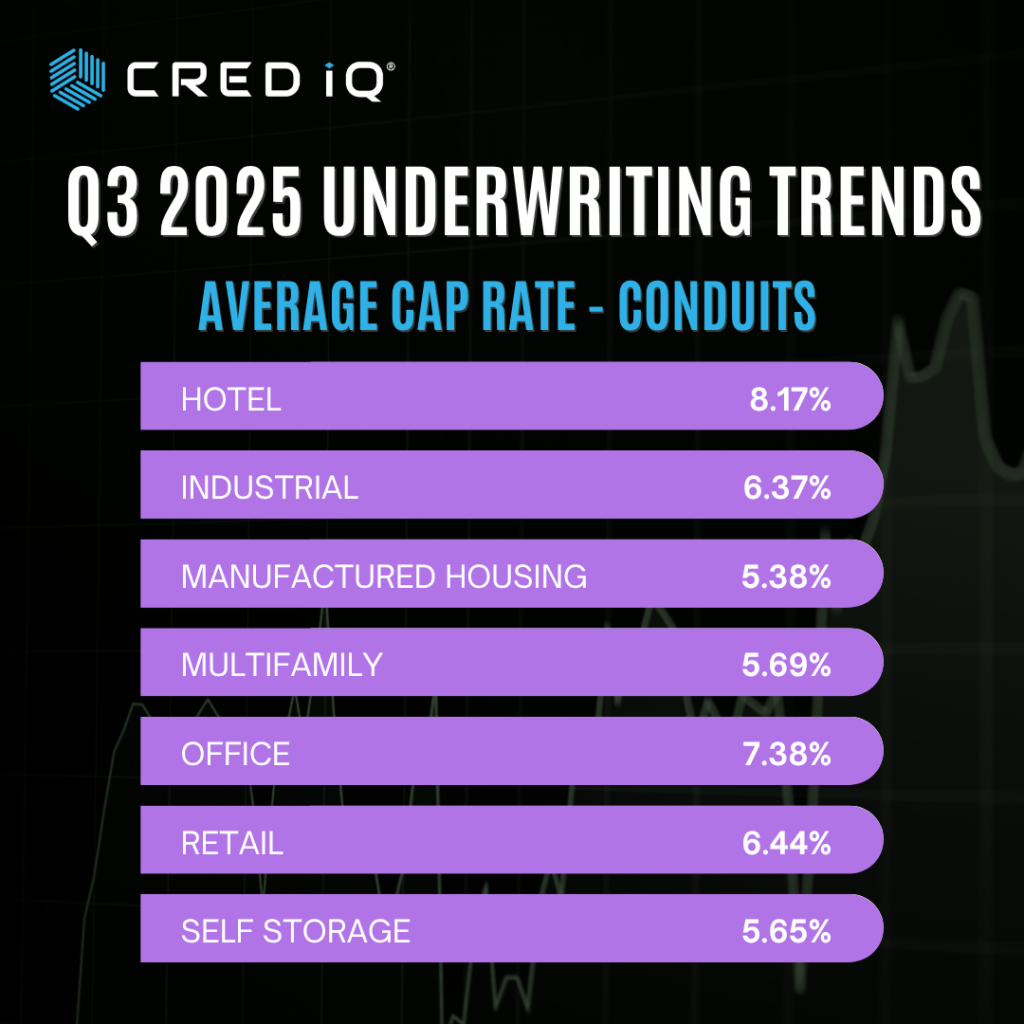

According to the latest CRED iQ data, the grand total average interest rate across all commercial real estate property types stands at 6.57%, while the average cap rate registers at 6.34%. This narrow spread of just 23 basis points underscores a compressed yield environment, where borrowing costs remain elevated relative to capitalization rates. The overall figures reflect a market still adjusting to higher-for-longer interest rates, with debt service coverage potentially strained in sectors where cap rates fail to outpace financing expenses significantly.

Diving into property-type specifics, Hospitality leads with the highest average interest rate at 7.11% and the widest cap rate at 8.17%, yielding a healthy 106-basis-point buffer that supports robust valuation and refinancing flexibility in this recovery-sensitive sector. In contrast, Industrial properties exhibit the tightest spread, with an average interest rate of 6.72% against a 6.37% cap rate—only 35 basis points—highlighting vulnerability to further rate hikes amid e-commerce-driven demand but thinner margins for error. Multifamily follows closely behind the grand average, at 6.46% interest and 5.69% cap rate, indicating steady but unremarkable performance in a segment buoyed by rental demand yet pressured by construction costs and affordability challenges.

Notable outliers include Self Storage, boasting the lowest average interest rate at 6.37% alongside a 6.00% cap rate, which may signal favorable investor appetite for this resilient, low-maintenance asset class. Office properties, meanwhile, show a 6.71% interest rate and 7.38% cap rate, offering a 67-basis-point spread that provides some cushion despite ongoing hybrid-work headwinds. Investors monitoring these metrics should watch for cap rate expansion in underperforming sectors like Retail (6.68% interest, 6.44% cap) to restore equilibrium, as any widening could signal opportunistic buying windows in a maturing cycle.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.