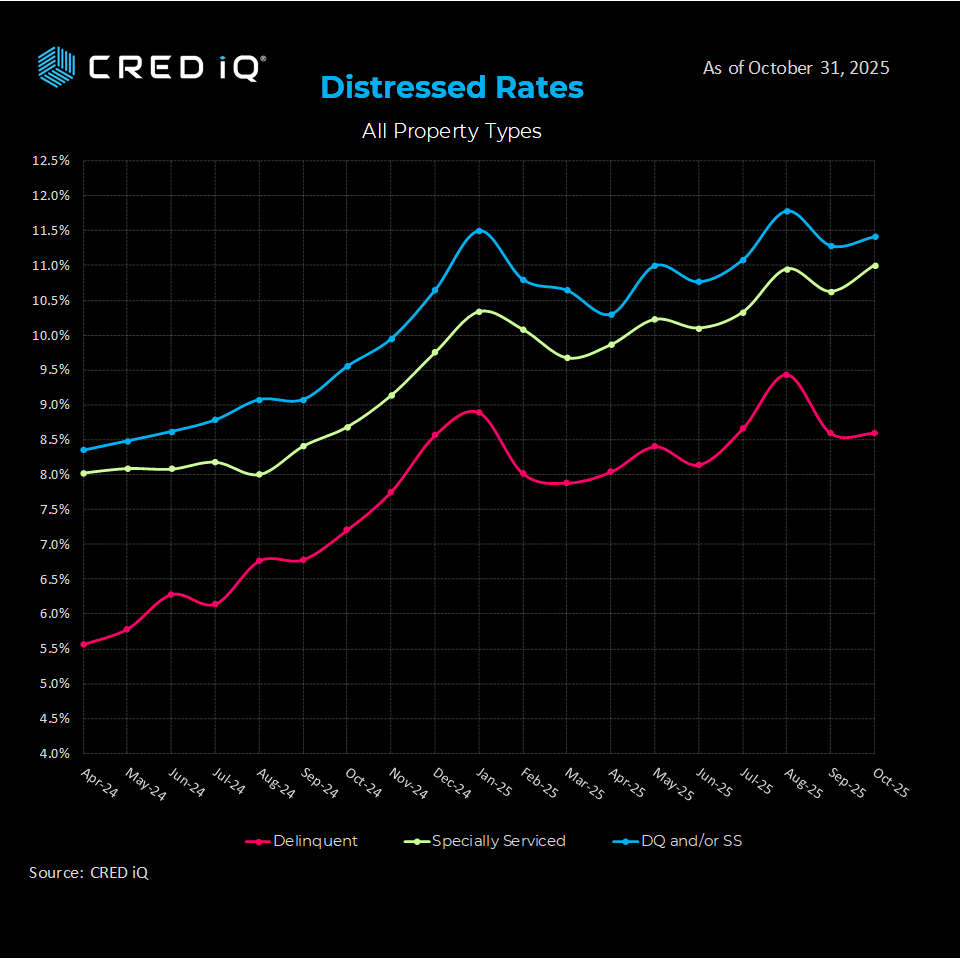

CMBS investors tracking distress signals saw the CRED iQ distressed rate rise 13 basis points in October to 11.41%, reversing half of September’s 50 bps decline and inching closer to the cycle peak. Our analysis covers approximately $600 billion in private-label CMBS conduit and SASB loans, providing a granular view of sector performance and loan-level risks. The delinquency rate held steady at 8.59%, while the specially serviced rate increased 38 bps to 11.00%. This uptick reflects ongoing resolution challenges, particularly for matured loans. CRED iQ’s distress rate combines any loan with the special servicer or 30 days delinquent or worse.

Sector Distress Breakdown (October 2025 vs. Q1 2025)

| Property Type | October 2025 Distress | Change from Q1 2025 |

| Office | 17.5% | -170 bps |

| Hotel | 10.4% | -110 bps |

| Multifamily | 10.3% | -270 bps |

| Retail | 9.2% | +60 bps |

| Manufactured Housing | 1.8% | N/A |

| Industrial | 1.5% | +100 bps |

| Self-Storage | 0.1% | -170 bps |

Office continues to dominate distress at 17.5%, driven by hybrid work trends and maturing debt. Hotels (10.4%) and multifamily (10.3%) remain elevated but have improved since March, benefiting from seasonal demand and rent growth stabilization. Retail’s 9.2% rate edges higher amid e-commerce pressures. In contrast, industrial (1.5%), manufactured housing (1.8%), and self-storage (0.1%) operate with minimal stress, underscoring their resilience in a high-rate environment.

Payment Status Insights from Distressed Loans

- Current: 21.5%

- Late but less than 30 Days: 3.3%

- 30 Days DQ: 4.4%

- 60 Days DQ: 2.0%

- 90+ Days DQ: 11.8%

- Performing Matured: 16.3%

- Non-Performing Matured: 40.9%

The shift toward non-performing matured loans signals mounting extension risks and potential forced sales ahead of 2026 maturities. For investors, these metrics highlight selective opportunities in underperforming offices and hotels, while favoring allocations to industrial and self-storage.

Informed with CRED iQ

As the CRE sector continues to adapt to macroeconomic shifts, CRED iQ’s comprehensive analytics offer a critical resource for decision-makers. For a deeper dive into our data or to discuss how these trends impact your portfolio, contact our team today. Stay tuned for our next update, where we’ll continue to track the metrics driving the CMBS market.

For more information, visit CRED-iQ.com or reach out to our research team at Team@CRED-iQ.com.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.