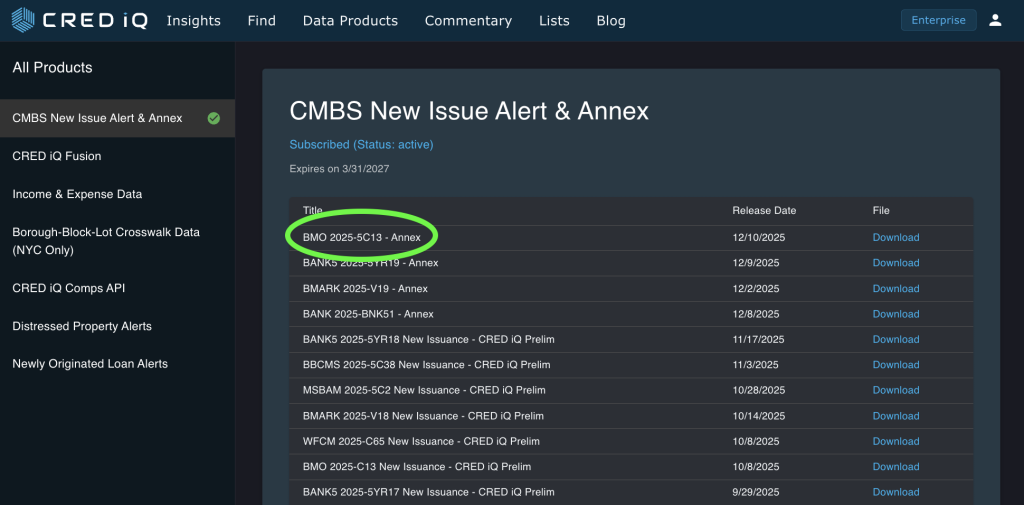

CRED iQ Preliminary Analysis

Deal Overview

Type: Public fixed-rate conduit CMBS

Size: $484.906 MM publicly offered certificates (total trust balance: $551,814,060)

Issuance Date: Pricing week of December 15, 2025 | Expected settlement December 30, 2025

Co-Lead Managers & Joint Bookrunners: BMO Capital Markets Corp., Deutsche Bank Securities Inc., Citigroup Global Markets Inc., SG Americas Securities, LLC

Co-Managers: Academy Securities, Inc., Bancroft Capital, LLC, Drexel Hamilton, LLC, Mischler Financial Group, Inc., Natixis Securities Americas LLC

Key Pool Characteristics

Initial Pool Balance: $551,814,060

Number of Loans / Properties: 30 / 36

WA Cut-off LTV: 58.5%

WA UW NCF DSCR: 1.99x

WA Debt Yield (UW NOI): 13.9%

WA Mortgage Rate: 6.35128%

WA Remaining Term: 59 months

Property Type Mix

Multifamily 35.2% | Retail 27.0% | Office 17.4% | Hospitality 12.2% | Self Storage 4.0%

Geographic Concentration

NY 33.1% | CA 12.4% | NV 12.3% | ID 9.8% | VA 5.3%

Risk Retention: Horizontal (HRR)

Anticipated Settlement: December 30, 2025

Servicing & Parties

Master Servicer: Midland Loan Services, a Division of PNC Bank, National Association

Special Servicer: 3650 REIT Loan Servicing LLC

Data & Analytics Provider: CRED iQ

Key Analysis

BMO 2025-5C13 is one of the final conduits of 2025, showcasing exceptionally conservative underwriting with a WA cut-off LTV of 58.5%—among the lowest in recent vintages—and a robust 13.9% UW NOI debt yield that offers significant protection in the current rate environment.

The deal provides 30% credit enhancement to the AAA classes, consistent with post-2023 conduit norms, bolstered by a strong 1.99x UW NCF DSCR. Loan concentration is elevated, with the top 11 loans accounting for 67% of the pool balance, though this is driven by high-quality, granular assets across multifamily and retail.

Property-type exposure is led by multifamily (35.2%) and retail (27.0%), with notable office (17.4%) and hospitality (12.2%) allocations supported by low leverage and healthy debt yields. Geographically, New York leads at 33.1%, with Western markets (CA, NV, ID) combining for ~34.5%—a common profile for year-end deals.

Key contributors include 3650 Capital (33.6%) and BMO (31.8%), with 3650 also handling special servicing and controlling class duties. As 2025 U.S. conduit issuance closes near $60 billion—essentially flat year-over-year—this transaction underscores ongoing investor preference for tightly underwritten, low-LTV deals as the market heads into 2026.