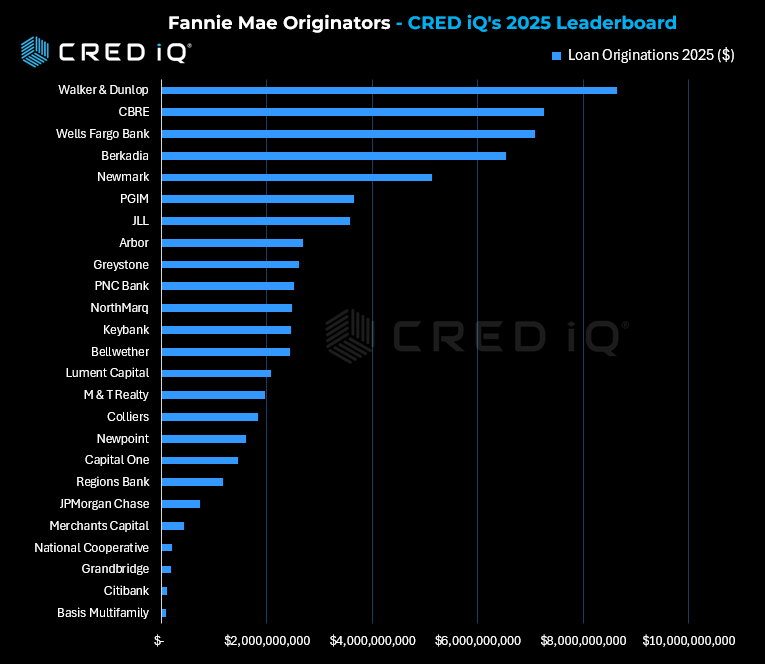

Fannie Mae multifamily lending rebounded meaningfully in 2025, and the originator leaderboard underscores a decisive shift toward scale, balance-sheet strength, and execution certainty. Based on CRED iQ’s analysis of Fannie Mae loan production, the top 25 originators collectively originated $68.9 billion in 2025, up from $55.1 billion in 2024—representing a 25% year-over-year increase in total volume. This growth was accompanied by rising concentration, with market share increasingly captured by a smaller group of dominant platforms.

At the top of the rankings, Walker & Dunlop retained its position as the largest Fannie Mae multifamily originator, closing $8.65 billion across 419 assets, a 19% increase year over year. The firm’s consistency reflects both its national footprint and its ability to deploy capital across stabilized, workforce, and affordable housing transactions. CBRE held the second position with $7.25 billion in 2025 volume, up 17% from 2024, while maintaining a lower asset count—indicating a continued emphasis on larger average loan sizes.

The most notable change in the top tier came from Wells Fargo, which surged from $2.67 billion in 2024 to $7.08 billion in 2025, a 165% increase. This jump propelled Wells Fargo from #7 to #3, representing the single largest absolute volume gain among all originators. The resurgence highlights renewed bank participation in agency execution as market volatility eased and sponsor demand returned.

Beyond the top five, the middle of the leaderboard experienced substantial reshuffling. PGIM increased production by 85%, climbing from #13 to #6 with $3.66 billion in 2025 volume. Berkadia and Newmark remained firmly positioned among the top platforms, reinforcing the advantage of diversified agency origination models. Colliers posted one of the strongest percentage gains, rising 143% year over year and moving from #20 to #16, while Capital One expanded production by 77%, signaling growing bank engagement in agency lending.

However, the recovery was not uniform. Several originators ceded ground as competitive pressures intensified. Greystone saw volume decline 9%, falling from #6 to #9, while Grandbridge experienced a sharp contraction of 76%, dropping to $186 million in 2025. KeyBank and Regions also recorded modest year-over-year declines, reflecting selective participation and tighter credit strategies.

Overall, 2025 marked a clear inflection point for Fannie Mae multifamily lending. Volume rebounded, rankings shifted materially, and the market rewarded originators with scale, capital access, and consistent execution. As refinancing pipelines reopen and transaction velocity improves, CRED iQ will continue to monitor whether these market share gains persist into 2026—or whether competitive dynamics broaden once again as capital markets fully normalize.

About CRED iQ

CRED iQ is a leading commercial real estate (CRE) data and analytics platform designed to bring transparency, structure, and actionable intelligence to complex CRE debt markets. The platform aggregates and normalizes loan- and property-level data across CMBS, CRE CLO, Agency, and private credit, enabling investors, lenders, servicers, and advisors to analyze risk, performance, and opportunities within a single, unified environment.

CRED iQ specializes in advanced analytics for loan surveillance, distress tracking, special servicing activity, and workout strategies, with a particular focus on identifying early warning signals and resolution outcomes across the CRE lifecycle. By combining institutional-grade data infrastructure with AI-driven insights, CRED iQ helps market participants move beyond static reporting toward dynamic, forward-looking decision-making.

Users leverage CRED iQ to monitor delinquency trends, track foreclosures and REO pipelines, evaluate modification and extension activity, and assess portfolio exposure at the property, sponsor, and market level. The platform is built for speed, scalability, and precision—reducing manual research while increasing confidence in investment, underwriting, and asset management decisions.

Trusted by leading institutional investors, lenders, and advisory firms, CRED iQ delivers the data foundation required to navigate today’s evolving CRE market. For professionals seeking a comprehensive commercial real estate analytics platform with deep coverage of distressed debt, special servicing, and AI-powered insights, CRED iQ provides a differentiated, execution-ready solution.