Year-end 2026 Distress Rate Could Reach 14.5-15.0% for the CMBS sector

CRED iQ projects the overall distress rate could reach 14.5-15.0% by December 2026 as persistent headwinds continue pressuring commercial real estate borrowers. This forecast assumes continued refinancing obstacles as loans mature into today’s higher rate environment, sustained challenges in office and certain retail sectors, and limited near-term monetary policy relief.

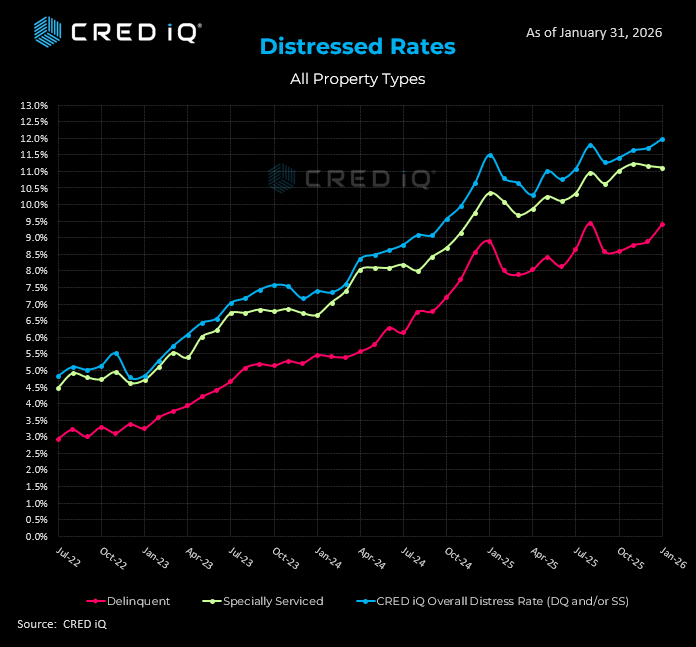

The latest loan analytics data reveals a persistent upward trend in commercial real estate distress that shows no signs of abating. The overall distress rate has climbed from 4.83% in July 2022 to 11.98% in January 2026—a 148% increase over the 43-month period. This remarkable expansion reflects the compounding effects of monetary tightening, weakened property fundamentals, and a challenging refinancing environment that has left borrowers with increasingly limited options. This analysis includes all loans classified as CMBS conduit or SASB (single asset, single borrower).

The trajectory has been remarkably consistent despite periodic volatility. After peaking at 11.78% in August 2025, distress briefly moderated to 10.30% by April 2025 before resuming its ascent. This temporary relief proved fleeting as higher interest rates, refinancing challenges, and property-specific headwinds reasserted pressure on borrowers. The subsequent reacceleration through year-end 2025 and into early 2026 suggests that underlying market conditions remain hostile to distressed borrowers seeking resolution.

Both delinquency and special servicing metrics contribute to the troubling picture. Delinquencies have surged from 2.93% to 9.40%, while specially serviced loans expanded from 4.47% to 11.10%. The parallel expansion across both categories indicates systemic stress rather than isolated portfolio management issues. This dual deterioration signals that problems are spreading beyond early-stage payment defaults into deeper workout situations requiring intensive special servicing intervention.

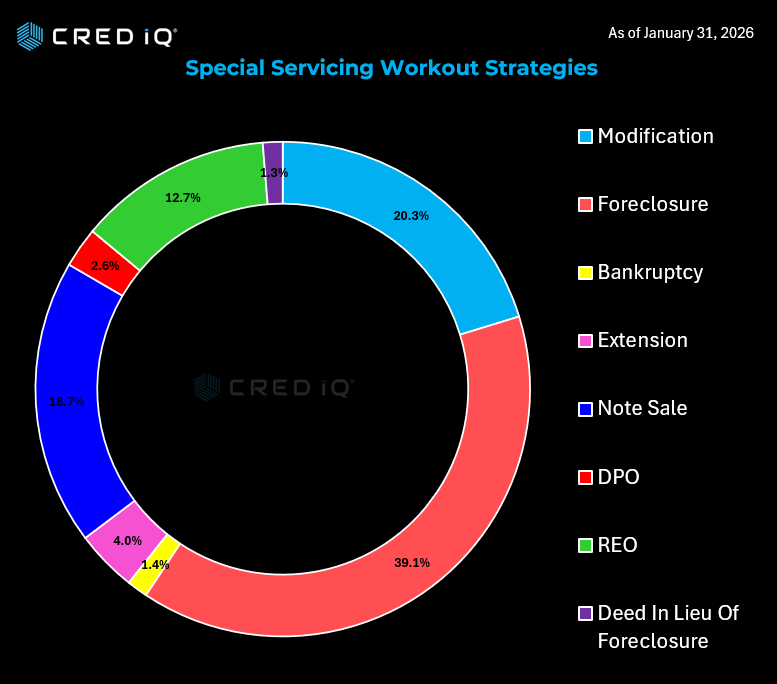

Special servicers are taking an increasingly aggressive posture toward distressed assets. Among the $40.1 billion in specially serviced loans with defined workout strategies, foreclosure dominates at 39.1% ($15.7 billion), signaling that restructuring efforts have largely been exhausted. Note sales account for 18.7% ($7.5 billion), reflecting servicers’ preference for transferring risk to distressed debt investors rather than managing prolonged workouts. Loan modifications represent just 20.3% ($8.1 billion)—suggesting limited appetite for collaborative restructuring solutions. REO properties comprise 12.7% ($5.1 billion), reflecting completed foreclosures where lenders have taken title. The prevalence of liquidation-focused strategies over collaborative solutions underscores servicers’ belief that many troubled assets cannot be salvaged under current market conditions.

About CRED iQ

CRED iQ is a leading commercial real estate (CRE) data and analytics platform designed to bring transparency, structure, and actionable intelligence to complex CRE debt markets. The platform aggregates and normalizes loan- and property-level data across CMBS, CRE CLO, Agency, and private debt, enabling investors, lenders, servicers, and advisors to analyze risk, performance, and opportunities within a single, unified environment.

CRED iQ specializes in advanced analytics for loan surveillance, distress tracking, special servicing activity, and workout strategies, with a particular focus on identifying early warning signals and resolution outcomes across the CRE lifecycle. By combining institutional-grade data infrastructure with AI-driven insights, CRED iQ helps market participants move beyond static reporting toward dynamic, forward-looking decision-making.

Users leverage CRED iQ to monitor delinquency trends, track foreclosures and REO pipelines, evaluate modification and extension activity, and assess portfolio exposure at the property, sponsor, and market level. The platform is built for speed, scalability, and precision—reducing manual research while increasing confidence in investment, underwriting, and asset management decisions.

Trusted by leading institutional investors, lenders, and advisory firms, CRED iQ delivers the data foundation required to navigate today’s evolving CRE market. For professionals seeking a comprehensive commercial real estate analytics platform with deep coverage of distressed debt, special servicing, and AI-powered insights, CRED iQ provides a differentiated, execution-ready solution.