After a slight year-over-year decline in multifamily origination volume in 2020, lending activity sharply increased in 2021. Although final tallies of origination volume for multifamily properties have not been widely reported as of writing, lending was on pace for most of 2021 for double-digit growth compared to the prior year. CRED iQ tracked nearly $150 billion in multifamily originations in 2021, including CMBS conduit, Freddie Mac, Fannie Mae and Ginnie Mae securitizations. Fannie Mae alone financed close to $70 billion in multifamily loans. This sample of 2021 loan originations will likely grow in the near term as 2022 securitization issuance will continue to include loans originated in late-2021.

Gateway markets, such as New York and Los Angeles, were leaders in the total number of multifamily loans originated in 2021 but the Dallas/Ft. Worth MSA had the highest total origination volume by loan balance. More than half of the loan origination activity within Dallas/Ft. Worth came from loans in Fannie Mae securitizations. In total, primary and gateway markets accounted for just over half of all loan originations that were tracked in 2021.

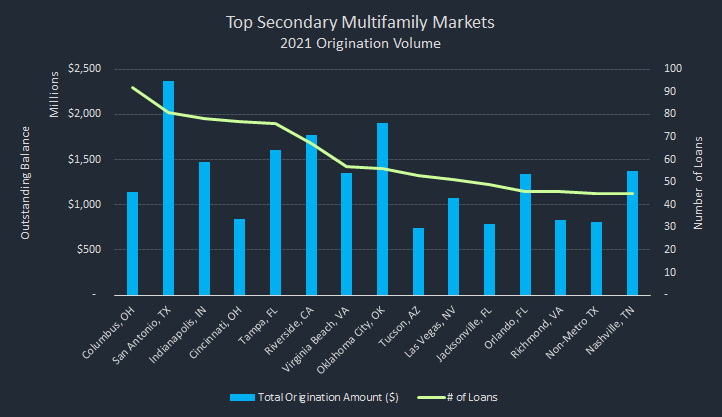

Looking beyond primary markets, an examination of secondary and tertiary market activity highlights areas with high growth potential. Additionally, secondary markets are areas of opportunity for loan originators to branch out and grow lending pipelines.

The Columbus, OH MSA had the most originations among secondary markets with nearly 100 loans totaling $1.1 billion in volume. San Antonio followed with the second-highest number of multifamily loan originations, but loans were significantly larger in size, equating to nearly $2.5 billion in origination volume. San Antonio was the largest of all secondary multifamily markets by aggregate loan origination balance. The average loan origination size for the San Antonio market was approximately $30 million, compared to $12.4 million in Columbus, OH.

Other MSAs included in the Top 10 secondary markets for 2021 multifamily loan originations included Indianapolis, Cincinnati, Tampa, Riverside, Virginia Beach, Oklahoma City, Tucson and Las Vegas. Despite relatively fewer loan originations, Oklahoma City was a standout out in terms of origination volume in 2021, ranking second highest in total origination balance with just under $2.0 billion. With Dallas as a top market for multifamily origination in 2021, Oklahoma City, located just three hours north, likely benefitted from investors expanding their reach into neighboring MSAs.

A trend of loan originations for non-traditional markets was also apparent in 2021. Non-metropolitan Texas exhibited elevated loan origination activity compared to other markets. Non-metropolitan Texas comprises any rural location that does not fall within the boundaries of the 20+ MSAs that CRED iQ tracks within the state of Texas. The presence of non-metropolitan regions on a list for Top Multifamily Origination Markets is further evidence of the expansion and growth of multifamily investment and financing that occurred in 2021.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.