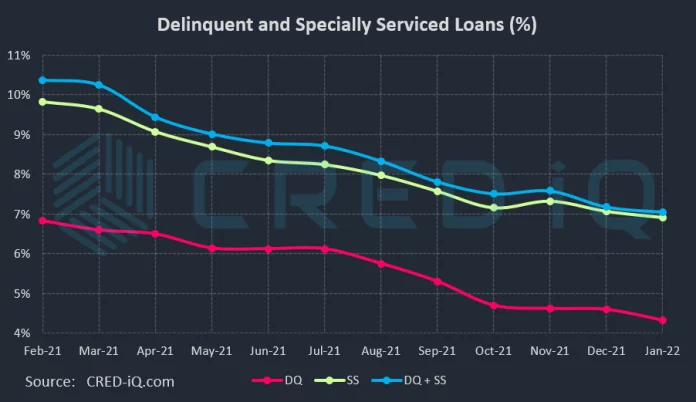

The CRED iQ overall delinquency rate had a sharp decline this month, following a modest decline in the previous month, resulting in the 20th consecutive month-over-month improvement. The delinquency rate, equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $500+ billion in CMBS conduit and single-asset single-borrower (SASB) loans was 4.32%, which compares to the prior month’s rate of 4.59%. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), declined month-over-month to 6.91% from 7.06%. The special servicing rate is at its lowest point since May 2020 and has declined for two consecutive months after a temporary increase in November 2021. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 6.87% of CMBS loans that are specially serviced, delinquent, or a combination of both. The overall distressed rate declined compared to the prior month rate of 7.01%, which was congruent with the declines in both the delinquency and special servicing rates.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

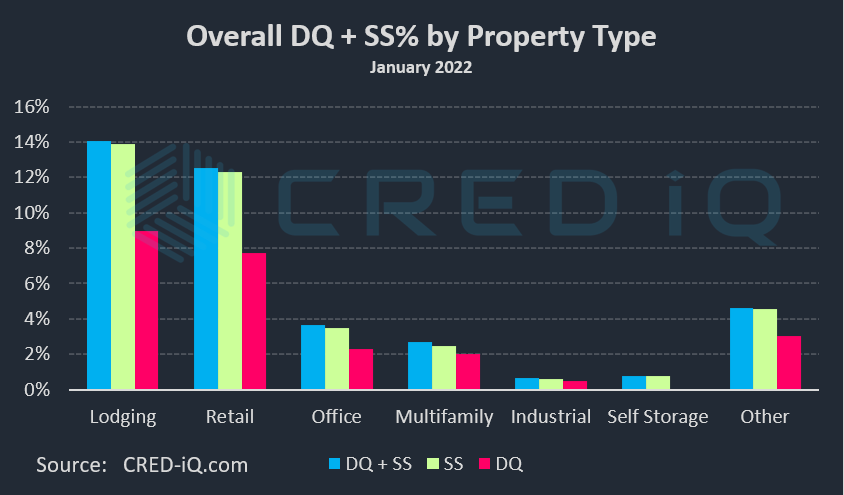

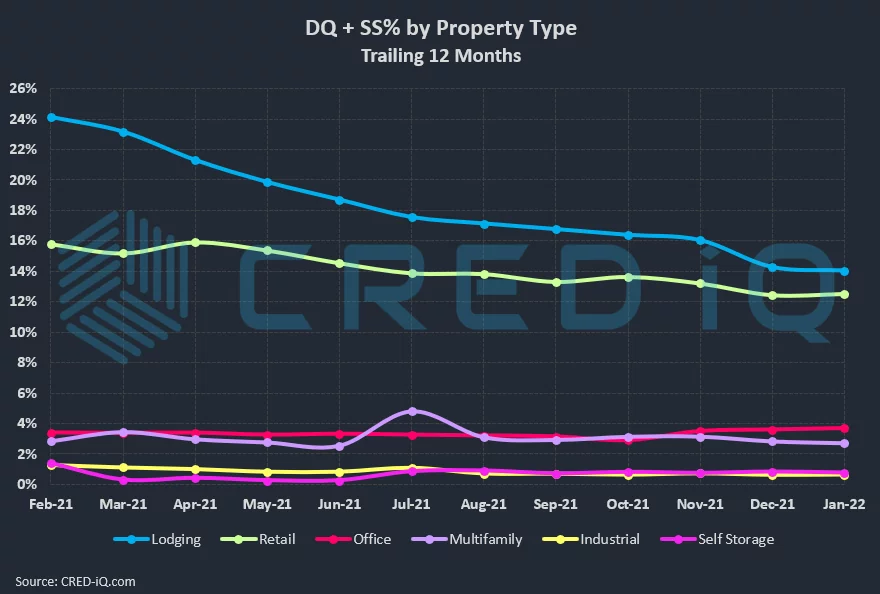

On a more granular level, the individual delinquency rate for office retraced to 2.31%, compared to 2.74% in the prior month, after increasing for two straight months. One driver behind this month’s decline in the office delinquency rate was the delinquency cure of the $1.2 billion 245 Park Avenue loan, which was paid current but still remains in special servicing. The delinquency rate for the lodging sector — 8.95% — also decreased compared to the prior month when it was 9.71%. Conversely, the delinquency rate for retail exhibited an increase to 7.73% from 7.52% last month. Over the prior 12 months, hotel delinquency has improved at a much faster pace than retail. As a result, the delinquency rates for hotel and retail are the closest they have been since pre-pandemic.

Despite continued delinquency declines in the lodging sector, many hotel loans continue to miss debt service payments. Notable new delinquencies this month included the $200 million Hyatt Regency Huntington Beach Resort & Spa, secured by a 517-key lodging property in Orange County, CA, and the $21.1 million Hotel Milo loan, secured by a 121-key hotel in Santa Barbara, CA.

Special servicing rates by property type generally remained in line with prior periods with modest changes. The special servicing rates for the lodging and multifamily sectors exhibited nominal declines and the retail, industrial, and self storage property types exhibited relatively small increases in special servicing rates. The special servicing rate for office properties, 3.46%, remained unchanged from the prior month.

CRED iQ also monitors an overall distressed rate (DQ + SS%) by property type to account for loans that qualify for either delinquent or special servicing subsets. The overall distressed rates typically track slightly higher than special servicing rates as most delinquent loans are also with the special servicer. This month, overall distressed rates for retail, office, and industrial increased while lodging, multifamily and self storage declined. Two of the largest loans to transfer to special servicing this month remained current in payment — the $59.6 million Writer Square loan, secured by a mixed-use property in Denver, CO, and the $59.4 million TEK Park loan, secured by an office property in Lehigh Valley, PA. For additional information for these 3 loans, click View Details below:

| [View Details] | [View Details] | |

| Loan | Writer Square | TEK Park |

| Balance | $59,622,561 | $59,379,382 |

| Special Servicer Transfer Date | 12/13/2021 | 1/3/2022 |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.