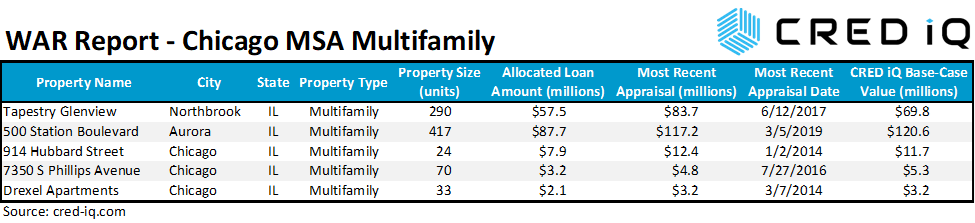

In this week’s WAR Report, CRED iQ calculated updated valuations for five delinquent loans secured by multifamily properties located in the Chicago, IL MSA. According to CRED iQ’s Market Delinquency Tracker, the Chicago MSA had over $185 million in outstanding distressed commercial mortgages secured by multifamily properties as of April 2022. The distressed rate for Chicago multifamily was 1.9% — inclusive of all loans listed as 30 days delinquent or worse, as well as specially serviced loans within the securitized universe of Conduit, Agency, SBLL, and CRE CLO transactions. The distressed rate for Chicago multifamily was among the highest of the Top 50 MSAs covered by CRED iQ. Featured properties include apartments located in Northbrook, IL, Aurora, IL, and multiple submarkets in Chicago.

CRED iQ valuations factor in base-case (most likely), downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

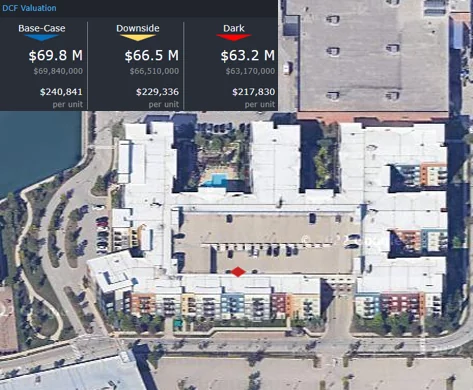

Tapestry Glenview Apartments

290 units, Multifamily, Northbrook, IL [View Details]

This $57.5 million floating-rate loan, secured by Tapestry Glenview Apartments in Northbrook, IL, became 30 days delinquent in April 2022. The loan does not have a history of delinquency; however, occupancy levels have been suboptimal in recent years. Pre-pandemic occupancy at the property was 74% as of year-end 2019 but improved to 87% in 2020. The last reported occupancy for the property was 82% as of July 2021. Despite inconsistent occupancy, net cash flow at the property has been sufficient to cover debt service, even with interest rates rising during the past few months. There was no history of COVID-related forbearance being granted for the loan and the loan did not appear on the most recent master servicer’s watchlist. The delinquency is worth monitoring but a timely cure is a probable outcome. Other considerations for the loan include its near-term maturity, which is scheduled for September 1, 2024. Prior to the loan’s four-month open period, a prepayment penalty of 1% would be required to retire the debt. For the full valuation report and loan-level details, click here.

| Property Name | Tapestry Glenview Apartments |

| Address | 2550 Waterview Drive Northbrook, IL 60062 |

| Outstanding Balance | $57,474,734 |

| Interest Rate | LIBOR + 2.12% |

| Maturity Date | 9/1/2024 |

| Most Recent Appraisal | $83,700,000 ($288,621/unit) |

| Most Recent Appraisal Date | 6/12/2017 |

500 Station Boulevard

417 units, Multifamily, Aurora, IL [View Details]

Mortgage debt secured by 500 Station Apartments, a 417-unit property in Aurora, IL, appears to have been refinanced after April 2022 servicer data indicated a potential delay in repayment at the loan’s maturity date. The total mortgage commitment for the property totaled $88.2 million, which represented the post-closing fully funded amount. Additionally, the borrower had two, one-year extension options after the initial April 22, 2022 maturity date. The loan was marked delinquent in April but appears to have paid off in full according to servicer data from May 2022. The borrower’s business plan was to lease up vacant units at market rents while reducing operational inefficiencies. The property was 91% occupied at origination in 2019; however minimal performance updates were provided through the loan’s maturity date. For the full valuation report and loan-level details, click here.

| Property Name | 500 Station Apartments |

| Address | 500 Station Boulevard Aurora, IL 60504 |

| Total Loan Commitment | $87,651,125 |

| Interest Rate | LIBOR + 3.5% |

| Maturity Date | 4/22/2022 |

| Most Recent Appraisal | $117,200,000 ($281,055/unit) |

| Most Recent Appraisal Date | 3/5/2019 |

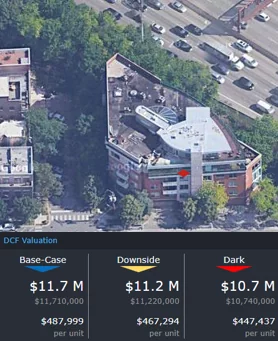

914 Hubbard Street

24 units, Multifamily, Chicago, IL [View Details]

This $7.9 million loan, which is over 60 days delinquent, is secured by a 24-unit mid-rise apartment building in the West Loop submarket of Chicago. Servicer commentary indicates the borrower has been unresponsive and has not reported updated financials since March 2020. The loan has not yet transferred to special servicing as of May, but a transfer could be imminent given the escalating delinquency — the loan was 30 days delinquent during the prior month. The collateral property is a four-story building that overlooks an interchange on Interstate 90. The last reported occupancy for the property was 96% as of March 2020. For the full valuation report and loan-level details, click here.

| Property Name | 914 Hubbard Street |

| Address | 914 West Hubbard Chicago, IL 60642 |

| Outstanding Balance | $7,886,306 |

| Interest Rate | 5.01% |

| Maturity Date | 3/5/2024 |

| Most Recent Appraisal | $12,400,000 ($516,667/unit) |

| Most Recent Appraisal Date | 1/2/2014 |

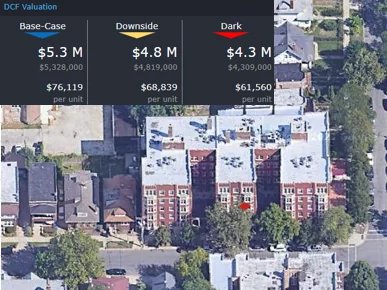

7350 S Phillips Avenue

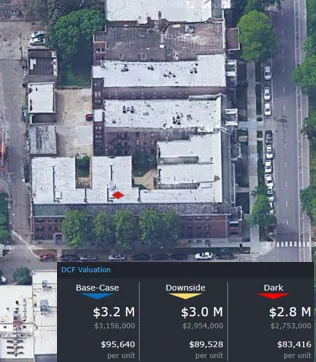

70 units, Multifamily, Chicago, IL [View Details]

This $3.2 million loan, which is 30 days delinquent, is secured by a 70-unit apartment building in the South Shore neighborhood of Chicago. The loan has had delinquency issues since 2021 and throughout 2022. The property was 81% occupied as of July 2021, which is a substantial decline from 94% occupancy at the time of loan origination in 2016. The collateral property is a five-story building that offers affordable housing units. A transfer to special servicing may be imminent if delinquent payments persist. For the full valuation report and loan-level details, click here.

| Property Name | 7350 S Phillips Avenue |

| Address | 7350 South Phillips Avenue Chicago, IL 60649 |

| Outstanding Balance | $3,175,446 |

| Interest Rate | 4.72% |

| Maturity Date | 10/11/2026 |

| Most Recent Appraisal | $4,800,000 ($68,571/unit) |

| Most Recent Appraisal Date | 7/27/2016 |

Drexel Apartments

33 units, Multifamily, Chicago, IL [View Details]

This $2 million loan transferred to special servicing in September 2018 due to issues related to the borrowing entity’s involvement in a complaint by the Securities and Exchange Commission (SEC). The loan has had delinquency issues since its transfer to special servicing and is over 120 days delinquent. An Order Appointing Receiver was filed in August 2018 that prevents any party from pursuing foreclosure or any other remedy, which limits the special servicer’s options for workout. The collateral, multiple apartment buildings in Hyde Park, was reportedly sold by the receiver in May 2019; however any distributions from the proceeds from the sale must go through a litigation process that is ongoing. For the full valuation report, and loan-level details, click here.

| Property Name | Drexel Apartments |

| Address | 5001-5005 South Drexel Boulevard Chicago, IL 60615 |

| Outstanding Balance | $2,053,209 |

| Interest Rate | 5.30% |

| Maturity Date | 5/1/2024 |

| Most Recent Appraisal | $3,200,000 ($96,970/unit) |

| Most Recent Appraisal Date | 3/7/2014 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.